Review The Credit Bureaus Response

The Fair Credit Reporting Act requires any information considered inaccurate, incomplete or unverifiable to be corrected or deleted from your credit report within 30 days. However, due to the COVID-19 pandemic, as of April 2020, the Consumer Financial Protection Bureau has temporarily extended that deadline to 45 days.

How Do You Obtain A Credit Report

You might be able to get your credit report for free from your financial institution or credit card issuer, or you may have to pay to get it. Also, your credit report must be given to you free of charge once a year by each of the major credit bureaus if you ask for it. Its important to check your reports from all three bureaus because they may contain slightly different information. Thats three opportunities a year to make sure the information kept on you and your credit is accurateand to ensure that no one is fraudulently opening accounts in your name.

Youre also entitled to a free report if you apply for a credit card or loan and are declined.

How To Get A Credit Report

Youre allowed one free copy of your credit report every year from each of the major credit-reporting agencies we just talked about. But the reports arent automatically mailed to youyou have to ask for them! And since each agency keeps different details about you on file, its worth checking with all three. If you play your cards right, you can even stagger them so youre getting a free report nearly every quarter.

Now that you know how to get a credit check, well walk you through the four major areas you need to inspect for any red flags. These could help you spot potential identity theft situations, so listen up!

Recommended Reading: Does American Express Report To The Credit Bureaus

Sometimes You Really Forget Where You Came From

I breezed through the Equifax and Experian questionnaires but got tripped up by TransUnions questions. Erring on one set of surprisingly tricky questions isnt a terribly uncommon occurrence.

If you mess up the security questions, call 877-322-8228 to request your reports from all three bureaus, or , fill it out, and mail it in.

Will A Bad Credit Message Stay On My Report Forever

Bad credit on your report can lower your score. If you miss payments or make partial payments, or if there’s been an error, it can leave you with a bad credit message or note. These messages can linger on your credit report not forever, but for years. Bankruptcies and consumer proposals stay on your credit report for up to seven years from the date of discharge for your first occurrence, and even longer for subsequent bankruptcies.

If you think there’s an error on your report or you have the opportunity to fix a situation that’s hurting your credit, ask the lender to report it to the credit bureau. They may be able to help raise your credit sooner.

Read Also: How To Remove Inquiries Off My Credit Report

Why Is A Credit Score Important

Why is spending less on everything important? Because it saves you money, of course. Not unlike your high-school report card, a credit score essentially tells the whole financial sector if youre able to pay off debt on timemeaning, whether youre creditworthy or not.

Having a great score means youll have to spend less on utility bills and credit card purchasesit will also mean you will be looked upon favorably by financial institutions and companies, as well as potential employers.

If were talking about getting a loan, then a credit rating is even more important. Instead of paying a 30%+ interest rate for a loan, you will likely be able to get the same loan with a 6% interest rate if your credit is excellent. Even if your score is somewhere between 650 and 750, the best loans for good credit are miles ahead of those you can get with a bad ratingthats one of the reasons why it literally pays to understand your credit report and get that rating up.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: How To Raise Credit Score 100 Points

Where Can I Check My Credit Scores And Reports

There are a number of places that might be able to show you your credit reports and scores. Just be aware that some of those places may charge you for the information.

But you can visit AnnualCreditReport.com to learn how to get free copies of your credit reports. And you can use a service like to get an idea about your credit scoresâand more.

You can read more about both options below. There may also be options from other credit card issuers, credit bureaus, scoring services or credit counselors. Just remember that you may be charged to use them.

Itâs also important to remember that decisions about loan applications or credit cards are ultimately up to each lender. And because there are multiple scores and reports out there, what you see in reports and scores youâre given might not be exactly the same as what lenders use to judge creditworthiness.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.50 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Recommended Reading: Does Easy Financial Report To Credit Bureaus

Positive Vs Negative Records

- Negative Records These are reports in which payments were made late, were not made in full, or were not paid altogether. Negative records can stay on your report for up to 7 years.

- Positive Records These include accounts in which payments were on time and in full, with no NSF cheques or black marks. These records have a high credit rating due to their favourable payment history and lack of bad debts. Positive records can stay on your credit report longer .

How Can A Credit Report Help Over Time

Good credit can set you up for other financial successes. For example, you may be more likely to receive a loan or you may qualify for a lower interest rate, which can save you money in the long run. A clean credit reportand its positive effect on your credit scorecan make it easier to get rewards credit cards, which offer perks, such as travel deals or cash back. And you may qualify for higher credit limits on your cards.

Read Also: How To Get A Credit Rating

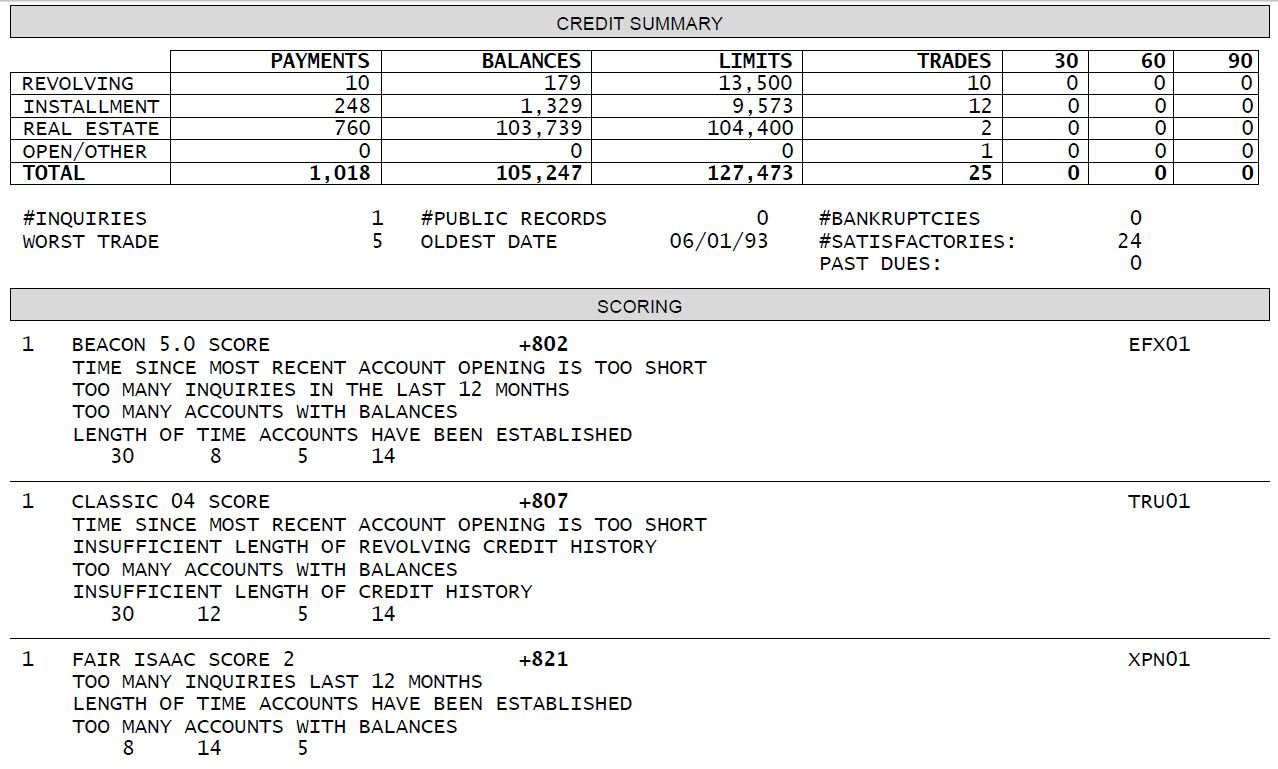

How Is My Credit Score Calculated

Although it’s hard to find a definite mathematical formula, Equifax reports that several factors contribute to your overall score to some degree. These include:

- Your payment history, including what you’ve paid and how much

- Your credit utilization, which measures your credit balances in relation to your credit limits

- The length of your credit history

- Public records, for example monies owed from civil legal proceedings, liens, unpaid taxes, and so on

- The number of credit inquiries on your account

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Why Did My Credit Score Go Down

How To Get A Free Credit Report From Annualcreditreportcom

AnnualCreditReport.com is the only website authorized by the federal government to provide you with your free annual credit reports from Equifax, Experian and TransUnion. This website is also where you can access a free copy of your credit report each week until April 20, 2022.

Once youre ready, head to AnnualCreditReport.com on a private, secure internet connection. Do not enter sensitive information while connected to public Wi-Fi, even if you trust the website. And do be sure that youre on the correct webpage, as there are many look-alike sites that will try to harvest your personal information.

From the home page, click on Request your free credit reports. Youll need to complete three main steps to access them, which shouldnt take you more than five or 10 minutes if you have all of your personal information memorized or have the necessary documents nearby.

The first step is to fill out an online request form. You will need to provide the following information:

- Your full name

- Your phone number

- Your current address

- And your previous address if youve lived at your current residence for two years or fewer

The second step is to select which of the three you would like a credit report from. You can select one or all three, if youd like.

Lastly, you’ll need to answer a few questions to verify your identity for each of the credit bureaus you selected.

Repeat this process as necessary for each credit bureau.

Annual Credit Report Request Service

P.O. Box 105281

One Free Report Every 12 Months

Everyone is entitled by law to look at their credit report from each of the three credit bureaus free of charge once every 12 months, or you can buy a credit report from each of the three bureaus if you want to view your report more often.

The three large U.S. credit bureaus Equifax, Experian and TransUnion were required by a 2003 federal law to set up AnnualCreditReport.com as a central online resource for report requests. You can also request your reports by calling 877-322-8228 or by downloading a request form and mailing it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Upon visiting AnnualCreditReport.com, users are directed to a form page and asked to provide personal identifying information, including name and address, Social Security number and date of birth.

After submitting your basic information, you go to a page allowing you to select reports from the three large credit bureaus by checking boxes next to the Equifax, Experian and TransUnion logos. You can select one or all of the credit bureaus. Instructions discuss whether you should review all three reports immediately, or whether you should spread the requests over a period of time.

If you use up your free credit report and want to check again for some reason, you can pay about $20 for each report. Or, you can get a free TransUnion credit report from CreditCards.com.

Recommended Reading: How To Remove Closed Accounts From Your Credit Report

What A Good Credit Score Can Do For You

A good credit score offers more than just bragging rights. Having a high score makes it easier to be approved for credit cards and loans, qualify for lower interest rates, and get higher credit limits and loan amounts. Not only that, your credit score opens up a range of credit card options, including top-tier rewards credit cards.

Many auto insurers use a to calculate your insurance premium, too. So having a good credit score allows you to pay less for insurance than if you had a lower credit score.

Add cellphone retailers to the list of companies that use your credit score. With smartphone price tags commonly topping $1,000, paying for a phone in installments is budget-friendly. Depending on your carrier, your credit score may be used to determine whether you can finance a new phone and the amount you’re able to finance. A good credit score may allow you to finance the phone of your choice with a low or no down payment.

Request A Change To Your Credit Report

If you believe there is inaccurate, incomplete or out-of-date information inyour credit report, you can apply to amend the information held on the CentralCredit Register.

If you believe you have been impersonated by another person, you have theright to place a notice of suspected impersonation on your report.

Add a statement to your credit report

It is possible to add a personal statement to your credit record to clarifyit. This is known as an explanatory statement.

For example, if you have had significant expenses due to relationshipbreakdown, bereavement, illness or another cause, you may add these details toyour record.

The statement must be factual, relevant to the information in the creditreport, and under 200 words. It should not contain information that couldidentify another individual .

You can get more information in the factsheet Placingan explanatory statement on my credit report .

The statement is added to your credit report and it can be viewed when yourdata is accessed. However, lenders do not have to take your statement intoaccount when assessing you for a loan.

You May Like: What Kind Of Credit Score To Buy A House

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

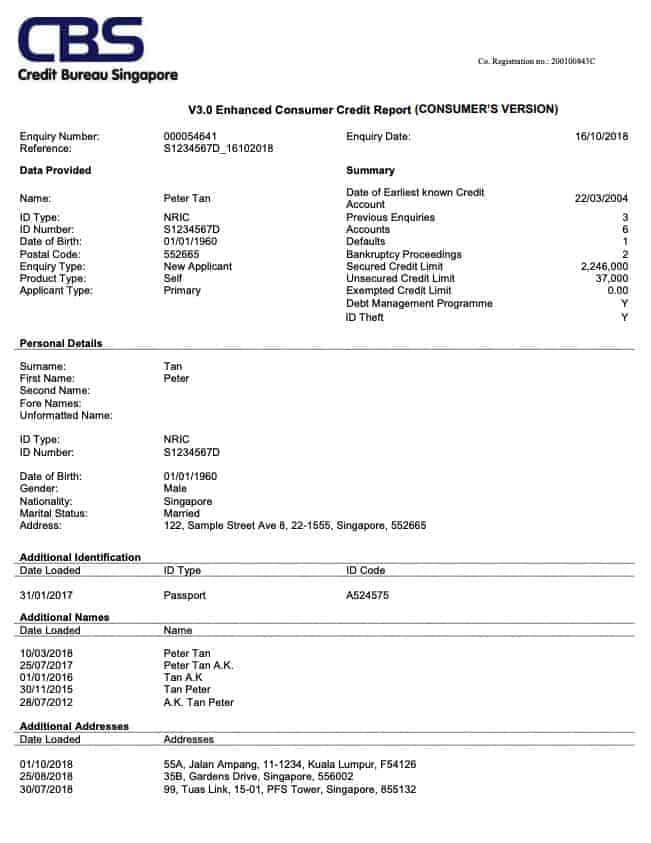

What Is A Credit Report

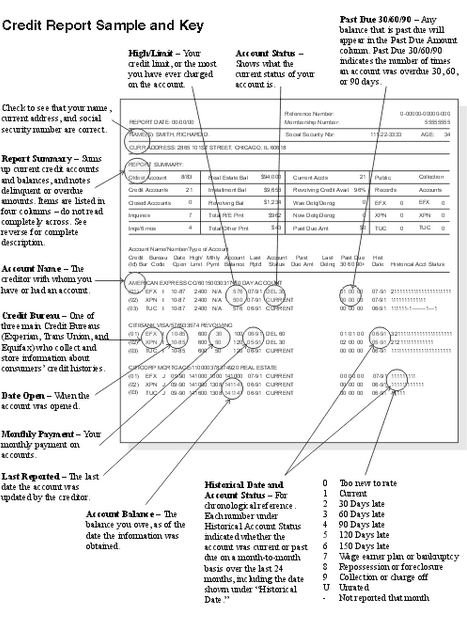

A credit report is kind of like a report card for your credit history. It can be used by potential lenders to determine how risky it is to lend you money, which is basically just how likely you are to pay your monthly payments on time. Your credit report can tell them:

- The date you opened any credit accounts or took out any loans

- The current balance on each account

- Your payment history

- The credit limits and total loan amounts

- Any bankruptcies

- Your identifying information

A credit bureau or credit-reporting company like Equifax, Experian or TransUnion will provide your information to whatever company may be considering giving you a loan or credit account. These bureaus all operate independently, so their reports may be slightly different depending on the information provided by the lenders they used.

You May Like: How To See Your Credit Score For Free

Personal Datamake Sure You Are Really You

Nothing special here, just the basic stuff. Every report begins with your name, social security number, address, phone number, and employer info. This section will also show all past addresses and employers, as well as your unique credit report number.

Red Flags: Make sure all your info is correct. Its quite possible for the bureaus to mix you up with someone that has the same or similar name. If that happens, it could be catastrophic for your credit score, so make sure everything checks out right out of the gate. While youre in the area, double-check your social security number as welljust to be safe.

Additional Ways To Acquire Your Credit Report

The above strategies are focused on the three major credit bureaus: Equifax, Experian and TransUnion. However, while those three bureaus are nationwide and are likely to have the most comprehensive consumer data on you, they are not the only organizations to compile credit reports.

According to the CFPB, you are also eligible to receive free annual reports from approximately 50 additional specialty credit-reporting agencies. These companies compile consumer data in the following areas:

- Checking and banking accounts

- Gaming history

- Low income and subprime credit

- Medical records

- Supplementary credit records

- Tenant and rental records

- Utility payments

While it may be overkill to pull dozens of credit reports from these niche agencies on a regular basis, their reports can come in handy in certain circumstances. If a bank denies your request to open a checking account or if a landlord rejects your rental application, you can pull a report from the corresponding agencies to see if somethings on your consumer record.

View the CFPBs detailed list of credit agencies for contact details of the individual companies and what areas they specialize in. Note that not all of the companies are nationwide, and they might not all have data on you.

Don’t Miss: How Long Does Eviction Stay On Credit Report