The Hilton Honors American Express Business Card

With the Hilton Honors American Express Business Card, you can earn Hilton Honors Bonus Points for each dollar of eligible purchases on your Card: 12X at hotels and resorts in the Hilton portfolio, 6X on select business and travel purchases, and 3X on all other eligible purchases. If Hilton is your exclusive travel partner, this can be a great card to boost your earning power

Why wasnt it number one? The Marriott Bonvoy business card currently offers a bit more flexibility. With three different hotel brands under the parent company, there are a lot of options. In addition, the Marriott Bonvoy card also offers a bit more value when it comes to transferring points.

For example, if you want to use your points to book a flight with Delta, 30,000 Marriott points will earn you 10,000 Delta miles, while 10,000 Hilton Honors points will only earn you 1,000 miles.

With so many credit card options on the market today, American Express small business credit solutions shine through for a variety of reasons. Many of these cards offer highly competitive rewards programs and numerous small-business minded perks and benefits.

How Charge Card Payments Work

You likely wont notice a difference between a charge card versus a credit card when you swipe it or insert either payment method into a chip reader to pay for a transaction. But when your first charge card statement shows up in your inbox or mailbox, a few features might surprise you if youve only used credit cards in the past.

Unlike credit cards, which feature minimum payments and give you the option to roll a portion of your balance over each month, charge card issuers expect you to pay your full statement balance by the due date. Its a good habit to pay your statement balance in full anywayregardless of whether youre using a charge card or credit card. However, if you opt to use a charge card, paying in full is typically not optional.

Its worth noting that certain cards, such as some offered by American Express, might give you the option to pay over time with interest on some purchases. If you elect to take advantage of such an offer, your charge card bill may behave more like a credit card, especially in terms of interest charges.

What Issuers Arent Saying

Some of the issuers are less clear about the circumstances under which theyll report business card activity to personal bureaus, but we can determine their usual practices based on reader reports and other sources. Capital One, for example, declined to say whether it reports any activity to either consumer or commercial bureaus, but the company has previously acknowledged it reports to both types of bureaus, while cardholders have said theyve seen Capital One business cards on their personal credit reports.

Meanwhile, Chase says it may report business cards to consumer bureaus and American Express says business card account information is reported to both the consumer and commercial bureaus, but based on reader reports, neither issuer routinely report business card accounts to personal credit agencies. However, both issuers in the past have suggested theres a negative trigger for when business accounts get reported to bureaus late or no payment, for example.

Barclays confirmed that it runs a credit check and reports users activity to both business and consumer credit bureaus. In practice, Barclays record on reporting business accounts is mixed, so your mileage may vary with them. We didnt have any official answers from Citi, but readers report that most Citi business cards are not reported on personal credit reports.

Don’t Miss: 524 Credit Score Good Or Bad

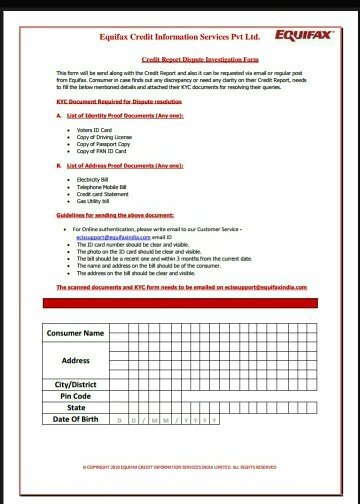

Which Credit Card Companies Report Authorized Users

Most of the biggest credit card issuers in the United States report additional users to all three credit bureaus: Experian, Equifax and TransUnion.

In most cases, you’ll need to provide the authorized user’s date of birth and Social Security number for the credit bureaus to update their file. American Express, Bank of America and Discover, for example, require this information in order to add an authorized user. Chase, on the other hand, doesn’t require an SSN to add an authorized user .

Should You Add Your Child To Your Credit Card To Build Credit

Most issuers will allow you to add a child so long as they are at least 13 years old. In fact, there is no restriction on who you can add as a user even if that person is below the age of 18. There are currently no regulations requiring that the authorized user be a family member, even if they are a minor.

There are clear financial benefits to your child if you add them as an authorized user. As long as the card issuer reports these users to one of the three credit bureaus, then adding your child to your credit card account will make it appear on their credit file. Also, you should only add children to accounts with good payment histories an account with a lot of late payments on record could negatively impact your child’s score .

Normally, young adults need to apply for student credit cards or credit cards for users with no credit. By adding the child to your account, a score will be generated for them, helping them qualify for better cards as well as making their loan terms more favorable. For example, having a high can qualify your child for a lower and higher rewards.

Also Check: What Credit Score Does Carmax Use

Which Credit Report Does American Express Pull

American Express has long been known as a premium credit card provider that gives cardholders a wide variety of perks. Given its reputation, wanting to apply for a card from American Express is not unusual.

When you apply for an American Express credit card, the company will almost always check your with Experian. In some very rare cases, American Express will check with a different credit bureau. Remember that all three credit bureaus get their information from the same place: your financial life. That means there isnt a big difference between them, so which report is pulled doesnt usually matter. However, there are some cases where knowing which bureau is pulled.

We found out that American Express primarily works with Experian by reviewing 337 consumer-reported credit inquiries from January 2016 through December 2017. That information showed that American Express works nearly exclusively with Experian.

Apply For A Credit Card Based On Your Credit Score

It’s important to avoid applying for just any credit card. If your credit score isn’t considered good or better, you’ll have a hard time getting approved for a card directly from American Express. As such, it’s best to avoid the unnecessary hard credit inquiry and apply for a card with better approval odds.

Before you apply for a credit card, check your credit score to see where you stand. Then use an online tool like Experian CreditMatch to get an idea of which cards are accessible based on your credit profile. CreditMatch can pair you with cards suitable for your unique credit profile, so it’s a great resource if you’re unsure where to start.

Recommended Reading: 586 Fico Score

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Some Credit Cards For Bad Credit

Some credit card issuers take advantage of people with bad credit by offering them credit cards that charge outrageous fees and interest and dont help them build credit.

In general, try to avoid credit cards that charge fees to process your application or open your account. Also, stay away from cards that charge APRs higher than 30%.

Finally, double check with a credit card issuer before you apply to make sure it reports your account activity to all three credit bureaus. Most issuers that do will list that on their website. But dont be afraid to call if you cant find it anywhere.

Don’t Miss: How To Get Credit Report With Itin Number

How To Apply For An American Express Business Credit Card

Once you determine which of the American Express small business credit cards you want to apply for, youll start the application process online. Be ready to provide:

- Your companys legal business name, business address, and phone number

- Type of industry your business is in

- Company structure

- Number of years your company has been in business

- Number of employees

- Federal Tax ID, or Social Security number

What Is A Charge Card

A charge card is similar to a regular credit card in that it provides the ability to make purchases and pay for them later. You can also earn points and/or miles on these purchases like you would with a rewards or travel card, plus other benefits too.

However, charge cards have two big differences: 1) There’s no preset spending limit and 2) you can’t carry a balance month to month.

While other credit cards assign , charge cards don’t. This can provide you with more buying power, since your balance is able to fluctuate every month. But doesn’t mean you can spend whatever amount you want.

For instance, Amex describes its spending limit policy:

“No preset spending limit does not mean unlimited spending. Purchasing power adjusts with your use of the card, your payment history, credit record and financial resources known to us, and other factors.”

In other words, you don’t receive a maximum spending limit when you’re approved for the card. Rather, the charge card issuer adjusts your credit limit from month-to-month based on your behavior and history as a cardholder and it’s constantly in flux.

As a general rule, cardmembers tend to have few issues when using their charge cards for predictable, everyday spending. But to avoid your card being declined, there are ways to double check that your card will be approved for big purchases, trips or business expenses ahead of time. This will save you hassle and help you plan accordingly.

Read Also: Unlock My Experian Credit Report

How Many Authorized Users Can Be On A Credit Card

The number of authorized users that can be added on a credit card varies by issuer and card. For example, American Express allows four authorized users to be added to the American Express Everyday Preferred card. Chase allows up to 99 authorized users on an account for its business cards.

If no Social Security number is linked to an authorized user, the bank may not send over payment information to the credit bureaus.

Can An Authorized User Take Over A Credit Card Account

As the primary account holder, you are in control of and legally responsible for your credit card account. Any access that an authorized user has comes from permissions that you as the primary account holder grant. So while an authorized user may be able to make transactions and redeem rewards on the account, they can never take over the account and remove you as the primary account holder.

Recommended Reading: Does Barclaycard Report To Credit Bureaus

Which Credit Bureaus Banks Check

When you apply for a credit card, the issuer contacts a credit bureau to purchase a copy of your credit report. Included in your report are the categories mentioned above. Knowing which credit reporting agency a card issuer uses to pull reports might help give you a better picture of your approval odds.

You can also use this knowledge to space out your applications in such a way that helps you maintain an optimal credit score, even if you are applying for multiple cards in a shorter timeframe.

Many credit card companies tend to rely on one bureau when they process . The credit bureau they use to buy reports, however, may change depending on the state you live in and the specific card you want.

Here are a few anecdotal data points that have been reported over the years:

- Citi usually pulls credit reports from Equifax or Experian.

- Amex primarily pulls Experian, though sometimes Equifax or TransUnion reports.

- Chase favors Experian, but may also buy Equifax or TransUnion reports.

Lets say you find out that Citi usually pulls from Equifax and Chase primarily uses Experian. You could apply for cards from both issuers in a single day and potentially improve your approval odds for both.

Does Being An Authorized User Build Credit

Being an authorized user can potentially build credit, especially for teenagers or young adults who may not have had many opportunities to show responsible credit usage.

Without any history to go off, many lenders will not approve credit applications. An authorized user account gives lenders a credit history to go off of. This can open up additional opportunities for accessing credit and lower interest rates.

Note, your credit card issuer must report the account to the credit bureaus, and lenders must use a credit scoring system that incorporates authorized user accounts. There are a multitude of credit scores employed by different lenders, and some scores may not include authorized-user activity in determining your creditworthiness.

Furthermore, an authorized user will most benefit from an account with a long history of timely payments. On the other hand, an account with a lot of missed payments could actually negatively impact your score. If that happens, you can contact the credit bureaus. Some credit bureaus, like Experian, will remove delinquent authorized user accounts from your credit report, since you are not legally responsible for the debt. Experian also reports that they generally do not include negative payment history on an authorized user’s account, but other credit bureaus may include this information.

You May Like: Does Paypal Bill Me Later Report To Credit Bureau

The 3 Major Credit Reporting Agencies

There are three major credit reporting agencies that collect your financial information and compile it into a report TransUnion, Equifax and Experian. Those reports are what determines your credit score, and its what banks and creditors pull when you apply for a credit card, loan or other lines of credit.

Each credit reporting agency has its own method for compiling your credit report and determining your credit score. Thats why your score may vary by agency. Lets take a look at each agency and the scores each produces. Then, well talk about which issuers look at which scores when you apply for a new card.

Why Dont I See It On My Credit Report

While American Express may report your card information on the last day of the billing cycle each month, its possible that the credit reporting agencies wont immediately have that information available on your credit report. It may take a day or two before you actually can see the data on your credit report. In addition, if your billing period were to end on a bank holiday, it would be reported a day or two late, which would then delay the updating of your credit report.

But, bottom line, American Express reports to the major credit bureaus on the last day of a cards billing cycle, and you should be able to see that information reflected in your credit report shortly thereafter.

Also Check: How Bad Is A 500 Credit Score

The Business Platinum Card From American Express: Best For Big Spenders

- Great for business owners with significant travel expenses

- Strong welcome bonus

- Annual airline fee credit

- High annual fee

The Business Platinum Card® from American Express often has one of the best welcome offers, and in many cases, the same is true for the rewards program. Get 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com. Adding to the travel perks is an annual $200 airline fee credit and a statement credit for Global Entry or TSA Pre. Its easy to see how business owners with travel needs can leverage this charge card.

You can also get a $200 statement credit when you purchase computers and more directly with Dell and a pay over time option to carry a balance with interest on purchases of $100 or more.

Amex business platinum cardholders who dont do a lot of traveling will have a hard time validating the $595 annual fee understandably so but for those who do, the statement credits and rewards programs can certainly make it worth it. Plus, though you must book through Amex Travel to get the most points rewards, you arent tethered to one airline or hotel group as you would be with a co-branded card.

How To Improve Your Credit Score Before Applying

Even if you meet the minimum requirements to get an American Express credit cardor any other card for that matterit’s still usually a good idea to work on your credit score for a better chance of approval, or better terms such as a lower interest rate.

Here are some things you can do to improve your credit:

- Pay your bills on time every month.

- Get caught up on past-due payments and accounts in collections.

- Get added as an authorized user on a family member’s credit card account with a positive history.

- Use Experian Boost to get credit for on-time utility, cellphone and streaming payments.

- Pay down credit card balances and keep them low.

- Avoid closing unused credit card accounts.

- Take on new credit only when necessary.

- Dispute inaccurate information on your credit reports.

Building credit can take some time, but as you start making positive changes, you may start seeing results as quickly as a few months. Experian Boost can help you improve your scores instantly.

Also Check: Does Paypal Credit Affect Credit