How Can I Deal With A Late Payment

Of course, itâs best to avoid a late payment in the first place, but life can be unpredictable. If you canât help missing a payment, you should contact the company as soon as possible. Explain your situation, as they may be able to agree a temporary solution with you. You might also want to get in touch with a debt advice charity such as StepChange.

It can be easy to forget or miss a payment on your credit card if youâre not careful, especially when life gets hectic. But there is a simple solution on how to avoid late fees on your credit card: set up a direct debit, ensuring your credit card payment goes out each month automatically. You can set the direct debit so you pay the minimum amount, a fixed amount or the full amount.

If you do get a late payment recorded on your credit report, you can try and balance out its negative impact by taking steps to improve your score. You can keep track of your credit score with a free Experian account â it gets updated every 30 days if you log in.

You may also want to give Experian Boost a try to see if you could get an instant boost to your score. By securely connecting your current account to your Experian account, you can show us how well you manage your money. Weâll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings or investment accounts.

What Qualifies As A Late Payment

Lenders use standard codes when sending your payment information to the credit reporting agencies. At the end of each code is a number between one and nine that relates to whether your payment was made on time.

If you make an on-time payment within 30 days of billing, this is considered ideal and youll typically receive a one rating.

This rating can help maintain and improve your credit health. If the number is two or higher, its considered a late payment and could negatively impact your credit health. A rating of two means your payment was made 31 to 59 days late.

There are many factors that affect your credit scores, and payment history is a key component, says David Blumberg, public relations director of TransUnion. Paying bills on time each month can have a positive impact on your scores, while late payments can negatively impact your scores and stay on your report for up to six years.

Also, a more recent late payment may be more detrimental to credit scores than one from several years prior, Blumberg says.

Q: What Do I Do If The Repayment History Information On My Credit Report Is Incorrect

A: As always, if there are any incorrect listing on your credit report, first contact the organisation that provided the incorrect detail, if they do not resolve the issue, you can also reach out to Experian and follow their correction process.

Its essential that you find out exactly how late payments are affecting your credit reputation and how you plan to get your finances back on track. To get you started, sign up for your free credit score at Credit Savvy!

You May Like: Unlocking Credit Report

What To Do If You Missed A Payment

Dont panic if youve missed a payment. The first thing you should do is pay what you owe, if you can. You can also reach out to your creditor to see if its been reported to the credit bureaus yet and discuss how to make your account current if you cant make the full payment on the spot.

If you miss a payment, catch up as soon as you can, Griffin says. Let them know youre facing some issues, especially today with COVID-19 and what were going through with our economy. Lenders are able to work with you and want to make sure theyre working with you.

Some creditors give borrowers a grace period, which can give you a few extra days to make a payment without additional fees or penalties. But they may charge you a fee, penalty, or both as soon as you miss your due date.

If youre late but can pay the bill immediately, talk to your creditor to see if you can get a late fee waiver or refund. Creditors have the right to deny your request but they may be willing to make an exception if you typically make on-time payments.

If youre past 30 days and cant bring your account current, still reach out to your creditor to talk about hardship options. You may be surprised to find out there are still options to rectify the situation.

Payments More Than 30 Days Late

Once a late payment hits your credit reports, your credit score will likely drop from 90 to 110 points. Consumers with high credit scores may see a bigger drop than those with low scores.

The first delinquency impacts FICO Score more than a different consumer who might have multiple delinquencies on credit history, said Tommy Lee, principal scientist at FICO.

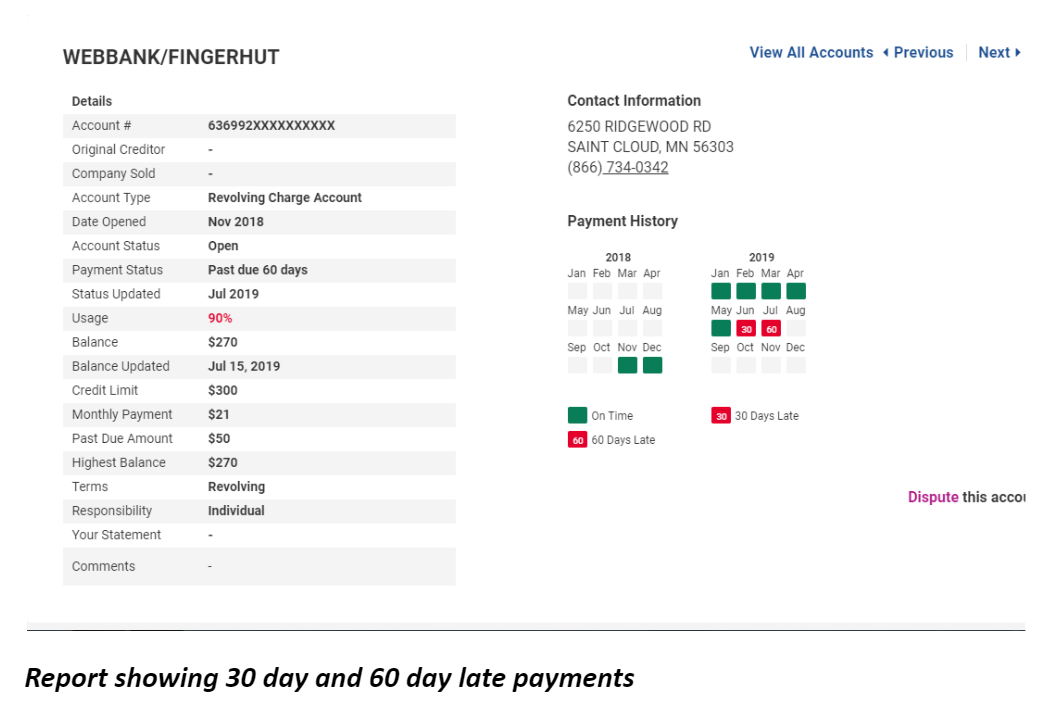

Some lenders dont report a payment late until its 60 days past due. However, you shouldnt count on this when planning your payment. The later you pay, the worse the impact on your credit score. Late payments show on your credit report as 30, 60, 90, 120 and 150 days late.

Heres an example of the effect a 30-day delinquency has on two different consumers:

| 30-day delinquency |

| 90-110 |

*Note this study was done on selected consumer profiles, and there are a wide range of profiles so results may vary.

Recommended Reading: Does Carmax Take Bad Credit

What Is Considered A Late Payment With Your Landlord

For the answer to this question, you are going to have to look carefully at your lease agreement. Some landlords and leasing companies have variations on what they consider a late payment, something you can negotiate with your landlord when signing a new lease.

Technically, any late payment is considered late if it is not turned in on the rent due date agreed to in your lease, however there is typically a grace period of 3 5 days. Some states have mandatory grace periods and others do not so be sure to check the renter rights laws in your state!

What are the penalties?

If you dont pay rent when its due, expect your landlord to call, email, or otherwise contact you, to collect the rent. They can also begin assessing late fees if there is a late fee provision in your lease or rental agreement.

As an extreme measure they can even send you a termination notice, telling you that if the rent is not paid within a certain number of days or if you havent moved out by then, the landlord will begin eviction proceedings.

If this ever happens, be sure to check the rental laws in your state because as a renter, you do have legal rights that landlords must respect.

Will I Be Charged Fees And Interest On Late Payments

Companies often charge penalty fees and interest on overdue payments, so it can get quite expensive. Some companies will give you a grace period â this starts when the payment is due, and if you pay during this time you wonât be charged late fees. Check your contract with the lender to see if you have a grace period.

Some companies have tiered late fees based on how much you owe. However, there are legal restrictions on what you have to pay. For example, charges of over £12 for late credit card payments may be seen as unfair. If you think youâve been charged too much, speak to your lender first. If you canât come to an agreement with them, you may want to seek free advice from the Financial Ombudsman.

You May Like: Does Opensky Help Build Credit

Why Do Late Payments Impact Your Credit

Payment history is one of the key details that banks and issuers consider when deciding whether or not to approve you for credit.

A long-standing history of on-time payments suggests that youre a responsible and reliable borrower a poor history of on-time payments suggests to banks and issuers that you may not repay debts and could result in a costly loss to their business.

Because of this, payment history is one of the most important factors that goes into calculating your credit scores. So when you miss a payment or make a late payment, it can have a more dramatic impact on your scores than something like a hard inquiry.

Can A Landlord Ruin Your Credit

Just because you’ve missed rent payments, it doesn’t mean your landlord will automatically report you to the credit bureau. This is where your relationship with your landlord and the rapport you’ve built comes into play. For example, if you’ve been paying on time for years and have been an exceptional tenant, your landlord is more likely to be sympathetic to your circumstances and not report a late payment.

Of course, not all landlords will care what your situation is, especially if you’re consistently late on your payments and have built up rent arrears.

There are cases where a landlord might use a rental payment service that may automatically report the late rent or rent defaults to the credit bureau. It’s also likely that they’re liable to report you if the house is part of a property management company, as they might have various policies on late payment.

We recommend you ask for clarity around the issue of late payment before you sign a lease on a place, especially if you know you’re going to have a rough time ahead financially.

Recommended Reading: Navy Federal Personal Loan Approval Odds

How Long Does A Late Payment Stay On Your Credit Report

Late payments that were reported to the can stay on your credit report for seven years from when the account was initially reported late. But not all late payments are reported. Ultimately, this will depend on how soon you correct the problem. If you are late by even a day, you are likely to incur a late charge, but you wont be reported. It is not until you pass the 30-day mark that you need to be concerned about a late payment notation on your credit report.

There is one exception to the 30-day-and-youre-late rule: medical bills. Medical bills dont get reported as late until they are six months old. This allows time for wrestling with your insurance company, provider or hospital over your bill.

Late Payments And Your Credit

All creditors want to know that a borrower will pay his or her debt as agreed. They use credit reports and scores in a backwards-looking fashion to assess how much of a risk a consumer is likely to pose. If a person has established a pattern of paying their bills on time, they are viewed as a responsible user of credit and not likely to cause the creditor any financial losses. Having a history of late payments, on the other hand, signals unreliability, financial instability, and greater financial risk.

The consequences of late payments escalate in severity as the account becomes more and more delinquent. The consumers credit report shows payment history with degrees of lateness: on-time, 30 days late, 60 days late, 90 days late, 120 days late. Each degree of lateness causes incrementally greater damage to the credit score than the previous one.

Collection, repossession, charge-offs, bankruptcy, and other notations that signify a failure to fulfill a financial obligation may also be listed, and they result in an even greater blow to the consumers score than late payments.

As mentioned earlier, a cable or other utility bill will generally not be reported at all unless it is seriously delinquent and in collections. That usually happens around the 90-day mark after a missed payment. Before that, the consumer is likely to be hit with late fees and ultimately a suspension of service.

The longer you fail to pay a bill, the more damage it can do to your credit score.

Don’t Miss: Snap Finance Credit Score

Can You Remove Late Payments From Your Credit Report

Accurate and timely notations to a credit report generally cannot be removed. However, if the cause of the late payment was a genuine mistake on your part and it is a one-time-only thing, you can certainly ask your creditor not to report it in the first place. But the key will be to get to the creditor before they report. Its easier to stop the credit reporting train before it leaves the station than after it has left.

If you are not successful in getting your creditor to not report, there are actions you can take to minimize the damage. Payment history and account for a whopping 65 percent of your total FICO credit score. So its in your best interest to avoid making late payments and be mindful of your credit utilization ratio. Experts recommend using less than 25 percent or so of your total credit limit. Its also best to avoid applying for a new unless you really need to and only when you are fairly sure you will be approved.

Within a few months, you should see your score back to where it was before, or close at least, even though the late payment notation will remain on your credit reports.

When You Cant Pay All Of Your Bills On Time

If you find yourself unable to pay all of your bills on time, pay the essentials bills off first. You need a place to live, food to eat, light and heat to function well, and so on. Pay off what you need in order to live and work first.

If you have a mortgage, you might get hit with costly late fees, but the foreclosure process takes several months so skipping a payment if you are desperate wont leave you without a roof over your head. Of course we do recommend being delinquent on your mortgage payments, no running water or electricity might be a more pressing problem. Just remember, though, that the late payment history will negatively affect your credit score.

If you do have to miss a payment to anyone, call each of the companies and ask for an extension. Often you make arrangements up front and get companies to defer payments, give you more time to pay, reduce late fees, or hold off on reporting to credit bureaus. If you show a genuine effort to pay your debts responsibly, they may work with you. You may want to offer a partial payment as a sign of good faith.

Also Check: What Company Is Syncb Ppc

The Chase Credit Card Late Fee In Plain English

Credit card companies do lots of things that don’t seem to make sense. For example, they’ll charge you late fees when it’s clear you might not be able to pay them. If you could make the payment, you wouldn’t be marked as “late” in the first place!

But none of this common-sense logic makes a difference here. The bottom line is that credit card lenders make money from this process. They accumulate more and more fees from this initial late fee so that once you do catch a financial break, you’ll owe all that money to the company.

With this in mind, it’s important as a credit card user to be ahead of the game. If you are a Chase cardholder, you’ll need to understand the ins and outs of the Chase credit card late fee. This way, you can protect yourself from falling into a vicious cycle of debt and fees.

The good news is that we’re here to help. We’re on your side when it comes to getting through the credit card process as unscathed as possible. Furthermore, you can actually get these late fees refunded by negotiating directly with the bank or using auto-negotiation platforms like Harvest. Keep reading for some of our most important pointers about the late fee for Chase credit cards.

Removing Delinquent Bills From Your Credit History

If there is a delinquent bill on your credit report and it is inaccurate, you can ask the credit reporting agency to remove it. They will contact the company that reported the late payments to request verification. If they do not respond in a timely manner or admit the error, the delinquent bill will be removed.

If the late fee is accurate, you have fewer options. Your best approach is to contact the company reporting the late payment and ask them to remove it. A so-called Goodwill Letter explaining the reason behind the late payment, a pledge not to do it again, and a history of on-time payments may help convince them to remove the report. However, they are under no obligation to do so.

Delinquency reports stay on your credit report and impact your credit score for seven years. The more recent it is, the bigger impact it will have.

Also Check: How To Get A Repo Removed From Your Credit

Student And Personal Loans

How a late payment on a student loan is handled can vary between lenders. If youre dealing with a private student loan, refer to your student loan contract. For federal student loans, details are spelled out online by the U.S. Department of Education:

- Your loan becomes past due the first day after you miss a payment.

- After 90 days, your loan servicer reports the late payment to the credit bureaus.

- Eventually, your loan will go into default. Some of the penalties youll have to deal with once your loan is in default include the entire unpaid loan balance plus interest becoming due immediately, losing eligibility for additional federal student aid, your wages potentially garnished and your tax refunds potentially put toward your debt.

You may face some similar penalties if you miss a payment on a personal loan. After 30 days, your lender will report it late to the credit bureaus. You may also be charged a late payment fee and your interest rate can increase. After 60 days, your lender may ask for the full amount owed to be repaid. Eventually, the lender will likely sue you or sell the debt to a collection agency.