Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

How To Improve Your Credit Score

You May Like: How To Get An Eviction Off Your Record In Texas

Understanding The 5 C’s Of Credit

The five-C’s-of-credit method of evaluating a borrower incorporates both qualitative and quantitative measures. Lenders may look at a borrower’s credit reports, credit scores, income statements, and other documents relevant to the borrower’s financial situation. They also consider information about the loan itself.

Each lender has its own method for analyzing a borrower’s creditworthiness but the use of the five C’scharacter, capacity, capital, collateral, and conditionsis common for both individual and business credit applications.

Investopedia / Alison Czinkota

Why You Might Have A Bad Credit Score

You will have a bad credit score if you regularly fail to make credit card or loan repayments on time or miss them altogether.

REMEMBER: A default will stay on your credit file for six years from the date of default whether you eventually pay off the debt or not.

The good news is that once your default is removed, the lender wont be able to re-register it, even if you still owe them money.

Being declared bankrupt, entering an individual voluntary arrangement to pay back creditors over a set period, or having a county court judgment made against you may also badly affect your credit score.

It takes six years for bankruptcy to be wiped from your credit score, provided it has been discharged.

Making just the bare minimum repayment on your credit card each month can have an adverse effect on your credit report too. Lenders may read that as a sign that you are struggling to clear your debts.

If you are struggling with debt, contact your lender as soon as possible to ask for help. Its much better for you to be upfront than repeatedly miss repayments with no explanation.

Find out more: Consolidate your debt with a balance transfer credit card

Read Also: Repossession Credit Repair

What Is A Fico Score

Many aspects of life are affected by credit ratings. They may:

- Determine whether a lender approves a new loan.

- Influence your interest rates and fees on the loan.

- Be reviewed by employers before they offer you a new job.

- Be used by landlords when deciding whether to rent to you.

- Determine your student loan eligibility, including most private loans.

- Be reviewed by insurance companies when you apply for many types of insurance, including car or homeowners insurance.

Learning Your Credit Scores Shouldnt Be The End Of Your Credit Evaluation

Your credit reports from the three major consumer credit bureaus can help shed light on your credit history by showing information like why you may have been turned down for credit, how negative information may affect your credit, and whether someone tried to fraudulently apply for credit under your name.

Equifax, Experian and TransUnion issue separate credit reports, which may contain information about your credit activity, payment history and the status of your credit accounts based on reporting from creditors and other sources.

So why are these reports important? Because credit card issuers and lenders pull and review them to help determine things like whether youre a credit risk, what interest rate theyll offer you, and the amount of your credit limit. Your credit reports may also be reviewed when youre renting an apartment or purchasing insurance.

With so much information, where do you even start when it comes to reading your credit reports? Lets take a look.

- Address

- Phone number

If you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. You can also notify the creditor that reported the information and request that it send an update to the credit bureau.

Don’t Miss: 691 Credit Score Auto Loan

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

How Credit Score Impacts Loan Rates

With loans, an average rate is often advertised instead of a range. If you have a good credit score, you may qualify for a rate thats at or below average. With a bad credit score, you may end up with a rate far above the average.

A higher credit score doesn’t guarantee you the lowest interest rate possible. Mortgage lenders also consider other factors when setting the terms of your loan, such as your:

- Income

- Assets and savings

You can use a loan savings calculator to find out how much you can save on a loan based on your credit score. The calculator shows sample APRs and monthly payment for mortgage or auto loans with specific repayment periods for various credit score ranges.

You won’t know what APR you’ll be offered until you apply and are approved for a loan. Different lenders may also offer you different terms on interest rates. If you are taking out a loan, it can pay to get rates from several lenders, no matter what your credit score is.

Recommended Reading: Report To Credit Bureau Death

Poor Credit Score: Under 580

An individual with a score between 300 and 579 has a significantly damaged credit history. This may be the result of multiple defaults on different credit products from several different lenders. However, a poor score may also be the result of a bankruptcy, which will remain on a credit record for seven years for Chapter 13 and 10 years for Chapter 11.

Borrowers with credit scores that fall in this range have very little chance of obtaining new credit. If your score falls in it, talk to a financial professional about steps to take to repair your credit. Additionally, so long as you can afford to pay a monthly fee, one of the best credit repair companies may be able to get the negative marks on your credit score removed for you. If you attempt to obtain an unsecured loan with this score, be sure to compare every lender youre considering in order to determine the least risky options.

Doing things such as paying down debt, making timely payments, and maintaining a zero balance on credit accounts can help improve your score over time.

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

Also Check: Coaf Credit Inquiry

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

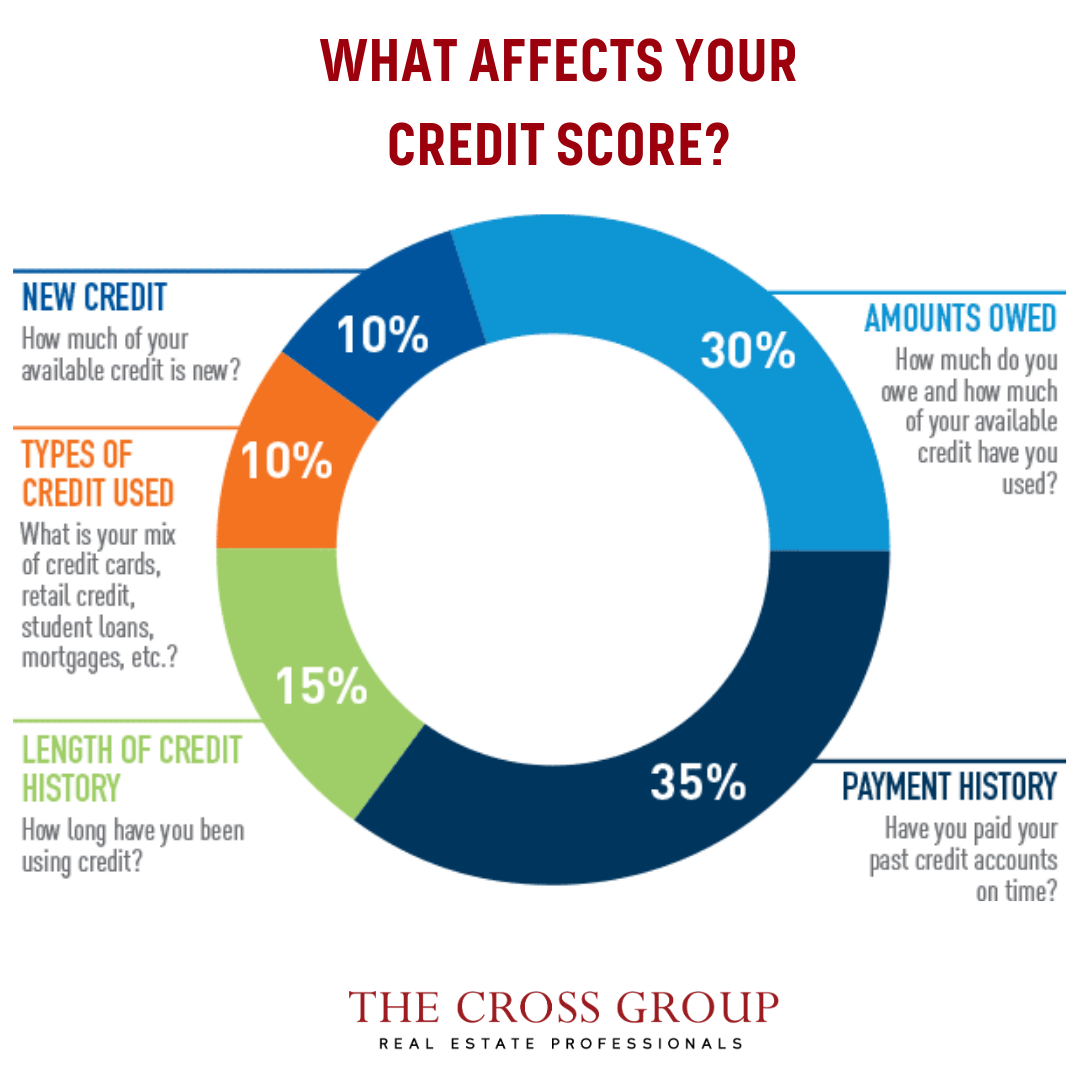

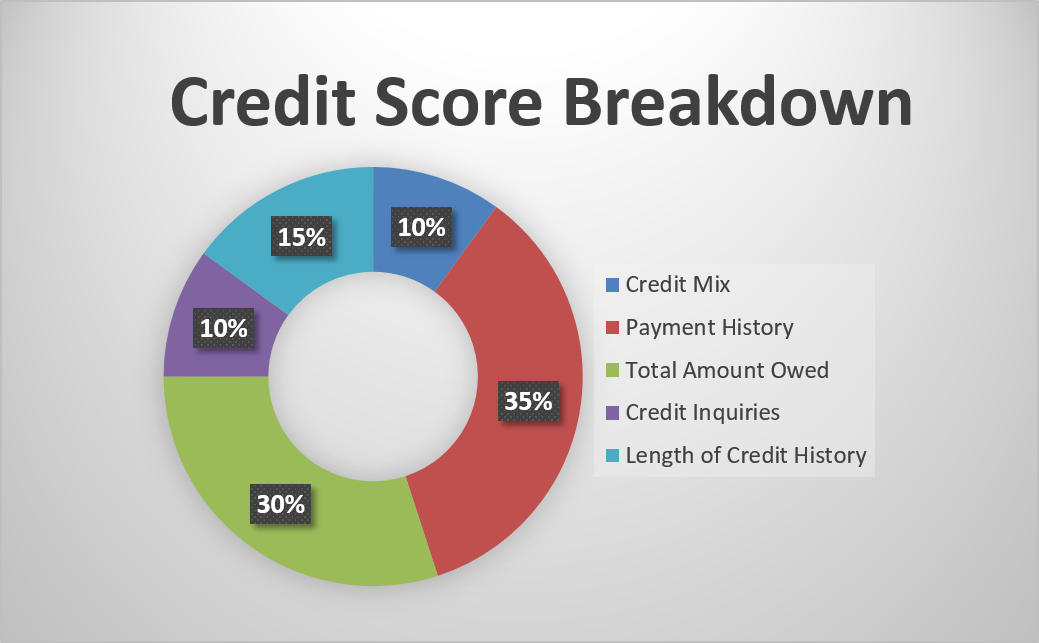

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

Don’t Miss: What Is A Factual Data Credit Inquiry

Significance Of Credit Rating

Now let us understand what the credit rating signifies.

A credit rating determines the probability of the company paying back its financial indebtedness within the stipulated time. The ratings could be assigned to a particular company, or could also be issue specific.

Below is the chart illustrating the credit rating scale from the global credit rating agencies S& P, Moodys, and Fitch. To be noted that Indian rating agencies ICRA, Crisil, and India rating and research are Indian subsidiaries of Moodys, S& P, and Fitch, respectively. The long term ratings are usually assigned to a company, while the short term ratings are essentially for specific loans or debt instrumentsDebt InstrumentsDebt instruments provide finance for the company’s growth, investments, and future planning and agree to repay the same within the stipulated time. Long-term instruments include debentures, bonds, GDRs from foreign investors. Short-term instruments include working capital loans, short-term loans.read more.

Good Credit Puts Money In Your Pocket

Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all billsincluding credit card minimum paymentson time, every time are smart financial moves. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest.

1 Scores and rates as of January 9, 2015, as reported on myFICO website.

Read Also: What Credit Bureau Does Care Credit Use

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Don’t Miss: Is 524 Bad Credit

What Are Credit Reference Agencies

Your score can range between 0-999 depending on your financial history but also the agency doing the scoring. In the UK, there are three main credit reference agencies:

- Experian

- Equifax

- TransUnion

They work with banks, building societies, mobile phone companies and retailers to help them decide whether the person applying for credit is likely to pay it back.

They may score you slightly differently and a lender may use just one or several agencies when deciding whether to offer you a financial product and at what interest rate.

Find out more: Applying for a mortgage with bad credit

Tips To Improve Or Maintain Your Credit Rating

If your credit rating is good, then you want to improve or maintain it. If you have poor credit now, then rest assured that it’s possible to improve ityou do not need to live with a particular credit score for the rest of your life.

- Make loan payments on time and for the correct amount.

- Avoid overextending your credit. Unsolicited credit cards that arrive by mail may be tempting to use, but they won’t help your credit score.

- Never ignore overdue bills. If you encounter any problems repaying your debt, call your creditor to make repayment arrangements. If you tell them you are having difficulty, they may be flexible.

- Be aware of what type of credit you have. Credit from financing companies can affect your score negatively.

- Keep your outstanding debt as low as you can. Continually extending your credit close to your limit is viewed poorly.

- Limit your number of . When your credit report is “hit”that is, viewedan excess number of requests for credit might be perceived negatively.

You May Like: Does Removing Hard Inquiries Increase Credit Score

Exceptional Credit Score: 800 To 850

Consumers with a credit score in the range of 740 to 850 are considered consistently responsible when it comes to managing their borrowing and are prime candidates to qualify for the lowest interest rates. However, the best scores are in the range of 800 to 850.

People with this score have a long history of no late payments, as well as low balances on credit cards. Consumers with excellent credit scores may receive lower interest rates on mortgages, credit cards, loans, and lines of credit, because they are deemed to be at low risk for defaulting on their agreements. Having an excellent credit score is particularly useful for qualifying for a personal loan, as it typically more than makes up for a lack of collateral.