When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

How Long Can A Debt Be Chased

If you do not pay the debt at all, the law sets a limit on how long a debt collector can chase you. If you do not make any payment to your creditor for six years or acknowledge the debt in writing then the debt becomes ‘statute barred’. This means that your creditors cannot legally pursue the debt through the courts.

Is There Anything More Annoying Than A Roommate Who Leaves Their Dirty Dishes In The Sink

Youve asked them to wash their dishes before, and they said they would do it, yet they dont. Then they forget again and a few more dishes are added to the sink. By this point, youre frustrated, but not as angry as when they then do it a third consecutive time. Ultimately, you move out and tell all of your friends what a horrible roommate they were, and your old roommates reputation is ruined.

Dirty dishes might seem irrelevant to your credit reports, but what if the dirty dishes symbolized late credit card payments? Imagine that youre the annoying roommate to your creditors, who are becoming increasingly frustrated with your delinquency. They might tolerate one late payment and give you a second chance. But if you keep making mistakes, you can ruin your relationship with them, in addition to maiming your credit scores.

You May Like: How Do Evictions Show Up On Credit Reports

Get Rid Of Negative Information

Removing negative information from your credit report can boost your credit score, but erasing things from your credit report isnt easy. You can dispute negative entries that are inaccurate, wait for the credit reporting time limit to pass , or try to get the information furnisher to remove the entry from your credit report with a pay for delete or goodwill offer.

If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Samples of templates you can use for a credit report dispute letter can be found here at the Consumer Financial Protection Board website.

Can I Get A Mortgage With A Derogatory Mark On My Credit

Ultimately, your lender will look at your total credit score when deciding whether you qualify for a loan and what terms to offer you. If you have enough derogatory marks that your credit dips into the low 600s or below, you may have trouble qualifying for certain mortgages. However, there are still mortgage options for borrowers with low credit scores, such as FHA loans, USDA loans, and VA loans.

Don’t Miss: How Long Does A Dismissed Bankruptcy Stay On Credit

When Delinquency Turns Into A Default

The point at which your loan defaults depends, again, on the lenders policies. Generally, it occurs after youve missed several payments.

Defaulting is worse than delinquency because when a loan defaults, the entire loan balance is due. In addition, while you can remove a loan from delinquency just by making whatever payments are due, removing a loan from default is far more difficult. In fact, its often impossible for business owners to accomplish.

What To Do If Your Loan Application Is Rejected

If the application is denied after explanation is provided, the applicant may still have some recourse.

A consumer may challenge a loan denial if they are able to provide verification that the information on the credit report is inaccurate or not their responsibility.

It is important to understand that the lender needs verification for anything out of the ordinary that would negatively impact the loan approval.

If your challenge is unsuccessful, its probably best to wait at least a couple of months before reapplying.

Too many applications can result in multiple hard inquiries on your credit report, and can impact it negatively since they can remain on your account for 2 years.

As a result, the lender will most likely perceive that perhaps you are struggling to secure new credit.

It further damages your credit report and ultimately does prevent you from securing any credit.

If, during the time from the first denial and the second application, you have been able to resolve your credit issues, the lender will most likely acknowledge this and no longer request for a credit issues explanation.

Recommended Reading: Paypal Credit Report

How To Get Out Of Delinquency

While you may assume that you should pay what you can when you can, thats not necessarily the case, and the last thing you want is to make a payment that will not benefit your situation. Rather, the amount that you can afford to pay will dictate whether or not doing so is wise since a minimum payment at the very least is required to prevent delinquency from progressing. For example, suppose your minimum payment is $50 and you only have $25. Even if you pay that amount, your credit card company will still consider you delinquent and will assess late fees accordingly. Its therefore in your best interest to save the money until you have the full $50. This will help you avoid falling too far down the slippery slope of delinquency.

Now, lets say youve missed two $50 payments and have another due date coming up. In order to fully climb out of delinquency and become current on your bill, you would need to pay $150 total .

In order to go back to current status in this example, you would need to pay the two missed payments plus the current payment due a total of three minimum payments.

Once you become current on your credit card bill, you should start counting the months. After six months of on-time payments, you have the right to request an interest rate reduction under the CARD Act.

Know Your Rights With Debt In Collections

Having a debt in collections doesnât mean you donât have rights. You shouldnât suffer harassment as a result of being unable to pay your bill.

The Fair Debt Collection Practices Act outlines your rights, including the following:

- A collection agency cannot contact you at work if you have specifically informed them that your employer will not allow you to receive their calls in the workplace.

- They cannot contact you before 8 a.m. or after 9 p.m.

- Debt collection agencies are strictly prohibited from deceiving you. For example, it would be illegal for them to claim they are a law enforcement agency in order to scare consumers into paying.

Having a debt in collections is overwhelming for anyone, but you should remember that you still have rights. If a debt collection agency violates these rights, you can report them to the Attorney Generals office in your state or the Federal Trade Commission .

Also Check: How Long Do Repossessions Stay On Your Credit

Current And Historical Delinquency Rates

The delinquency rate is the amount of debt that is past due. This rate is expressed as a percentage and is generally used to characterize a financial institution’s lending portfolio. Delinquency rates are calculated by dividing the total number of delinquent loans by the total number of loans held by a lender. Lower delinquency rates mean fewer people are late on their payments.

The Federal Reserve tracks delinquency rates in the United States every quarter. As of the fourth quarter of 2021, the average rate for all loans and leases was 1.53%. Residential real estate delinquencies were highest, with a rate of 2.33% while credit cards topped the list of delinquency rates for consumer loans at 1.62.

The rate has steadily dropped since the recovery period following the 2007-2008 financial crisis. For instance, the overall delinquency rate during the first quarter of 2010 was 7.4%, which included rates of 11.54% and 5.78% for residential real estate and credit cards, respectively.

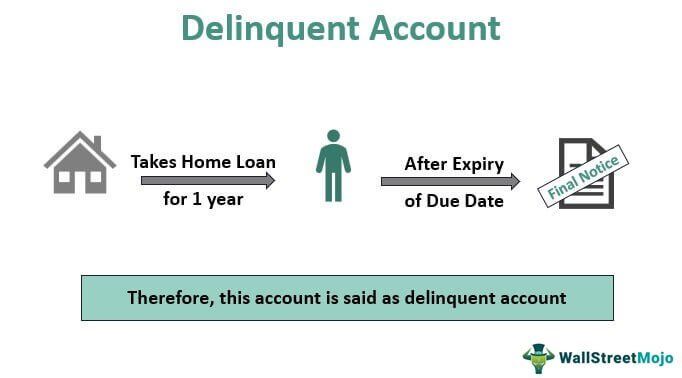

Example Of A Delinquent Account Credit Card

Mark is a client of XYZ Financial, where he holds a credit card. He uses his credit card regularly for a variety of purchases and typically pays only the minimum payment required each month.

One month, however, Mark forgets to make his payment and is contacted 30 days later by XYZ. He is told by XYZ that his account has become delinquent and that he should promptly make up for the lost payment in order to avoid incurring a negative impact on his credit score. Because the missed payment was unintentional, Mark apologizes for the oversight and promptly makes up for the lost payment.

If Mark had refused to make up the lost payment, XYZ may have had to collect on his debt. To do so, they would have first reported the delinquency to one or more credit reporting agencies. Then they would either seek to collect the debt themselves, or they would rely on a third-party debt collection service. If Mark was unable to pay his outstanding debt, this would have impacted his credit score.

Donât Miss: Opensky Locked Account

Don’t Miss: Navy Fed Car Buying Program

Will Paying Off Collections Improve My Credit Score

In terms of credit reporting, negative items can remain on your report for seven years from the date of the original delinquency. That includes things like late

Mar 11, 2021 This means they wrote off your debt as a loss. A charge-off is a negative notation on your credit report because it shows you didnt pay the

Mar 1, 2021 The delinquency will stay on his credit report for the next seven years. What does a delinquent loan mean for the borrower?

How Do I Remove Delinquencies From My Credit Report

How To Remove Negative Items From Credit Report Yourself

Don’t Miss: Chase Sapphire Required Credit Score

Reduce Additional Card Purchases

When money is tight, credit cards are sometimes your best means of emergency payment. However, make sure not to increase your debt on other cards in order to cover the delinquency payment for one card. Its best to only have one creditor reporting delinquency, if possible.

If you find yourself with multiple accounts in delinquency at one time, make sure to contact all of your creditors. Explore your payment options and look for ways to cut back where possible. If youve trimmed your budget and are still struggling, reach out to a HUD approved credit counselor. They can help you better evaluate your options and consider if debt settlement is necessary.

How Can I Avoid Delinquency

Delinquent accounts can be bad for your credit scores and your bank account. Its smart to do everything in your power to avoid them.

That being said, most people dont just wake up one morning and think, Today feels like a great day to skip my credit card payment. No, delinquencies generally happen because of an underlying problem.

A job loss or a reduction in income, for example, can make it difficult to keep up with your bills. An illness or emergency expense could also cause financial problems. Sometimes delinquencies happen because you dont have a good plan for how to spend your money.

Whatever the reason youre making late payments, the following tips might help you get back on track.

Recommended Reading: How To Remove Evictions From Your Credit Report

What Is Credit Card Delinquency

When using a credit card, you must pay a certain fraction of your balance each month to stay current on your account. By giving you a line of credit, the credit card issuer is basically providing you with a loan that you must pay down little by little each month. By failing to make required monthly minimum payments, you, as the cardholder, are breaking the terms of your agreement with the lender, and the account becomes delinquent.

Delinquency is divided into levels, which are indicative of how many payments the cardholder has missed. These levels are often referred to in terms of days. For example, the day after you miss your first payment, you are one day delinquent. After you miss your second payment, you are 30 days delinquent, and so on.

Technically, a consumer becomes delinquent after missing a single monthly payment. However, delinquency is not generally reported to the major until two consecutive payments have been missed. Consumers are thus provided a buffer zone and are allowed one misstep without suffering significant repercussions.

How Credit Card Delinquency Works

When And How To Remove Delinquency From My Credit Report

If you have a delinquent credit card debt that has not yet been charged off or sent to collections, making timely debt payments is the best way to reduce the impact of the delinquency on your credit score. Your credit report will still show that you missed a few payments, but a strong history of on-time payments can overcome a brief period of delinquency.

If your debt has been delinquent for so long that it has become derogatory, you can expect that derogatory mark to remain on your credit report for seven years. If old debt has not fallen off your credit report after seven years, contact the three major credit bureaus and request that they remove the delinquent debt from your credit report.

You may also have a delinquent debt on your credit report that is not actually yours. Believe it or not, one in five consumers discover errors on their credit reports which is why it is important to request copies of your credit reports regularly and dispute any errors you find. If your credit report includes a delinquent debt that you dont recognize, get the debt removed as quickly as possible. That way, you can maintain the credit report and credit score that you deserve.

Also Check: 611 Credit Score Mortgage

What Is The Fastest Way To Get A Report Of Collection And Late Payments Off A Credit Report

What is the fastest way to get a report of collection and late payments off a credit report?

- Understand that accurate information canât be removed from your credit report.

- Review the procedures for disputing inaccurate information from your credit report.

- Take the right steps to improve your credit.

There is no reliable way to remove accurate credit information from a credit report. Despite the claims of many organizations offering â,â derogatory items that accurately represent your payment history will stay on your credit report for 7 years. Why? Let us start by looking at the rules for credit reports.

Goodwill Adjustment With Phone Call/letter

You can try for a goodwill adjustment on two fronts: by phone and by mail. Some people try just one or the other, while some try both. Occasionally, people report success from calling and sending multiple letters over time, but we cant verify this.

Whether youre on the phone or writing a letter, remember that youre at fault here and asking forgiveness. Your tone should reflect that. Be polite, thankful, and conscientious. Above all, dont get angry or demanding.

Here are some examples to get you started on the phone or with your goodwill letter. If you get a positive response from the lender, try to also get it in writing.

Phone

You can use this script to start the conversation about removing your late payment. Be sure to have your explanation for why you were late at the ready. If you dont have a perfect payment history, youll have to adjust this slightly to reflect your actual situation.

For credit cards, call the number on the back of your card to speak with the issuer, or check out our listing of backdoor credit card company phone numbers.

Late Payment Goodwill Adjustment Sample Phone Script

Hello, my name is . I recently made a late payment on my account, which was a total accident.

As you can see, my payment history is perfect other than this one mistake. I ended up paying late because . The late payment is also showing up on my credit reports and its done a lot of damage to my credit scores.

That should get the ball rolling in the right direction.

Don’t Miss: What If My Credit Score Changes Before Closing

How Do I Get A Copy Of My Credit Report

Right now, its easier than ever to check your credit report more often. Thats because everyone is eligible to get free weekly online credit reports from the three nationwide credit reporting agencies: Equifax, Experian, and Transunion. To get your free reports, go to AnnualCreditReport.com. The credit reporting agencies are making these reports free until April 20, 2022.

Each of the three nationwide credit reporting agencies Equifax, TransUnion, and Experian are already required to provide you, on your request, with a free credit report once every twelve months. Be sure to check your reports for errors and dispute any inaccurate information.

In addition to your free weekly online credit reports until April 20, 2022 and your free annual credit reports, all U.S. consumers are entitled to six free credit reports every 12 months from Equifax through December 2026. You can access these free reports online at AnnualCreditReport.com or get a myEquifax account at equifax.com/personal/credit-report-services/free-credit-reports/ or call Equifax at .

What Will Not Work

A lot of people think filing bankruptcy will remove negative information from your credit report, but thats not true. When your debts are discharged in bankruptcy, the balances will be reported as $0, but the accounts will remain on your credit report.

Also, accounts that were included in your bankruptcy will be noted they belong to it.

It doesnt matter if you closing an account or not, this wont eliminate the delinquency reporting on your credit. If you close an account with a past due balance, your payment will still be reported as delinquent until that payment is caught up.

The only thing closing an account does is keep you from using it.

Paying a delinquent balance doesnt erase the negative entry on your credit report. Once you pay the balance, the account status will change to Current or Ok as long as the account isnt charged off or in collections.

Charge-offs and collection accounts will continue to be reported that way even after you pay the balance.

Read Also: Does Paypal Credit Report To Credit Bureaus

Also Check: Chase Sapphire Score Needed