How Many Hard Credit Inquiries Is Too Many

Many factors shape your credit scores, including the number of hard inquiries you have on your credit file. Hard inquiries occur when you apply for new credit and the lender requests to review your credit report before approving you. They can have a minimal, temporary negative effect on your scores.

These inquiries differ from a soft inquiry that might occur when, for example, a lender provides quotes and preapproves you for credit offers. Soft inquiries have no influence on your credit scores.

So how many hard inquiries is too many? When it comes to calculating your credit scores, hard inquiries represent just one part of the bigger picture that makes up your credit scoresand a small one at that. Your payment history, credit utilization and length of credit history all play important roles.

Two Types Of Credit Inquiries

There are two basic types of credit inquiries and they’re each treated differently when it comes to your credit score.

Inquiries that are made because of an application you’ve made are known as “hard” inquiries. These are the only credit inquiries that count toward your credit score. For example, an inquiry made when you apply for a credit card or loan will appear on your credit report and can affect your credit score.

In reviewing your credit report, you might notice that several inquiries appear from businesses to which you didnt apply for credit. These are often from businesses who’ve checked your credit report because they want to offer goods and services to you. For example, creditors who send pre-approved credit card offers have often checked your credit report first to see if you meet the basic criteria for the credit card. These “soft” inquiries count toward your credit score.

You can opt-out of prescreened credit card offers by visiting OptOutPrescreen.com.

The version of your credit report that you see includes all inquiries made into your credit report within the past 24 months older inquiries drop off after 24 months. Only hard inquiries appear on the version of your credit report that lenders and creditors view.

So How Many Points Are We Talking Here

The credit impact from a hard inquiry will vary from person to person depending on their individual credit history as well as all the other information in the credit report. FICO says that one new inquiry typically results in a less than five-point drop in your credit score.

Five points isnt a colossal amount, but it could drop you into a lower rate tier. Generate a few hard inquiries in a short period of time, and the points can add up to a more significant drop in your scores.

You May Like: How Long Will A Repo Stay On My Credit

Differences Between Hard And Soft Inquiries

Soft inquiries, also known as soft pulls, which never have any effect on credit scores, often come from:

- Companies obtaining names and addresses from the credit bureaus to make promotional credit offers to qualified consumers.

- Consumers accessing their own credit reports and scores.

- Requests for credit-based insurance scores.

- Rental property applications.

Hard inquiries, also known as hard pulls, which can hurt your score, are most often the result of:

- Follow-up credit evaluations after a promotional credit offer is accepted.

- Rental property applications.

Recommended Reading: How To Get Credit Report With Itin Number

How Much Does A Hard Inquiry Impact You

Hard inquiries are somewhat strange. Most of the time they are required but they still lower your score. This isnt the only thing that can happen, however. While in the grand scheme of things these hard inquiries are pretty inconsequential, they can still cause an impact if you dont pay attention. Lets look at some of these impacts so we can understand hard inquiries some more.

Also Check: What Is Syncb Ntwk On Credit Report

How Do Hard Pulls Affect Your Credit Score

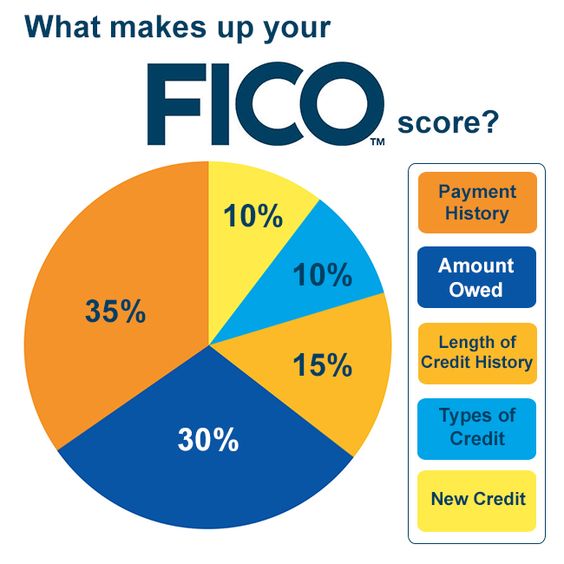

FICO determines your credit score in the following ways:

Hard inquiries fall into the New Credit category that accounts for 10% of your score. Other factors in this category are:

- How many new accounts you have

- How long its been since you opened your last account

I dont think FICO releases exactly how these factors ultimately impact the 10% category of new credit but they have provided us with some guiding information that Ill discuss below.

Related: How to Raise Your Credit Score by 200 Points

Hard Credit Inquiry Or Soft Inquiry

Some inquiries can be either soft or hard. If you rent a car, apply to rent an apartment, sign up for cable TV or internet service, open an account at a financial institution, or someone just needs to verify your identity, you may get hit with either a hard inquiry or a soft inquiry. The only way to know ahead of time is to ask the potential landlord or service provider.

Finally, if you believe a hard inquiry is on your credit report but should not be, you can dispute a hard inquiry just as you can other inaccurate information. Itâs definitely worth pursuing because it could suggest fraud or identity theft.

Read Also: What Is Coaf On My Credit Report

Don’t Miss: Does Carmax Accept Itin Number

What If You Can’t Dispute Any Hard Inquiries B/c They’re Reported Accurately

Even if a hard inquiry is reported correctly, with the 1 in 5 odds, it’s likely something else isn’t. Double-check any other negative items on your credit report for errors. That way if you find any, you can start rebuilding your credit by disputing them. If you’re not comfortable identifying inaccurate info consider help from an expert â like Credit Glory.

How Long Will A Hard Inquiry Stay On Your Credit Report

Hard inquiries usually stay on your credit report for two years. 5 However, theyll stop affecting your credit score after 36 months to one year . 578

Unfortunately, you cant remove a hard inquiry from your credit report early unless its an error . If you find any hard inquiries that you believe are mistakes, dispute the items on your credit report with the bureaus in question.

Don’t Miss: Itin Credit Report

Do Mortgage Inquiries Affect Your Credit Score Yes But You Can Still Shop

Mortgage Q& A: Do mortgage inquiries affect credit score?

When preparing to take out a mortgage, you may have concerns about your credit report being pulled numerous times within a short period of time.

This can occur while shopping for that perfect mortgage with multiple mortgage lenders or mortgage brokers over the span of a few weeks or even months.

But while mortgage inquiries can certainly add up, they wont necessarily lower your credit score or affect your ability to obtain home loan financing.

How To Reduce The Impact Of Hard Inquiries On Your Credit

Hard inquiries on their own generally aren’t enough to significantly reduce your score in a lasting way. This is especially true for those who have a positive credit history. In most cases, hard inquiries result in a temporary credit score drop that rebounds within a few months.

Improving your credit score is one of the best ways to cushion the blow of hard inquiries. To do this, focus your attention on the following areas:

- Always make on-time payments across all your accounts.

- Pay down your debt and keep your below 30% the lower, the better.

- Pay off any past-due accounts, including collections or charge-offs.

- Periodically check your credit report and credit score and pay close attention to the risk factors included with your score.

- Apply for credit only when you need it.

Recommended Reading: Syncb/ppc Credit Card

Does Your Credit Score Go Up When A Hard Inquiry Drops Off

If you recently passed the 2-year mark from the last time you had a hard inquiry on your credit , you might think that your credit score should increase as a result. However, this might not be the case.

First, a hard inquiry will only drop your score by a few pointstypically less than 5. Even if your score increases, you might not notice much of a difference.

Next, credit scores are created through a variety of factors. Its likely that your credit score already rebounded a few months after your hard inquiry anyway. If you continue to pay off your loans and practice good financial health, your credit score will overcome any hard inquiries.

Finally, most credit modeling companies only look at the past 12 months of your history. This means they might not take your older hard inquiries into consideration when assigning you a credit rating.

A hard credit inquiry is meant to provide clarity into your financial history and behavior. Its not meant to punish your credit score. This is why a hard inquiry dropping off might not have the impact you expect.

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

5 MINUTE READ

Read Also: Can You Dispute A Repossession

Erase Inaccurate Negative Items For Good W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

How Do Credit Inquiries Affect Your Credit Scores

Now you know that hard credit inquiries can have an impact on credit scores. But you might be wondering how.

According to credit-scoring company FICO®, a hard inquiry can cause your credit scores to dropâusually by just a few points. Hard inquiries can stay on your credit reports for up to two years. But they might only affect your scores for a year.

Why would a hard credit inquiry cause a drop in credit scores? As the Consumer Financial Protection Bureau explains, credit-scoring models generally look at how recentlyâand how oftenâyouâve applied for credit. So a single hard inquiry may have a relatively minor impact on your scores. But multiple hard inquiriesâespecially multiple hard inquiries over a short period of timeâcould have more of an impact.

Hard inquiries can also have more of an impact on your scores if you have few accounts or a short , according to FICO.

Ultimately, as FICO explains, âThe impact from applying for credit will vary from person to person based on their unique credit histories.â

Keep in mind: Credit-scoring companies use different formulas, or models, to calculate credit scores. And there are many different credit scores and scoring models. Some credit scores even use different ranges. That means people may have more than one score out there.

Also Check: Afni Pay For Delete

Can You Remove Hard Pulls From Your Credit Report

If theres a hard pull on your credit report that you know is not supposed to be there you can dispute it. There have been controversial ways to remove hard pulls in the past but Im not going to get into those since they are mostly dead and they can often be more hassle than they are worth.

Keep in mind that if you aggressively dispute things on your credit report , your credit report can become subjected to heightened fraud protections. This can be a real pain when youre pursuing multiple credit cards because it might bring unwanted attention to your applications and lead to denials, since youll often have to call in and may not be able to get auto-approved. Just something to think about.

Managing The Impact Of Hard Inquiries On Your Credit

There are three ways to manage the impact of hard inquiries on your credit:

- Apply for credit only when you need it: The fewer credit accounts you apply for, the fewer hard inquiries youll receive and the fewer points youll lose. Youre also more likely to be approved for a loan if you dont open too many accountsseeking a lot of new credit in a short period of time may be taken as a red flag by potential lenders.

- Check if youve been pre-approved: If a lender has pre-approved you, it means they think youre a good candidate for a loan or credit card. Formally applying will still trigger a hard inquiry, but if youre pre-approved, your application is more likely to be successful, which may prevent you from needing to apply with other lenders. This will minimize the number of hard inquiries you receive.

- Monitor your credit: Use a credit monitoring service to regularly check how many hard inquiries are on your credit report. If you already have several inquiries, consider waiting before you apply for a new line of credit.

Takeaway: Lenders set their own standards for how many hard inquiries you can have.

Article Sources

Read Also: Affirm Credit Requirements

What Are Credit Report Inquiries

A credit inquiry is just that: When someone formally inquires about your score or credit report. Why do they do this? To judge your credit worthiness. It shows up on your credit report under a heading called inquiries. So when anyone in the future pulls your credit report to judge your credit worthiness, they will see it listed.

While an inquiry itself is not inherently bad it doesnt mean you did anything wrong too many can damage your credit score

It is important to understand that there are two basic types of inquiries: soft and hard.

The difference between a hard and soft credit inquiry is:

Ahard inquiry would be when someone pulls your report with your permission, because you applied for credit or something else . This gets listed on your report, as described above by impacting your credit.

On the other hand, a soft inquiry is a bit different in that it may be listed on your report but will NOT impact your score .

Soft inquiries are visible on this report, but they dont affect credit score.

Soft inquiries are often pulled by a creditor that you already have, such as your current mortgage company or a bank whose credit card you already have in your wallet. They may request an updated credit score without your explicit approval .

How Do Loan Inquiries Affect Your Credit Score

When it comes to calculating FICO credit scores, the two most important contributing factors are payment history and credit utilization ratio , with each contributing approximately 35% and 30%, respectively to the overall score. These two variables are what matter most.

However, loan inquiries, and specifically the number and frequency of hard pulls contribute approximately 10% to the calculation of a FICO credit score. As an individual searches for an appropriate mortgage or auto loan, it is common practice to apply for several loans and shop around for the best loan amount, interest rate and terms. Then there are those individuals who are less certain about their credit and ability to receive a loan that apply to multiple lenders in an effort to increase their chances.

In either case, potential lenders will run a hard pull on the individuals credit score and profile, and this negatively impacts a credit score. But how badly? How does it work? Read more on our website about how loan inquiries can affect your credit score and how to best go about finding the right loan option for your unique situation.

You May Like: Credit Report With Itin

Does Checking Your Credit Score Lower It

Checking your own credit score is considered a soft inquiry and does not lower your credit. There are many free credit score services and out there, and these services do not generally perform hard inquiries on your credit file. If a credit-tracking app or website does make an inquiry into your file as part of its credit monitoring process, it will be a soft inquiry that will have no effect on your credit score.

You also dont need to worry about lowering your credit by checking your credit report. Any time you pull your credit file from Experian, TransUnion or Equifax to assess your credit history and/or dispute credit report errors, it counts as a soft inquiry and wont affect your credit score.

How Many Points Does A Hard Inquiry Affect Credit Score

A hard inquiry on your credit will likely cause your credit score to drop points. Depending on your current credit situation, you might lose more or fewer points. According to FICO though, you can reasonably expect your score to decrease by 5-10 points. This type of credit check or credit inquiry can show up on your credit reports as well. What even is a hard credit inquiry and why does it sound so bad? Well, lets explore it some more.

Also Check: Paypal Credit Report To Credit Bureau