How Long Does It Take For My Credit Score To Update After Paying Off Debt

It can often take as long as one to two months for debt payment information to be reflected on your credit score. This has to do with both the timing of credit card and loan billing cycles and the monthly reporting process followed by lenders. However, the impact of the debt payment on your credit score may not necessarily be significant.

One Of Your Credit Limits Is Lowered

On occasion, a creditor may lower your available credit. This happens for various reasons, but when it does occur, your credit utilization ratio can go up very quickly and impact your credit score.

âSolution: Ideally, you should make good financial decisions to prevent a bank from considering you as a bad credit risk and lowering your limit in response. You also want to keep your customer profile data updated, including any pay raises you received. Showing an increase in income may be enough to stop or even reverse a harmful credit limit decision from the lender. In the meantime, keep paying off credit card balances to lower your utilization ratio.

You Closed A Credit Account

If youve noticed a slight dip in your credit score, recently closing an account could be the reason why. Cancelling a credit card, for example, could increase your credit utilisation ratio as it could reduce your overall available credit.

That being said, closing an old account may still be right for you if you want to responsibly limit the amount of credit you can use. However, it may be worth being careful about how you do it. Keeping hold of long-held and well-managed credit accounts can improve your score with some lenders as it shows youve been a reliable borrower in the past, which may suggest youre likely to keep up with your repayments.

Its also important that you make sure youve paid off any outstanding balances before trying to close an account as this can lead to missed payments, further affecting your credit score.

Read Also: When Does Capital One Report To Credit

Inaccurate Information On Your Credit Reports

Sometimes creditors make credit reporting errors. Because of this, its a good idea to review each one of your reports from the three major credit bureausEquifax, Experian and TransUnion. You can view all three of your reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to make sure your accounts and personal information are correct. If you spot an error, dispute it with each credit bureau that lists it online, by mail or phone. Also, keep in mind that if you see an account that you never opened, it could be a sign you are a victim of identity theft.

If you believe someone has stolen your identity, file a report with the Federal Trade Commission through IdentityTheft.gov and freeze your credit with all three credit bureaus as soon as possible .

You Reached Your Credit Limit

Expensive sums on your credit card can have an impact on your credit utilisation ratio. Your credit utilisation ratio is calculated based on the total amount of credit across all balances divided by the total credit limit across all of those accounts.

Maxing out your credit limit or a spike in your credit utilisation ratio can show instability and many lenders and credit reference agencies will take this into account. The lower your credit utilisation ratio remains, the better as it indicates that youre doing a good job of managing your financial responsibilities and not overspending.

You May Like: How Long Do Evictions Stay On Credit Report

You Dont Pay Child Support

When delinquent child support payments go into debt collections or end up with a court judgment, your credit takes a huge blow.

Your score could have 100 points or more taken off your FICO score. If there is a court judgment made, you could also face repercussions like wage garnishments, withholding of tax refunds and a property lien to make sure the child support is paid.

More From GOBankingRates

Account Sent To Collections

If you are significantly late making a payment, the lender may write off a delinquent debt and sell it to a collection agency, who will then try to recover the money.

When this is happens, it can hurt your credit score.

The extent of the damage will depend on two factors:

- Size of debt the more you owe, the greater the drop in your score

- Your original credit score the higher it was, the greater the drop is likely to be

Collection accounts can stay on your credit report for up to seven years, so it is worth dealing with it quickly. Settling the account with the collection agency may minimize the damage.

Under the most recent FICO scoring model FICO 9 collections accounts will be ignored once they have been paid in full.

Recommended Reading: Whats A Good Credit Age

What Is A Good Or Bad Credit Score

Maintaining a good credit score has plenty of benefits, including potentially saving you a significant amount of moneyand stressover time. Good scores will help you qualify for more credit products at lower interest rates. Bad scores, on the other hand, may prevent you from qualifying for certain types of credit or may result in getting approved for credit products at higher interest rates, since your profile presents a bigger risk to the lender.

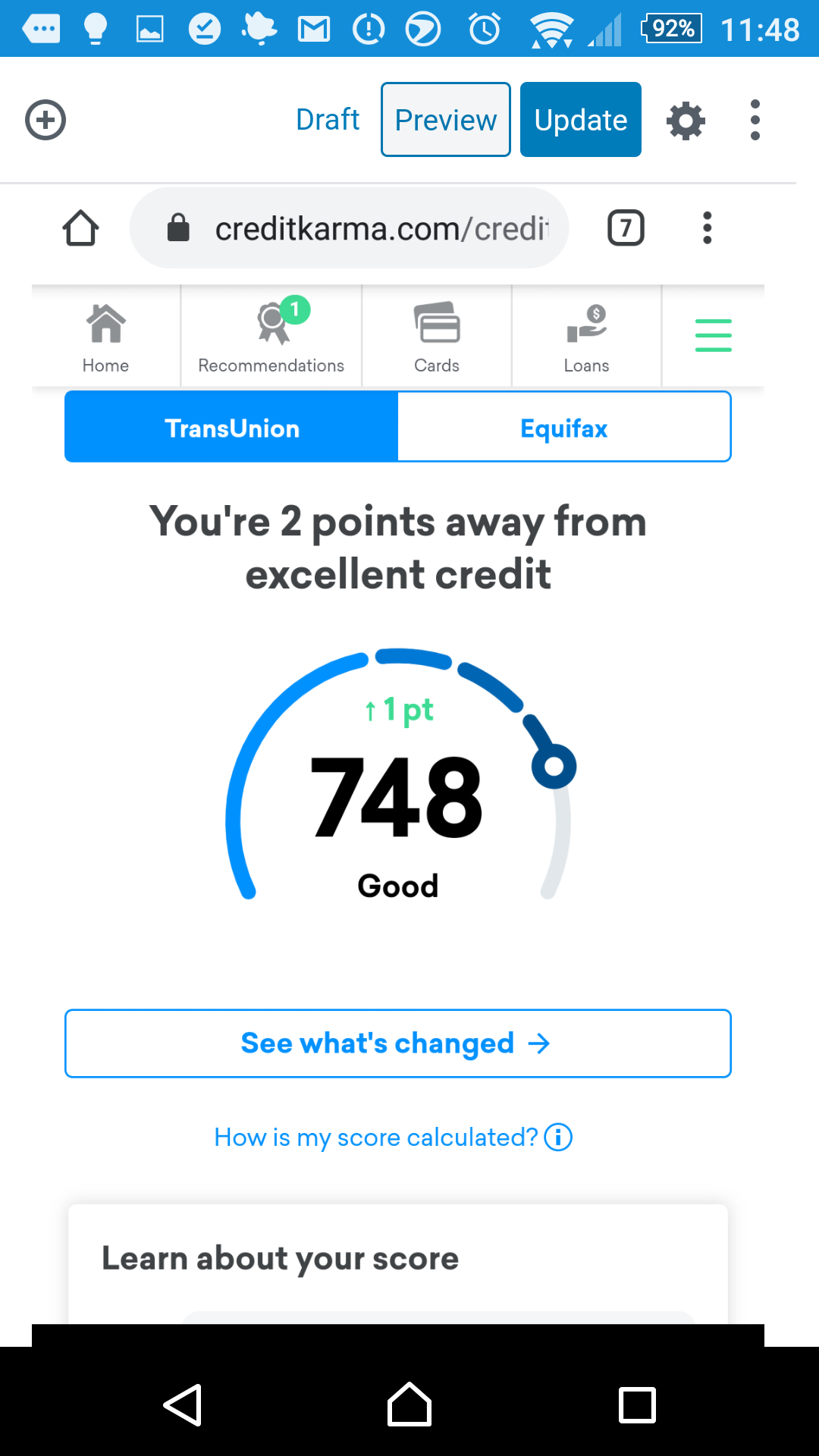

Credit scores are divided into different scoring ranges. Many scoring models, including the FICO® Score, use a range of 300 to 850. In that model, scores above 800 are considered exceptional, while anything above 700 is typically considered good. Scores below 669 are considered to be fair or poor. In 2020, the average FICO® Score in the U.S. was 710, according to Experian data.

Why Your Credit Score Dropped: 13 Common Reasons A Fico Score Declines

So youve checked your credit score and noticed that it has dropped.

Should you be worried?

After all, your credit score can affect so many different parts of your life.

The answer depends on the reason your score dropped.

Lets look at some of the most common reasons a score declines, because theres no way your credit score dropped for no reason. Then youll be able to better understand the issue, and how to resolve it.

Your FICO score is calculated using a secret formula. However, the essential components of the method are well-known.

As the chart shows, five elements go towards your FICO score. Each of these has varying degrees of importance in the calculation.

These are:

- Amounts of money owed 30%

- The length of time you have had credit 15%

- New lines of credit taken out 10%

- Your credit mix 10%

New information is regularly fed into your credit report. So it is not unusual for your credit score to fluctuate as a result.

A change of a few points upwards or downwards is normal and nothing to worry about. This fluctuation will happen on a day-to-day and month-to-month basis.

If the drop in your score continues or worsens, its worth looking into what could have caused it.

Lets take a look at what it could have been.

Don’t Miss: Is 524 Bad Credit

How To Pay Off Debt And Help Your Score

Paying off debt, in my humble opinion, is one of the best things you can do for yourself. Its certainly a good move for your financial health, and I believe that will help your overall health, too. When the time comes to pay off a debt whether its revolving debt or an installment-type loan you should know that youre doing the right thing for yourself, and your score will reflect your good behavior in the long run.

Here are some of my favorite debt reduction techniques:

- Set a fun goal Paying down debt may not be fun, but it is always easier if you are doing it for a specific reason. Making a plan for the money you eventually free up can help motivate you to pay it off quicker.

- Determine a time frame Take a look at your budget and determine how much you can reasonably put toward your debt each month. Then, using a debt calculator, you can set a definite date to dump the debt.

- Make it automatic Once you decide how much you can put toward your debt each month, set up monthly automatic payments to keep yourself on track.

And remember that when it comes to credit cards, its best not to close them unless there is a good reason to do so . If the card carries a high interest rate and you believe thats a good reason to close it, I would suggest you use the card only for purchases you can pay in full each month or just put it in a drawer and get a new card with a lower or zero introductory APR for other purchases. Thats a win-win in my book.

Editorial Disclaimer

You Closed A Credit Card Or One Was Cancelled

Closing a credit card can hurt your credit score, especially if the card has a balance or more available credit than your other credit cards. Credit card issuers can also cancel your credit card, which will impact your creditnot necessarily because it was the creditor who closed the account, but because the account was closed at all.

Closing your only credit card or your oldest credit card can also impact your credit score.

Recommended Reading: Highest Credit Limit For Victoria Secret

Tips For Improving Credit Score After Paying Off Debt

While paying off your credit card debt is important, what matters more is on-time payments and your utilization rate. Many times, borrowers will ignore these factors, thinking that clearing up their debt as quickly as possible is the key to a stellar score. But there are a few other methods to consider:

- Be strategic with the order in which you pay off your debts. Personal loans and credit cards often have higher interest rates than mortgages, car loans and student loans. Paying off those first not only helps keep your credit utilization in check, but will also save you money in interest. You can also use a debt paydown calculator to help .

- Check your credit utilization. If youve paid off your debt and your credit score went down, look at just how much of your credit you are using. If its above 30 percent, you might consider charging less each month. If that isnt an option, you could speak with your issuer about increasing your credit limit. Both of those should help increase your credit score.

- Open another credit card. While opening accounts could temporarily lower your score due to hard credit checks, opening a new card could increase your total available credit and spread your charging among several cards.

How Often Can You Check Your Credit Score

You can check your credit score as often as you want without hurting your credit, and it’s a good idea to do so regularly. At the very minimum, it’s a good idea to check before applying for credit, whether it’s a home loan, auto loan, credit card or something else.

When you do this, you can help make sure there aren’t any problems that could make it difficult to get approved for a new loan or credit account. By checking at least a few months in advance, it can also give you time to address anything that could be hurting your credit score.

It’s also a good idea to check your credit report at least once a year. While your credit score is a numerical snapshot of your overall credit health, your credit report provides the actual information used to calculate your score.

As you check your credit report, look out for anything you don’t recognize. If you find something odd, contact the lender to make sure it’s legitimate. Sometimes, a lender may operate under a different name and report a name you’re not familiar with to the credit bureaus if you’re applying for a car loan, the dealership may submit a credit application to multiple lenders.

If you find information you believe is inaccurate or even fraudulent, report it to the credit bureaus.

You can get a free credit report from each of the three credit bureaus every 12 months through AnnualCreditReport.com. You can also get a free copy of your Experian credit report online every 30 days.

Don’t Miss: Do Pre Approvals Affect Credit Score

You Pay Your Bills Late

Your payment history has a major impact on your credit score. U.S. News & World Report estimated that a single late payment can lower a credit score by 100 points or more. However, borrowers might be able to mitigate the damage, assuming they act fast. While missing a payment by just a few days likely wont put your scores at risk, paying bills 30 or more days late can have a serious effect on your credit.

How to avoid it: Do whatever is necessary to avoid being late on payments. If you are forgetful, set up reminders on your phone or computer. If you spend too much, tighten your belt so youll have the cash to make your payment.

How to fix it: If you paid a bill late, contact your lender to get its policy on reporting late payments. Unfortunately, if the lender has already reported the late payment, you probably wont be able to get it removed from your credit report. Youll just have to make sure all future payments are made on time.

Two Top Online Savings Account Picks

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Many or all of the products here are from our partners that pay us a commission.Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Featured Offer

Recommended Reading: Usaa Check Credit Score

Handling A Dip In Credit Scores

A drop in your credit score can be stressful, but it doesn’t have to be permanent. There are ways to bring your score back up and to prevent another decrease in the future. Remember that credit scores are dynamic, and that you have the ability to improve yours with your own habitsan empowering truth that you can apply to other parts of your financial life too.

Hard Inquires: Mortgage Applications Auto Loans Credit Approvals Etc

Hard inquiries generated by lenders and credit issuers can remain on your credit report for a year or longer. If you have a lot of these entries, it could appear as if financial trouble is requiring you to apply for more credit even if thats not the case. And it can be a big red flag for lenders and may even lower your overall credit score. Most score models, including FICO, make allowances for rate shopping by ignoring related inquiries made within a 30-day period.

Read Also: What Card Is Syncb/ppc

A Spike In How Much Credit You Use

Your total available credit limit is the amount youâre able to borrow across your credit accounts. .

With your credit limit, itâs all about balance. Using too little credit could harm your score, as youâre not able to prove to lenders how you manage credit. However, using too much of your credit limit could suggest to lenders that you’d struggle to repay any new debt. This can cause your credit score to drop.

Itâs recommended that you try to keep your below 30% of your total credit limit.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Also Check: Chase Sapphire Required Credit Score

Mistake On Your Credit Reports

So far weve assumed that your credit scores dropped because of accurate information on your credit reports. But what if thats not the case?

Lenders can make mistakes too. Thats why its important to check your credit reports to keep an eye out for errors. The CFPB says that credit report inaccuracies are one of the most common issues it deals with each day.

If you find a mistake on your credit reports, you have the right to dispute it with the credit bureaus and with the reporting lender. Companies are required to investigate the dispute free of charge and promptly correct errors that are confirmed.

You Have Late Or Missing Payments

Your payment history is the most important factor in your FICO® Score, the most widely used credit scoring model. It accounts for 35% of your score, and even one late or missed payment can have a negative impact. So, it’s key to make sure you make all your payments on time.

If you are more than 30 days past due on a payment, credit issuers will report the delinquency to at least one of the three major credit bureaus, likely resulting in a drop in your score. Payments that become 60 or 90 days past due will have an even greater effect on your score..

If these delinquencies are not paid, the credit issuer may send your debt to a collection agency, and the collection account will be recorded on your credit report. Records of your late and missed payments remain in your credit file for seven years, while positive payment history on an open account can stay on file indefinitely . Be sure to make all your payments on time so the record of your strong credit behavior bolsters your score for years to come.

Read Also: Does Affirm Show On Credit Report