Make A Goodwill Request For Deletion

If you have a good relationship with a creditor that has listed a late or missed payment, consider sending a goodwill request for deletion letter. The letter requests the original creditor to pretty please remove the offending item from your credit report. You can send the letter through the mail or make the request through email or on the phone.

Goodwill requests work best when you have a long and positive relationship with the creditor. Naturally, youll have to be completely current on your payments to the creditor. The letter you send should be polite because the creditor is under no obligation to agree.

As with other credit repair letters, examples of goodwill request for deletion letters are available on the internet for free. Note that a creditor may be willing yet unable to remove an item due to its own policies or agreements with credit bureaus. Nonetheless, you have nothing to lose by making the request, except for some of your time.

Since a goodwill letter is not considered an official credit dispute letter, you may never get a response back from the creditor there are no mandatory deadlines for response. Your best bet is to demonstrate that the late payment was a rare oversight, and youll never do it again.

Goodwill letters are usually less successful for more serious transgressions, such as collections and repos.

How Long Does Collections Stay On Credit Report

Unless otherwise handled, a debt collection account stays on your credit report for seven years, much like other accounts on your credit history. Credit scores update continuously but closed accounts only stay for seven years.

Remember, a closed account doesnt mean that the account was paid off. An unpaid collection would have a massive negative impact on your credit score. By showing to other lenders that you never paid back this debt, you reduce the chances of getting loans for a house or car in the future.

A paid collection account is another story, however. While some credit score calculations do not factor in paid-off debt collections, others do. For these accounts, they stick around for seven years or until the reporting agency removes it from their records.

Either way, seven years is a long time. If you can avoid going into debt collection in the first place, thats the best way to prevent this stain from showing up on your credit report. However, there are some ways you can speed up the process.

File A Complaint With The Financial Consumer Agency Of Canada

If you have noticed inaccuracies or outdated information on your credit report, and have been unable to get a response from the relevant creditors, you can turn to The Financial Consumer Agency of Canada.

On their website, you can find forms to dispute both against inaccuracies from financial companies, as well as .

If you have a legitimate claim to have a negative item removed from your credit report, but have been unable to resolve it in any other way, filing a complaint is sure to get the notice of your creditors.

Dont Miss: Navy Federal Checking Line Of Credit Myfico

Also Check: Does Qvc Do A Credit Check

How Long Do Collections Stay On Your Credit Reports

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

The long answer: Once the original creditor determines your debt is delinquent and sells it to a collection agency, the collection account can be reported as a separate account on your credit reports.

Assuming the collection information is accurate, the collection account can stay on your reports for up to seven years plus 180 days from the date the account first became past due.

Confused? Lets look at an example:

- Your account becomes late on

- After 180 days of nonpayment, your creditor charges it off on

- The original delinquency date is Jan. 1, 2018, but the account appeared on your credit report 180 days after that date. So the account should fall off your credit report by

Tips For Getting Out Of Credit Card Debt

- Sometimes we bite off more than we can chew especially with credit cards. Youre chugging along and then suddenly, youve got credit card debt! Its important to take care of it sooner rather than later. Leaving it to accumulate even more interest only means youll owe more and more. Once you see that you owe money, make a plan to repay that credit card debt as soon as possible.

- One solution you have available to you is to transfer one cards balance to another card. Ideally, you should be transferring that balance to a 0% APR credit card. This 0% APR usually only lasts for a few months, though, so be sure to pay off your debts before it ends. You may also want to consider switching to a low interest credit card. That way you wont get caught up in a quickly growing balance.

Read Also: Usaa Credit Card Approval Score

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

What Should You Know About Debt Collections And Dealing With Debt Collectors

In the US, its very easy for people to fall victim to debt collector scams or to paying debt they no longer owe. That is why the first thing you need to receive from the collection agency is a debt validation letter which contains confirming information concerning your debt, the name of the creditor, and how to resolve the debt.

This debt collection letter is supposed to be in your hands within five days of the agency first contacting you. Afterward, you will have 30 days to dispute the debt. You have the right to request official written evidence of your payment from the collection agency.

A common misconception is that a debt collector is supposed to be rude and frighten you into paying your debt. According to the Federal Trade Commission and the Fair Debt Collection Practices Act , debt collectors are not allowed to use abusive language and scheming practices when collecting debts. If they do, you can report them directly to the FTC.

Here is some additional information on what a debt collector can and cannot do:

| DID YOU KNOW: The statute of limitations is a law that provides a time frame during which debt collectors have the right to take legal action against your unpaid debt, such as taking the case to court. This usually lasts three to six years and is only available if you do not try disputing collection accounts during that time. |

Read Also: How Bad Is A 500 Credit Score

How Long Can You Be Forced To Pay Collection Accounts

Every debt has a statute of limitations, or a certain length of time that you can be compelled to pay it. After this, it becomes time-barred debt and you cant be sued over it anymore.

The statute of limitations on your debt depends on your state or jurisdiction and the type of debt you have, but its usually between 3 and 6 years. 7 Once the statute of limitations has passed, debt collectors can still try to get you to pay, but they wont have any legal recourse and wont be able to get a court judgment against you.

Leave really old debts alone

The statute of limitations on your debt begins from the date of your most recent activity on the account. Be very careful to avoid doing anything on an old credit account that might reactivate the debt.

Even the smallest payment could revive debt collection efforts and result in legal action against you. Specifically, refrain from doing any of the following:

- Making any payments

- Acknowledging the debt is yours

- Agreeing to a repayment plan

- Accepting a settlement offer

Theres no legal way to completely erase your credit history.

All negative items on your credit report should be gone in 710 years, but theres no way to clear your credit early. Stay away from credit repair companies that sell tradelines or credit privacy numbers as a substitute for your social security number. These practices indicate shady or illegal activity that could get you into trouble.

How To Get Collections Off Your Credit Report

Getting collection activity off your credit report can help you accomplish credit goals like improving your score or qualifying for certain types of loans. Though theres no one way to remove collections or guarantee youll get the exact outcome you are hoping for, its still good to know how to remove this information from your credit report whenever possible.

The good news is that its possible to remove this derogatory information, so heres exactly what you need to know about removing collections from your .

Recommended Reading: 779 Fico Score

How To Remove Items From Your Credit Report After 7 Years On Your Own

Here are the steps you can take to help you remove items from your credit report after 7 years.

Need Help Removing Collections From Your Credit Report

This is where hiring a credit repair company can really make a difference. They help most people to remove collections by disputing errors with the three credit bureaus for you. This means you dont have to contact any of the credit bureaus or collection agencies yourself directly.

If you arent sure where to start regarding disputing collections, talk to one of their credit repair professionals and get your questions answered. Of course, you can do it yourself, but youre likely to have more success by enlisting professional help.

They offer a no-obligation consultation to explain what they can do to help in your particular situation.

Recommended Reading: How To Unlock Transunion Credit Report

Does Paying Off Collection Improve Credit Score

Unfortunately paying off a collection does not improve your score. In some instances, the score may actually decrease from the status update of that collection on your credit report.

Hence, paying off a collection will not help. Only getting it deleted will repair your credit. The scores you see online at Credit Karma, Experian, Equifax or Transunion or any other website, do not show you the version of Fico scores lenders look at.

So if you have a paid collection on your credit report, it will be greatly impacting the Fico score lenders use.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Often Does Discover Report To Credit Bureaus

Hire A Credit Repair Company

If youre looking for the easiest way to fix your credit report, the following three credit repair services earn our top marks based on BBB ratings, industry reputation, and our own reviews.

These services challenge each of three major credit bureaus to verify, correct, or remove negative items on your credit reports.

| $79 | 9.5/10 |

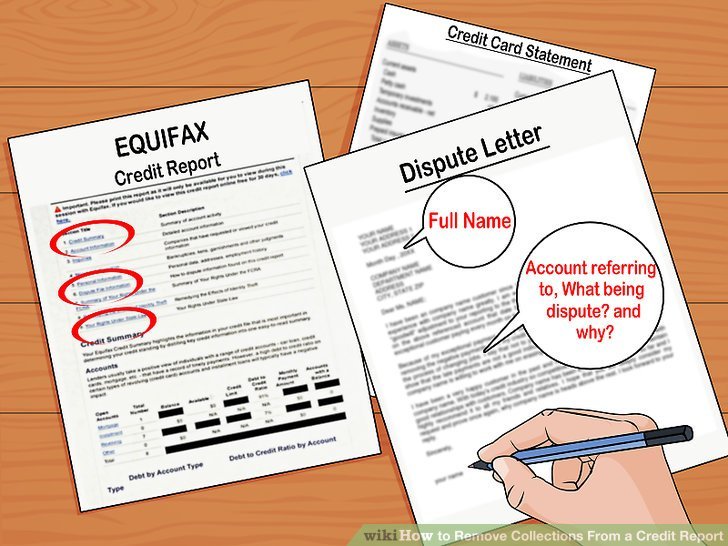

The Fair Credit Reporting Act entitles you to dispute inaccurate items on your credit reports. You can do so through the mail or online at the three credit reporting company websites.

While you can attempt to fix your credit yourself, the process requires effort, patience, organization, and expertise. For what many consumers consider to be a reasonable price, you can hire a credit repair organization to do the work for you.

Some disputes are easy to resolve, such as the removal of outdated information. Other disputes require more work, including submitting evidence to contest items and forcing the bureaus to validate questionable data. The ideal outcome is to remove enough negative items to give your score a boost.

Most credit repair services offer a free consultation to review your credit reports and identify fruitful areas worth challenging. The credit specialist will review with you the different plans the company offers, what services come with each plan, and how much each plan will cost you.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

You May Like: How To Remove Hard Inquiries Off Your Credit Report

Dispute After 7 Years

According to the Fair Credit Reporting Act , past-due accounts can only remain on your credit report for seven years from the first date of delinquency. Sneaky collectors often try to re-age a debt, making it look like the account became delinquent later than it did. This re-aging keeps the debt on your credit report longer.

If the seven-year reporting period is up , dispute the debt from your credit report. Any proof you have regarding the first date of delinquency will strengthen your dispute.

Write A Goodwill Letter

No luck with direct contact or a written dispute? A goodwill letter is another tool in your arsenal to nix those late payments from your credit report.

These letters are ideal in situations where you missed payments and are now in good standing. is already in collections, a pay for delete arrangement may be your best bet. More on that shortly)

In a nutshell, a goodwill letter is a written request to the bank, credit card issuer, or other creditor asking that they remove the late payment from your credit report.

Theres no guarantee that theyll remove the negative mark, but its worth a shot. Plus, you can plead your case again if they reject your request the first time around.

When drafting up your letter, be honest about why you were delinquent. For example, if you hit a rough patch because you became unemployed or dealt with medical issues, put that information in there. Or maybe your account was compromised, or there was a glitch in autopay, so the payment was returned or didnt go through.

Regardless of your reasoning, be as specific as possible and reiterate that the entry does not reflect your true character. It just resulted from a financial rough patch, and that youve worked hard to get back on track.

Read Also: How To Remove A Repossession From Your Credit Report

The Final Step: Take Action To Repair Your Credit

Now comes the time to figure out what to do about this problem. Take action now!

From experience, I can tell you that the sooner you take action to address collections, the better the chances of success.

If youre too overwhelmed or feel you may not have the time to do this, you may want to consider the help of a credit repair specialist.