Tips For Sending Your Pay For Delete Letter

- Before you make a pay for delete offer on a collection account, make sure it’s your debt and the debt collector has the right to collect on it. You can request verification of a debt by sending a debt validation letter, if your initial contact with the collector was within 30 days ago. A debt collector who cannot verify your debt with sufficient proof cannot collect from you, that includes listing the debt on your credit report. However, if the debt collector does have and provides you with proof, collection activity can resume.

- It may be better to simply wait until the has expired for debts that are close to the seven year mark. Once the item automatically falls off your credit report it won’t impact your credit score.

- Send the pay for delete letter only if you can pay the full amount once your offer is accepted. You may only have a certain time to pay before the offer is rescinded and collection actions resume.

- Send the letter and your follow-up payment via certified mail with return receipt requested. This gives you proof that the letter and your payment were mailed and received.

- Make sure you keep a copy of the letter for your records or in case you want to try the strategy with a different creditor or collector.

When Can A Pay For Delete Letter Be Used For Credit Repair

This tactic can be used with any type of debt that has gone to collections, including credit card debts, medical debt, utility payments, student loans, or any other type of consumer debt. You should only use a pay for delete letter on debt that your creditor has already verified. If the creditor hasnât validated your debt, they cannot legally continue to try to collect on that debt or report it on your credit report. Be sure to send a debt verification letter to any creditor that is trying to collect a debt from you that has not been verified.

A delete letter is an especially useful tool to settle debts that arenât very old. After seven years, most of your debts can no longer be legally reported on your credit file. This is a right extended under the Fair Credit Reporting Act . Until then, all of your outstanding debts can be reported to the major credit reporting agencies . If you become delinquent on any of your accounts, your may suffer.

Why You Shouldn’t Pay Off Your Collection Accounts

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. … Any action on your credit report can negatively impact your credit score – even paying back loans. If you have an outstanding loan that’s a year or two old, it’s better for your credit report to avoid paying it.

Recommended Reading: 24 Hour Credit Inquiry Removal

Q What Happens If A Pay For Delete Letter Is Rejected

There are instances when your pay to delete collections letter will be rejected â not all collection agencies will agree to your terms.

If they do accept your offer, make sure you communicate in writing. Verbal agreements are hard to prove if something falls through.

If an agency rejects your pay for delete letter, you still have options to delete the collections.

Final Thoughts On Pay For Delete

Pay for delete is a fairly complicated process. And that assumes you can get a creditor or collection agency to go along with it. In most cases, you wont be able to especially if its either a direct lender, like a bank, or a very large collection balance. More reputable companies wont participate, out of fear of violating their agreements with the credit bureaus.

In the end, your best bet is to try one of two strategies:

One of the big advantages with collection accounts is that they do get better with age. And that happens even more effectively when the account has been paid off.

Forget about pay for delete, and play it straight instead.

Recommended Reading: How To Remove Repo From Your Credit Report

How Do Collections Affect Credit

Collection accounts are considered by both FICO®s and VantageScores credit scoring systems and can be highly influential to your credit scores. Collections fall under payment history, which is the biggest factor in your FICO® Score calculation, driving 35% of your score. Consumers with collections on their credit reports are likely to have lower credit scores than consumers who have no collections.

In addition to the potential impact to your credit scores, the presence of collections also can influence lender decisions. For example, Fannie Mae, which provides financing to mortgage lenders, has several policies requiring that collections be paid off prior to you closing on a mortgage loan.

Its always a good idea to pay collection debts you legitimately owe. Paying or settling collections will end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you. The debt collector will then update your credit reports to show the collection account now has a zero balance.

While its natural to assume that paying or settling a collection account will lead to a higher credit score, this is not always the case. As with most questions regarding credit scores, the answer to whether paying a collection will be helpful is: It depends.

What Is A Collection Account

When you fail to make payments, your creditor will call or send you letters to remind you of your debt. Collections happen if you havent paid your bill for 90 days or more. The creditor may decide to sell your account to a debt buyer or transfer it to a collection agency. Once this happens, you still have to make payments.

But this time, you wont be dealing with the original creditor but the debt buyer or the collections agency. Some debt collectors are persistent, but they still have to respect your rights. If you believe youre being harassed, know what your rights are by checking out the Federal Trade Commissions website.

Any type of debt can go into collections, including credit card loans, student loans, and car loans. Generally, youll know if your account has been moved to the collection because the debt collector will get in touch with you. But the best way to verify if you have one is to check your credit report by getting a copy from the three national credit bureaus: Experian, TransUnion, and Equifax. You are entitled to receive one free copy each year.

Read Also: Care Credit Hard Inquiry

Can I Get A Paid Collection Account Off My Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A paid-off collection account will come off your credit report eventually, but it’s not usually possible to get this account taken off your credit report proactively. You can ask your creditor to take the account off your report – either as a condition of your full payment or as a matter of good will – but no creditor is obligated to honor this request. This article will go into detail about how an account that has been sent to collection can affect your credit score, how a “pay for delete” letter works, and what you can do if the collection account on your credit report is there by mistake.

Having a collections account noted on your credit history can have a negative impact on your finances. Maybe the negative item has dropped your credit score too low to get a good interest rate on a car loan, or maybe the reminder that you werenât always able to pay your debts on time is making new creditors hesitant to lend you credit at all. Having this account on your credit report isnât doing you any favors, but youâve worked hard and youâve paid off the collection account , so now what?

Is It Really Possible

In theory, yes. In fact, it used to be a negotiating tactic that settlement companies would use to get consumers to pay a higher percentage of the debt owed. They would offer to remove the collection account if you agreed to pay a higher percentage of the balance owed.

However, in 1970, Congress enacted the Fair Credit Reporting Act to promote accuracy, fairness, and privacy of information in the files of consumer credit reporting agencies. The goal of the law was to protect Americans from inaccurate reporting. For instance, it allows you to correct mistakes in their credit report through the process of .

However, an offshoot of the law is that it requires data furnishers to provide accurate information to credit reporting agencies. This means lenders, creditors, and debt collectors must, by law, report accurate information. If they dont, they can lose access to consumer credit reports entirely.

Don’t Miss: Navy Federal Credit Score For Auto Loan

How To Improve Your Credit Scores After A Collection

The good news about collection accounts on your credit reports? As they age, they count less toward your credit scores. And even while you have a collection or collections on your credit reports, there are many other ways to improve your credit scores.

The best way to start improving your credit score is to prevent new derogatory information from appearing on your credit reports. You can achieve this by making all of your debt payments on time, without exception. If your bills are paid on time, your debts will never go into default and there will never be a need for a debt collector to get involved.

Ensuring that your credit card debt is as low as possible is another great way to improve your credit scores. Credit scoring models consider your , or amount of credit card balances relative to total credit limits, when calculating your scores. Maintaining low balances ensures a low utilization ratio, which can improve credit scores.

Finally, don’t apply for credit unless you need it. Each time you do so, the lender will likely pull one, if not more, of your credit reports. This will result in a hard inquiry on your reports, which can lower your scores temporarily. And while inquiries are the least influential factor in your credit scores, they can still be a red flag to lenders.

Is Pay For Delete Legal

The Fair Credit Reporting Act governs credit reporting laws and guidelines. Anything that a debt collector, creditor, or credit bureau does regarding a credit report will be based on the FCRA, says Joseph P. McClelland, a consumer credit attorney in Decatur, Ga.

Technically, pay for delete isnt expressly prohibited by the FCRA, but it shouldnt be viewed as a blanket get-out-of-bad-credit-jail-free card. The only items you can force off of your credit report are those that are inaccurate and incomplete, says McClelland. Anything else will be at the discretion of the creditor or collector.

Recommended Reading: Tri-merge

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

How Much Should I Offer For Pay To Delete

With this in mind, you should always start your offer at 25 percent or less. Let’s understand the math here. If your debt is $1,000, let’s say at the most, the collection agencies has paid or will collect 7 cents on the dollar, or $70. If you offer them $250 , they are still making a profit of $180.

You May Like: How Long Do Repos Stay On Your Credit

What Are Collection Accounts

A collection account is an entry on your credit report that indicates default on a previous obligation. The original creditor either sold the defaulted debt to a debt buyer or consigned the debt to a collection agency. The goal of the collector, not surprisingly, is to work on behalf of its client to collect the defaulted debt from the debtor, or as much of it as possible.

Collection accounts often are reported to the credit reporting agencies, and are allowed to remain on credit reports for up to seven years from the original debt’s first delinquency date, per the Fair Credit Reporting Act .

Does Paying Off Collections Improve My Credit Score

Topics:

Current accounts in good standing are not turned over to collections. For your account to wind up in collections, it must be past due, have missed payments, or otherwise be delinquent. Any kind of delinquency on your account can put negative marks on your credit report and unfortunately, simply making a payment to bring your account current does not erase the fact that your account was delinquent and reported to credit reported agencies as such. Negative marks, such as those from missing payments, can take up to seven years to fall off your credit report.

Collections are reported to credit reporting agencies as payment history, a category that makes up thirty-five percent of your credit score. Therefore, having an account go to collections can affect your credit score by over one hundred points, which is enough to drop a fair credit score too poor. This mark on your credit report can deter potential lenders from working with you in the future because it shows that you are unreliable and may not repay the money loaned to you. Having a low credit score and negative marks on your credit report can also affect the repayment terms and interest rates with those lenders who decide to take a risk on you. Additionally, poor credit can affect your ability to take out student loans, your housing options, and it can even limit your employment opportunities.

Don’t Miss: How To Dispute Old Addresses On Credit Report

Debts That Dont Require Pay For Delete To Remove Credit Damage

Its definitely worth noting that some collection accounts can drop off your credit report without pay for delete. If you meet certain payment requirements for these debts, the credit bureaus will remove them from your report. You wont have to wait seven years for them to stop affecting your credit score.

Ways To Get A Paid Collection Account Off Your Credit Report

A paid collection account will not disappear from your credit history just because youâve paid it off. It will stay there until the statute of limitations has passed, which is at least seven years in most cases. You cannot have it removed by contacting the credit bureaus and requesting it be removed. They will keep that item on your credit report until the statute of limitations has passed, but they are required to remove it once this period of time has elapsed. If the statute of limitations has passed and the account is still on your report, you can then call the credit bureaus and tell them to remove it.

You can proactively ask a creditor to remove a paid account from your credit report. You can make this request as a negotiating incentive before paying the account or you can ask your creditor for a goodwill deletion after paying your account. Both options are explored below.

Read Also: How To Unlock My Transunion Credit Report

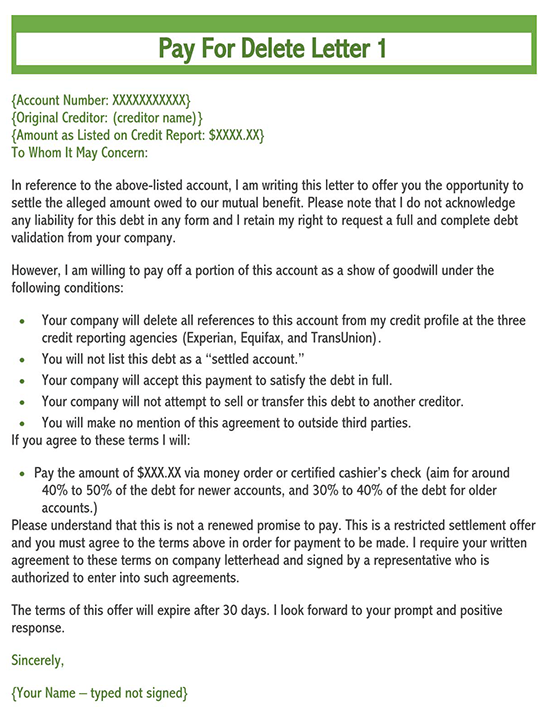

Send A Pay For Delete Letter

As part of your agreement to pay off the collection, you can request the account be removed from your credit reports.

To do this, you submit a pay for delete letter to the debt collection agency outlining how much you are going to pay to settle the account and your request for the removal of the account from your credit reports.

Youll want to receive a confirmation of the terms from the debt collector before you proceed with payment.

Collection agencies usually honor their word in this matter. Just be aware that this letter is in no way legally binding. Technically, collection agencies can accept payment and mark your collection as paid, but not remove the collections from your credit report.

Even if they do follow through, removing the collection will not remove the original late payment marks you received from the original creditor.

Also Read:How Many Points Will My Credit Score Increase if a Collection is Deleted?

So How Will My Score Change

If youre able to pay or settle a delinquent collection account and you apply for a loan or credit card with a lender thats using a newer credit scoring system, its possible that your scores are going to be higher than if the collection still had a balance. Keep in mind, however, that your score may not change at all, especially if youve got other negative information on your credit report.

In terms of how much you could see your score climb, it could be as little as a few points or as much as several dozen points. If youve recently paid off a delinquent debt or youre planning to in the near future, you can check your free credit score right here at Credit Sesame to see whether youve gained any points. We use the VantageScore 3.0 model, which is one of the scoring systems that ignores zero dollar collections.

You May Like: Does Zzounds Report To Credit Bureau

Read Also: When Do Collections Fall Off Credit Report