Although Federal Law Allows Employers To Check Credit Some States Don’t

By Lisa Guerin, J.D.

Has your credit taken a hit in the last few years? If so, you’re not alone: The recession has inevitably led to more late and missed payments, evictions, foreclosures, and other unfortunate events that can really do a number on your credit report. If you’re also looking for work, you may be concerned about whether and how a potential employer can check your credit report.

If an employer checks credit reports when hiring employees, it has to follow the legal rules set out in the federal Fair Credit Reporting Act . The FCRA requires employers to:

- get your consent before pulling the report

- give you a warning if the employer plans to reject you on the basis of the report, and

- give you an official adverse action notice if the employer does not hire you because of the contents of the report.

This article explains each of these requirements. It also covers some state laws, which limit an employer’s ability to use credit reports in hiring.

What Is A Rental Background Check

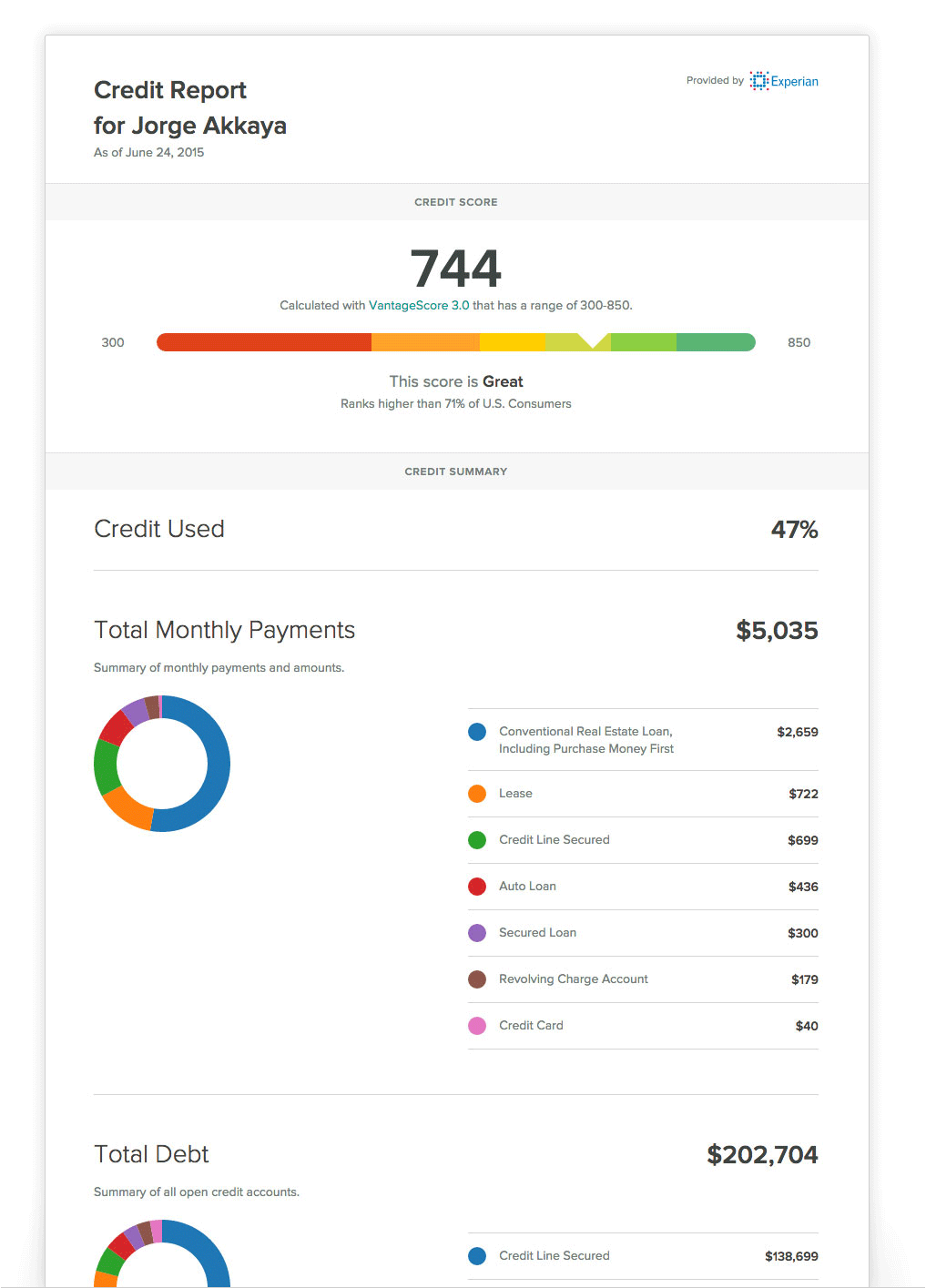

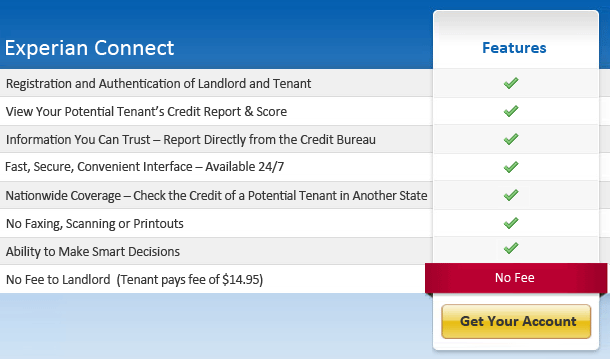

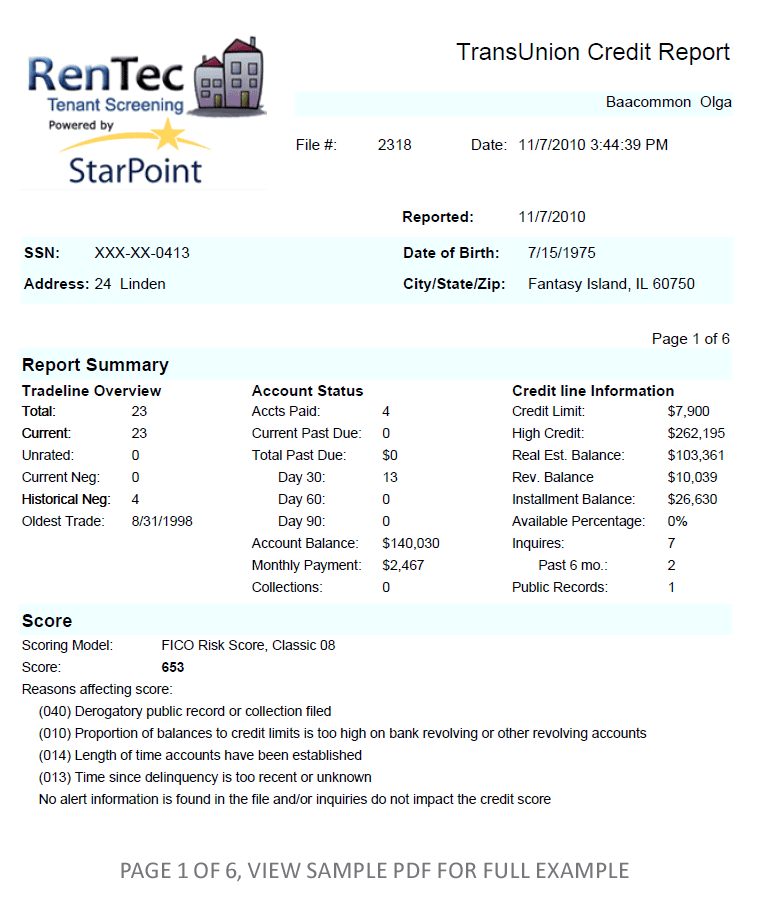

A rental background check is an additional screening tool that allows landlords to see various aspects of a tenant applicants past behavior.

The majority of the data youll see comes from the three major credit bureaus:

- TransUnion

- Experian

This data helps to paint a picture of how responsible a tenant might be.

Some landlords look at the overall credit score while others pay specific attention to the details of the report.

What Is A Credit Freeze

In simplest terms, a credit freeze restricts access to credit reportseither temporarily or long-term. Consumers can freeze and unfreeze their credits fairly quickly with the three major credit bureaus: Equifax, Experian, and TransUnion.

When a credit freeze is in place, lenders, companies, employers, or third-party services conducting wont be able to view the consumers credit reports until the consumer unfreezes their creditthis includes employment screening providers running checks on job candidates.

Credit freezes are typically done voluntarily by consumers to make it more difficult for their personal and sensitive information to be stolenand for a good reason. In the US, 33% of adults have experienced identity theft, which is more than twice the global average. And while the total number of data breaches fell in 2020, the number of personal records compromised in those breaches jumped 141%.

Read Also: Does Speedy Cash Report To Credit Bureaus

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Race National Origin Color Sex Religion Disability Genetic Information Age

Sometimes, its legal for an employer not to hire you or keep you on because of information in your background, and sometimes, it isnt. For example, its illegal when the employer has different background requirements depending on your race, national origin, color, sex, religion, disability, genetic information , or age, if youre 40 or older. Its also illegal for an employer to reject applicants of one ethnicity with criminal records for a job, but not to reject other applicants with the same criminal records.

Even if the employer treats you the same as everyone else, using background information still can be illegal discrimination. For example, employers shouldnt use a policy or practice that excludes people with certain criminal records if it significantly disadvantages individuals of a particular race, national origin, or another protected characteristic, and doesnt accurately predict who will be a responsible, reliable, or safe employee. In legal terms, the policy or practice has a disparate impact and is not job related and consistent with business necessity.

If you think an employer discriminated against you based on information in your background report, contact the EEOC.

Recommended Reading: What Is Syncb Ntwk On Credit Report

How To Minimize The Effect Of Hard Credit Inquiries

When youre buying a home or car, dont let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries, like those for mortgage or auto, are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loans as a single inquiry as long as theyre made within a certain window. This window is typically about 14 days.

While some lenders can rely on scoring models that give you more time to shop without incurring an additional hard inquiry, you may want to stick to 14 days to do your comparison shopping, since you likely wont know which scoring model a lender relies on to generate your score.

Exceptions To The Rule

Although the vast majority of background checks dont include your credit score, its possible you may run into an exception for example, if youre applying for a job in the financial industry or any job where you might handle a lot of money.

But in all cases, you must give written permission for a background check, and the screeners would need to specifically note their intention to pull a credit report. As Harzog put it, Its not going to be a sneak attack in the middle of the night.

This is one more reason its so critical to take advantage of your free annual credit report. By keeping an eye on your file, youll be able to get ahead of any false or fraudulent information.

You May Like: Does Afterpay Affect Credit Score

Fair Credit Reporting Act And Background Checks

When employers conduct a background check using a third party, the background check is covered by The Fair Credit Reporting Act of 1970 .

Learn more about FCRA and how it impacts any background checks done by employers. Also, read below for general information about background checks and your rights as related to them.

How Long Does It Take For An Inquiry To Show Up On A Credit Report

Every time you apply for credit, a notation appears on your credit report. These inquiries affect your credit score and are displayed for anyone who pulls your credit. According to MyFICO, a person opening multiple lines of credit at once presents a greater credit risk. Fewer inquiries give the appearance of a lesser risk, as the consumer isn’t looking for credit. Often, the inquiry immediately appears on your report — and is definitely there within 30 days.

Don’t Miss: What Credit Report Does Capital One Use

What Do Employers See When Checking Your Credit

“They see largely what a lender sees, except for your credit score,” Ulzheimer says.

Since a lot of the credit report data that lenders and employers see is the same, employers have access to a comprehensive background report that includes, in addition to your credit history, your past employment, insurance and legal activity.

Though prospective employers don’t see your credit score in a credit check, they do see your open lines of credit , outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

How To Prepare For A Background Check

Some facets of a background check can’t be changed, but if you suspect an employer is going to request a background check, there are some steps you can take to prepare if you’re feeling concerned.

Start by requesting copies of your records. You can get a free credit report online from each of the three major credit bureaus through Annual Credit Report. Although an employer won’t see your credit score, they may see your debt-carrying accounts or any bills sent to collections. You can take steps to start fixing up your credit report, but do note these updates won’t happen overnight. It can take up to one or two months for a credit report to update, so it’s best to start this process sooner than later.

If your driving record is going to be particularly important for a job, you can request a copy from your state’s Department of Motor Vehicles. This process will vary by state, but typically you can request this online, in person, or via phone or mail.

You May Like: Does Paypal Credit Affect Credit Score

How Are Soft And Hard Credit Checks Different

Soft credit checks arenât visible to companies, but hard credit checks are. That means that soft credit checks wonât impact your score , while each hard credit check may lower your score.

Here are some examples of when a soft credit check can happen:

- You search your own credit report

- A company searches your credit report as part of an identity check

- You use Experian to compare credit and see how eligible you are

Here are some examples of when a hard credit check can happen:

- You apply for a loan, credit card or mortgage

- You apply to a utility company

- You apply for a pay-monthly mobile phone contract

Why Would An Employer Look At Your Credit

An applicant’s credit history can flag potential problems an employer would want to avoid:

-

Lots of late payments could indicate youre not very organized and responsible, or dont live up to agreements

-

Using lots of available credit or having excessive debt are markers of financial distress, which may be viewed as increasing the likelihood of theft or fraud

-

Any evidence of mishandling your own finances could indicate a poor fit for a job that involves being responsible for company money or consumer information

The National Association of Professional Background Screeners worked with HR.com on a nationwide survey of 1,528 human resources professionals about screening checks. The results showed 25% of the HR professionals use credit or financial checks while hiring for some positions, while 6% check the credit of all applicants.

» SIGN UP:Get your free credit report and see where you stand

Don’t Miss: How To Remove Repossession From Credit Report

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

How Can You Prepare For A Credit Check By A Potential Employer

Since employers are mainly checking to see any patterns or habits of mismanaging money when they conduct a credit check, the best way to prepare is to know what your credit report says before applying to any job .

“You certainly don’t want to be surprised when you go apply for a job to learn something negative is on your credit reports,” Ulzheimer says. “I always advise people who are job hunting to get a good idea of what your credit reports looks like well in advance. And, be able to explain any negative entries.”

Every year, you’re entitled to one free credit report from each of the main credit bureaus Experian, Equifax and TransUnion. You can access these reports for free at annualcreditreport.com, which is authorized by federal law. We recommend you don’t access all three reports at the same time, but instead space one report out every four months.

If you have a Capital One credit card, such as the Capital One Venture Rewards Credit Card or Capital One Savor Cash Rewards Credit Card, you may have come across CreditWise . provides access to your free TransUnion credit report.

Keep in mind that while employers can legally pull your credit report, it’s one of many factors that go into getting hired for a new job. But there is a simple way to appear just as good on your credit report as you do in your job interview: Make sure you always pay your bills on time.

Editorial Note:

You May Like: Does Zzounds Report To Credit Bureau

Why Employers Check Credit And What They See

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Employers sometimes check credit to get insight into a potential hire, including signs of financial distress that might indicate risk of theft or fraud. They dont get your credit score, but instead see a modified version of your credit report.

Heres what you need to know about employer credit checks, including what information prospective employers can see, your rights and how to present the best possible face.

Saying No To A Background Check

Background checks are becoming more and more common among employers during the job hiring process. While you can say no to a background check, an employer may choose not to hire you because of this.

However, if you are asked to fill out information for a background check early on in the process , and are uncomfortable with that, you could always ask if you could fill it out once you and the employer have both decided whether you are moving forward in the job hiring process. However, keep in mind that the employer could reject that request.

Generally, prepare for a number of requests for background checks during your job search process.

Read Also: Does Paypal Report To Credit Bureaus

Check Your Own Credit First

Before applying for a job where theyll likely check your credit, go to AnnualCreditReport.com and get a free copy of your report from the three major credit bureaus, Experian, Equifax and TransUnion.

Its vital to do this before you apply for a job because you might discover a mistake, or something more sinister like identity theft, on your credit report.

According to the Consumer Financial Protection Bureau, one in five people will have a mistake on their credit report. This can be a bankruptcy from eight years ago that should no longer be on your credit report or a debt that isnt yours at all.

For example, once I was checking my credit report and noticed that there was a $76 medical bill from my old doctors office. I was so confused. I called them and they said they had sent the bill to my house, but I hadnt paid it.

I explained that I had recently moved and hadnt gotten the bill, even though I had mail forwarding set up. They said I could pay the bill and they would withdraw it from collections.

Youre allowed to get one free copy from each credit bureau once a year. If youve already looked at a report once this year, youll have to pay an extra fee. This fee may be no more than $12.50 per report. If you find that the price is more, see that youre not also being charged for a credit score.

Some states also dont allow credit bureaus to charge for extra credit reports. When you view your credit report, save it as a PDF so you have a copy for your records.

Why Are Soft Credit Checks Useful

Because soft credit checks leave no trace on your credit report, you can use them to see how eligible you are for a wide range of credit without actually applying â whether youâre looking for a loan to pay for a holiday or a . Thereâs no limit to how many soft checks you can have and theyâll never affect your credit score, even if you have lots close together.

Also Check: Is 575 A Good Credit Score

Requirements For Employment Credit Checks

The best way to prepare for a credit check is to get a copy of your credit report as soon as possible. You are legally entitled to one free copy of your credit report every year from each of the three nationwide credit reporting companies. This way, you can check for any issues or errors and dispute them before an employer sees them.

You can also add a brief statement of dispute to your credit report to explain why an issue occurred. For example, you might explain that you were late on a car payment due to an emergency medical issue.

Since the employer needs your written permission to run a credit check, you’ll know whether you need to address any issues. Prepare a brief explanation of potential issues the employer might see and explain what you’ve done to rectify the situation.

Employers do understand that applicants experience financial challenges like unemployment, so past credit issues don’t necessarily mean you won’t be hired.

Does The Employer Have To Disclose If I Fail The Background Check

There are federal laws that protect your rights in relation to background checks:

Also Check: What Credit Score Does Carmax Use