How To Check Your Credit Score

There are several convenient ways to check your credit score and keep tabs on your creditworthiness:

- Visiting a free credit scoring website is one of the easiest and most convenient ways to check your credit score. These services, which update weekly to monthly, sometimes offer credit monitoring in addition to scores and limited reports. Checking your credit through these websites is typically free, but some platforms offer additional tools for a monthly fee.

- Many credit card issuers also offer cardholders free credit scores and score forecasting tools. Just check with your card provider to see if the service is offered, and then opt in to access available resources.

- Nonprofit credit counselors. Beyond just checking your score, working with a nonprofit credit counselor can help you better understand your credit profile and help you build more responsible financial habits.

Good Credit Puts Money In Your Pocket

Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all billsincluding credit card minimum paymentson time, every time are smart financial moves. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest.

1 Scores and rates as of January 9, 2015, as reported on myFICO website.

Why Should I Check My Credit Reports And Credit Scores

Reading time: 4 minutes

Highlights:

-

Checking your credit history and credit scores can help you better understand your current credit position

-

Regularly checking your credit reports can help you be more aware of what lenders may see

-

Checking your credit reports can also help you detect any inaccurate or incomplete information

Your credit history and credit scores are vital pieces of information that are important to your overall financial wellbeing. Viewing your credit history as shown on your credit reports and your credit scores may help you understand your current credit position.

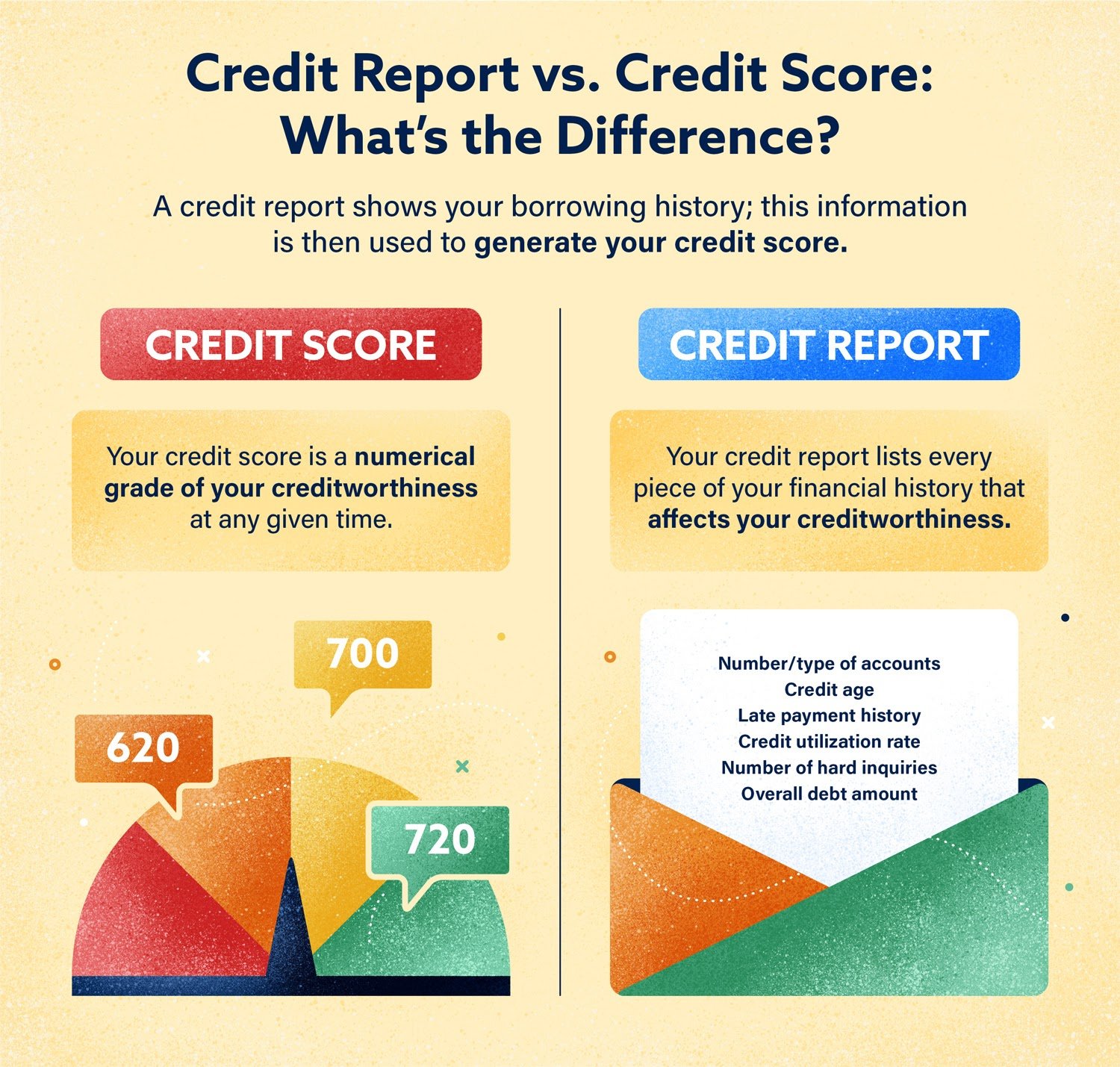

Generally speaking, a is a three-digit number designed to represent your credit risk . Your credit history is the record of how you have managed your credit accounts. It may include your current and past credit accounts, information on your payment history and the total amount you owe. Credit scores are calculated using information from your credit reports, although credit scoring models are different.

Along with many other pieces of information, potential lenders and creditors including credit card companies, mortgage lenders and auto lenders may use your credit scores and credit history to help make lending decisions. These companies want to know how likely you are to pay the money they lend back as agreed.

It’s a good idea to check your credit reports at least once a year. Follow our checklist to review your Equifax credit report.

Identify inaccurate or incomplete information

Recommended Reading: How Often Do Companies Report To Credit Bureaus

Definition Of Credit Report

A credit report is described as a snapshot of a persons credit history, prepared by the credit agency considering their personal details and their bill-paying habits.

It encompasses information related to that persons identity such as name, address, birth date, Social Security Number, etc. and his credit details like car loans, education loans, credit card accounts, history of meeting obligations and the amount owed to creditors. Further, a credit report also includes information concerned with any court verdict against the person or if the person has filed bankruptcy.

A credit report is like a report card which gives a detailed idea of how a consumer handles debt in the past? Along with that it also evaluates how often a consumer pays debt on time? Do you take more debt than you can afford?

How Do I Get A Copy Of My Credit Report

Everyone is entitled to one free credit report per bureau per year by federal law. You can access yours at AnnualCreditReport.com. You’ll have to answer some security questions to verify your identity and then you can view your reports. You have the choice to view all three reports at the same time or to space them out throughout the year.

If you’ve already used your annual free credit reports for the year, you can purchase additional credit reports from the credit bureaus themselves. Some credit monitoring companies may also offer credit reports to customers who sign up for their services.

Recommended Reading: Cbcinnovis Hard Inquiry

What Can I Do To Improve My Credit Score

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

How To Access Your Credit Report

To access your credit report, all you need to do is visit AnnualCreditReport.com. Be prepared to provide personal information and verify your identity with the bureau.

In response to the pandemic, credit bureaus are offering weekly access to your credit reports through April 2022 . You can also submit a request or mail.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Whats The Best Credit Score

Theres really no such thing as a best or worst credit score theyre just different, and different lenders may use different credit scores. With that said, FICO Scores are used in over 90 percent of U.S. lending decisions, so your FICO Scores may have more sway over your financial life.

On the other end of the spectrum, some credit scores are meant only for educational purposes and are rarely, if ever, used by lenders when making credit decisions.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Also Check: How Accurate Is Creditwise Credit Score

There Are Few Numbers In Life That Matter As Much To Your Financial Well

Whether youre applying for a credit card or buying a home, these three-digit numbers can go a long way in determining whether a lender will do business with you.

The problem is, there are so many out there. How can you keep track of them all?

And what should you do if your scores differ between credit-reporting agencies ?

First things first: Its perfectly normal for scores to differ slightly between agencies. Its up to lenders to decide which information they report to the major credit agencies and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency. Of course, there may be other reasons for any discrepancies in your scores more on that later.

The good news? Many agencies look at similar factors when calculating your credit scores. So long as you make payments on time, keep your credit card balances low and dont go wild opening new credit card accounts when you dont need them, you should be in good all-around shape.

Here at Credit Karma, we want to help you develop the healthy financial habits that credit-reporting agencies look for when they crunch your credit scores.

So, listen up .

Information From Public Records

Your credit report also lists any financial information that’s in the public record, like bankruptcies and accounts sent to collections. Repossessions and foreclosures also show up here. You don’t want to have any information in this part of your credit report because everything that shows up here is bad and can seriously drop your credit score. All of these negative records will remain on your credit report for seven years, except for bankruptcies, which remain on your credit report for 10 years.

Recommended Reading: Itin Credit Report

What Is The Difference Between A Credit Score And A Credit Rating

The credit score is a numerical value assigned to an individual or small business depending upon their credit report. A credit rating is a letter grade given to businesses and governments based on their credit report.

A credit score is a three-digit number. It ranges from 300 to 850. Credit rating is a one, two, or three-letter grade assigned to companies. It follows AAA, AA, A, BBB, BB, B, CCC, CC, C, and D series in decreasing order.

A credit score is based upon the credit reports made by mainly three agencies- Equifax, Experian and TransUnion. For credit rating S& P Global, Fitch Ratings, and Moodys are the most popularly used agencies.

Both are used for showing the potentiality of companies and individuals in repaying their debts.

How Long Do Financial Records Remain On Your Credit Report

- Generally, information remains in the credit report for up to 7 years.

- Bankruptcy reports can stay on your credit report for the period between 7 to 10 years. This duration depends on the type of bankruptcy.

- Closed accounts information which is paid as agreed remains on the credit report for almost 10 years.

- And hard inquiries stay in the credit report for up to 2 years.

A credit report shows the compiled information of individuals transactions. This also provides a detailed representation of their financial condition. The credit score is dependent on the credit report. It is ascertained by calculating the information on a credit report.

It is important to update your credit report for knowing the actual credit score. Lenders are responsible for the updation of the credit report after a particular interval of time.

Read Also: Will An Eviction Show Up On My Credit Report

Why Does Information Differ Between Credit Reports

When you check your credit reports with each bureau, the information listed may vary between reports. A side-by-side comparison may show more inquiries on one report versus another, or different balances listed. This can happen since creditors aren’t required to report your account to any or all bureaus. However, most creditors report to at least one bureau.

For instance, a creditor may check your credit with Experian. This results in an inquiry on your Experian credit report, but may not appear on your Equifax or TransUnion reports.

Learn more: Keeping track of your credit report doesn’t have to be a manual process if you sign up for a credit monitoring service. CNBC Select ranked the best free and paid credit monitoring services that automatically provide daily alerts for new information on your credit report, access to your credit score and more.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Read Also: Check Credit Score With Itin

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Lets Start With Your Fico Credit Scores

In the old days, banks and other lenders developed their own score cards to assess the risk of lending to a particular person. But the scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

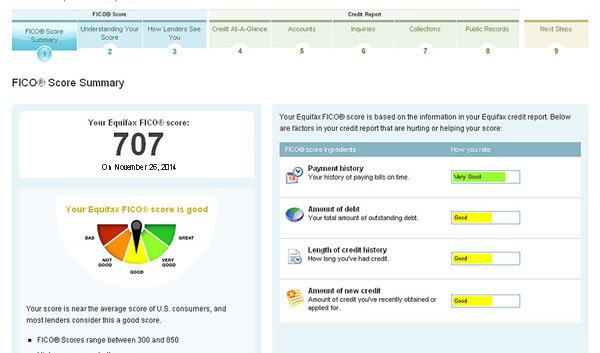

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various credit card, mortgage and auto lending decisions.

Read Also: What Is Syncb Ntwk On Credit Report

Does A Credit Report Show Bank Accounts

Your bank account information doesnt show up on your credit report, nor does it impact your credit score. When applying for loans and/or credit cards, lenders first look at your credit score and credit report to see your open and closed credit accounts and loans, as well as details about your payment history.

What Is A Credit Report

A is a comprehensive record of a consumers credit history that includes outstanding and past lines of credit, payment histories, third-party collections, lender inquiries and public records such as bankruptcies and repossessions. Every consumer has three reportsone compiled by each of the three major credit bureaus. Notably, however, credit reports do not include the consumers credit score.

Read Also: Shopify Capital Review

Who Creates Credit Scores

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit you’re using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

How Your Credit Score Affects You

Suppose you want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan.1 This means a monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869 percent that would result in a $1,061 monthly payment. Although quite respectable, the lower credit score would cost you $184 a month more for your mortgage. Over the life of the loan, you would be paying $66,343 more than if you had the best credit score. Think about what you could do with that extra $184 per month.

Read Also: Is 766 A Good Credit Score

What Is The Difference Between A Credit Score And A Credit Report

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

A credit report is a record of your experiences handling debt, and a credit score is a three-digit number, calculated using a credit report, that reflects the statistical likelihood you’ll fail to repay a debt. Lenders often use both credit reports and credit scores when deciding whether to accept your application for a loan or credit card.

Who Can Access Your Credit Report

Different organizations and authorities can have access to your credit report and credit scores. In short, if you apply for a loan, service, or anything related to checking your credit report, the organization reserves the right to verify before lending you any money. Below we have mentioned some of the companies that can pull out your credit report based on your application.

Also Check: Removing Repossession From Credit Report

What Information Is On A Credit Report

by Kailey Hagen | Dec. 2, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Everyone should know about their credit report information.

You probably think you’re done with report cards once you’re finished with school, but there’s one that follows you from the day you open your first credit card or loan account until the day you die — your credit report. Your credit report information is a record of how you manage borrowed money, and it can affect your chances of getting loans, , apartments, and even jobs.

It’s a pretty big deal, so you ought to know what yours is saying about you. Here’s everything you need to know about your credit report information and how you can check yours.