Length Of Credit History

The general math is that the longer your credit history, the higher your credit score all things being equal. Credit score companies will ascertain the age of your oldest credit account, your newest credit account, and the average age of all your credit accounts to get a big picture. Another variable is the frequency by which your credit accounts are used.

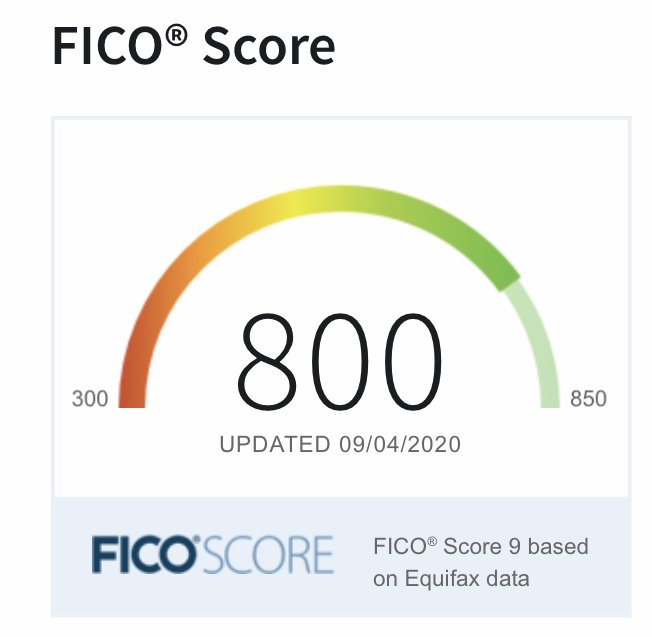

My story: I think the length of credit history is the main variable which put me over the 800 credit score. For the past 14 years Ive demonstrated myself as a good creditor who paid on time on amounts big and small for various types of credit. I have not taken on any new significant loans over the past eight years and have instead reduced my debt levels over time.

Its important to highlight that my overall income took a big hit over the past 16 months since I left my day job. A higher debt-to-income ratio poses a risk to people wanting to get new credit. However, I was grandfathered into my existing lines of credit so institutions arent going to be taking away access.

I postulate that if I continue paying all my bills on time with a lower income level, then I may look even more creditworthy to lenders if my debt stays constant or declines. Getting more new lines of credit will probably prove difficult if my income stays the same.

Optimize Your Credit Utilization Ratio

If you already have one or more credit cards, this could be the biggest move to make if you want to get to 800+. Its the second most important factor that affects your credit score, since it accounts for about 30% of your score. You can change it quickly, and it has a major impact if you get it right.

Ideally, you want a credit utilization ratio of below 10%.

First, if you carry a credit card balance from month to month, pay that off asap. The interest rates are horrendous and its negatively impacting your credit utilization ratio.

Second, if you have two cards that each have, say, a $7,500 credit limit, and you have $6,000 in debt on one card and only $1,000 in debt on the other card , then try to balance them out. Pay down the higher debt one first, so that none of your individual cards have a very high credit utilization ratio.

Third, even if you do pay off your credit card balance each month, your payment timing might be unfairly hurting you. Credit card issuers usually report your credit information to the credit rating agencies once per month, around the end of your billing cycle. But what if you just paid for a major $3,500 car repair on your $5,000 limit card right before they report your credit utilization? Theyll say you have a 70% credit utilization ratio, which is bad, even though you always pay your card off every month.

There are two main ways to fix that:

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Read Also: When Do Credit Card Companies Report Balances To Credit Bureaus

What Is A Credit Score

A credit score is a number assigned to you FICO based on data from all 3 of the big credit bureaus .

Your score is a range of 0 to 850, with 850 being the best. Anything 700 or higher is considered good and anything 800 or higher is considered excellent.

Your score is not a measure of financial success.

After all, if Warren Buffet never borrows money, his credit score would be 0. No, a credit score is a measure both of how much money you borrow and owe, AND how well you do in repaying those debts in a timely manner.

As Dave Ramsey likes to say, your FICO score is an I love debt score.

FICO, which stands for Fair, Isaac, and Company is the company that calculates the commonly used credit scores in the USA.

In turn, there are 3 credit reporting agencies that report your history too. As I mentioned, these 3 are Equifax, TransUnion, and Experian.

Because each of the 3 bureaus may have slightly different information, they will all have slightly different credit scores for you.

Its also possible some creditors you may be trying to borrow money from wont check your score with all 3 agencies.

Here is a chart of the good, the bad and the ugly in terms of your credit score

So you can see a good credit score is 700 and higher.

So to get into the excellent range youll need an increase of at least 50 points. Can you boost credit score overnight? Maybe, but theres a lot of factors involved.

So how do we do that? Lets dive in deeper!

Set Up Automatic Payments

This is the most important step in the process. Missing just one single payment can ding your credit score and incur interest, so set up automatic payments to ensure your credit card bill, student loans, and other debts are paid on time. Once you’ve set up your automatic payments, double check that they’re scheduled correctly and on time. Once you’ve double-checked, triple check.

Your payment history is the biggest score influence, accounting for 35%. So paying your bills on time is a huge help, even if you’re not able to pay your balance in full.

It’s also smart to check your credit report to make sure it accurately reflects your good behavior. About 1 in 5 consumers has an error on their report, according to the Federal Trade Commission. You can get a copy of your report at AnnualCreditReport.com.

Also Check: Can A Repo Be Removed From Credit Report

How To Improve Your 800 Credit Score

A FICO® Score of 800 is well above the average credit score of 704. It’s nearly as good as credit scores can get, but you still may be able to improve it a bit.

More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range . A Very Good score is hardly cause for alarm, but staying in the Exceptional range can mean better chances of approval on the very best credit offers.

Among consumers with FICO® credit scores of 800, the average utilization rate is 11.5%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

Open New Account Types

That is the bulk of your credit score. To polish it even further you can get additional loans to mix up your credit, things like car loans, mortgages, personal loans and lines of credit which shows your proficiency at paying off different types of debt, but this only accounts for about 10% so its not something to really worry about.

You May Like: 877-392-2016

How To Get A 775 Credit Score

Theres no secret for getting a 775 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 775 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 775.

How To Get A Credit Score Of 700 Or 800

5-minute readDecember 21, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

A credit score is a three-digit number that can have a big impact on your life. While a good credit score can open many doors, a bad credit score could leave you in a lurch.

Luckily, credit scores arent static numbers, and if you can figure out how to get a credit score of 700 or 800, you can enjoy some of the best rates and terms on financial products like mortgages, car loans, credit cards and personal loans.

If you dont know where to start, were here to help. Read on to learn more about the benefits of knowing how to increase your credit score and the best tips for doing so.

Recommended Reading: Remove Inquiries Off Credit Report

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Don’t Open Too Many Accounts At Once

FICO and VantageScore look at the number of credit inquiries, such as applications for new financial products or requests for credit limit increases, as well as the number of new account openings. Making these kinds of inquiries frequently dings your credit, so only apply for what you really need in order to avoid damaging your score.

If you want a new card, but you’re not sure you’ll qualify, you can submit a pre-qualification form online. You can submit as many pre-qualification forms as you want, as they won’t impact your credit score.

Also Check: Carmax Financing 650 Credit Score

Habits Of People With Excellent Credit Scores

Want to improve your credit score? Take a page from the best. People with excellent scores know that following a few basic rules is the key to success. Adopting their habits could boost your score into the stratosphere, opening the door to the best interest rates and terms on loans. And capturing the lowest loan rates can save you a bundle of money in the long run.

The two big consumer credit scoring companies are FICO, whose scores are most commonly used in lending decisions, and VantageScore, a company created by the three major credit bureaus whose scores have been gaining ground among lenders. The latest models of both scores operate on a scale of 300 to 850. Generally, a score of 750 or higher is considered excellent.

Once you know your score, you can start taking steps to raise it by following these seven habits of people with excellent credit scores.

1. They Pay Bills on Time

The most influential factor in your credit score is your payment history, so staying on top of bills is crucial. Just one late payment can damage your score. FICO recently reviewed the profiles of consumers it calls high achievers and found that 72% of those with scores from 750 to 799and 95% of those with scores of 800 or higherhad no late payments on their credit reports.

2. They Watch Their “Utilization Ratio”

3. Keep Balances Low

4. Give It Time

5. Apply for Credit Sparingly

6. Choose the Right Credit Cards

7. Monitor Your Scores and Credit Reports

Credit Score: Is It Good Or Bad

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit.

21% of all consumers have FICO® Scores in the Exceptional range.

Less than 1% of consumers with Exceptional FICO® Scores are likely to become seriously delinquent in the future.

Recommended Reading: Affirm Required Credit Score

Get Credit For Paying Monthly Utility And Cell Phone Bills On Time

If you are already responsible about making your utility and cell phone payments on time, then you should check out Experian Boost. It’s a free and easy way for consumers to improve their credit scores. The way Experian Boost works is simple: Connect your bank account to Experian Boost so it can identify your utility, telecom and streaming service payment history. Once you verify the data and confirm you want it added to your Experian credit file, you’ll get an updated FICO score delivered to you in real time.

Visit Experian to read more and register. By signing up, you will receive a free credit report and FICO score instantly.

Apply For Loans Within A Short Time Period

Lots of hard inquiries in a short time could be an indication to lenders that you’re searching for lines of credit you won’t be able to pay. Smart borrowers, though, will apply for a few loans of the same typesuch as a mortgage, car or personal loanto compare rates. For that reason, credit scorers treat multiple hard inquiries of the same loan type made around the same time as one, reducing the negative effects on your credit score. So try to submit applications within a short time frame, ideally two weeks. Keep in mind, though, that the scoring models don’t offer this same allowance for credit card applications all of these will count individually regardless of when you submit them.

Read Also: How To Remove Hard Pulls From Credit Report

Why Your Fico Score Matters

FICO, or Fair Isaac Corporation, is the nations oldest and most trusted provider of credit scores. Over 90% of businesses use the FICO score to help determine a consumers creditworthiness.

FICO scores are the three digits that tell lenders how likely you are to pay back the loan on time. Unlike your weight or age, the higher the number, the happier youll be.

A score of 800-850 is considered excellent 740-799 is very good 670-739 is good 580-669 is fair and anything below 580 is poor.

You can increase your score using the steps shown above, but they are not necessarily easy. If that prospect bothers you, blame William Fair and Earl Isaac, the founders of the credit scoring system. They were the mathematical engineers who devised the first credit-monitoring system in 1956.

Fair, Isaac and Company was eventually shortened to FICO, and it is the go-to information source for the three major credit-reporting agencies: Equifax, Experian and TransUnion. The three agencies evaluation methods differ slightly, but the final numbers consistently reflect your credit-worthiness.

The final numbers are all based on algorithms only pointy-headed professors like Fair and Isaac would truly comprehend, but heres all you really need to know: Your age, race, religion, sex, marital status, address, income and employment history have no bearing.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Ideal Credit Score To Buy A House

Dont Hit Your Credit Limit

If you want to get into the 800+ credit score club, be sure that you dont use your credit card up to its full limit. Use no more than one-third of your credit limit if you dont want to hurt your credit score, Nitzsche says.

For example, if your credit card has a limit of $9,000, dont have a balance of more than $3,000.

Ideally, credit card utilization should be 10% or less. Jennifer Martin, a business coach, says she has a credit score of around 825, and that she tries to keep her spending to no more than 10% of a credit cards available credit.

Outstanding debt accounts for 30% of a credit score, Ross says.

If you are overextended and close to your credit limit this indicates overextension and you need to work at getting your credit card balances well below the limits, she says.

Is 625 A Good Credit Score To Buy A House

If your credit score is a 625 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. With a 625 score, you may potentially be eligible for several different types of mortgage programs.

Read Also: Afni Pay For Delete