Does Requesting A Credit Limit Hurt Your Credit Score

Most of the time, automatic credit limit increases only trigger a soft inquiry, which doesnt affect your score.

However, when you request a credit limit increase, your bank might perform a hard pull, depending on the issuers policies. Normally youll be made aware if thats the case in advance. But if you havent, make sure to ask so you know what to expect.

A hard inquiry can take a few points off your credit score. Luckily, the impact of a single hard pull is rarely significant. While it will stay on your credit report for two years, it will stop affecting your scores in 12 months.

At the same time, multiple hard inquiries can result in a more serious impact and be interpreted by creditors as a move to get access to more funds in a desperate situation.

For this reason, avoid requesting a higher credit line with more than one issuer at the same time. Ideally, you should wait at least six months before requesting more credit.

That said, it can be a good strategy to increase your credit limit every year. This is a positive credit habit that can help you ensure you proactively earn credit points on a regular basis while getting the most out of the cards you have.

If youre denied, dont worry and try again in six months or later. Ask your issuer how you can improve your chances and follow that advice to work on your credit.

How Large Of A Credit Limit Increase Should You Request

Theres no one-size-fits-all answer to how much of a credit limit increase you should request. It depends on your income, credit score and account history.

If youre looking for a small increase, credit card issuers may be able to approve this based on your income and account history alone. Larger credit limit increases, on the other hand, will likely require a hard inquiry on your credit reports.

If youre comfortable with a hard inquiry, you might want to start by requesting a credit limit thats twice the size of your current credit line. If youre denied instead of receiving a counteroffer, you may have requested too much for that particular credit card company and your current credit level.

You should also think about your spending habits.

What size credit limit can you handle responsibly? If an increased credit line is going to lead to increased charges and higher interest and minimum payments its probably not worth it.

Do you often maintain a credit card balance? If so, you might not want to request a credit limit increase. Instead, it may be better to focus on paying your bill in full each month.

Select Spoke With Experts To Find Out If Asking For A Higher Credit Limit Impacts Your Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We earn a commission from affiliate partners on many offers, but not all offers on Select are from affiliate partners.

Getting your credit limit increased can be as easy as calling customer service or making a request through your issuer’s mobile app. While a credit limit increase might make it easier for you to pay for your next big purchase or improve your credit score, consumers should know that it can actually impact your credit score.

Select spoke with Ted Rossman, credit card senior industry analyst at Bankrate, and Matt Schulz, chief credit analyst at LendingTree, to find out more about how your credit score could be affected by requesting a higher credit limit.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Don’t Miss: Do Late Payments On Closed Accounts Affect Credit Score

What Else You Should Know Before Getting A Credit Limit Increase

Before you ask

When to ask

- Got a pay increase

- Paid an existing debt in full

- Have a proven track record of paying your bills on-time for at least six months

- Continually pay more than the monthly minimum

- Have had a steady revenue stream for several months

- Have maintained a credit utilization of 30% or less

Sometimes, you dont have to ask at all

- Have a history of making late or less than minimal payments. Late or missed payments remain on your report for up to seven years

- Recently filed bankruptcy. Bankruptcies can remain on your account for up to 10 years

- Asked within the past few months

- Requested an increase on other cards within a couple of months. Space your requests out over time

What goes up must come down

- Your income has been reduced

- You dont use or rarely use your card

- Tough economic times are changing your credit habits

- You missed one or more payments

Why You Should Think Twice Before Accepting A Credit Limit Increase

A favourite with credit card companies is a credit limit increase. Youll usually receive a letter in the mail letting you know that as a valued cardholder youre entitled to a credit limit increase. Before you pick up the phone and call your credit card company to accept, there are some important things to consider.

Read Also: Does An Overdraft Improve Your Credit Rating

A Higher Credit Limit May Help Improve Your Credit Score

In the long term, a higher credit limit may actually help to improve your credit score. However, there is one important caveat: your debt-to-credit ratio.

If you get a higher credit limit and your balance stays the same, then your debt-to-credit ratio will be lower, which is likely to improve your credit score over time. Paying down your debt will reduce the debt to credit ratio further and your credit score should improve thereafter.

However, if you cannot control your spending, your debt-to-credit ratio will be higher and your credit score may drop as a result.

Request A Credit Increase By Phone

If you dont think your case is straightforward, you may want to call your card issuer and speak with a representative. Speaking by phone will allow you to provide additional information beyond what will be available through online forms.

Calling is also a good way to find out what type of credit check your issuer requires in order to process your request. Soft inquiries wont be evident to other lenders who evaluate your credit report, but hard inquiries are visible for at least 12 months. Hard inquiries can also temporarily lower your credit score by a few points. A hard pull vs. a soft pull on your credit matters if you anticipate applying for a mortgage, auto loan or new credit card in the near future.

You may also want to make your request by phone if you have an urgent need for a credit increase, such as a large, imminent purchase. The associate you speak with can expedite the information collection process so that you dont have to wait for follow-ups. Of course, you still might not get an instant decision.

Don’t Miss: When Do You Get A Credit Score

How To Request A Credit Limit Increase

When you ask for a credit limit increase, your card issuer might ask you to provide information surrounding your employment status, income and monthly mortgage or rent payments to determine if it should approve your request. It might also take a look at your credit report. If youre unsure about whether your card provider will carry out a hard or a soft pull, all you have to do is call and ask.

Remember that credit card providers dont shy away from increasing credit limits as long as they know that borrowers have the ability to make repayments.

- Card Issuer

-

Capital One states that requesting a credit limit increase does not lead to a hard inquiry on your credit report. You may request a Capital One credit limit increase online or over the phone. Capital One asks you for your desired credit limit, and you also need to provide details about your employment status, income and mortgage/rent payments. Depending on the information you provide, Capital One might approve your request

-

If you request a Chase credit limit increase on your own, you may expect a hard inquiry on your credit report. Chase lets you request a credit limit increase only over the phone.

-

to request a credit line increase. Depending on the specifics of your Wells Fargo credit limit increase application, it might carry out a hard or a soft credit pull. As a result, you might want to confirm this with a customer service representative in advance.

Show more

When Should You Accept A Credit Limit Increase

If you’ve had a credit card for a while, or if your income has recently increased, you might be thinking about asking for a credit limit increase. You can usually request a credit limit increase on your credit cardâs website or by calling your credit card issuer.

Can requesting a credit limit increase hurt your credit? Just like when you apply for a new card, credit card issuers might initiate a hard inquiry on your credit score, which can cause a temporary dip in your score.

Read Also: Does Applying For A Credit Card Affect Your Credit Score

When Is It Time To Ask For A Credit Limit Increase

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This is a recurring post, regularly updated with new information.

There are many reasons to ask for a credit limit increase. For example, you may frequently spend up to your credit cards limit. Or, you may be looking to lower your in order to boost your credit score and get a new rewards credit card.

Regardless of why you want to increase your credit limit, you may be wondering when is the right time.

Heres everything you need to know.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter.

Does Getting A Credit Limit Increase Affect Score

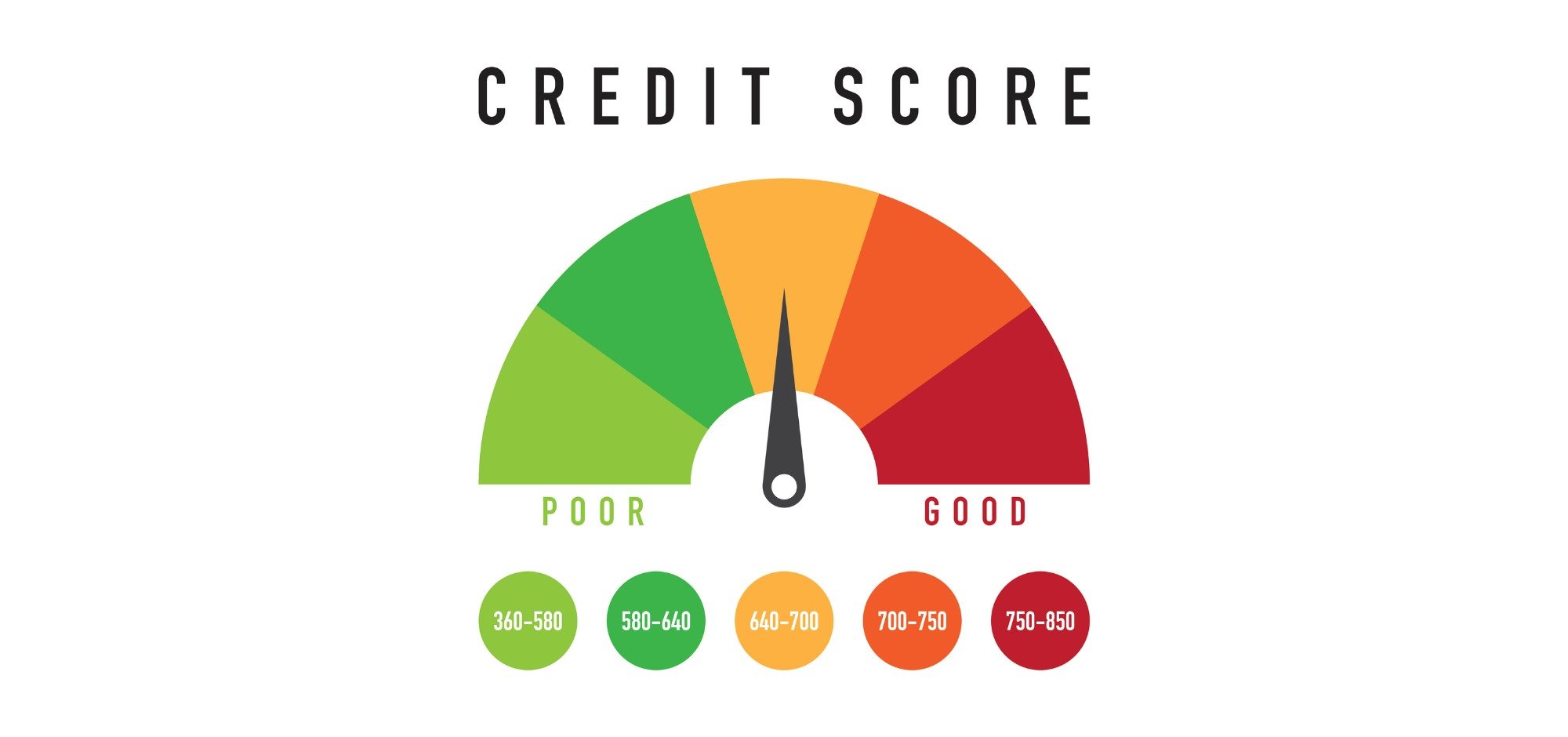

Your credit score is based on the information found on your credit report.

When any details on your credit report changeâsuch as your credit card limitâit can have an impact on your credit score. In fact, merely asking for a credit limit increase might affect your score, even if the card issuer denies your request.

Whether your credit score improves, declines, or stays the same depends on three critical factors:

Read Also: What Credit Score Do You Need For Amazon Credit Card

What To Do After Your Credit Limit Decreases

If you notice one of your limits drop, contact your creditor immediately for more information. This reduction could be a mistake, but if it’s not, you’ll want to know why your limit was reduced.

Ask the creditor whether it has a policy for reissuing previous credit limits. If you catch it in time, you may be able to get it back. If not, you’ll need to figure out why it was reduced and work toward remedying whatever caused it.

If you see your utilization ratio increase as a result of a credit limit reduction, focus on how you can bring it down before it impacts your scores too much. Here are a few things you can do to improve your utilization:

As you consider actions to take when a creditor decreases your credit limit, monitor your credit scores so you can see what your overall credit utilization is and how it’s impacting your scores. You can get free credit monitoring from Experian that can alert you to changes in your credit.

When Can You Request A Credit Limit Increase

Your credit card issuer sets your credit limit when you apply for your credit card. Some issuers require you to hold a card for a minimum amount of time before requesting a credit limit increase. And some issuers have policies regarding how frequently you can request a credit limit increase.

For example, if you have an American Express card, you can request a credit limit increase once your account has been open for at least 60 days. And, if you have a Capital One card, you generally arent eligible for a credit line increase if you opened your account within the past several months.

After that point, you may request a credit line increase anytime you like, but in general, Capital One doesnt change an accounts credit line more often than every six months.

Other issuers such as Chase and Citi likely have policies regarding when theyll increase your credit line, but these policies arent publicly available, so its best to call customer service to discuss your available options.

Some credit card issuers may automatically increase your credit limit if youve used it responsibly for a certain amount of time. And, in the case of some secured credit cards, the issuer may even move you from a secured credit line to an unsecured credit line.

Recommended Reading: Is 710 A Good Credit Score

Does A Credit Limit Increase Affect Your Score

A credit limit is the maximum amount of money that you can borrow from banks using credit cards.

The credit limit is revised mostly during the revision process. If you have a good credit track record, then you may be offered a credit limit increase. There is a common misconception that an increase in credit limit will affect credit scores negatively. However, the fact is that it has both, advantages and disadvantages. Here is a list of both.

List of Advantages

- Improved credit score – A higher credit limit can result in a lower credit utilisation ratio. It also becomes a bargaining tool for getting a bigger loan. A lower credit utilisation ratio improves credit score and therefore, better chances of easy credit availability in the future.

- Helpful in emergencies – A higher credit limit can prove helpful during emergencies such as sudden hospitalisation which requires large payments to be made upfront.

- More purchasing power – A credit card with a higher credit limit allows big-ticket purchases, like white goods, expenses related to annual vacations, etc.

List of Disadvantages

Can My Credit Limit Be Reduced

Credit card issuers hold the right to reduce your credit limit at any time by providing little to no notice, irrespective of how well you might have maintained your account. Reports suggest that over 62 million credit card holders had their cards closed or experienced reduced credit limits during the first four months of 2021 because of the threat that issuers perceived from the COVID-19 pandemic.

Also Check: Does Free Credit Report Hurt Credit

What Is Your Credit Utilization Rate And Why Does It Matter

Your credit utilization rate, also known as your debt-to-credit ratio, represents your total debt divided by the total credit available to you across all of your revolving accounts. Your credit utilization rate is important because it is one of several factors lenders and creditors consider when they evaluate your request for credit. In general, lenders and creditors like to see a debt-to-credit ratio of 30 percent or below.

Heres an example of how a credit utilization rate may be calculated: If you have two credit cards with a combined limit of $10,000, and you owe $2,000 on one card and $1,000 on the other for a total of $3,000, your debt-to-credit ratio is 30 percent.

However, if one of your lenders or creditors were to reduce your credit limit by $3,000 and cap your combined credit limit at $7,000, then your credit utilization rate would skyrocket to 42 percent in the previous example. Although your spending habits and total debt havent changed, this higher debt-to-credit ratio could still have a substantial impact on your credit score.

You can read more in-depth about your credit utilization rate and how its reflected in your credit scores here.

Dmitriy Fomichenko President Sense Financial

A credit limit increase can help improve your credit score. Assuming that you keep your spending at the same level, an increase in credit limit will lower your credit utilization and help improve your score.

Keep in mind that if you request a credit limit, your credit card provider will be likely to do a credit check, which can lower your score. However, the impact from such inquiries is usually minor and temporary.

Recommended Reading: What Is A Good Fico Credit Score

Downsides Of Increasing Your Credit Limit

Even if you think youll be able to manage borrowing more, increasing your credit limit might not be the best thing to do.

Having a higher credit limit might encourage you to spend more. This means you would end up facing larger repayments than you would have done.

If youre regularly using your overdraft, this can also affect your chances of qualifying for other kinds of credit, such as a mortgage.

However, having a high credit limit doesnt necessarily impact your chances of being approved for further credit.

Is There Any Reason Not To Take A Credit Limit Increase

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you apply for a credit card, youre given a certain spending limit based on your income and creditworthiness. After six months to a year of timely payments and low revolving debt, you may be able to request an increase of your credit limit. But is this always a good idea? Heres why you may or may not want to ask for a higher limit.

Also Check: How To Read Experian Credit Report