Cnbc Select Reviews Credit Report Basics And How You Can Get A Free Credit Report So You Can Start Monitoring Your Credit Now

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Monitoring your credit report is a smart and simple way to be proactive about your finances. Checking your credit report regularly can help you spot fraud early and ensure the correct information is reported to the credit bureaus. There are many resources available so you can get a free credit report as often as once a month.

Below, CNBC Select reviews credit report basics and different ways you can get a free credit report, so you can start monitoring your credit now.

Other Situations Where You Are Eligible For A Free Credit Report

If you are a victim of identity theft, you are entitled to place a fraud alert on your file and to receive copies of your credit report from each of the three credit reporting companies free of charge, regardless whether you have previously ordered your free annual reports.

For more information on ID theft, including advice for victims and tips on prevention, review the Attorney Generals Consumer Alerts: Identity Theft Prevention and Identity Theft Recovery.

If a company takes adverse action against you, such as denying an application for credit, insurance, or employment, you are entitled to a free credit report if you ask for it within 60 days of receiving notice of the adverse action. The notice will give you the name, address, and phone number of the credit reporting company to contact.

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Also Check: Removing Repossession From Credit Report

How To Get A Free Annual Credit Report:

- Online: Visit AnnualCreditReport.com and click on Request Your Free Credit Reports, then fill out the request form, which will require your name, address, Social Security number, and date of birth. Then, choose which bureau you want a report from to view them online.

- : Call 1-877-322-8228 and press 1, then follow the prompts. You will need to provide the same information as the online method.

- : Print and fill out the Annual Credit Report Request Form. Then, mail it to Annual Credit Report Request Service / PO Box 105281 / Atlanta, GA 30348-5281.

If you get a report from AnnualCreditReport.com, its best not to check your Experian, Equifax and TransUnion reports all at the same time. Review one of them now, and save the others for later, spreading them out across the year. Pulling your reports in rotation will help you ensure that youre not missing anything for an extended period of time.

Just bear in mind that using only AnnualCreditReport.com would be a mistake, as it would normally blind you to credit-report changes for much of the year. Due to the COVID-19 pandemic, however, all three credit bureaus are offering free reports weekly on AnnualCreditReport.com through April 2021.

While WalletHub and AnnualCreditReport.com are the best options for getting a free credit report, there are plenty of other choices, too.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Read Also: Does Renting A Storage Unit Build Credit

Make A Request For Your Credit Report

Once you have chosen how you want to request a credit report and have all of your personal information ready, it’s time to make or submit your request. You can either request a report from all three companies simultaneously or you can order one at a time. In regards to the latter, by spacing out your requests for each company’s report , you can consistently monitor your credit health over time at no cost to you. After youve received your free annual credit report from one company, you can still request another from the same agency, though you may be charged up to $13.50 for each subsequent report until 12 months have passed since your prior request.

Can I Get A Free Credit Score Too

Unfortunately, the law does not mandate that credit reporting agencies give you a free credit score with your free credit reports. However, Lexington Law Firm offers a free FICO credit score as well as a free credit repair consultation. You can get that by visiting their site or calling .

There are also several credit card companies that offer a free credit report.

You can often order your credit score alongside your free credit report for an additional fee as well from the credit reporting agencies. However, these scores are considered FAKOs as they are not real FICO credit scores .

While the VantageScore is used by some businesses and institutions, the vast majority still rely on FICO scores to make credit decisions. So before you pay for any credit score, make sure that its one that will be useful to you.

If you want to monitor your credit reports and credit scores monthly, you might want to consider a credit monitoring service.

You May Like: Does Removing Hard Inquiries Increase Credit Score

How Do I Get A Free Copy Of My Equifax Canada Credit Report

How do I get a free copy of my Equifax Canada credit report? You may request a free copy of your Equifax credit report through one of the options below:

1. Click here to order your free credit report online from Equifax Consumer Services LLC , a company based in the United States. ECS securely collects and stores your credit report from Equifax Canada and uses it to provide your product.

2. To order your free credit report directly from Equifax Canada by phone, call 465-7166

3. To order your free credit report directly from Equifax Canada by mail, please download and complete this Canadian Credit Report Request Form and mail it along with photocopies of the required identification to:

Equifax Canada Co.P.O. Box 190Montreal, Quebec H1S 2Z2

4. To order your free Equifax credit report in person, visit one of our three office locations listed below.

Please bring with you at least two pieces of valid government-issued identification, including one piece of photo identification, and proof of current address. Photocopies and electronic versions are not accepted at the office. We require these documents so that we can validate your identity and confirm your information.

The locations, hours of operation and languages available onsite are listed below. Hours of operation are subject to change. Province-specific credit report request forms are available at each office location.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

You May Like: Does Carmax Accept Credit Cards

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Read Also: What Credit Report Does Chase Pull

Other Ways To Get A Free Credit Report:

The free annual credit report is available to everyone in the United States. However, in addition to that, you can also get a free credit report directly from a credit reporting agency if youve been denied credit.

You have 60 days from the time you are notified of the denial to request your credit report. Your request must also be with the credit reporting agency that was used to check your credit.

If you are ordering a free state report, or you are getting a free credit report due to any of the other factors weve talked about, youll need to contact the nationwide credit reporting agencies directly. Equifax and TransUnion make it easy to order these free credit reports online, but to get your free Experian credit report, you may need to call.

The contact information and links for each are here:

- Free Experian Credit Report call 1 866 200 6020 to confirm eligibility and get your credit report by mail or use this link.

- Free TransUnion Credit Report order online through this link.

Remember: Keep track of when you order your credit reports and from which bureau so that you know when youll be eligible to order your next credit report for free.

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Recommended Reading: Is Opensky Reliable

How To Get Your Annual Credit Report From Experian

Starting April 20, 2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports for the next year through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

Go To Annualcreditreportcom Or Call 1

You can only request your credit report through AnnualCreditReport.com or by calling the verified phone number 1-877-322-8228. If another source claims to have your credit report in exchange for personal information, it’s probably a fraud.

Requesting your credit report won’t negatively affect your credit, but again, you’re limited to three reports per 12 months under federal law.

Don’t Miss: Tri Merge

Repeat The Process At Regular Intervals

Once you know how to request and read your credit report, it’s crucial to repeat the above steps at regular intervals in order to continuously monitor the state of your credit. In addition to giving you a means of tracking how your credit is growing, this practice will also enable you to better keep an eye out for potential problems or mistakes. As previously mentioned, this can easily be achieved by spacing out your free annual credit report from each of the three major credit reporting companies throughout the year.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Also Check: Syncb/ntwk

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

Read Also: Is 524 Bad Credit

Why Don’t My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Nationwide Consumer Reporting Agencies

The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on consumers. Your credit history contains information from financial institutions, utilities, landlords, insurers, and others. The credit bureaus provide information on you to potential credit granters, insurers, landlords, and employers. You have the right to get a free copy of your credit history in several situations:

You also have the right to a free copy of your report from each of the credit bureaus every year.

You May Like: Credit Karma Rapid Rescore

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: How To Get Repossession Off Credit

If Something Looks Wrong File A Dispute

If any of the details, such as a date, balance, or payment looks incorrect or if there’s an entirely unrecognizable account you can file a dispute directly from the online report, or by calling the credit bureau’s help line.

Again, all three credit bureaus will give you your report for free once a year, but all three bureaus offer paid identity-monitoring services, should you so choose. TransUnion, Experian, and Equifax’s services include unlimited credit reports, email alerts when someone applies for credit in your name, and ID theft insurance.

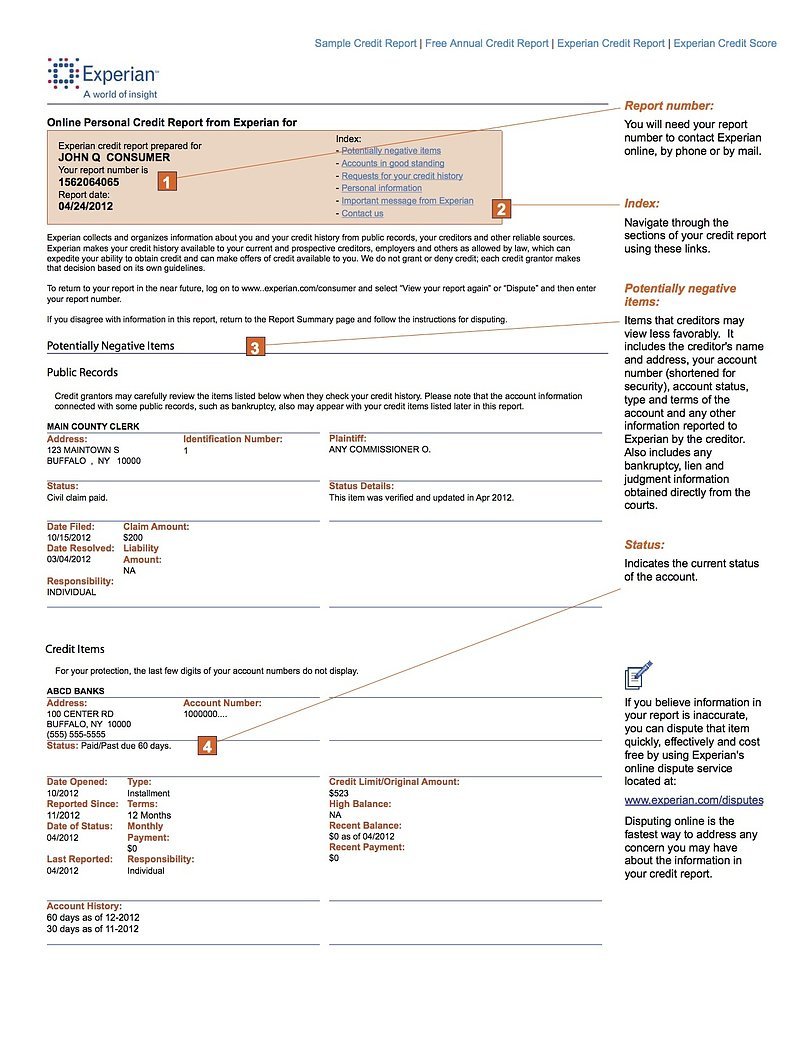

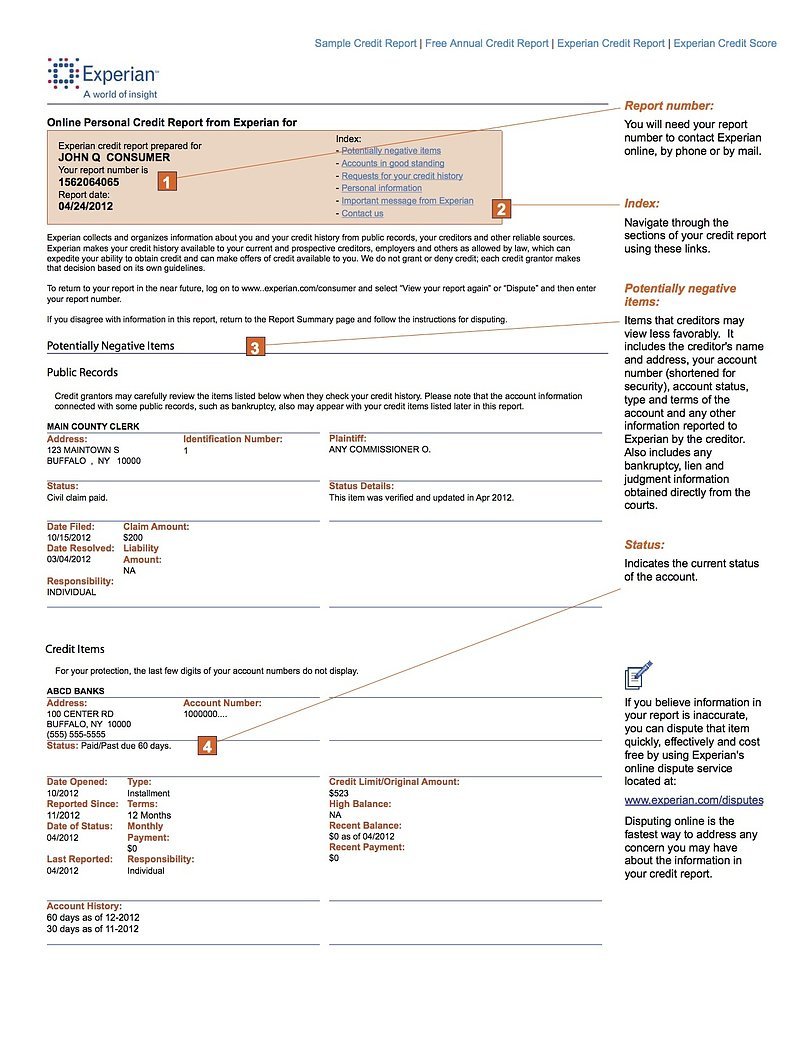

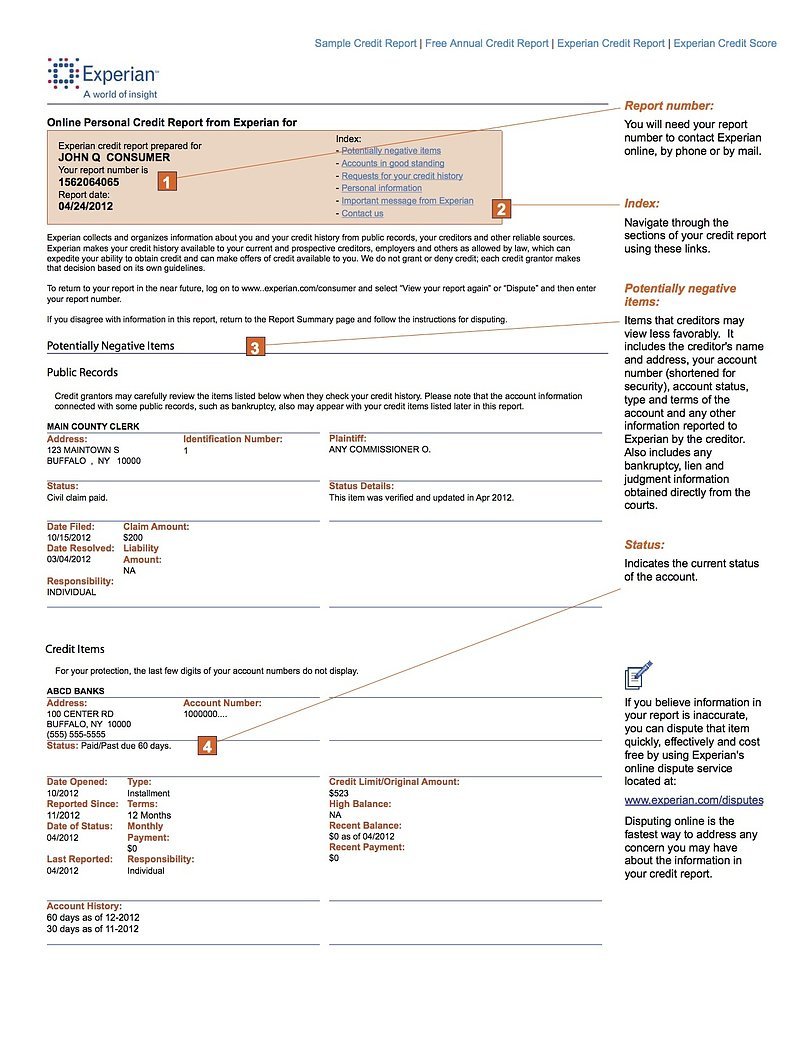

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Read Also: Care Credit Credit Score Requirements