Can I Freeze My Child’s Report

If your minor children have credit files, it can be a good precaution to freeze those files. Underage children ordinarily have credit files only if you’ve made them an authorized user on a credit card or as a result of identity theft.

To freeze a credit report for someone under 16, you’ll need to prove you have authority to make that request. Proof of this authority can include:

- A court order

- A lawfully executed and valid power of attorney

- A document issued by a federal, state or local government agency in the United States attesting to your parental relation to the minor

- A birth certificate

You can thaw the files when the children come of age and are ready to begin seeking credit on their own.

A Lock Can Be More Convenient

All consumers requesting a freeze from Experian get a personal identification number to use to manage their credit information. Equifax and TransUnion have you create a password if you manage your credit online, and will issue you a PIN if you manage your credit on the phone or by mail.

These PINs and passwords are important because youll need them in case you want to temporarily lift your credit freeze in the future, for instance, if you want to apply for a new credit card. And remember, youll have to make the request with each of the credit bureaus.

Its important to keep somewhere safe, Rossman says.

And it may take a bit of time before a request to lift a freeze goes into effect.

The new law mandates that credit freezes can be lifted in less than 1 hour, but I recommend allowing a bit more lead time, says CreditCards.com industry analyst Ted Rossman. For example, if youre planning on car shopping soon, Id lift the freeze about three business days before applying for an auto loan. That gives you a grace period in case you hit an unexpected delay.

A credit lock, on the other hand, is activated or lifted using an app on your smartphone, and its instantaneous.

How To Freeze Your Credit With Experian Equifax And Transunion

Freezing your credit with all three major credit bureaus is the single most important thing you can do to protect yourself against identity theft and stop criminals from opening lines of credit in your name and its free!

In this article, well show you how to place a security freeze on your credit with all three main credit reporting bureaus Experian, Equifax and TransUnion.

Well also answer questions that Team Clark gets most often surrounding credit freezes and let you know about the one key step you need to take before you freeze your credit.

Read Also: Carmax Approve Bad Credit

Pros And Cons Of Locking Your Credit File

According to Alayna Pehrson, digital marketing strategist at the consumer review site BestCompany, Its a lot easier to unlock and lock credit than it is to unfreeze and freeze credit.

Credit lock services typically cost a monthly or annual fee, Pehrson says. However, some bureaus now offer the service for free in light of recent data breaches.

Just remember, youll no longer be able to lock your credit report if you get rid of the service or product with a bureau.

As we briefly mentioned above, you should also note that credit locking isnt governed by law as credit freezing is in most states. This means that a credit freeze generally has more protections guaranteed by law, so you may have more rights if fraud occurs after a credit freeze as opposed to a credit lock.

Freeze Your Credit For Free

Placing a security freeze on your credit reports can block an identity thief from opening a new account or getting credit in your name. North Carolina residents can set up and manage security freezes free of charge. Credit bureaus must comply with online or telephonic requests for a security freeze within one business day of receiving them. The credit bureaus must comply with requests made by mail within 3 business days of receiving them.

Don’t Miss: 830 Credit Score Mortgage Rate

Limitations Of A Child Credit Freeze

Just like credit freezes for adults, credit freezes for kids cant prevent all forms of identity theft. Freezing your childs credit will prevent anyone from opening new accounts in their name, but it wont stop thieves from using your childs information for other purposes, such as:

- Work and Taxes. Undocumented immigrants sometimes use stolen or fake SSNs to apply for jobs. If theyre hired, they continue to use the same SSN to file tax returns. Your first sign that someone is using your childs SSN in this way could be a notice from the IRS saying that your child owes income taxes for this year.

- Medical Identity Theft. Thieves can also use your childs stolen information to obtain medical care, or sell it to others for that purpose. You could end up receiving a bill for medical care someone else received using your childs name.

- Benefits Fraud. Sometimes thieves use stolen SSNs and other information to apply for government benefits, such as Medicaid. Later, if your child needs to apply for the same benefit, they could be turned down because theres already an account in their name.

- Synthetic Identity Theft. This type of identity theft involves combining a real SSN with a fake name and birthdate to create a new identity. Thieves then use this fake identity for other types of fraud. Child victims often dont discover this crime until they try to apply for an account in their own name and find their SSN is already in use.

Who Can Access Frozen Credit Reports

A credit freeze makes your credit reports inaccessible to most people, with a few exceptions:

-

You can access your own records, including getting your free annual credit reports. You can also check your free credit report summary and score from NerdWallet while your credit reports are frozen.

-

Your current creditors still have access, as do debt collectors.

-

In certain circumstances, government or child support agencies can see them.

-

You can still give permission to an employer or potential employer to check your credit .

You May Like: Does Qvc Do A Credit Check

How To Freeze Your Childs Credit

Parents and guardians can freeze the credit of a child under 16.

If you request a freeze for your child, the credit bureau must create a credit file for the child, then freeze it. In addition to supplying the information required for an adult credit freeze, youll also need the childs birth certificate and proof that you have standing to freeze the childs credit.

Yes. Placing a freeze on your credit reports can protect you from fraudulent credit applications. Unfreezing your credit is typically quick when you need to apply for credit.

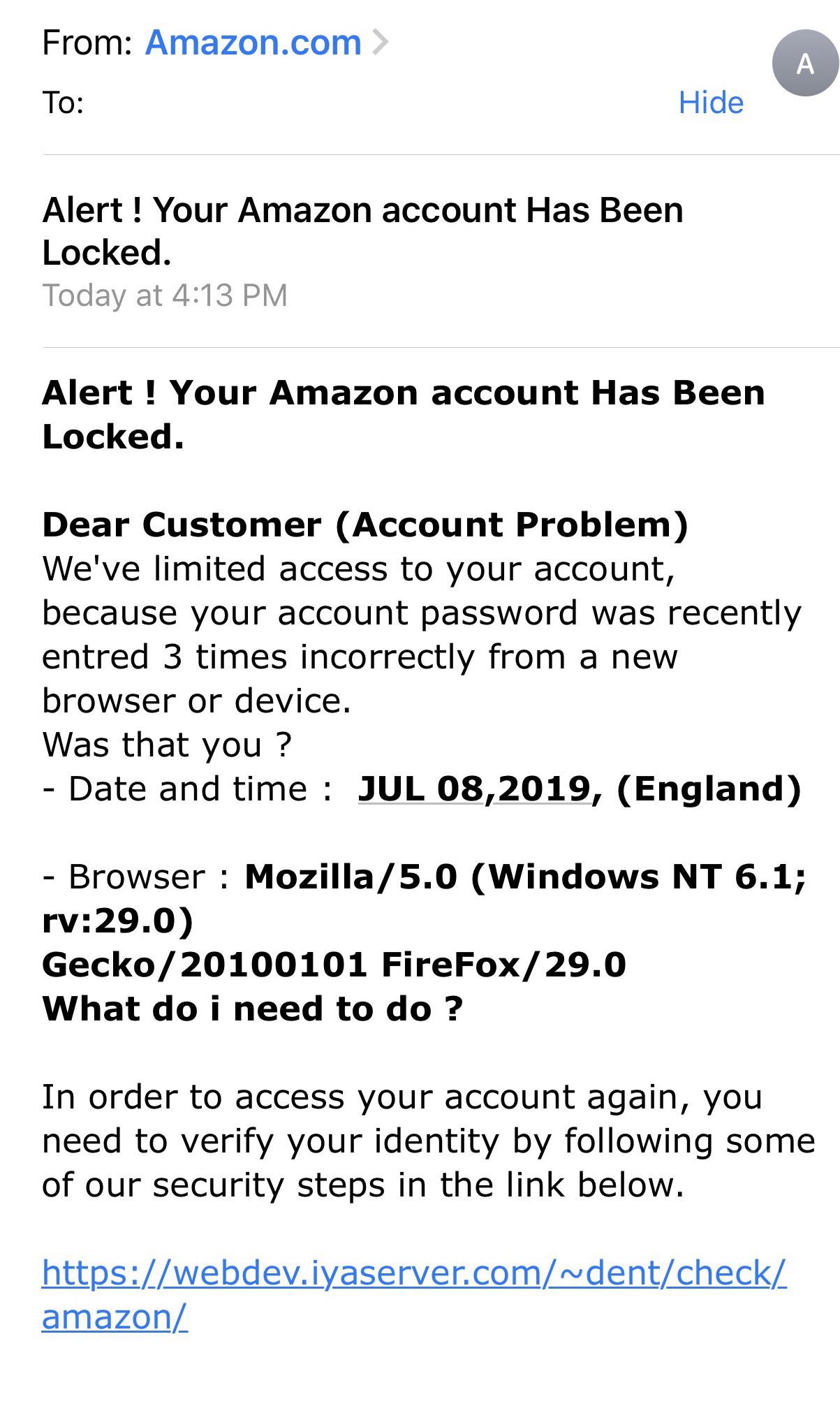

There are some downsides to freezing your credit. You may be susceptible to scams involving your Social Security number and your insurance rate could increase if your state allows insurers to use credit information to set rates.

Credit freeze services are mandated by federal law and are free. A credit lock is an optional service a credit bureau may offer you for a fee, but it offers fewer legal protections than a freeze.

What Is A Security Freeze

A security freeze blocks access to your credit unless you have given your permission. This can prevent an identity thief from opening a new account or getting credit in your name. All consumers can get a free security freeze online, by phone or by mail. A security freeze, also known as a credit or a file freeze, can be lifted temporarily when you are applying for credit, or removed permanently. Parents and guardians can also shield their childrens credit report with a special Protected Consumer security freeze. These freezes can also be used to safeguard incapacitated adults.

Don’t Miss: 820 Fico Score

When To Get A Credit Freeze

If youre not actively shopping for a credit card or loan, freezing your credit is wise. Now that freezing credit and unfreezing credit are free, NerdWallet recommends that all consumers protect themselves in this way.

If you think your data may have been compromised, for instance in a data breach, get a credit freeze. Its especially key if your all-important Social Security number may have been disclosed.

How Credit Locks Work

When you lock your credit file with a specific credit bureau, lenders can no longer access your credit file from that bureau.

While the timing for each bureaus product varies, credit locks allow you to quickly lock and unlock your reports in a relatively painless manner . Locks may be removed instantly or take up to 48 hours to be removed.

Also Check: What Credit Score You Need For Care Credit

Other Ways To Protect Your Credit

If you don’t want to pay for credit locking and a credit freeze seems too extreme, there are other things you can do to keep tabs on your credit information and protect your identity.

For instance, don’t forget that you can get your credit reports for free once each year through AnnualCreditReport.com. Reviewing your credit reports for errors or suspicious-looking activityand calling any that you find to the attention of the credit bureaucan help you preserve your good credit score.

How Do You Lock Your Credit At Each Bureau

Unlike a credit freeze, which you can add and remove from your account as needed, a credit lock requires you to enroll in a program. To make a credit lock most effective, enroll in the programs at all three of the major consumer credit bureaus Equifax, Experian and TransUnion.

Locking your credit costs nothing at Equifax and TransUnion if you enroll in their separate locking programs, but if you choose to use their joint program that locks both at once and also includes theres a fee. Theres no free option from Experian, but its credit lock program also comes with additional features like credit monitoring that may make the cost worth it to you.

To enroll in a credit locking program, youll fill out an online form that requires personal information like your name, address and Social Security number, and then youll answer some identity-verification questions.

Heres how each bureaus credit locking program works and how to enroll.

Read Also: Repo On Credit Report

How Long Does It Take To Lift A Credit Freeze

If you make the request online or by phone, the three major credit bureaus are required to lift the freeze within an hour. The request can be done by mail, but note that this is a longer process. The credit bureaus, however, are required to remove the freeze within three business days of receiving notice.

If you are making the request on behalf of a minor, note that submitting a request to lift a credit freeze can only be done by mail.

When Should I Lock My Credit

If you know or suspect your Social Security number or other personal identification information has been exposed in a data breach, consider locking or freezing your credit. A credit lock may be preferable if you plan to apply for loans or credit cards in the months and years ahead and want the ability to block and enable access to your credit files on demand.

As long as and identity theft remain causes for concern , using credit locks is a good precautionary move as well.

You May Like: 626 Credit Score Car Loan

A Credit Freeze Can Protect You From Identity Theft

Having your identity stolen is no stroll along the beach. Victims of identity theft often suffer for months and even years after it occurs. Clearing your name takes a lot of time and effortand sometimes money. It can seem like youre the one doing time, even though you werent the one who committed the crime.

To prevent your identity from being stolen, or to prevent further identity theft after your identity has already been stolen, you might consider freezing your credit report, a free service that all three major credit bureaus offer.

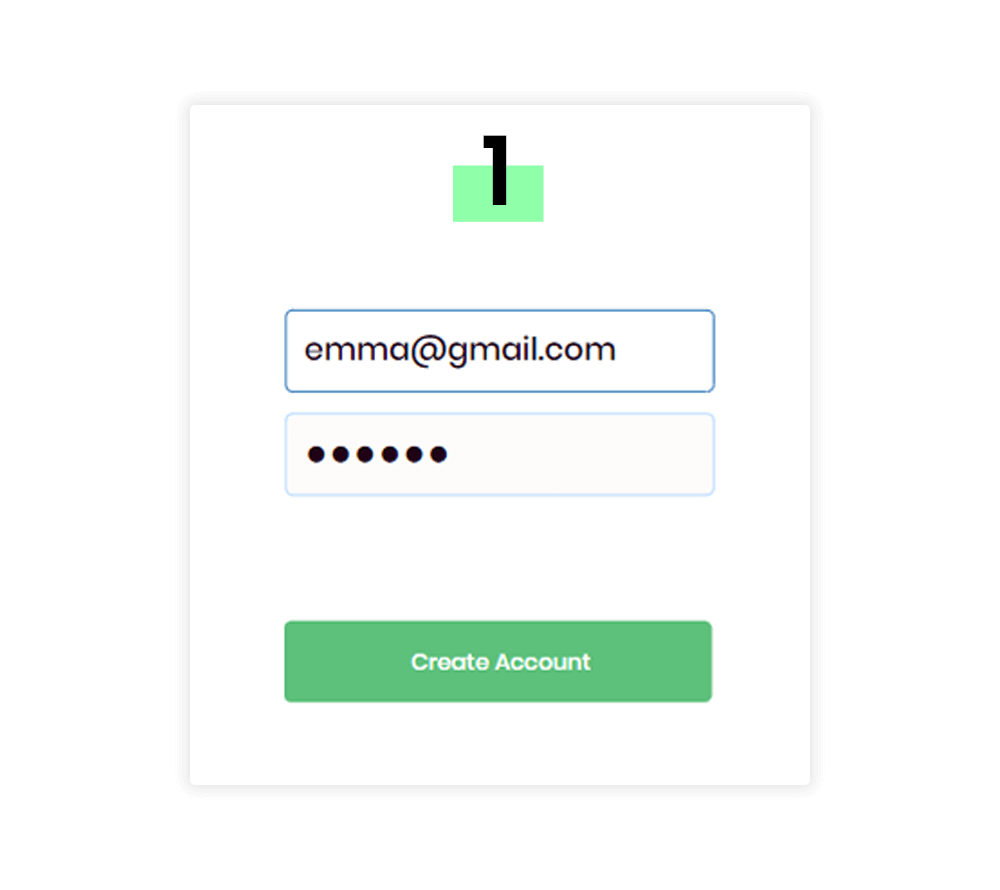

How To Get Free Security Freezes Online

To establish your security freezes, you will need to contact each of the three credit bureaus online:

Be prepared to provide detailed information about yourself, including:

- Your Full Name

- Your Date of Birth

- Your Social Security Number

You can establish and manage a security freeze by mail or phone, as well as online.

Read Also: Does Affirm Help Your Credit Score

Freeze Your Childs Credit Too

If you’re considering freezing your own credit, remember that you can freeze your childrens credit, too. A child’s Social Security number can be used by identity thieves to apply for government benefits, open bank and credit card accounts, apply for a loan or utility service, or rent a place to live.

But a lot of people dont think about the vulnerability of their kids future credit, Rossman says. In a recent study, CreditCards.com found that only half of U.S. adults had checked their own credit score or report in the 6 months after the Equifax breach came to light.

If youre not vigilant regarding your own credit, chances are, youre not thinking of someone stealing your toddlers identity and racking up fraudulent charges. This could potentially go undetected for many years until he/she grows up and starts applying for credit, only to find a big mess, Rossman says.

What Does Freezing My Credit Do

When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When your credit is frozen and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

Don’t Miss: What Credit Bureau Does Sprint Use

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

What Is A Credit Lock

Your credit reports contain key information about your financial accounts, as well as other personal details. A credit lock is a way to restrict who has access to that information.

Credit locking, offered by all three of the major credit bureaus, lets you control who can view your from your laptop or mobile device. If you lock your credit report and someone tries to check your credit history, access is denied. You can lock your credit reports with just one credit bureau or with all three.

Depending on which credit bureau’s locking service you use, you may have to pay a fee. Experian and TransUnion , for example, both charge a monthly fee to lock or unlock credit. Equifax offers this service for free .

Read Also: Does Ashley Furniture Repossession

How Do I Place A Credit Freeze

To place a credit freeze on each of your files, you must contact each credit reporting agency directly. Instructions are on the company websites:

- Equifax: 1-800-349-9660 or equifax.com

- Experian: 1-888-397-3742 or experian.com

- TransUnion: 1-800-680-7289 or transunion.com

Heres information youll likely need to supply: Name, address, data of birth, Social Security number, and other personal information.

When you set a credit freeze, you will select or be provided a personal identification number associated with the freeze.

Your PIN allows you to unlock your credit file when you want to provide access to lenders when you apply for credit. Its smart to keep your PIN in a secure place. That way, its there when you want to unfreeze your credit.

If you have been a victim of identity theft, you should consider placing a freeze on your credit files.

A credit freeze consists of three actions: You can add, lift, or remove a credit freeze.

- Adding a credit freeze means placing a freeze on your credit.

- Lifting a credit freeze temporarily removes the freeze so you can apply for credit.

- Removing a credit freeze permanently removes it.

You can do all of these actions for free.

How To Put A Flag On Your Social Security Number Or Credit Report

There are a few ways you can flag your social security number. The primary way to do this is to through a fraud alert, which will put extra protections in place for people trying to access or use your social security number or other private account details associated with your credit.

To get a credit flag or fraud alert placed with any of the three credit bureaus, do the following:

You can contact the credit reporting agencies using the following information:

| Agency |

|---|

| P.O. Box 105069Atlanta, GA 30348-5069 |

As stated earlier, youll only need to contact one credit reporting agency. By law, each of the agencies must contact the other agencies after you set up a fraud alert. This makes your life easier, as youll only need to do this once.

Don’t Miss: How Long Do Repossessions Stay On Your Credit