Get A Cosigner Or Guarantor

If you can’t get a credit card or loan on your own, consider asking a friend or relative to cosign. A cosigner promises to repay a loan or credit card charges if the primary debtor defaults. Although creditors typically report both your name and the cosigner’s name to credit reporting agencies, confirm in writing with the creditor that the account will be reported in your name.

Things That Wont Rebuild Your Credit

If youre trying to repair your credit, think twice before trying these methods:

1. Paying for everything in cash or with a debit cardWhile its beneficial to keep your credit card balances low, switching entirely to cash and debit wont help your credit history. Cash and debit transactions dont help you establish a history of repaying debts.

2. Payday loansPayday lenders generally dont report to the major credit bureaus9so making on-time payments wont help your credit history. On the flip side, if you cant repay your payday loan and the lender sends your account to a debt collector, the collector might report to the credit bureauswhich could hurt your credit history.

Want to learn more about improving your credit score and achieving your financial goals? Visit .

How Can You Check Your Credit Score

You can request a copy of your report by phone, by mail or in person for free, with either Equifax or TransUnion. Many Canadian banks also provide your credit score for free through their websites.

Its recommended that you review your credit report once a year to check for errors. If you find something that is incorrect, contact the credit reporting agency and your financial institution. You have the right to dispute any information on your credit report that you believe is wrong, and you can ask the credit bureaus to correct errors for free. Read more about checking for errors here.

Read Also: Aargon Agency Pay For Delete

By Step Instructions For How To Rebuild Your Credit

You can rebuild your credit in about six months to a year if you have a bad credit score . Just take these five steps:

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online you’ll just need to update your annual household income. Its possible to be approved for a higher limit in under a minute. You can also request a credit limit increase over the phone.

Read Also: Ccb/mprcc On Credit Report

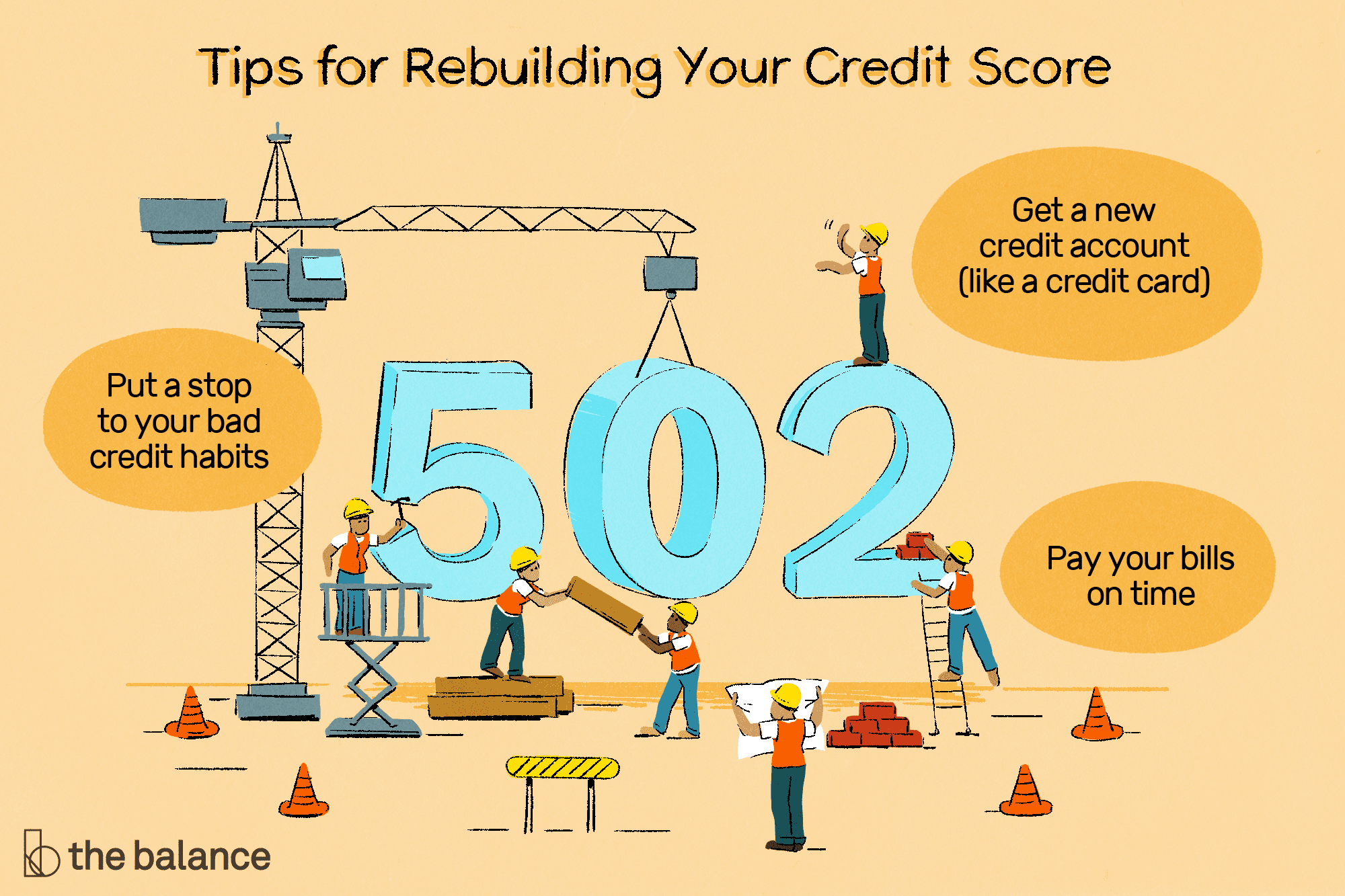

To Recap Rebuilding Your Credit Can Be Accomplished By:

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

Read Also: Credit Inquiries Fall Off

Rebuilding Credit Is A Worthwhile Journey

Remember: The path to a healthy financial future is a marathon, not a sprint. Be patient with yourself in this journey. There may be setbacks along the way, but if you stick with your plan and prioritize good habits, youll be able to reach your credit and financial goals.

Ready to learn more? Check out this post about how credit scoring works.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Try To Avoid Closing Credit Card Accounts

When possible, avoid closing accounts. The longer your credit history, the better your score. However, if you are very far behind in your payments, you may not have a choice. A payment plan may require you to cancel your credit card. If possible, though, keep your older accounts so that you have a substantial credit history on your side.

Don’t Miss: When Does Barclaycard Report To Credit Bureaus

Plastk Secured Credit Card

Annual fee: $48, plus a $6 monthly maintenance fee.

Interest rates: 17.99% for purchases and 21.99% for cash advances .

Security deposit: $300 to $10,000.

Rewards: Earn rewards points on everyday purchases 5,000 sign-up bonus points.

The Plastk Secured Visa* Credit Card is one of the best secured cards for those with bad credit.

You can apply for a credit limit of up to $10,000 and can easily make payments to settle your balance using Interac e-Transfer.

Unlike traditional secured cards that offer no rewards, the Plastk Secured Credit Card offers the following perks:

- 0% APR for first 3 months

- 5,000 bonus points

- Rewards points when you pay with your card

- 25 days interest-free grace period for purchases and 3 days for cash advances

- Referral program

You can redeem your rewards points as a statement balance or redeem them for merchandise, gift cards, travel, charitable donations, and more.

This card has a $48 annual fee. After adding the $6 monthly maintenance fee, it costs $120/year.

The low-interest-rate version of the Home Trust Secured Visa Card has a $59 annual fee that is counterbalanced by a 14.90% purchase APR.

You can apply for a credit limit of up to $10,000.

Cardholders enjoy purchase security which protects eligible items against theft or damage for up to 90 days following purchase.

Become An Authorized User On Someone Else’s Card

Another way to rebuild credit is to become an on another person’s card. When you become an authorized user on someone else’s credit card, you receive your own credit card with your name. But the credit account is still the responsibility of the primary account holder. The card company typically reports the credit card account to the credit bureaus for both the primary account holder and the authorized user.

As long as the account is in good standing, being added as an authorized user can help raise your credit score.

Being an authorized user isn’t without risks, however. For example, if the cardholder or the authorized user runs up a high balance, both users could see credit damage. Only tie your credit score to individuals you trust.

Don’t Miss: Report A Death To Credit Bureaus

How Long Does It Take To Rebuild Credit After Chapter 13

Chern also says that most Chapter 13 petitioners will see a reduction in debt-to-income ratio, but this wont occur as quickly.

After three to five years of living on a strict budget, Chapter 13 debtors should be much more equipped to manage their money efficiently, he says. In many cases, after 18 months of regular Chapter 13 payments, a debtor can refinance out of a Chapter 13, especially if the debtor has any equity in a home.

Taking Steps To Rebuild Your Credit

If your credit scores are lower than you’d like, know that change begins with you! The steps that you take to change your credit behaviors are usually reflected as positive updates in your credit scores over time, because the data that goes into your scores is comprised of all the actions you make when it comes to credit.

Pay Bills on Time

Think About Your Credit Utilization Ratio

No one wants to max out their credit cards, and creditors don’t like to see credit accounts that look maxed-out either. Your compares the total amount of credit you have available, based on credit card limits, to how much of your available credit you’re actually using . The lower your credit utilization ratio, the better. You can reduce your credit utilization ratio by:

Ask for Help from Family and Friends

Your family and friends may be willing to help you build your credit. They can do this in several ways, including:

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Think Twice About Working With Credit Repair Agencies

Instead of paying a credit repair agency, consider using that money to increase your emergency fund and savings. Focus your efforts on the habits and circumstances that led to your bankruptcy and how you can change them.

There are many unscrupulous agencies out there that will claim they can remove a bankruptcy or fix a credit report, says Samah Haggag, a senior marketing manager for Experian. There is nothing a credit repair organization can do that you cannot do yourself.

Why this matters: Credit repair agencies take the heavy lifting out of credit-building, but they charge fees. If youre willing to put in the work of checking your credit reports and disputing errors, you can save that money and use it to continue paying down existing debt.

How to get started: Take a look at your budget and request copies of your credit report yourself before looking into credit repair agencies.

Action #: Get Collections And Bad Debts Settled

First, you must make sure there are no unpaid debts or items in collections that have not been settled.

If you have unpaid bad debts these need to be dealt with prior to starting any credit rebuilding.

We have lots of information on our site about dealing with large amounts of debt. You can read about our credit rebuilding program here.

You May Like: Does Speedy Cash Report To Credit Bureaus

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

Don’t Miss: Does Paypal Report To Credit Bureaus

Like This Article Pin It

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we aren’t able to cover every product in the marketplace.

For example, Wise Bread has partnerships with brands including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, and Amazon.

Using A Credit Card To Rebuild Bad Credit

Responsible credit card use can be part of your credit recovery. Credit card use allows you to build a positive revolving credit history when paid on time. As long as you keep the balance on the card low or pay in full each month, then youll also promote a healthy credit usage ratio, giving your score another boost.

Consider these three options:

The best balance transfer credit card promotional offers are typically reserved for people with good to excellent credit.

Recommended Reading: Qvc Card Credit Score

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Lower Your Interest Rate

If youre making payments every month on large amounts of debt, you might feel frustrated by how much of your money is going toward interest. If you could lower your interest rates, these funds could instead be used to pay down the principal balance faster. Most consumers dont know you may be able to lower your interest rate simply by calling your creditor and asking. It wont work every time, but your chances of success are higher if youre a long-standing customer, are making on-time payments, or have recently increased your credit score.

Recommended Reading: How To Unlock Experian Account