How Do You Know When You’ Re Ready To Buy A Home Take

Here are five ways to know if you’re ready to buy a home. It has a fully funded emergency fund. Your emergency fund should have at least three to six months of hidden “must-have” expenses. This means that during this time you will have savings to cover bills, mortgage payments, groceries and essentials. This money should be out of sight and out of sight in a bank account and should not count as part of your down payment.

How To Calculate Mortgage Payments For A Home

Follow these steps to use the Forbes Mortgage Adviser Calculator: Enter your home value and the amount of the down payment. First add the total value of the house you want to buy on the left side of the screen. Enter your interest rate. If you’ve searched for a loan before and got different interest rates, enter one of these values in the interest field. Select an expiration date.

Dont Close Any Accounts

Finally, its best not to close any credit accounts while youre applying for a mortgage. There is a lot of debate over whether closing unused accounts hurts your credit. But given the fact that your score partly looks at your mix of credit and length of credit history, its probably best not to mess with anything so close to taking out a home loan.

Keeping the account open but inactive shouldnt hurt your credit, but closing an account so close to applying for a mortgage might cause concern on the lenders part. If you really want to shutter the account, wait until after youve closed on your new home.

Also Check: What Is Syncb Ntwk On Credit Report

How Much Do You Need To Buy A House

What are some things to consider before buying a home? Things to consider before buying a house 1. Visit at different times of the day. 2. Find the latest local news. 3. Talk to your neighbors. 4. Ask if the area has an association. 5. Ask the seller about problems in the house. 6. Have a check-up at home. 7. Get a detailed report on past improvements. 8. Don’t think remodeling is easy. 9. Look at the view.

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

Don’t Miss: How Can Personal Responsibility Affect Credit Reports

What Credit Criteria Do Mortgage Lenders Use

While youd think there would be complicated formulas involved, lenders actually use a pair of simple ratios to determine how much mortgage you qualify for. The first is total monthly housing costs versus total monthly income the second is your debt-to-income.

There are several factors that contribute to mortgage loans, and each is weighted differently. Take a look at the numbers below:

Factors and Weights in Mortgage Loans

| Factors |

|---|

| 10% |

As you can see, your credit score is the second most important individual factor that goes into your mortgage loan, only below your debt to income ratio. The best thing you can do when applying for a mortgage is to get your credit in shape beforehand which can help if your debt to income is not perfect.

But What Is A Credit Score Exactly

Definition:Credit scores are three-digit numbers that represent how a person has in the past borrowed money and paid it back. Such figures are determined on the basis of details contained inside credit reports of an individual. There are different kinds of models for scoring. The FICO credit score ranges from 300 to 850. The better the higher.

If in the past you were responsible for your borrowing you should have a strong ranking. It would boost the odds of securing a loan. At the other hand, former credit-problem lenders appear to have lower ratings.

Such three-digit numbers help mortgage lenders understand the probability of an individual paying back a loan obligation. These are used to determine the possible risk faced by lending money to a particular borrower and to prevent or minimize losses due to the default of the borrower.

Recommended Reading: Getting A Repo Off Your Credit

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Va Loans: What Credit Score Do I Need To Buy A House

For VA loans, there actually isnt a set number of credit score that youll need to buy a house. As a general rule of thumb, your loan likely wont be approved unless it is under 640. VA loans help servicemembers, veterans, and their spouses, become homeowners. VA guarantees a portion of the loan so that the lender can offer borrowers more favorable terms.

Also Check: What Is Syncb Ntwk On Credit Report

What Should Your Credit Score Be To Buy A House

What should your credit score be to buy a house? Here’s what you’ll have to know about your credit before signing the dotted line on your next home.

Sarita Harbour

If you’re even considering the possibility of buying a house in the near future, your mind is probably already buzzing with questions about the homebuying process, borrowing to buy a house, and how to pay for the costs that turn up after the place is yours. What should your credit score be to buy a house? What’s the best way to pay for furniture for your new house?

We’ve got answers! Here’s what you need to know about credit and buying a house.

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Also Check: What Is Syncb Ntwk On Credit Report

What Are Some Things To Consider Before Buying A Home Pros And Cons

Unlike renting or even owning apartments or townhouses, buying a home puts you in complete control of your home. You may not need approval from the board or owner of the Home Owners Association to renovate your home to fit your lifestyle. With the apartment next door there are no more pet or noise restrictions.

Consider The Current Housing Market

Your local housing market will play a big role in whether you decide to buy a home. It’s influenced by a number of factors that can have a direct impact on homebuyers. These include:

Ballooning home prices, a reduction in inventory and low interest rates have created a hot housing market during the pandemic, attracting an influx of cash buyers and real estate investors. Meanwhile, more Americans are moving, thanks in part to the explosion of remote work. A recent Neighbor.com survey found that 20% more people are planning on moving in 2021 when compared with 2020. This is all to say that a number of factors come into play when deciding whether to buy a home.

You May Like: Opensky Payment Due Date

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Recommended Reading: Syncb/ppc Credit Inquiry

How To Improve Your Credit Score Before You Buy A House

The first step to improving your score is to find out where you stand. During the coronavirus pandemic, you can check your credit report for free once every week with all three major credit bureaus at AnnualCreditReport.com.

If you find errors on any of your reports, you can dispute them with the credit bureau as well as with the lender or credit card company. When it comes to your credit score, your bank or credit card issuer may provide your score for free. If not, you can also use a free credit score monitoring tool like or .

What can you do if you discover that your score needs improvement? One idea would be to pay down your credit card balances to reduce your credit utilization rate. Also, avoid applying for any new forms of credit during the months leading up to a mortgage application.

And, most importantly, pay your bills on time each and every month. Your payment history is the factor that has the biggest influence on your credit score. Building a consistent history of on-time payments will always be a surefire way to improve your score.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

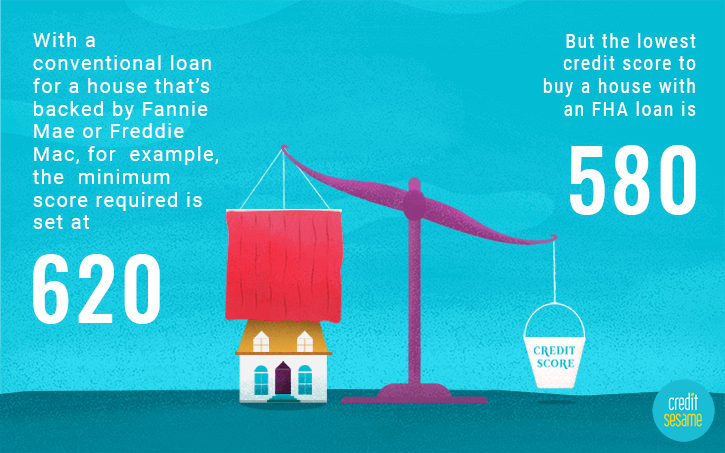

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Identify And Fix Issues With Your Credit Reports

Now that youve got your credit reports handy, you can focus on fixing the items that are bringing your score down.

Go through each of your three reports line by line. Verify that all the information is correct, and highlight any accounts or line items that are negative or inaccurate. These are your areas for improvement.

Also Check: Does Speedy Cash Report To Credit Bureaus

What Do You Need To Know About Buying A House In California

A credit score is another important requirement when buying a home in California. You’ve probably heard of the importance of good credit when it comes to getting a loan. Borrowers with a higher credit rating will generally qualify for mortgage financing more easily and will generally also receive higher interest rates.

You Should Have A Decent Income

The new mortgage stress test implemented by the Ministry of Finance at the end of 2016 looks exclusively at income to determine your ability to pay back a mortgage. This test looks at your income and assesses whether or not you could make monthly payments based on their posted rate, which is typically much higher than the interest rate you’d be approved for by your lender. This prevents you from running into trouble if there was ever a significant interest rate hike on your mortgage. There are two ways to get around this. You can increase your income, or save up to make a 20% deposit which allows you to bypass the test. Unfortunately, with housing prices as high as they are in Canada, saving 20% of the purchase price is very difficult.

Don’t Miss: Paydex Score Chart

Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Kate Wood writes about mortgages, homebuying and homeownership for NerdWallet. Previously, she covered topics related to homeownership at This Old House magazine.Read more

Improving Your Credit Score

Theres a lot that goes into determining your credit score, including your repayment history, the total balances on your accounts, how long youve had those accounts, and the number of times youve applied for credit in the last year. Improving in any of these areas can help increase your score.

You can:

- Pay down your existing debts and credit card balances

- Resolve any credit issues or collections

- Avoid opening new accounts or loans

- Pay your bills on time, every time

You should also pull your credit report and check for any inaccuracies you might see. If you find any, file a dispute with the reporting credit bureau, and include the appropriate documentation. Correcting these inaccuracies could give your score a boost.

You May Like: When Does Usaa Report To Credit Bureaus