Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Submit Your Credit Reports For Business Funding

Once you have Downloaded All Three Credit Reports to PDF files using your Experian.com account you can now submit your report to us so we can get you a pre-approval for business funding.

If you are a start-up business we have a few options to get you funding for your new or upcoming start-up business with as low as a 0%APR interest rate loan or line of credit.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Recommended Reading: Does Usaa Report Authorized Users

How Can I Correct Errors On My Credit Report

If you find a mistake on your Experian credit report you can let the agency know – for example that your address has changed. If there’s a mistake relating to a financial matter, or you want to explain why you missed a payment, you can write and ask for a notice of correction to be added to your file.

While this does not amend the information on your file, it will show lenders looking at your report in future that you are disputing some reporting, which they may take into consideration when assessing your credit application.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Recommended Reading: When Does Hard Inquiries Fall Off

Disputing Directly With A Credit Issuer

When you file a dispute with a credit issuer who provided inaccurate information to the credit bureaus, the process is much the same as disputing the bureau itself. Write a letter that indicates the error you found and explain why that information is inaccurate. Again, if you have proof that supports your claim, send copies along.

You can find an address for the business by looking at a recent billing statement. Make sure you look at the address that’s meant for correspondence, as it’s usually different from the address where you send payments. If you can’t find an address, or you no longer have billing statements, call the company and ask for the correct address for sending correspondence.

The information provider is required to do an investigation, just like the credit bureaus, and update your credit report if the information is indeed an error.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

You May Like: 1-877-795-9819

Need To Check Your Credit

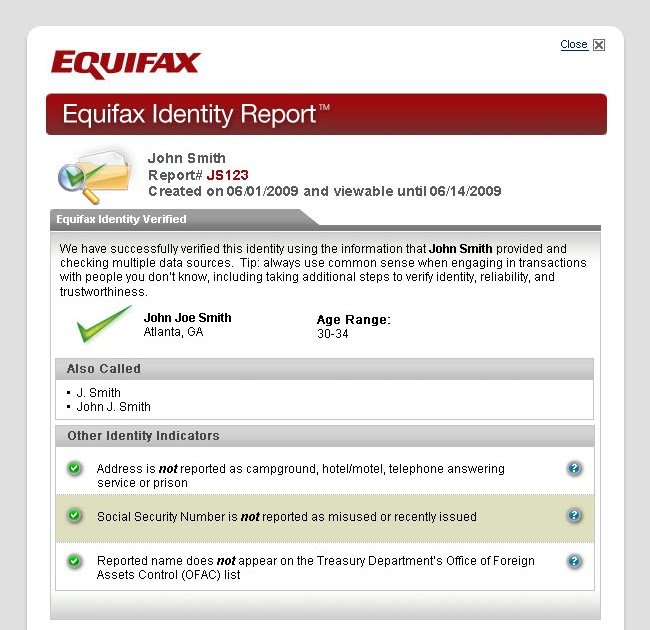

Whether you need to send your credit information to a prospective landlord or need to be approved for financing, Experian Connect will allow you to purchase and view your credit report and score for $14.95 and then securely authorize others to view it for 30 days from purchase.

Experian Connect allows you to safely display your credit report to others. There are no social security and account numbers displayed on your report. Access is direct through Experian, the credit bureau.

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Recommended Reading: Comenitycapital/mprcc

Do You Have To Pay For An Experian Credit Report

In the past you could send off £2 and ask the credit reference agency for your credit report. Now the agencies have to provide your credit score for free, after new GDPR rules came into force about how personal information is stored.

There are two options: you can sign up for a free Experian credit score, which shows how high your score is out of a possible total of 999. Experian says the average score is 789.

However, this credit score is not the same as a detailed credit report, which shows which credit cards you have, whether you have other forms of borrowing, and what your payment history is like.

Or, if you want to see your full Credit report, you have to sign up for an Experian account, known as CreditExpert, which includes a free 30-day trial, and then is charged at £14.99 per month after that. If you cancel before the end of the trial you will not be charged the monthly subscription however, you will need to remember to ring up to cancel the service, otherwise the money will be debited from your bank account automatically.

Prepare And File An Accurate Tax Return

Crypto exchanges might not report your gains or losses to the IRS, which is why failing to report your crypto sales won’t automatically trigger an audit or IRS notice. However, that doesn’t give you permission to be careless in your tax filings. The IRS has tools to track crypto transactions, and you still need to report all the required crypto transactions and resulting gains or losses to file an accurate tax return. If you underreport your income, you risk having to pay penalties and interest later.

Recommended Reading: Usaa Credit Score Monitoring

S To Report Credit To Equifax Experian Transunion And Innovis

Congratulations! You have made the right decision to report your consumer accounts to the credit bureau. This will reward your customers paying on time by opening financial opportunities for them after you report their positive score. At the same time, it may also encourage your delinquent accounts to pay on time.

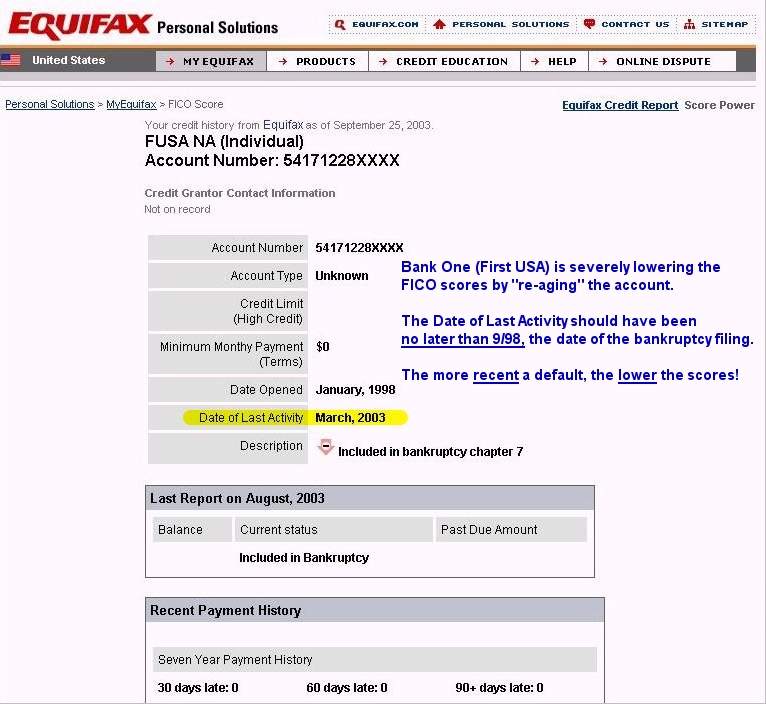

How To File An Equifax Dispute

Using the Equifax dispute page is easy, but you should understand the steps involved before you begin. You need to log into your account and find your dispute history. Once you have the information, you can click on the link to send an email to Equifax and request the company investigate your complaint. In most cases, you will receive a response from the company within 30 days. If you dont receive a response from the company, it is a good idea to follow up.

When filing an Equifax dispute, it is important to include certain information. You must provide your name, date of birth, Social Security number, and address. You should also send copies of any documents you have collected, such as utility bills and other bills. You can also use a utility bill to prove your address and phone number. If you have accounts that were opened by identity theft, you should also get release letters from those lenders and collection agencies. In some cases, you can also submit court documents to prove that your identity was stolen.

Once youve received a rejection, you can try filing a dispute again. If the first attempt doesnt succeed, you can try again later. If your first attempt doesnt work, you can try to resubmit your dispute by providing additional information and documents. If you have already submitted a dispute, you may be able to get it deleted. You can also contact Equifax to request a copy of your report.

Also Check: 809 Fico Score

Charming: How To Check Your Kids Credit Report Balance

| WAYS TO MAKE LIP SCRUB RECIPE | Privacy Policy.

Or your child may have a report because he or she is a victim of identity theft. While maintained for your information, archived posts may not reflect current Experian policy. Content Article Content. Equifax requires parents or guardians to send the following documents by mail:. You how to check your kids credit report balance need to provide documentation verifying your identity, such as a copy of your kies license. Learn more about credit reports and scores. |

| How to check your kids credit report balance | 652 |

| Diy lip scrub with vanilla extract instead | This fact sheet should not be used in lieu of legal advice.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. Equifax requires parents or guardians to send the following documents by mail:. Reporrt this answer helpful to you? Licenses and Disclosures. Place a security alert on your child’s credit report. |

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Recommended Reading: What Bank Is Syncb Ppc

Other Crypto Transactions You Need To Report To The Irs

The IRS asks taxpayers, “At any time during , did you receive, sell, exchange or otherwise dispose of any financial interest in any virtual currency?” You must answer the question accurately or risk legal consequences.

The IRS has said you don’t need to check yes if you only bought, held or transferred cryptos in or between your crypto wallets and accounts. You also might not need to report gifting crypto to someone else or donating crypto to an eligible nonprofit.

But you may need to check yes and report your associated gains or losses from a crypto transaction if you sold crypto or:

- Used crypto to buy a product or service

- Sold a product or service for crypto

- Exchanged one cryptocurrency for another

- Earned crypto via mining, staking, lending or an airdrop

In short, when you use or exchange crypto, you’re essentially selling it in exchange for the product, service, crypto or dollars you receive. That means you need to report the difference between its “sale price” at that point and its adjusted cost basis.

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

You May Like: What Happens If You Don’t Pay Speedy Cash

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Your Options Will Vary Depending On What You Want To Report

There are a number of services available that allow you to proactively add information to your reports or self-report your data to a lender.

They all work slightly differently and use different information to bulk up your financial profile. Experian Boost, for example, zeroes in on your cable, phone and utility payments. UltraFICO pulls an even wider variety of information from your account, including your cash flow, spending habits and account history.

Meanwhile, rent reporting services, such as Rent Reporters and Rental Kharma, will relay your on-time rent payments on your behalf.

Alternatively, you can work directly with a lender that uses alternative data and link your bank accounts so they can assess your transaction history. Or, you can use a nontraditional score service, such as PRBC, and ask a lender to consider it.

Depending on your goals and financial history, you could even use multiple alternative data reporting services to showcase your financial history.

If youre confident that giving lenders a more comprehensive view of your financial situation will help give you an edge, rounding out your financial profile with alternative data could be really useful especially if your credit history is thin or nonexistent.

Tip: In general, you cant remove accurate negative items from your credit report. And theyll stay there for up to seven years. But in some cases, black marks such as missed payments can be removed by contacting your creditors.

Also Check: What Is A 524 Credit Score

Sign Up With Credit Bureau As A Data Furnisher

First you should sign up your business as a data furnisher to report the consumer accounts to the credit bureaus. Some useful information and contact numbers of the credit bureaus are below.If you have provided an email to the sales person, Then you will receive all the communications through email. Check your spam folder regularly until you receive your approval to make sure the emails from the bureau are received

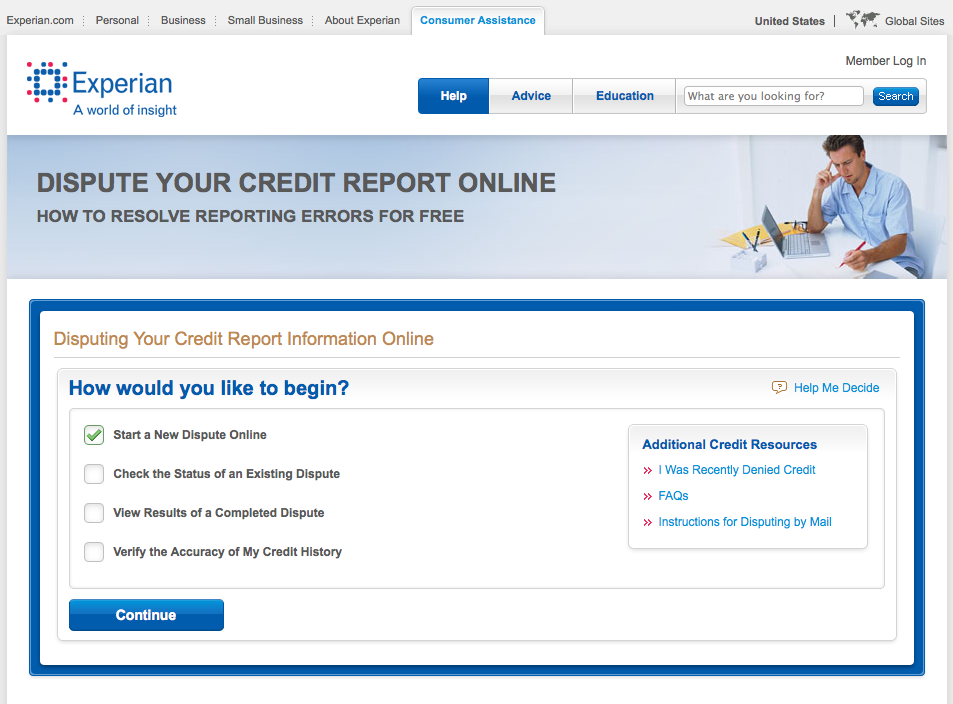

How Long Credit Reporting Bureaus Have To Resolve Your Dispute

Experian has 30 days from the date you open the dispute to try to verify the information youve challenged on your report. They must either prove that it is correct or remove it if it is inaccurate. If the company hasnt made a correction or verification after 30 days, the Fair Credit Reporting Act gives you the right to sue.

Recommended Reading: Is 650 A Good Fico Score

What You Can Expect To See On Your Experian Credit Report

A credit report offers you a snapshot of your credit status and overall financial health. It is a good habit to keep a tab on your credit score and review your credit report from time-to-time. Your credit report has a lot of information and keywords.

- Full Name

- PAN number

Note: Make sure the spelling of your name, mobile number and other personal information are correct in your credit report.