Fastest Ways To Improve Your Credit

It’s unlikely you’ll be able to get your credit score to where you want it in just 30 days, but there are some actions you can take that can improve your score more quickly than others:

Again, improving your credit can be a long process, but taking these steps can give you a head start and give you the chance to see improvements early on in the process.

How Can I Improve My Experian Credit Score

Its easy to improve your Experian credit score by taking the following steps:

- Make regular payments on your loans and credit cards.

- Do not apply for too many loans and credit cards within a short time.

- Ensure that your check your Experian credit report and credit score regularly. If you spot any errors or misinformation, raise a dispute with Experian.

- Keep your below 30%.

How Long Does It Take To Increase My Credit Score

Thankfully, you are not stuck with your credit score forever. Credit is a revolving machine that grows over time, constantly evolving as you spend and borrow. Today’s credit score doesn’t have to be the same one you have in a few months if you pay close attention to your finances and make timely payments.

Using research from FICO and CNBC, Bankrate assembled a 2022 report showing the typical time it takes to improve your credit.

|

Type of financial issue |

Average recovery time for credit score |

|

Applying for a new credit card |

3 months |

|

Late mortgage payment |

9 months |

|

Bankruptcy |

7 years |

To best understand how long credit scores may stick around, you must first examine which events are currently plaguing your report. Once you identify the trouble spots, you can look to see how long it will take to improve them. For example, if you have a bankruptcy on your record, it could take six years or more until it is removed from your report.

Also: The 5 best credit cards for bad credit

Don’t Miss: What Credit Score Do You Start With

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Keep The Accounts That You Already Have

One mistake that people often make is to close their credit accounts after paying off their balances. Its common for those with a secured credit card or one with an annual fee.

Unfortunately, doing so can come back to bite you. When you close a credit account, you have less open accounts on your credit report. Many lenders will turn down your credit application if you dont have enough open accounts in your name.

Also, closed accounts dont contribute to the length of your credit history. So your average credit history length could go down if you close your oldest accounts.

Since length of credit history is a credit score factor, it could decrease your credit score immediately.

If you have a secured credit card, its sometimes possible to get your deposit back without closing the account. Your credit card company might allow you to roll over into an unsecured card after six months to a year of good behavior.

If they dont offer the upgrade after a year or so, you can reach out and request one. If youre successful, theyll refund the deposit without closing the account. They may also increase your available credit, which will help your credit utilization. Double win!

As for cards with an annual fee, its up to you to decide whether theyre worth the cost. If you still use it and can accrue enough in rewards to cover the fee, its probably worth keeping.

Also Check: How To Get Free Credit Report Online

Limit How Often You Apply For New Accounts

While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Each application can lead to a hard inquiry, which may hurt your scores a little, but inquiries can add up and have a compounding effect on your credit scores. Opening a new account will also decrease your average age of accounts, and that could also hurt your scores.

Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. One exception is when you’re rate shopping for certain types of loans, such as an auto loan or mortgage. Credit scoring models recognize that rate shopping isn’t risky behavior and may ignore some inquiries if they occur within the span of a couple of weeks.

Does Experian Boost Actually Improve Your Fico Score

It depends. According to Experian, US users have boosted their FICO® Scores by close to 45 million points, and the average FICO Score has increased 12 points when using Experian Boost. Those with little to no credit history and those with very poor to fair credit generally see the biggest FICO Score increases.

We tried Experian Boost ourselves and found the process to be very straightforward, but we didnt see any increase in our credit scores. Thats likely because the CNN Underscored reviewers who tried it already pay their bills on time and have high credit scores to begin with.

But people who pay their bills through their bank account and dont have a longstanding credit card or loan history may see a bigger impact. Thats because youll start to fill in your payment history component of your FICO® Score, which is one of the most important factors in a credit score.

Don’t Miss: How Long Does It Take To Build A Credit Score

Is There A Quick Fix To Repairing Credit

Unfortunately, there’s no way to improve your credit overnight. In some cases, may advertise fast results, but they can’t do anything about your credit score that you can’t do for yourself.

In general, it’s best to develop good credit habits and use them to build your credit history. Go over your credit report and the credit score factors above to plan out the steps you can take to improve your credit score now and in the future.

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Recommended Reading: How To Get A Collection Off Of My Credit Report

Ask For Late Payment Forgiveness

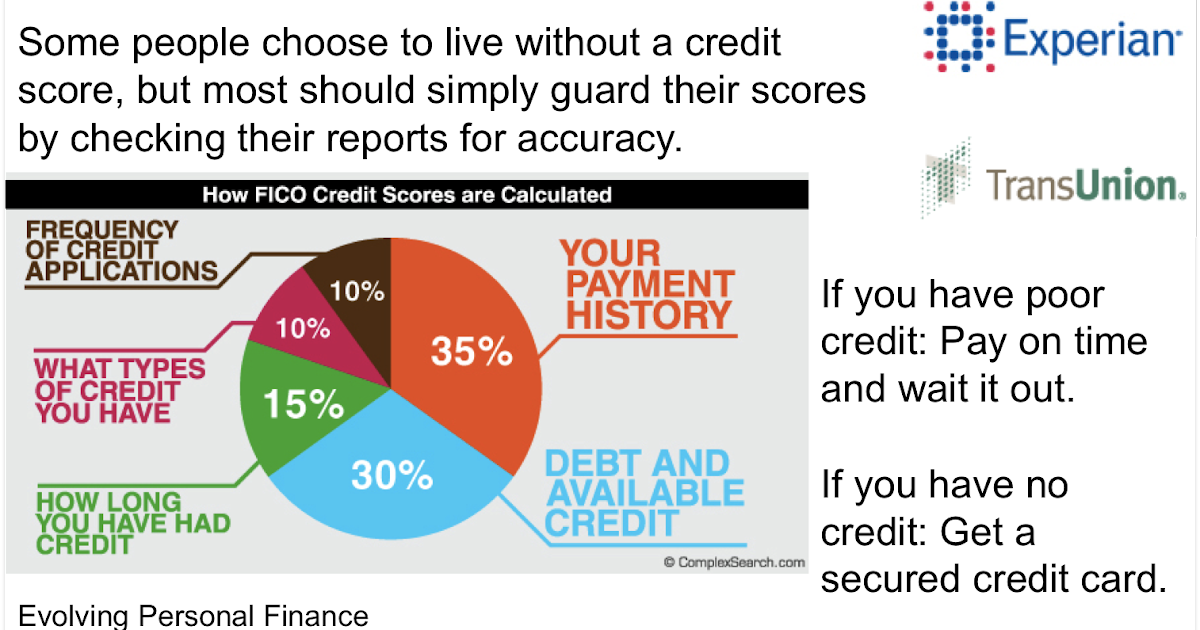

Paying on time constitutes 35% of your FICO Score, making it the most important action you can take to maintain a good credit score. But if youve been a good and steady customer who accidentally missed a payment one month, then pick up the phone and call your issuer immediately.

Be ready to pay up when you ask the customer rep to please forgive this mistake and not to report the late payment to the credit bureaus. Note that you wont be able to do this repeatedly requesting late payment forgiveness is likely to work just once or twice.

You have 30 days before youre reported late to the credit bureaus, and some lenders even allow as long as 60 days. Once you have a late payment on your credit reports, it will stay there for seven years, so if this is a one-time thing, many issuers will give you a pass the first time youre late.

How much will this action impact your credit score?

If youre a day or two late on a credit card payment, you might get hit with a late fee and a penalty APR, but it shouldnt affect your credit score yet. However, if you miss a payment by a whole billing cycle, it could drop your credit score by as many as 90 to 110 points.

Experian Boost: The Bottom Line

Experian Boost is an excellent consumer credit product that can help you improve your credit score instantly. The opportunity to do that for free in just a few minutes could be extremely valuable to some households. If youre planning on a home mortgage loan in the future, a higher credit score can save you tens of thousands of dollars over the life of a loan.

Don’t Miss: When Does Debt Fall Off Credit Report

How Will The Experian Credit Score Affect My Loan Applications

The higher your Experian credit score, the better are your chances of getting a loan. If your Experian credit score is above 750, you stand a decent chance of getting a loan at favourable interest rates. On the other hand, the lower your credit score, the lower are your chances of getting a loan. If your Experian credit score falls below a certain threshold , your loan applications are likely to get rejected.

Plan To Resume Paying Federal Student Loans

Since March 2020, federal student loan borrowers have not had to make monthly payments, and interest rates have been set at 0%. That forbearance period ends December 31, 2022.

The most important factor in your credit score is payment history. Help protect your score from the adverse effects of a missed student loan payment by making sure you understand the exact date when your loan payments come due again , and reviewing your budget to determine whether the resumed payments will stretch you financially. If you’re concerned about your ability to afford your loans long term, talk to your servicer about signing up for an income-driven repayment plan.

You May Like: Is 745 A Good Credit Score

How Is A Credit Score Determined

There are several factors that go in to your credit score. Its a good idea to understand how these impact your score both good and bad.

Your payment history: This looks at whether or not you pay your bills on time.

- Tip: Always pay the minimum payment due on time. Signing up for automatic/electronic payments can make this easier to remember.

Your credit utilization ratio: This measures how much credit you use compared to your credit limit.

- Tip: Use less than 30% of your total credit limit across all your cards. If you use more credit, your credit score may be lowered.

Your length of credit history: This basically means the longer youve been paying on time, the better.

- Tip: Instead of canceling old credit cards, consider keeping them open and active, without using them every day. To do this, try setting up a small automatic reoccurring charge that you can easily pay off each month.

Your credit mix: This looks at what types of credit you use: installment or revolving .

- Tip: Dont worry if you dont have a mix of these accounts today. Installment accounts likely come with time as you purchase larger items, like a car or a home.

: This looks at how often you are applying for new credit.

- Tip: Dont apply for, or close, several credit accounts in a short period of time. Doing so can ding your credit score.

Learn more about credit scores as well as how they are determined and how common each category is.

What Is The Best Credit Utilization Ratio

Your credit utilization ratio, also called a utilization rate, is a number that shows the percentage of available credit you’re using on your revolving credit accounts, such as credit cards. A lower credit utilization ratio is better for your credit scores, but a little utilization is better than none at all. As a result, the best revolving credit utilization ratio may be 1%. However, you don’t need a 1% utilization ratio to have an exceptional credit score. Keeping your utilization in the low single digits could be good enough.

| Average Credit Card Utilization in U.S. |

|---|

| 2010 |

Also Check: Does A Background Check Show Up On Your Credit Report

How To Increase Your Credit Scores Immediately

Join millions of Canadians who have already trusted Loans Canada

When it comes to getting approved for a loan that too at a lower-interest rate, your credit will generally have a big impact. High credit scores can not only help improve your odds of getting approved for a loan, but they will also help you access lower interest rates and better terms, thus making your loans more affordable. If you have poor credit and are looking to quickly improve your credit, there are certain actions you can take to increase it.

Checking Your Experian Credit Score Online

- Step 1: Visit the Experian website and click on the Free Credit Report button

- Step 2: Enter your details to log in, such as your name, mobile number, and email address.

- Step 3: You will receive an OTP to the mobile number shared above. Once it has been entered, you can click on the Get Credit Report option

- Step 4: Once you have logged in, you will be asked to verify your identity using your date of birth, residential address, and any government approved ID card number

- Step 5: Once this information is verified, you may be asked some further questions about your loans and credit history.

- Step 6: After this has been completed, you will be redirected to a page where your credit score will be generated.

- Step 7: You will also be able to download your credit report.

You May Like: Does Paypal Credit Report To Credit Bureaus

You May Like: What Does Charge Off Mean On My Credit Report

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the , adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

Dispute Credit Report Errors

One of the major jobs of the three major credit bureaus is to compile monthly credit reports that include data about your debt repayments. The bureaus use these reports to assign you a credit score.

Naturally, your score can suffer if your credit file contains inaccurate information, such as:

- Indications of a late payment even though you paid on time.

- Hard inquiries you didnt authorize.

- Accounts that you didnt open.

- Loan balances that seem too big.

- Any other activity you dont recognize.

Purging mistakes from your credit file can help an incorrectly depressed credit score rebound. You can correct misinformation by challenging your creditors to validate the information and by lodging disputes with the bureaus. Each bureau accepts disputes via online facilities, or you can communicate through registered mail or over the phone.

DIY credit repair is essentially cost-free but can be very time-consuming. By law, the bureaus have a month to adjudicate each dispute. If you can get a credit bureau to correct or remove inaccurate derogatory information, you should see an improvement to your credit score within a month or two.

Don’t Miss: How To Fix Mistakes On My Credit Report

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Keep Your Credit Utilization Ratio Below 30%

One of the most important metrics for judging the impact of your credit card debt is the or credit utilization rate which is the amount of credit used versus the credit line authorized, i.e., your credit card balance versus your credit limit.

The importance of the CUR is that you cant judge creditworthiness simply by the total of your credit card balances. Rather, creditors contextualize that total by comparing it to the sum of all your credit card credit limits.

For example, the fact that John owes $5,000 on his credit cards while Mary owes $3,000 does not necessarily make John a greater credit risk. If Johns credit lines add up to $20,000 while Marys total $6,000, some simple math puts their CURs at 25% and 50% respectively. John is in much better shape, credit-wise, than Mary, who needs to reduce her balances by at least $1,200 just to reach the critical 30% CUR target.

The following chart from Credit Karma shows the relationship between CUR and credit score:

How do we explain the relatively low average credit for the 0% CUR? We guess that some of these cardholders simply dont use their credit cards much and therefore have little opportunity to improve their credit scores. Further research is needed to nail down the answer.

Also Check: When To Pay Credit Card Balance To Increase Credit Score