Chase New Car Loan Rates

1. Finance and Drive Chase Auto Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles usually have a higher interest rate. Loan

Can I Get A Car Loan With A Credit Score Of 600

You can certainly get a car loan with a credit score of 600, which is considered subprime. However, youll probably have a tougher time getting approved for a loan with a favorable interest rate. According to ExperianTM, the average interest rate for a new car from a borrower with a deep subprime credit score in 2019 was 14.3%.

For new cars from a borrower with a super-prime credit score , the average interest rate was 4.01%. As you can see, those with low credit scores were paying more than 10% on their car loans.

Can I Buy A New Car With A 600 Credit Score

Yes, you can buy a new car with a 600 credit score. However, if you borrow money to do so, youll pay a lot in interest.

Bad credit auto loans for subprime borrowers carry an average interest rate of 11.92%. Thats more than three times higher than the lowest interest rates on the market.

If you need to finance your purchase, youd be better off waiting until you can increase your credit score to at least 660. If you can wait for a year or two, you could easily raise your credit score 100 points or more and reach the highest credit range.

With an excellent credit score in hand, youll have your pick of financing options.

You can find out more about taking your credit to the highest ranges here:How to Get an 800 Credit Score.

Resources

Recommended Reading: Carmax Auto Finance Defer Payment

Understanding Your Credit Score To Buy A Car

Buying a car is a major purchase. And if you’re like the majority of buyers in the United States, you might not have the budget to pay the full price of your new car in cash.

That’s where an auto loan comes in, allowing you to divide the cost of your vehicle into monthly payments over several years.

When you apply for a loan through your car dealership or financial institution, the lender often refers to your to determine how much of a risk you represent.

In this article, we’ll discuss what makes a good credit score, how your score affects the terms of your auto loan, the minimum score to buy a car, and what you can do to get a loan with bad credit.

How To Get A Car Loan Whether You Have Great Or Not So Great Credit

If you are serious about getting a car loan, regardless of your credit, then you should work with a local car dealership, one that specializes in securing car loans to credit-challenged borrowers.

The sooner you contact these dealerships, the sooner you can get a new car.

When youre ready for a car lease or loan, get in touch with the St. Catharines auto loan experts at Northway Ford for great deals on auto finance.

You May Like: Freeannualcreditreport Com Official Site

How To Boost Your Credit Score

There are many ways you can begin boosting your credit score before you consider applying for a car loan. Check out these guidelines to get you started.

Pay Your Bills On-Time

Since your plays a massive role in your final score, its essential to pay your bills on time. If you make sure you at least pay the minimum on your loans and credit cards, and dont make late payments, this should have a positive impact on your score.

Follow The 30% Rule

If you have numerous credit cards that are all maxed out, this rings alarm bells to your potential lenders. Its vital to ensure you keep outstanding balances on your credit cards below 30% of your overall limit. This will demonstrate to your banks or financial institutions that youre not low on cash and that youre responsibly for handling your finance.

Keep Credit Card Accounts Open

Its a common myth to think that if you close your credit card accounts, your credit score will increase. Thats not necessarily true. Whereas closing your credit card accounts will help you to fight the temptation of spending, it will affect your .

For example, if you have three credit cards and only one is maxed out, youve used less of your total available credit limit. But if you only have one credit card that one is maxed out, you have no available credit, therefore your credit utilization ratio is very high and your credit score will be negatively affected.

Written by Grace Gearon from | Contributing Writer for Loans Canada

A Car Loan Will Also Help Your Score

Its worth noting that once you are finally approved for a car loan, you can leverage it to build your score even more.

The biggest influence on your credit score is your payment history. When you make your car payment on time every month, your lender will report it to the three major credit bureaus .

Car loans also boost your score by helping with your credit mix. If the only type of credit you currently have is credit cards , adding an installment loan will help improve your score.

As you continue to strengthen your credit, it may make sense to refinance your auto loan in the future when you qualify for better rates.

You May Like: Affirm Financing Credit Score Needed

Shop For Car Insurance

Keeping your monthly payment under 10% of your gross income is the most important thing. Thats whats going to keep you from feeling pinched and stretched. Here are some of the top insurance providers on the market today that are operating in your local area. Find the policy that best suits your needs.

If you prefer to work with an agent, can help you save money. If youre an excellent driver, this insurer may be a great option for you. Sign up for Drivewise and earn as much as 25% back for every six months you go without an accident.

Those who have multiple types of insurance may want to look at . You can save big by bundling your auto policy with your renters, homeowners, or condo insurance. Their website makes it easy to get a quick quote to find out if you can save money by switching to them.

Related: Tips for Saving on Your Car Loan

Will You Get Credit Card Reward Points If You Buy A Car With Your Credit Card

Whether you accumulate reward points on your credit card will depend entirely on the credit card issuers policy. Some cards offer generous rewards programs, while others have strict rules on what is or is not permitted.

Suppose your credit card affords you the ability to collect travel points, cash-back incentives, or other valuable rewards points. In that case, employing it to buy a car could be a financially prudent decision. Ensure you scrutinize the fine print, so youre aware of what you stand to gain when making a large purchase like a car.

Recommended Reading: Usaa Authorized User

Not All Credit Reporting Agencies Are Created Equal

The first thing you need to bear in mind is that there are only two credit reporting agencies in Canada, TransUnion, and Equifax.

Each of these companies are private organizations and use different credit scoring models to determine the credit score of a consumer.

You could have a 720 with TransUnion but a 600 with Equifax . So, as a rule, you should sign up for with both agencies it is free, and this way, you know precisely where you stand, at least for the most part.

While you can access your credit score with these credit reporting agencies, different lenders will also use different scoring models, so these scores are only a ballpark figure at best.

Your Total Car Payment Should Not Exceed 10% Of Your Gross Income

Your dream car isnt worth having if your monthly payments eat up all the extra room in your budget. Staying below 10% means youll have money to put toward other things like an emergency fund, a down payment on a house, or a nice vacation.

It also means a change in circumstances say, a pay cut or a job loss wont turn your new wheels into an albatross around your neck.

Rules aside, everyones situation is different

Yeah, yeah, you might be saying but what if I need a car now? And not some junker, but a reliable one thatll get me to work on time?

The 20/4/10 guideline is just that a guideline. If you dont have the cash for 20% down, and you cant take the bus until you save some up, then put down less. If the only way to get your monthly payment down to 10% of your income is to extend the life of the loan, then do it.

Also, take advantage of our amazing resources to help you find the best car insurance for your individual needs. Get a quick quote from car insurance companies in your area using this tool:

You May Like: Is An 820 Credit Score Good

What Is A Good Credit Score For Buying A Car

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

To get an auto loan with a good interest rate and manageable monthly payments that fit your budget, youâll need a decent credit score. That begs the question, what is a good credit score for buying a car? Generally, youâll need a FICO credit score thatâs 500 or higher, but to get better terms and a better interest rate, youâll want a credit score thatâs higher than 660. This article will explain credit scores and what to do when purchasing a car with bad credit. Weâll also touch on how to improve your credit score and other helpful information on financing your auto loan.

Written byAttorney Eric Hansen.

Alright, itâs time. Youâve ridden the bus or taken the train for the last time. Youâve done the research, compared new and used cars, and saved up for a down payment. Youâre ready to buy a new car. But youâll need financing. To get an auto loan with a good interest rate and manageable monthly payments that fit your budget, youâll need a decent credit score. That begs the question, what is a good credit score for buying a car?

Car Loan Calculator: How Much Car Can I Afford

Modified date: Nov. 16, 2021

How much should you spend on a car? Probably not as much as you might think.

You can spend between 10% and 50% of your gross annual income on a car. Thats a big range, we know, so if we had to set a rule, it would be this:

Spend no more than 35% of your pre-tax annual income on a car.

Lower is better, but we recognize personal finance is personal. You might spend more only if you can securely pay cash for your vehicle and the kind of car you drive is important to you. You can explore how much car you can accord in our car affordability calculator below.

You can limit how much money you spend on your car by:

- Saving up and paying cash.

- Buying used.

If you do both of these things, youll save thousands of dollars compared to financing or leasing a new vehicle.

That said, sometimes you need transportation before you have cash saved to buy a car. So there are some additional rules to consider when you get an auto loan.

Whats Ahead:

Also Check: What Is Syncb/ppc

What Credit Score Is Needed To Buy A Car

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

There is no set credit score you need to get an auto loan. If you have a credit score above 660, you will likely qualify for an auto loan at a rate below 10% APR. If you have bad credit or no credit, you could still qualify for a car loan, but you should expect to pay more.

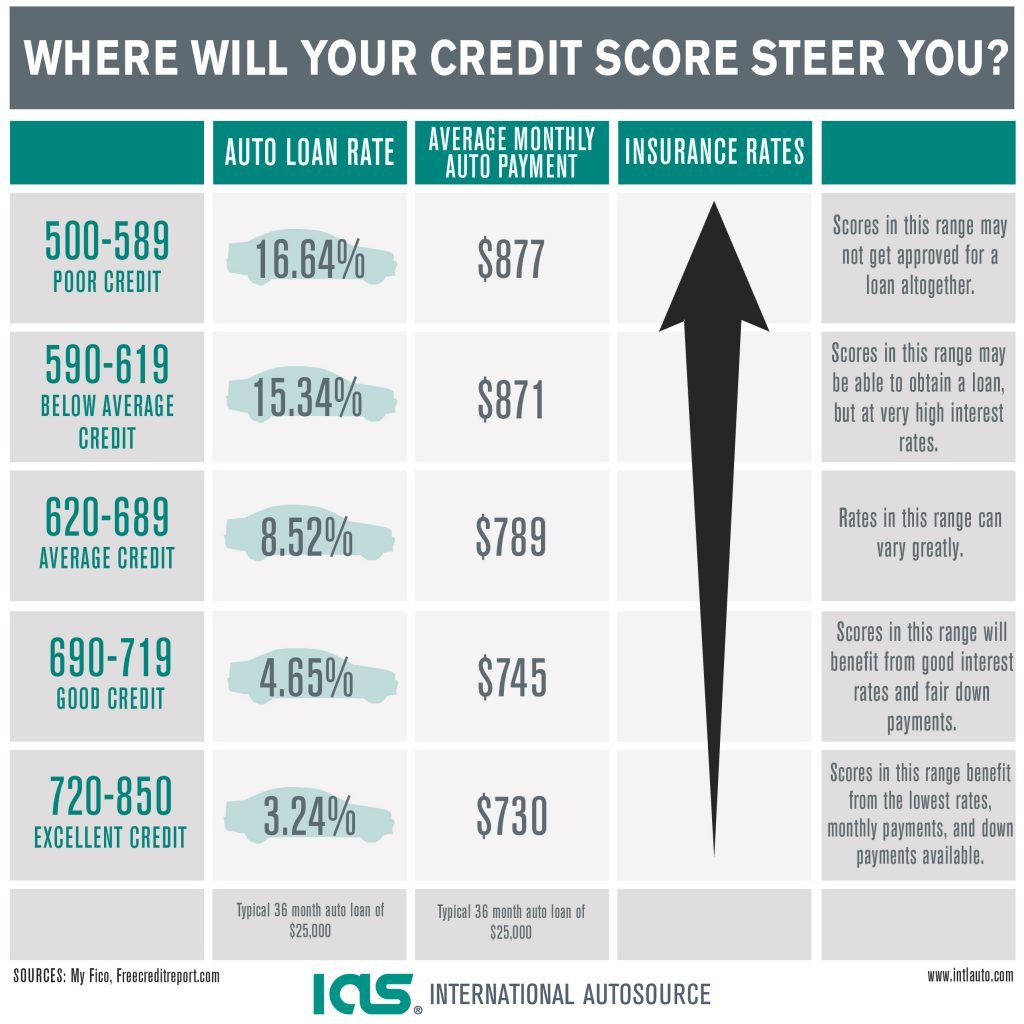

How Does Your Credit Score Affect Your Auto Loan Rates

Depending on what credit score you have, youll fall into a credit category ranging from deep subprime to super prime . As you climb up in these categories, you can be granted better interest rates and loan terms.

Lets look at an example. Currently, the interest rate for a new auto loan for someone with a deep subprime credit score is 13.97 percent. In comparison, someone with a super prime credit score can expect an interest rate of 3.24 percent for a new car. If both of these people take out a seven-year car loan on an $18,000 car, the deep subprime lender will pay $10,310 in interest over the life of their loan. However, the super prime consumer will pay only $2,142. In this scenario, having a bad credit score costs the individual more than 4.5 times in interest.

You May Like: Affirm Required Credit Score

What Does That Mean For You

It means that although different lenders use different measures, people with exceptional or at least good credit scores may qualify for lower rates, while people with lower credit scores will often qualify only for higher rates.

High Credit Score Low Interest Rate

Average Credit Score Medium Interest Rate

Low Credit Score High Interest Rate

Can You Buy A Card With A Credit Card

While its technically possible for you to buy a car with a credit card, car dealerships may be hesitant to accept this method of payment.

As buyers, we often forget that it costs businesses money to accept purchases made with credit cards. Dealerships are no different they can wind up paying 3% or more in processing fees, which adversely affects their profit margins. Unsurprisingly, they may be hesitant to allow credit card purchases.

Find out when you should use a .

Most dealerships will allow you to use your credit card to pay for a portion of the price, usually up to $5,000. Others will downright disallow using a credit card or severely restrict how much credit you can use. If there is a specific dealership youre targeting, its wise to give them a call beforehand to garner details concerning their credit card policy.

Read Also: How To Get A Car Repossession Off Your Credit

Be Willing To Pay A Higher Interest Rate

If you have poor credit, lenders see you as a riskier applicant. You may be able to get a car loan, but you’ll likely pay a much higher interest rate than someone with good or excellent credit will.

For example, the average interest rate for prime borrowers purchasing new cars was 4.21% in 2020. For nonprime borrowers, the rate was 7.14%, while for deep subprime borrowers, it was 13.97%.

That higher rate can add substantially to your total loan cost. For example, if you financed $37,000 with a four-year loan at 4.21% interest, you’d have an $839 monthly payment and would pay $3,268 in total interest.

But if you financed that same amount and only qualified for a four-year loan at 13.97% interest, your payment would jump to $1,011 per month. And youd pay $11,505 in total interesta difference of $8,237.

| The Better Your Credit Score, the Lower Your Interest Rate |

|---|

| $48,505 |

Is There A Magic Number

Be sure to check your credit report a few months before applying for an auto loan to ensure its accuracy. If youre not sure where you stand, you can order a free copy of your credit report 3-6 months before applying for an auto loan. That way, if you need to improve your credit, youll have time to do it. Its a good idea even if you arent borrowing for your car purchase because credit scores can also affect your car insurance premium.

You May Like: How To Unlock Your Credit

If You Have Some Time Before You Need To Buy

If you arent in the market for a new car immediately, now is the time to get your finances and credit in order. Consider:

- Working on your credit scores: Making on time payments is the best way to boost your credit rating.

- Establish a budget: Creating a set budget for purchases on groceries and entertainment can help you save up for that new car.

- Continue to pay down existing debt: Not only will this help your credit score, but it will decrease the impact of your future car loan.

- Dont apply for new credit: Applying for new credit could bring your credit score down, so avoid doing so until after youve purchased the vehicle.

- Dont exceed your credit limit: Avoid doing so to maintain or increase your credit score. Generally aim to use 30% or less of your credit limit if possible.

What Should Your Credit Score Be To Purchase A Car

4-minute readMarch 23, 2022

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Car shopping? If you plan to take out a loan, youll want to know how your credit score affects your ability to get approved for a loan, the term and rates.

And while there isnt a minimum credit score to buy a car, a low credit score can make it harder to get approved for a loan, or have you paying more in interest fees over the length of the loan.

Lets take a look at what your credit score should be to finance a car, and how your credit score affects what you end up paying.

In the market for an auto warranty?

Read Also: Notifying Credit Bureau Of Death