Can A Walmart Credit Card Help Build Credit

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

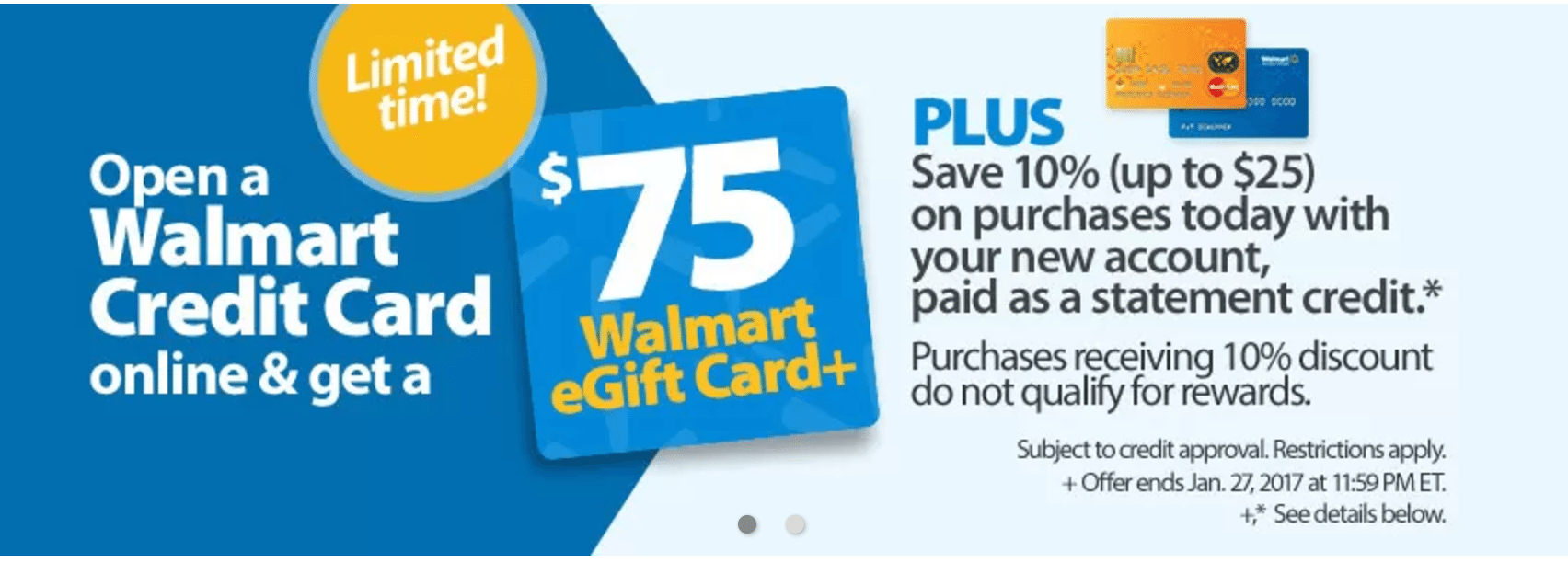

Walmart Inc. offers two kinds of credit cards, Walmart Rewards Mastercard, which can be used anywhere Mastercard is accepted, and a Walmart MoneyCard, which is a store credit card.

The Walmart Rewards Mastercard and its in-store credit card are issued by Capital One, and cardholders can earn rewards for shopping at Walmart. When used properly, both cards can help you build your credit history and credit score.

By reviewing the terms and conditions of the Walmart Rewards Mastercard and Walmart MoneyCard, you can verify that your account activity is reported to the three credit bureaus . Data, such as your account balance and list of late payments, will appear on your , which the credit bureaus use to calculate your credit score.

Learn the strategies below to help you build your credit with these two credit cards.

Bankrates Takeis The Capital One Walmart Rewards Card Worth It

For many, Walmart is more than a retailerits the primary hub for groceries, home goods, auto care and more. There are over 5,300 Walmart stores in the U.S., which makes this card offer very appealing. With unlimited 5 percent cash back on purchases at Walmart.com, which includes grocery pickup and delivery, theres a lot of upside for those who do all their shopping at the superstore.

For those who are not near a Walmart or prefer to do their shopping at a variety of stores, however, it may not make sense to get this card. Instead, consider adding a card to your wallet that offers rewards in broader categories that match your spending habits.

The information about the Capital One Walmart Rewards® Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Walmart Rewards Card Vs Citi Double Cash Card 18 Month Bt Offer

The Citi® Double Cash Card lets you Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. It also comes with $0 annual fee.

If you make a majority of your purchases online at Walmart, the Walmart Rewards Card may make sense for you. Otherwise, it may be wise to pick up a card like the Citi® Double Cash Card that gets 2% everywhere. Similar to the Walmart Rewards Card, the Citi® Double Cash Card does not come with an initial welcome offer or higher rewards amount. For the first 12 months, earning 5% in-store with the Walmart Rewards Card might be more attractive if you make a lot of Walmart purchases.

Don’t Miss: Coaf Credit Inquiry

High Apr Can Become Expensive

Both Walmart cards carry higher than normal APRs the Walmart Credit Cards APR is among the highest youll find with any credit card.

If you happen to be a shopper who pays your balance in full each month rather than carrying balances month to month, the APR probably wont be a concern.

However, if you consistently carry a balance, its best that you choose a card with the lowest APR possible because the interest charges are going to add up quickly.

On the other hand, cards like the tend to have attractive introductory APR periods.

Is There An App For The Walmart Credit Card

You can add your Walmart Rewards Card to the Walmart mobile app. This can be a great way to use Walmart Pay for shopping at Walmart. During the first 12 months of having the Walmart Rewards Card, using your card with Walmart Pay allows you to get 5% cash back at Walmart stores in addition to at walmart.com.

Also Check: Average Finance Rate For Carmax

Earn 5% Cash Back In Walmart Stores For The First 12 Months

The Walmart Rewards Card does not have an upfront sign-up bonus like many other cards. Instead, you will 5% back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval.

Walmart Pay allows you to store payment information securely in the Walmart app. Then when you check out, you simply scan the QR code from the register on your phone.

Top Unsecured Cards For 600 To 650 Credit Scores

With a middling credit score in the 600 to 650 range, you have a few more options for unsecured credit cards than you would were your score much lower but the easiest cards to get will still be the bottom-tier cards with annual fees and/or few perks.

If youre concerned about being approved for a particular card, or simply want to explore your options, many issuers will let you check for pre-qualified card offers online. Of course, the easiest way to stack the approval deck in your favor is often by applying for a card known to accept low scoring applicants, such as the cards below.

| Yes | 9.0/10 |

Cards from Credit One Bank® are exercises in variability, with everything from the annual fee to the APR youre offered being dependent upon your specific credit profile. On the plus side, eligible cardholders can earn cash back purchase rewards, which can boost the value of this card.

You May Like: How To Unlock My Credit Report

How To Apply For Walmart Credit Card

- Visit the Walmart credit card website.

- Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.

- Check the information is accurate and submit your application.

If your credit score is preventing you from qualifying for this credit card, check out our guide for the best credit cards for bad credit.

SuperMoney DisclosureEditorial Disclaimer

Top No Annual Fee Cards For 600 To 650 Credit Scores

Although many people associate annual fees with fancy rewards cards, many cards at the other end of the spectrum also tend to charge annual fees. In fact, outside of your local credit union, its actually rare for starter and credit-building cards to have a $0 annual fee rare, but not impossible to find.

If you want both a low-fee card and rewards, youll likely need to turn to a secured credit card. Otherwise, you can find some no-frills unsecured cards that wont charge you a fee, so you can build credit without having to pay for the privilege of using your card.

| Yes | 7.0/10 |

We like this card for a lot of reasons. For one, it has the lowest interest rate on this list, coupled with no annual fee and cash back rewards. Not to mention it doesnt require a credit check for approval, and theres no minimum deposit required to open an account a rather unheard of feature in the secured card market. Whats not to like?

Read Also: What Credit Score Do You Need For Klarna

Bottom Line: Are The Walmart Cards Worth It

Walmart cards are not a bad option for those with lower credit and are looking for a way to improve, while getting some rewards at the same time. Those with higher credit have better options with more rewards and better terms.

If you’re just looking for a credit card that’s easy to get, we advise going with a secured credit card instead. The interest rate on the Walmart cards is high enough that carrying a balance can REALLY hurt your finances.

If you are determined to have a Walmart store card or Mastercard, be careful and make sure you understand the terms.

Leah Norris is a research analyst at CreditDonkey, a credit card comparison and reviews website. Write to Leah Norris at . Follow us on and for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser’s affiliate programs.

Read Next:

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: What Is Gs Bank Usa On Credit Report

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

What We Love About Walmart Credit Card

The Walmart Credit Card is a full credit card that you can use at Walmart and at other stores. The card offers rewards and benefits when you use it to shop at Walmart and Walmart.com. For example, you can earn 3% cash back on purchases that you make at Walmart.com and 2% cash back when you buy gas from a Walmart gas station. The card also has a low minimum credit limit, which may make it easier for people with poor or no credit to qualify, giving them a chance to start building credit.

Recommended Reading: Aargon Agency Settlement

Re: Walmart Card Approved

Nice, grats on your new Walmart card

wrote:

Thank You for sharing . I found a pre approval link on a WalletHub review and click on the pre approval for the Walmart card .

I filed out the form and hit click . There I was pre approved for the Mastercard Version . I completed the app and much to my surprised I was approved for a $3000 limit. It’s my biggest starting limit since my rebuild . They pull three bureau’s but it was worth it since my other 2 Cap 1 cards are toy limits.

Nice SL!

wrote:

Congrats on the approval!!! The $1k SL is on the higher side for this card. Enjoy it! Continued success on your rebuild!!

I didn’t know that, thanks! I wonder if Cap1 does auto increases after about 6 months?

Capital One Walmart Rewards Mastercard

Annual fee

- Earn unlimited rewards every day, everywhere on purchases in and out of Walmart

- Earn unlimited 5% back on purchases online at Walmart, including Grocery Pickup and Deliver

- Earn unlimited 2% back on purchases in Walmart stores, 2% back on restaurants and travel purchases, and 1% back on all other purchases everywhere else Mastercard® is accepted

Show More

- Limited rewards for in-store shopping

- No intro APR period

This card earns 2% cash back on every purchase: 1% when you buy and 1% when you pay it off. There’s no sign-up bonus, but the annual fee is $0.

|

0% intro APR on Balance Transfers for 18 months |

Intro APR0% intro APR for 14 months on purchases and balance transfers |

Intro APR0% intro APR for 15 months on purchases and balance transfers |

Recommended Credit Score |

690850good – excellent |

Get more smart money moves straight to your inbox

Become a NerdWallet member, and well send you tailored articles we think youll love.

You May Like: Locked Out Of My Experian Account

Can You Use A Walmart Credit Card Anywhere

There are two Walmart credit cards you can apply for the Walmart Credit Card and the Walmart MasterCard. The Walmart Credit Card can only be used at Walmart stores, Walmart.com, Sams Club, and its associated gas stations. The Walmart MasterCard, however, can be used anywhere MasterCard is accepted.

Walmart Credit Cards: Your Complete Guide

Last updated Aug 6, 2021| By Kat Tretina

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

If youre a budget-conscious shopper, you likely frequent Walmart stores and Walmart.com for your everyday purchases. According to the company, more than 265 million customers visit Walmart stores each week, showing just how popular the retailer is with shoppers.

Do you regularly shop at Walmart or Walmart.com for your groceries and other essentials? Signing up for a Walmart credit card can be one of the great ways to earn cash back shopping at Walmart. Youll earn valuable rewards that you can redeem for statement credits, gift cards, or even to cover recent purchases.

But which Walmart credit card is best for you? Heres what you need to know about the two Walmart credit cards and how to choose the right one for you.

|

|

The Walmart Mastercard and Walmart Credit Card are the same in terms of their fees and their introductory offers.

There are some other important things to know about each of these , so let’s look at each in more detail as well as how their cashback rewards compare.

You May Like: Carmax For Bad Credit

Walmart Credit Card Credit Score And Approval Odds

Walmart does not provide specific numbers for its credit score requirements, customer service representatives for Walmart Credit Services said. However, one representative noted that the Capital One Walmart Rewards Mastercard is designed for good-to-excellent credit levels.

The Capital One Walmart Rewards Mastercard is an open-loop card, which you can use anywhere that accepts Mastercard. If you do not qualify for the Capital One Walmart Rewards Mastercard, Capital One will automatically consider you for the Walmart Rewards Card, which you can use at Walmart, Walmart.com, and Sams Club.

Quick Answer: Is A Walmart Credit Card A Good Idea

The Walmart® credit card options are best for people with low credit scores who cant get better rewards credit cards elsewhere.

They provide decent 0% financing options and some savings on gas purchases.

The Walmart® MasterCard® will also get you a 1% savings on all purchases, regardless of where they are made.

You May Like: How To Get A Repo Off Credit Report

Citi Double Cash Card

Offering one of the best flat cash back rates available, the Citi Double Cash Card is a great no-frills, all-purpose rewards card. You earn 2% cash back on all purchases , regardless of where, when or how theyre made. You can earn up to 2% on all purchases at Walmart, online or off. This is an especially good card if you dont want to track spending categories or be forced to shop online or at a specific store to earn rewards. Keep in mind, however, that the Walmart rewards card will earn you a higher rate for online purchases when shopping on Walmart.com.

More On Walmart Financial

Walmart Financial is a division of Walmart Canada Corp., owned by Walmart Stores, Inc., which was established in 1994. Walmart has over 9,000 discount retail stores in 28 countries, employs 2.2 million associates worldwide and serves more than 245 million customers each week. It is Canadaâs largest retailers, next to Costco, Shoppers Drug Mart, Canadian Tire and Home Depot.

Also Check: How To Delete Inquiries From Your Credit Report

Make Payments On Time

Whether you’re just beginning your credit history or looking to strengthen it, the single most important thing you can do to improve your credit is to make monthly payments on time. Accounting for 35% of your FICO , payment history is the biggest component of a good score. By paying on time, you improve your payment history and avoid late payment fees.

If you miss a payment deadline, make that payment within 30 days. A missed payment isn’t reported to any credit bureau unless it is made 30 days after the deadline. However, you’ll still be responsible for applicable late payment fees .

You can’t use your Walmart MoneyCard anywhere but Walmart. You can use your Walmart Rewards Mastercard anywhere that Mastercard is accepted.

What Credit Bureau Does Walmart Use In 2022

Walmart uses information from credit bureaus such as Equifax, Experian, and TransUnion in North America for its store credit card as of 2022. Applicants for the Walmart store credit card need a credit score of around 690 and a Social Security number to be eligible.

If you want to learn more about the credit bureaus that determine an applicants eligibility, what benefits do you get with Walmarts store credit card, and much more, keep on reading!

Read Also: How To Report A Tenant To Credit Bureau