Consumers In The Same Credit Score Range Share Common Characteristics

If your credit score falls into a certain range, its likely that your credit report is similar to others who are in the same credit score range as you. The following charts show some interesting data about consumers that fall into the subprime credit score range , the very good credit score range , and the exceptional credit score range .

| Subprime Credit Score Range Characteristics | |

|---|---|

| Average FICO Score | 577 |

| Average Overall Credit Utilization Ratio | 4% |

If youre hoping to move up to the exceptional credit score range, it can be wise to try to emulate the credit management habits of people that are already in that group. Likewise, taking a look at the habits of people with credit scores in the subprime range can give you a clue about which credit behaviors its best to avoid.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

Don’t Miss: Remove Repo From Credit

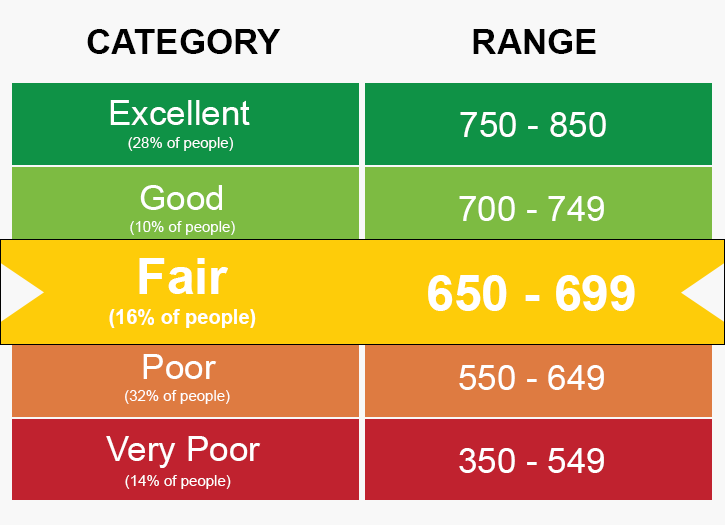

Do I Have Fair Credit

In addition to a score in the same range, people with fair credit tend to share other traits. For example, they usually have less than $5,000 in available credit.

You can see how you compare to the other credit tiers and to the average person with fair credit below:

| Category |

|

Never 60+ days late on payment Never declared bankruptcy |

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Also Check: Realpage Credit Inquiry

Only Use The Credit You Really Need

Just because you have three credit cards, that doesnt mean its wise for you to max them out every month, even if youre making the monthly payments on time. The credit bureaus frown on individuals using too much of their available credit although they do like to see a diversity of credit accountsmortgages, auto loans, credit cards, installment accountsmanaged responsibly. Solution: Go easy on the credit. Make a determined effort to not use more than 10% of your total available credit. Your credit score will thank you.

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

You May Like: What Mortgage Company Uses Factual Data

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Read Also: Afni Subrogation Department Bloomington Il

What Is The Credit Score Range

Theres no such thing as the credit score range. You have not one, not three, but actually hundreds of different based on your credit history.

The reason there are so many credit scores available commercially is because scores come in many shapes and sizes. There are different brands of credit scores, different types of scores created by those brands for different purposes, and different generations of credit scores as well. Not only that, each credit reporting agency has a unique file of your credit accounts, each with the ability to generate a different credit score based upon your data.

Insider tip

Most people will tell you that credit scores range from 300850. And while that is certainly the most popular credit score range, its not the only possibility.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Also Check: Does Carmax Accept Bad Credit

The Top Credit Card Recommendation For Canadians With Fair Credit

If you have fair credit, youll be happy to know that you have access to credit card options to fit your needs. While you may not get approved for the most competitive card options those with exclusive perks and generous rewards you will qualify for cards that still offer some great benefits. Its important to know what cards will be available to you with an average score, as well as the benefits and limitations that come along with them.

If you have a fair credit score, heres a great option to consider:

BMO Preferred Rate Mastercard

Understanding Your Credit Scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide on which scores are based. So depending on what information each bureau gets from individual lenders and that can differ the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they dont match. Its difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, its worth knowing the general range that your scores fall into especially since they can determine your access to certain financial products and the terms youll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

You May Like: Factual Data Inquiry

How To Improve An Average Credit Score

More than seven in 10 Americans report feeling anxious about their financial situation, according to the Mind over Money survey by Capital One and The Decision Lab. But there are actions you can take to improve an average credit score and achieve your financial goals. Follow these tips to help raise your credit score.

- Make on-time payments. The most important factor of your credit score is payment history, so it’s key to always pay on time. Consider setting up autopay or reminders to ensure timely payments.

- Pay in full. While it’s essential to make at least your minimum payment every month, you should aim to pay your bill in full each month to reduce your utilization rate, which is the percentage of your total credit limit you’re using. To calculate your utilization rate, divide your total credit card balance by your total credit limit.

- Don’t open too many accounts at once. When you apply for credit, whether it’s a credit card or loan, an inquiry appears on your credit report, regardless if you’re denied or approved. Inquiries temporarily lower your credit score about five points, which doesn’t seem like much but can add up if you submit multiple applications. Your score will bounce back within a few months, but you should still try to limit applications as needed.Fortunately, you can shop around with prequalification tools that don’t hurt your credit score and can provide insight into the cards that you may have the best qualification chances for.

Is A Fair Credit Score Average

Some people use the terms fair credit and average credit interchangeably. But thats actually incorrect. The average credit score is 669, according to WalletHub data. And thats 10 points above the upper bound of the standard fair credit range. As a result, the average American actually has good credit.

Don’t Miss: What Is The Minimum Credit Score For Care Credit

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Read Also: How To Check Itin Credit Score

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Why Is It Important To Have A Good Credit Score

There are several reason why itâs important to have a good credit score. If youâre hoping, for example, to take out a mortgage to buy your own home one day, your credit score will need to be in good shape to get accepted and to get the best rates. Having a good credit score also means youâre much more likely to get the best rates when you take out other credit products. For example, youâre much more likely to get better credit card offers , low-APR loans, and even 0% finance agreements if your credit score is good. If your credit score isnât good, though, it doesnât necessarily mean you wonât get accepted for credit. However, lenders will view you as more of a risk, and as a result your interest rates will probably be higher, and any purchase or balance transfer offers you get will probably be shorter. Before you apply for anything, itâs always a good idea to check your eligibility and see your chances of being accepted.

You May Like: 673 Credit Score Mortgage Rate

What Is A Fair Credit Score Learn The Meaning

A fair credit score is usually defined as any score in the range of 620-659. Roughly 13.5% of people have fair credit, according to WalletHub data. The average person with fair credit is 47 years old and has an annual income of $54,000 per year.

Bear in mind that not all lenders define fair credit the same way. Some may have higher standards, for example, starting the fair credit range as 640 and ending it at 699. Furthermore, fair credit is far from a life sentence. Graduating to good credit could take as little as one month, depending on your circumstances. You can see exactly where you stand and how long it will take to improve by checking your latest credit score for free on WalletHub.

In addition to free daily updates to your credit score and report, you will also get a personalized credit analysis. That guidance, combined with the additional fair credit info that youll find below, will help you reach Top WalletFitness® in no time.