The Factors That Affect Credit Scores Most

The two major scoring companies in the U.S., FICO and VantageScore, differ a bit in their approaches, but they agree on the two factors that are most important. Payment history and , the portion of your credit limits that you actually use, make up more than half of your credit scores. Focus your attention mostly on those two while keeping an eye on the other factors.

Here’s a breakdown of all the factors that affect your scores:

Top 5 Credit Score Factors

While the exact criteria used by each scoring model varies, here are the most common factors that affect your credit scores.

Don’t Withdraw Cash On Credit Cards

This is both expensive to do, as interest is higher and you’re charged it even if you repay in full each month. Crucially, many lenders see it as evidence of poor money management.

The one exception is withdrawing cash on a specialist card abroad. See Overseas Credit Card ATM Withdrawals for full info and why they’re not too bad.

Also Check: 588 Credit Score Car Loan

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Don’t Miss: 1?800?859?6412

Check Your Credit Report Annually Or Before Any Major Application

Your credit reference reports, held at Equifax, Experian and TransUnion, contain enormous amounts of data on you. Errors happen and can kill applications, so it’s important to check them regularly and to go through line by line to check nothing’s wrong.

If possible, check your report at all three agencies as different lenders use different agencies and don’t assume the info will be identical on each.

Following the introduction of the General Data Protection Regulation in May 2018, it’s now always free to check your credit report. See our full Check Credit Files For Free guide, which also includes info on what to check.

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

Also Check: Paypal Working Capital Forum

Payday Loans Can Kill Mortgage Applications

Some payday lenders disingenuously suggest that taking them out and repaying on time can boost your credit score, as it starts to build a history of better repayment. This is true to a very minor extent for those with abysmal credit histories though using a correctly is generally both more effective and far cheaper.

If you’re getting a mortgage though, by definition you’ll need a far better than abysmal credit score. So you should avoid payday loans like the plague. Not just because they’re hideously expensive see the Payday Loans guide but because some mortgage underwriters have openly said they simply reject anyone who has had a payday loan, as it’s an example of poor money management.

To underscore the point, recent research has found that since the start of the coronavirus pandemic, a fifth of want-to-be first-time buyers who’ve had a mortgage application rejected were declined because of a payday loan.

Historically many people have been mis-sold payday loans they couldn’t afford to repay. If that happened to you, you can reclaim £100s or even £1,000s and request that any poor payment records on loans deemed to be ‘unaffordable’ are removed from your credit file. See our Reclaim Payday Loans for Free guide.

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Also Check: Do Pre Approvals Hurt Your Credit Score

How Your Credit Score Is Used

When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not. The credit score gives a snapshot of how reliable you are as a borrower, which lets lenders know whether you are a good risk for a loan or credit card or not.

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are.

These higher interest rates are designed to lower the risk that lenders take on by offering loans or credit cards to less reliable borrowers.

Pay Your Bills On Time

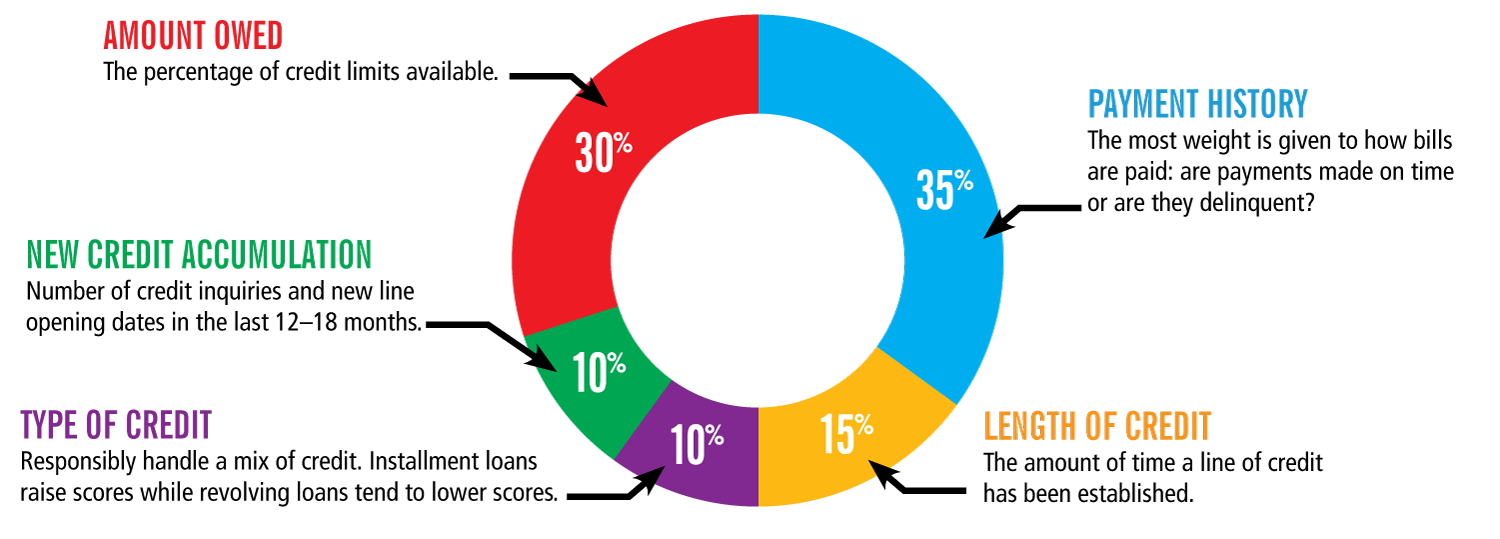

Failing to pay your bills in a timely manner is one of the fastest ways to ruin your credit history because 35% of your FICO credit score stems from your payment history.

Most creditors will report a late payment that is 90 or more days past due. Once reported, your credit score could lose 100 points or more.

If you find yourself simply forgetting to make some bill payments, set up automatic payments wherever possible. Consider using personal financial software to remind you of upcoming bills and/or initiate repayments automatically.

Also Check: How To Get Credit Report Without Ssn

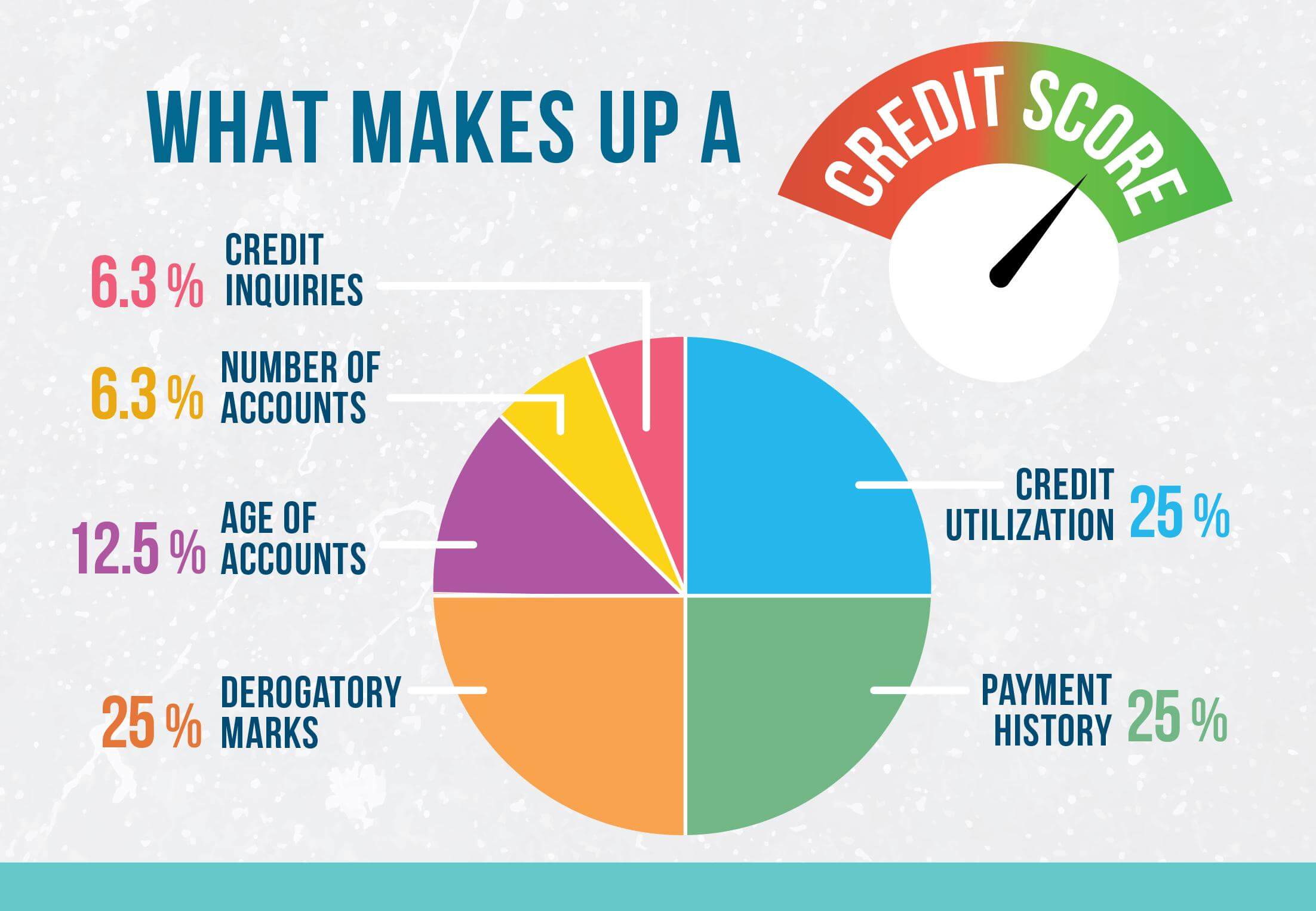

Things That Make Up Your Credit Score

Were all trying to improve our , but doing so can often feel like a shot in the dark. The first step to improving that number is understanding the 5 things that make up your credit score.

When you understand what factors go into that number, you can take specific, intentional and strategic steps toward actually raising your credit score with success.

Pay Down Revolving Account Balances

Even if you’re not behind on your bills, having a high balance on revolving credit accounts can lead to a high and hurt your scores. Revolving accounts include credit cards and lines of credit, and maintaining a low balance on them relative to their credit limits can help you improve your scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits.

Recommended Reading: Aargon Agency Settlement

Boosting Your Credit Score Is A Bit Like Going On The Pull

You need to make yourself as attractive as possible to lenders, in the hope you’ll fit their bespoke lending criteria.

Some borrowers are unattractive to almost all lenders . However, a small few may have a fetish for those with poor credit histories as they can charge more.

And sadly for those rejected, just as when the guys ask Sarah or Jane why they’re not interested, they just say: “‘Cos I don’t fancy you,” and that’s about it. We don’t always get to know other than: “Your credit score wasn’t high enough.”

The tips below are to make sure that lenders see you in the best possible light. So that when they’re looking at you, you’re always dressed up to the nines, looking as hot as you can, and your skirt/shirt isn’t tucked into your pants without you knowing.

Age Of Credit History

This factor shows how long youve been managing credit. It doesnt refer to as some may think your actual age.

While your average age of accounts isnt typically the most important factor used to calculate your credit scores, its important to think about. Closing your oldest credit card account, for example, could end up negatively impacting your scores.

To sum up: The longer you manage your credit responsibly, the more you demonstrate your creditworthiness to lenders.

Don’t Miss: Experian Unlock

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

How To Use Your Newfound Knowledge

Credit scoring companies review your credit reports to see how youre doing on all these factors. Then they build your scores from that data. You can see the same things they do by checking your credit reports.

Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores. You can track your score and get personalized tips with NerdWallets free credit score dashboard.

Recommended Reading: When Does Comenity Report To Credit Bureaus

Learn More About Credit Scoring Through These Resources:

- MyFico.com shows you in great detail what makes up your credit score. Youll also find instructions to positively impact your score in the future. And, youll be able to see information and practices that can protect you when obtaining credit.

- MyCreditEducation tools you need to manage your credit, protect your identity, and to prepare for major purchases.

- will show you where your credit score falls within the general population and what kinds of loan rates youll receive with your current score. There are also sections for you to learn about debit management and credit counseling.

- AnnualCreditReport.com You are entitled to receive your credit report for free, once each year, from the three major credit-reporting agenciesEquifax, Experian and TransUnion. Its a good idea to do this so that you can look for inaccuracies or errors that may be affecting your score. You can also call 1-877-322-8228 for help over the phone.

- Consumer Affairs lists the top 10 rated credit score sites. It also provides information on what features matter most, what are the different types of credit reports and more.

For additional information on your Credit Report, your Credit Score and how they can affect your overall financial health, give us a call at 321-455-9400 or 800-662-5257 or come visit us at any one of ourconvenient branch offices.

Company

Always Check Your Credit Files After Rejection

There’s a nightmare scenario you need to avoid called the rejection spiral. It works like this:

This continues, until finally you check your files and get the error corrected. So…

You apply again. You’re rejected, not due to the error, but because of recent ‘searches’.

If you’re rejected once, check your files are correct immediately. Otherwise you may mess up your score for an age, as more applications mean more searches, compounding the problem. You’ll be told by the lender which credit reference agency it used to assess your info, so focus on that one.

After an error, it’s possible to get successive searches wiped, but it involves negotiating both with the agency and the lender, and it isn’t easy.

The rejection spiral also applies when you apply for credit normally reserved for those with an excellent score when you, say, only have a good score .

If you’re thinking of applying for a new card, check our best buy credit card guides. Our eligibility calculator gives an indication of which loans and cards are likely to accept you, plus those likely to turn you down.

Recommended Reading: Cbna Inquiry

What Factors Affect Your Credit Scores

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you’ve used credit. Understanding what factors affect credit scores helps you plan the most effective way to build your credit or protect it.

Credit scoring companies calculate your scores from data in your credit reports. While they wont reveal their exact formulas, they share the basic ingredients they use to calculate scores.

Why do you care? Because your : whether you can get a credit card or car loan, and at what interest rate whether you can buy a house or rent the apartment you want even how much you pay on car insurance and utility deposits.