Don’t Open Too Many Accounts At Once

FICO and VantageScore look at the number of credit inquiries, such as applications for new financial products or requests for credit limit increases, as well as the number of new account openings. Making these kinds of inquiries frequently dings your credit, so only apply for what you really need in order to avoid damaging your score.

If you want a new card, but you’re not sure you’ll qualify, you can submit a pre-qualification form online. You can submit as many pre-qualification forms as you want, as they won’t impact your credit score.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

How Do You Check Your Credit Score In Canada

Nearly half of Canadians dont know where to check their credit scores.

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time though your credit score is not included on the reports.

Both of these bureaus can provide you with your credit score for a fee, and also offer credit monitoring services. For more information visit TransUnion or Equifax.How do you improve your credit score?

When you understand how your credit score is calculated, its easier to see how you can improve it. Thats the good news: no matter how bruised your score is, there are a few relatively easy ways that you can change your behaviours and improve it.

1. Make regular payments

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see: consistency, dependability, regularity and history.

When it comes to credit cards, the best financial advice is always to pay it off every month so youre never running a balance. Making regular payments is one of the best habits to get into because youre always paying down your debt.

2. Close your newer accounts

3. Accept an increase on your credit limit

Just be careful you’re not getting into more debt in an attempt to improve your credit score.

4. Use different kinds of credit when possible

Read Also: Highest Credit Limit For Victoria Secret

Why A Very Good Credit Score Is Pretty Great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 759 typically pay their bills on time in fact, late payments appear on just 23% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Connections Credit Union Nampa

Category: Credit 1. Connections CU At Connections Credit Union, we provide savings, checking, auto loans, home loans, and more at competitively low rates. We pride ourselves on offering Oak St. Branch Office. 1150 North 8th Avenue, Pocatello, Idaho 83201 Boise Downtown Branch. 249 N. 9th Street, Boise, Idaho 83702 2.

Also Check: What Is Syncb Ntwk

What Is A Credit Score

As far as your bank is concerned, your credit score is a big number above your head that tells them how much of a risk you are.

Your credit score indicates to your bank whether your past debt repayment behaviour will make you a good risk or not. Through various calculations based on your transactional records, the credit bureau will provide your bank with a three-digit number ranging between 0 and 999. Naturally, the higher the better, and a high credit score rating is one of the most valuable personal finance assets you can have.

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Also Check: Aargon Agency Settlement

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

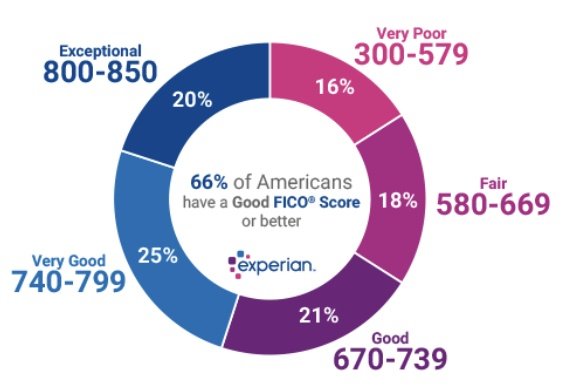

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Recommended Reading: What’s My Credit Score Chase

Formulating A Plan To Improve Your 597 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

What Does Vantagescore Have To Say

Though there are no magic score numbers or strict cutoffs, VantageScore does provide some guidance on the quality of certain VantageScore 3.0 score ranges in this credit score chart:

The above grades/categories are meant to give a general idea of how a score stacks up, but again, it all depends on the lender, the loan and your entire application.

While you cant control how a lender might view your TransUnion credit score, you can control credit behaviors affecting your score. So make sure you use credit responsibly: pay your bills on time, dont borrow more than you can afford, and watch how frequently youre applying for credit.

See your credit trends, at a glance. Get smarter about your credit with our interactive score-trending graph.

Recommended Reading: Is A 742 Credit Score Good

How Your 599 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although there are some minor differences between FICO and VantageScore, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the amount of credit that youre using . Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiry. Hard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

Usually, if your score is 599, it suggests you have one of the following issues with your credit history:

To do this, follow these tips:

How Long Does It Take To Fix A Fair Credit Score

How long it takes to fix a score of 597 will depend on various factors. If you have accurate negative items on your report, such as a collection account, these items can stay on your report for up to seven years. Until these items fall off your report, itll be much more challenging to see significant increases in your credit.

On the other hand, if you dont have anything serious bringing your score down, a few months of on-time payments and responsible financial patterns can result in a relatively quick improvement in your score.

As we mentioned earlier, a fair score is only a few points away from a good credit score. If you take the right actions, your score might improve to the good range within a few months.

Recommended Reading: Unlock My Transunion Credit Report

Reduce The Amount Of Debt You Owe

Reducing debt goes beyond just improving your credit score and signifies to lenders that you’re not a high-risk borrower. Check your credit card report to see how much you owe and stop using all your credit cards immediately, so you don’t pile up any more debts.

This one is always good when you want to improve a low credit score, as it involves establishing a good payment history by paying your bills on time and not missing any payments.

Explanation Of Credit Score Ranges

When it comes to purchasing something that requires borrowing money, your credit score is the three-digit number that tells lenders if you’re a worthy investment or not. Whether you are applying for a mortgage, home loan, car loan or boat loan, lenders will make a decision after looking at your credit score and other information. The higher your credit score is, the more chances you have at obtaining any loan you want at affordable interest rates .

Also Check: Credit Score Usaa

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 597 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Also Check: Qvc Shopping Cart Trick

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Can I Get A Car / Auto Loan W/ A 597 Credit Score

Trying to qualify for an auto loan with a 597 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 597 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Recommended Reading: How To Remove A Repo From Credit Report