What Are The Most Common Fha Loans Requirements

DOCUMENTS REQUIRED FOR THE FHA LOAN A clear copy of your driver’s license or green card if you are not a US citizen Two or more consecutive paychecks equal to a full month’s salary. Last two years H2 or 1099. Last two years: Complete tax return with all statements. Two months of updated statements for all accounts, including pages intentionally left blank.

Fha loan floridaWho should get an FHA loan?FHA are pro Those Who Need A Lower Down Payment If the idea of paying 10% less doesn’t work for you, you need to apply for an FHA mortgage. What is FHA loan?4 common disadvantages FHA loan Loan limit the. one of the biggest drawbacks FHA loan is this loan Limitation of mortgage insurance. I don’t need to pay any private mortgage insurance FHA You need insurance loan loan .Limited Choices. C

Make The Most Of A Thin Credit File

Having a thin credit file means you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways you can fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isn’t normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with no or limited credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. Rental Kharma and RentTrack, for example, will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

What Is Fha Loan And What Are Their Requirements

An FHA loan is a home loan insured by the Federal Housing Administration. They allow borrowers to finance their home with such low down payments and are especially popular with first-time buyers. FHA loan applicants must have a minimum FICO score of 580 to qualify for the low down payment, which it currently is. If your credit score is below 580, the down payment is 10%.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Council Tax Arrears & Parking Or Driving Fines

Councils don’t share data about your payments, whether good or bad. If you’re in arrears, it won’t affect your credit score. However, it’s always wise to prioritise your council tax payments as many councils are quick to prosecute. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Any fines you’ve incurred, for example, a parking or driving fine, won’t be listed. Even though they’re issued by the courts, they aren’t ‘credit’ issues, so they’re not listed.

How Fraud Can Affect Your Credit Rating

When lenders search your credit reference file, they may find a warning against your name if someone has used your financial or personal details in a fraudulent way. For example, there may be a warning if someone has used your name to apply for credit or forged your signature.

There might also be a warning against your name if you have done something fraudulent.

To be able to see this warning, the lender must be a member of CIFAS. This is a fraud prevention service used by financial companies and public authorities to share information about fraudulent activity. CIFAS is not a credit reference agency. The information it provides is only used to prevent fraud and not to make lending decisions.

If there is a warning against your name, it means that the lender needs to carry out further checks before agreeing your application. This may include asking you to provide extra evidence of your identity to confirm who you are. Although this may delay your application and cause you inconvenience, it is done to ensure that you don’t end up being chased for money you don’t owe.

Also Check: How To Get Credit Report Without Social Security Number

What Deductions Can A First

What Deductions Can a First Time Home Buyer Make? Mortgage Interest Rates. If you’re surprised by how much interest there will be over the life of your loan, rest assured you know. Real estate tax. As a homeowner, you can also deduct your annual property tax. Points. Non-deductible expenses.

Building a new houseHow much does it cost per square foot to build a new house? The average cost of building a new home ranges from $90 to $1,095 per square foot. They know it’s a great lagoon! Where you live can significantly affect the price: the high cost of housing increases the amount you pay per square foot to build a new home. The next determining factor will be the capriciousness of your pleasures.What to know bef

Tips To Boost Your Creditworthiness

The better your creditworthiness, the more ways youâll have to get ahead.

We have previoulsy looked at why creditworthiness matters. We learnt that law changes in March 2014 altered what information is collected for your credit fileâand how this âpositiveâ reporting can help you.

But your credit score isnât fixed. Here are our top 10 tips to improve it.

You May Like: How To Unlock Your Credit

What Information Is Kept By Credit Reference Agencies

Credit reference agencies are companies which are allowed to collect and keep information about consumers’ borrowing and financial behaviour. When you apply for credit or a loan, you sign an application form which gives the lender permission to check the information on your . Lenders use this information to make decisions about whether or not to lend to you. If a lender refuses you credit after checking your credit reference file they must tell you why credit has been refused and give you the details of the credit reference agency they used.

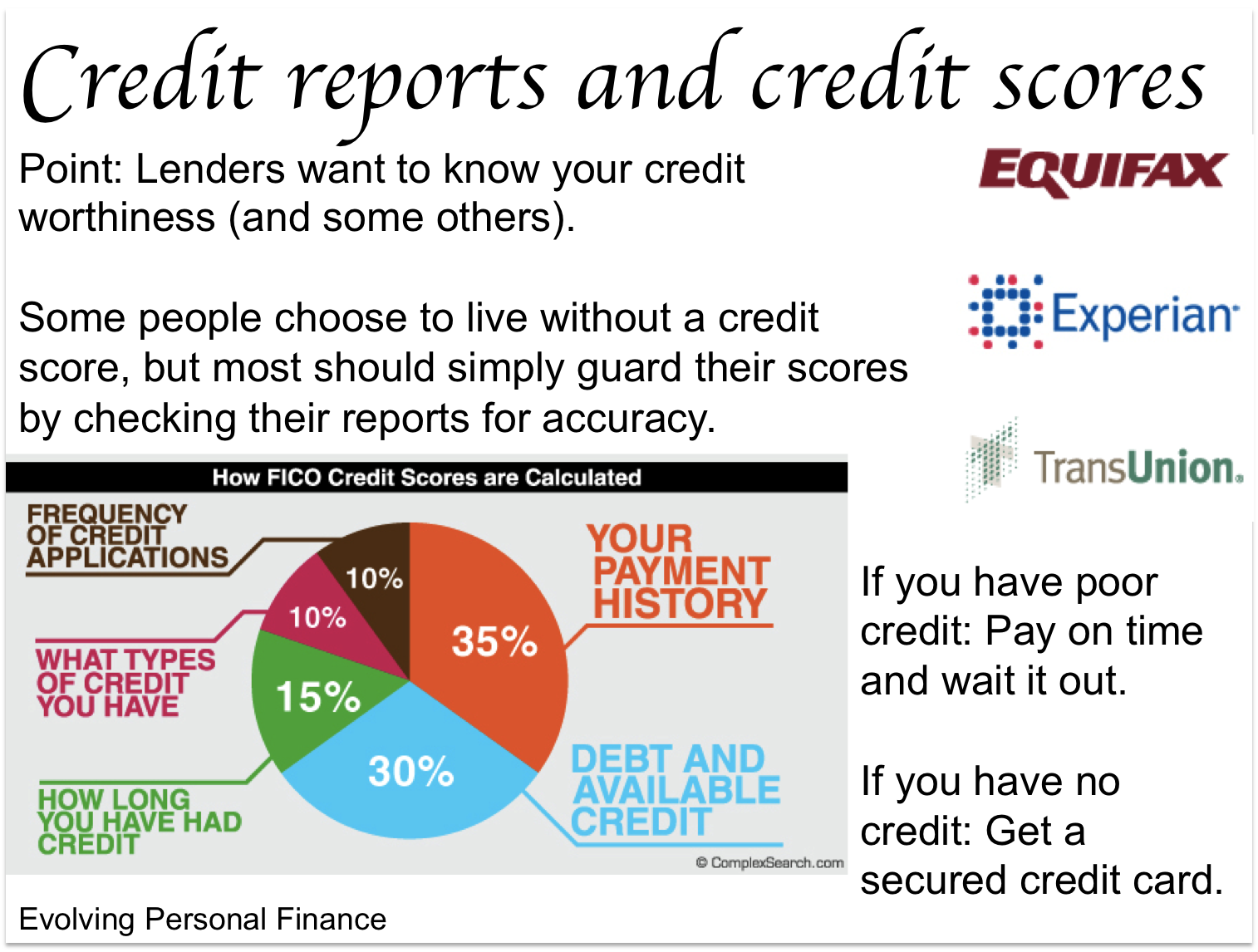

There are three credit reference agencies – Experian, Equifax and TransUnion. All the credit reference agencies keep information about you and a lender can consult one or more of them when making a decision.

The credit reference agencies keep the following information:

If there has been any fraud against you, for example if someone has used your identity, there may be a marker against your name to protect you. You will be able to see this on your credit file.

Small Business Loan Disbursals Increased 40% In Fy21

The latest edition of the Sidbi TransUnion Cibil MSME Pulse Report has been published and it shows that loans worth Rs.9.5 trillion have been disbursed by the lenders to micro, small, and medium enterprises for the current financial year.

This number is 40% more than the previous years disbursal of Rs.6.8 trillion. The report suggests that the interventions from the government such as Emergency Credit Line Guarantee Scheme have played a major role in the surge of the credit disbursement to the MSMEs.

11 August 2021

Don’t Miss: Synch Ppc

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

What Credit Score Is Needed For A Fha Mortgage

The FHA insures mortgages for those with a Fico rating of 500 to 600, which is why it is popular with first-time buyers and those with little or no credit. When they discover that there are other mortgage options for those with low credit ratings, many potential buyers have questions.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

Always Make Payments On Time

Once you have a credit card, make sure to pay your bill on time every month. Your payment history is the single most important factor in your credit score, accounting for 35% of your FICO® Scoreâ .

Keeping your credit utilization ratio low is another way to build good credit. This ratio refers to the percentage of your available credit you’re using. If your credit card has a limit of $200 and you’re carrying a balance of $100, you’re using 50% of your available credit. Maintaining a credit utilization ratio below 30% of your credit limit will help to boost your credit score. Paying your balance in full each month helps tooâand will also prevent you from accruing interest on your purchases.

Do you have any outstanding student loans? Paying those bills on time can help improve your credit score. Student loans are installment credit, while credit cards are revolving credit. Having a mix of both types of credit helps to increase your credit score. Finally, if you pay your own cellphone bills or utility bills, consider signing up for Experian Boostâ¢â , a free service that adds on-time payments for those services and more to your credit report, potentially helping improve your FICO® Score.

Why Is This Fico Score Different Than Other Scores Ive Seen

There are many different credit scores available to consumers and lenders. FICO® Scores are the most widely used credit scores and are the only credit scores used in over 90% of U.S. lending decisions. Its important to know that there are also several different versions of FICO® Scores. Different lenders may use different versions of FICO® Scores. In addition, your FICO® Score is based on credit report data from a particular credit bureau, so differences in your credit reports may create differences in your FICO® Scores. The FICO® Score Wells Fargo is providing you for free is for educational purposes. When reviewing any of your credit scores from any source, take note of the date, bureau credit report source, version, and range for that particular score. For more, see Understanding the difference between credit scores.

Also Check: Does Cashnetusa Report To Credit Bureaus

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

Also Check: Syncb/ntwk Credit Card

Get Your Credit Score

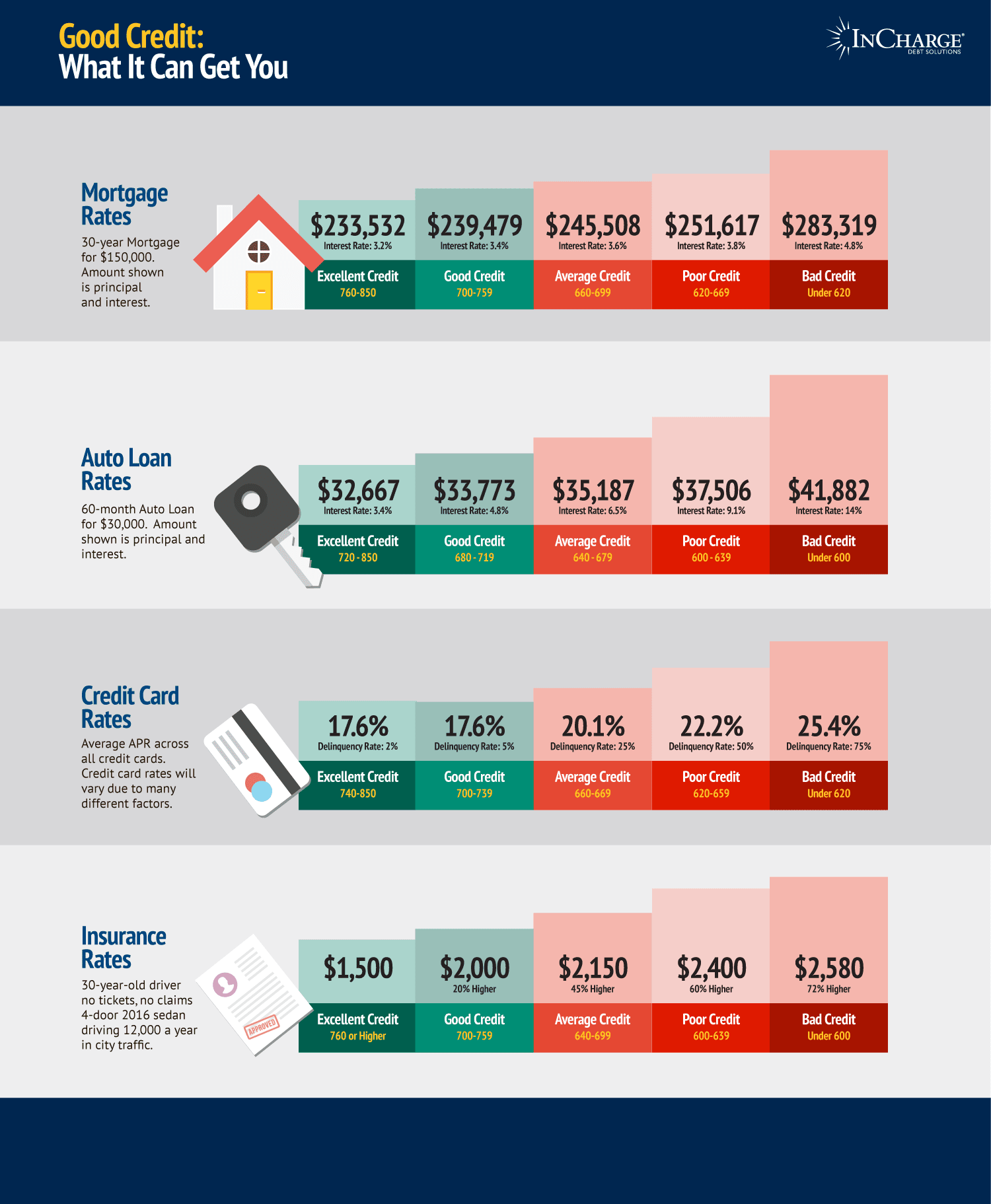

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

How To Fix Your Credit Score Yourself

If you have poor credit, you can fix your credit score , but it can take time – even years. Because of the time involved, we prefer to talk about this process in terms of re-building or re-establishing your credit rather than simply fixing your credit. Fixing sounds like a fast process, but aside from a couple exceptions, there is rarely anything quick about it.

Read Also: Does Speedy Cash Report To Credit Bureaus

What Rating Requirements Does A Company Coming With A Cp Need

As per SEBI guidelines, the company looking forward to raise funds via CP should have a minimum credit rating of A-2. The company also needs to obtain the credit rating either from CRISIL, ICRA, CARE, FITCH or any other credit rating agency that may be specified by RBI. The issuers also needs to ensure that at the time of issuance of Commercial Paper the rating so obtained is current and has not fallen due for review. Since such instruments are not backed by collateral, only firms with high credit ratings from a recognised rating agency will be able to sell their commercial paper at a reasonable price. CPs are usually sold at a discount from face value, and carries higher interest repayment rates than bonds. Typically, the longer the maturity on a note, the higher the interest rate the issuing company or institution would have to pay. Interest rates will tend to fluctuate with market conditions, but will be lower than bank rates

3 December 2018

Costa Coffee To Shake

3 September 2021

Everyone should take time to manage their credit score, especially during this time of coronavirus uncertainty. It’s no longer just about whether you can get a mortgage, credit card or a loan, it can also affect mobile phone contracts, monthly car insurance, bank accounts and more. Here’s what you need to know about credit checks and how to boost your credit score.

Also Check: How To Get A Repo Removed From Your Credit

How Long Information Is Kept By Credit Reference Agencies

Information about you is usually held on your file for six years. Some information may be held for longer, for example, where a court has ordered that a bankruptcy restrictions order should last more than six years.

If information is held for longer than it is supposed to be, you can ask for it to be removed.

In England and Wales, for more information about bankruptcy, see Bankruptcy.

How Big Of A Down Payment Do I Need To Buy A Home

Your down payment can be whatever you want or as small as you make the minimum investment required by your lender. The five most common low down payment mortgages used by first home buyers are FHA Loans, VA Loans, USDA Loans, Common 97 and HomeReady.

Credit to buy a houseWhat is a good credit score to buy a house? These are the credit requirements for the most popular mortgages: Typically: 620 FHA: 500 to 580 VA: Usually low to medium USDA 600, depending on the lender: Usually around 580, depending on the lender.Do I need a good credit score to buy a house?In general, a good credit rating for buying a home is 620 or higher. With a of at least 6

Don’t Miss: How To Get Repossession Off Credit