Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Clearscore* Free Access To Your Monthly Equifax Credit Report

What you get: Clearscore* provides free Equifax credit scores and reports, updated once a month, and also has an eligibility checker. Clearscore’s services are free for life.

Clearscore sometimes needs basic details about which bank you’re with in order for you to sign up. For instance, Clearscore might ask you to confirm the first two digits of your banking sort code and last six digits of your account number. These details are only used to match you to your credit report and are not saved.

You can also earn up to £6 for signing up if you’re new to Clearscore and sign up via this Topcashback* link.

How to cancel: Go to your ‘My Account’ page, and click on ‘Delete My Account’, you’ll be sent an email to confirm your cancellation request has been processed.

Or alternatively…

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

You May Like: How To Check Credit Score On Chase

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

You May Like: How To Notify Credit Bureaus Of Death

Ways To Get Something Removed From Your Credit Report

Before you get started, note that if your negative information wasnt the result of an inaccuracy or crime, neither Equifax or TransUnion will remove it from your credit report prior to the designated date. Otherwise, there are 6 different ways to get an error or other negative incident removed from your credit report:

Wait For It To Go Away Naturally

Normally, timely payments and other positive incidents will stay on your credit report indefinitely and will improve your credit score over time. On the other hand, negative information will remain in your credit history for several years, the length of which depends on the incident. Common examples of negative information include:

- Late/missed payments = 6 years

- Consumer proposals = 3 years

- Bankruptcies = 6 7 years

In these cases, the simplest way to deal with the negative information is to wait until Equifax and/or TransUnion clears it from your report. As mentioned, whether the incident was intentional or accidental, neither bureau will remove it immediately, because it was technically your responsibility to pay your debts on time.

File a Dispute

Although waiting for the negative information to be removed is the most convenient option, remember that it can damage your credit score while its on your credit report. You may not want to wait for years, during which you could get denied for new credit.

- For the dispute to have grounding, be sure to provide any proof you have that shows that the incident was not your fault

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Also Check: What Credit Card Is Syncb Ppc

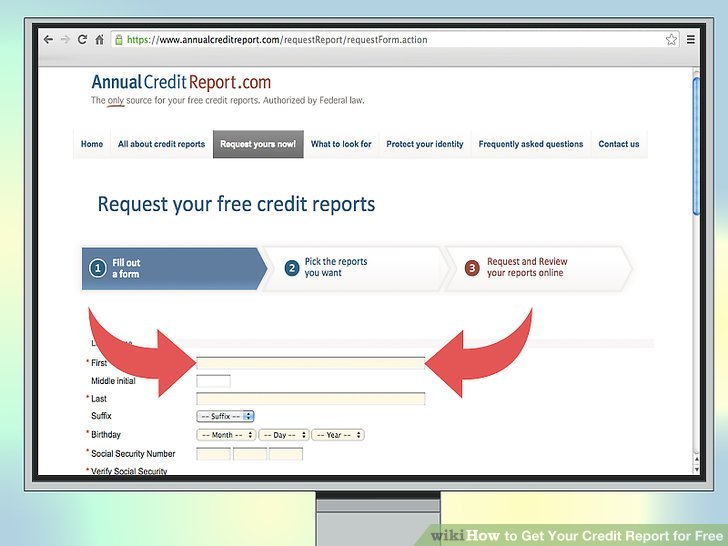

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

How Long Does Information Stay On My Credit Report

Positive credit information, like information about paid accounts with no negative history, may remain on your credit report for up to twenty years. By sharing this information with creditors, lenders see the types of credit you managed successfully in the past and recognize your previous good credit history, even when you have limited or no current credit history.

Adverse credit history, collections and defaulted accounts that were not settled through a debt repayment program , are removed automatically from your credit report after six years from the date the account first went delinquent.

Public records such as judgments and bankruptcies may report on your file for 6 to 10 years depending on the province.

In the case of multiple bankruptcies, each bankruptcy will report for 14 years from the date of discharge.

TransUnion may delete credit information reported about you by a data supplier if our relationship with the data supplier comes to an end. The end of a data supplier relationship may impede our ability to maintain a current and accurate credit file and/or carry out our investigation procedures. We delete credit information in these circumstances to ensure that your credit file remains as accurate, complete and up-to-date as possible.

Don’t Miss: Syncb Inquiry

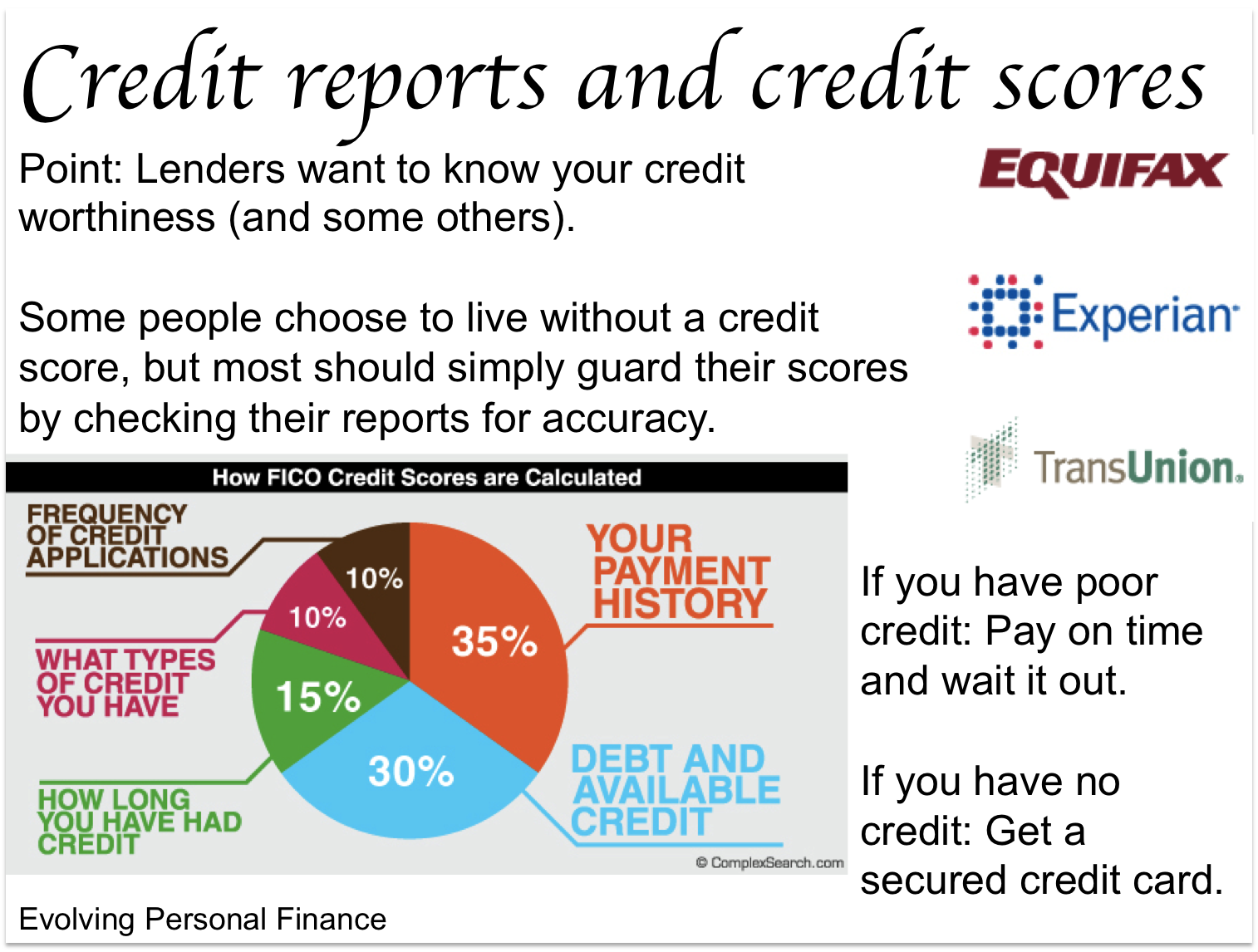

What Is A Credit Score

A credit score is the score that a credit provider will use to help them decide which customers to lend to. Its broadly based on three sets of information:

- your application form

- your credit report

- any information they have about you already.

Guide credit scores are created by credit reference agencies. Theyre based on the information included in your credit record, and are only available to you. Theyre designed to help you understand how firms might use your credit information to decide whether to offer you credit.

Guide scores only offer a general indication of how likely it is that firms might offer credit to you. Having a high score doesnt guarantee any particular lender will actually offer you credit. This is because each firm uses its own criteria, which might vary depending on which credit product youre applying for.

The information held on your credit report and your credit application form might be used to decide:

- whether to offer you credit

- how much credit youll be offered

- how much interest you would be charged.

The most recent information on your report will have the most impact. This is because lenders will be most interested in your current financial situation.

However, information about your financial transactions over the last six years good or bad will still be on record.

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Don’t Miss: Is 524 Credit Score Bad

How Do I Unlock My Equifax Credit Report

To lock your Equifax Credit Report:

Why is my credit locked?

A report lock or has the same impact on your reports as a security freeze, but isnt exactly the same. A report lock generally prevents access to your reports to open new accounts. If you want to apply for , you must unlock your report to allow a check.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: Does Wells Fargo Business Secured Credit Card Report To Bureaus

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Reporting Problems With Your Credit Freeze

All three credit reporting bureaus are legally required to freeze your credit report at your request, at no charge. However, you can submit a complaint if you believe one of these agencies is not placing the credit freeze properly. Complaints can be registered with the Consumer Finance Protection Bureau online or by calling 855-411-2372.

You May Like: Opensky Credit

Don’t Miss: Which Credit Bureau Does Paypal Use

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

In the UK, companies called credit reference agencies compile information on how well you manage credit and make your payments.

The three main CRAs are:

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

You May Like: What Day Does Opensky Report To Credit Bureaus

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Recommended Reading: Is 586 A Good Credit Score

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

Crisil Revises Credit Rating Of Basf India

CRISIL has decided to put the rating of CRISIL AAA to the Non-Convertible Debentures of BASF India under rating watch with negative implications. The move to do so is been seen as an emerging situation which may affect the credit profile of BASF India. It must be noted here that the ratings on Fixed Deposits have been reaffirmed at FAAA/Stable and that of Commercial paper at CRISIL A1+. CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services.

9 April 2020

Recommended Reading: Remove Items From Credit Report After 7 Years