How Long Does Debt Stay In Collections

The statute of limitations that determines how long you are legally liable for your debt depends on the type of debt and the state where you live. In general, most debt comes with a statute of limitations between three and six years, but some debt is collectible for more than a decade. After the statute of limitations has passed, you are not legally required to repay the debt, though that doesn’t protect you from negative credit report impacts.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

What Going Into Collections Means

Depending on the type of debt owed, collections can affect you in different ways. If your debt is unsecured, such as credit card debt, and you default on your payments with that debt sent to collections, the credit card company would stop trying to collect the debt from you. Instead, the collections company that your debt was sent to, would pursue the debt and try to collect money from you. If your debt was secured, such as an auto loan and you default, then the lender might repossess your car, sell it at auction, and sell the remainder of debt you owe to a collections company. Lenders can collect money from debt in the following ways:

- Contact you on their own and ask for payment using their internal collection department.

- Hire a collection agency to try and collect.

- For revolving debt, such as credit card debt, the credit card company could sell your debt to a collection agency, which would then try to get the money from you.

- For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

The federal Fair Debt Collection Practices Act strictly regulates how debt collectors can operate when trying to recover a debt. For example, they can’t threaten you with imprisonment or make any other kind of threat, if you don’t pay. However, they can and typically do report the unpaid debt to credit reporting agencies.

Recommended Reading: Is Creditwise Transunion

Collections On Your Credit Report

When an account becomes seriously past due, the creditor may decide to turn the account over to an internal collection department or to sell the debt to a collection agency. Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your . Collection accounts have a significant negative impact on your credit scores.

Collections can appear from unsecured accounts, such as and personal loans. In contrast, secured loans such as mortgages or auto loans that default would involve foreclosure and repossession, respectively. Auto loans can end up in collections also, even if they are repossessed. The amount they are sold for at auction may be less than the full amount owed, and the remaining amount can still be sent to collections.

Collections can be removed from credit reports in only two ways:

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.

Don’t Miss: Will Paypal Credit Affect Credit Score

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Learn More About Credit Scores

If its not clear from everything above your credit score in the U.S. will be an essential part of living in America on a visa. That said, there are lots of other important topics around credit scores that it would be worth it to familiarize yourself with:

Its crucial that you understand these things if you want to make the most of your financial freedom in the U.S.!

Read Also: 714 Fico Score

Mandi Woodruff Executive Editor At Magnifymoney Responds

First, congratulations. One of the last things you want on your credit report is a collection account, so having some of them fall off your report is definitely a good thing. Also, good for you for monitoring your credit report and noticing theyre gone.

Is your credit rating holding you back? Find out how to fix it.

As you may know, the collections likely first appeared on your credit report because of unpaid debt. When your bills go unpaid, the debt is eventually sold to a collections agency and recorded on your credit report as a collection. In most cases, its there for seven years, or more specifically, seven years from the date your debt was originally 180 days overdue.

If you believe the collection is an error, you can dispute it, but if its legitimate, theres not much you can do to remove it during that seven-year span. Even if you pay off the debt, the collection remains on your report unless youre able to successfully reach a pay-for-delete deal with the collection agency.

Of course, one of the main concerns with having collections on your credit report is how much it affects your credit score, which lenders use to determine whether to grant you loans and determine the interest rate they offer if they do. Essentially, the lower your score, the fewer and less attractive financial choices youre likely to have when it comes to buying a car, home or other items.

Good luck.

How Does A Collection Entry Impact Your Credit Score

Once one of your credit accounts is sent to collections, a collection entry is logged on your . Its this negative information that can hurt your credit history. Having a negative entry like this can turn your good credit score into a poor credit score.

Its hard to say how much of a drop it will lead to in your credit score. Both Equifax and TransUnion have separate credit scores. A collection entry may lead to a bigger credit score drop with one credit reporting agency over the other.

How big of a drop largely depends on how good your credit scores were to start with. If you had an excellent credit score, it could really drag down your credit score. Meanwhile, someone who already had a poor credit score might not seem that much of a drop.

Likewise, the longer the collection entry appears on your credit report, the less it will affect your credit score.

Read Also: When Does Usaa Report To Credit Bureaus

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Don’t Miss: Ccb Credit Report

Information On My Credit Report Was Removed Now Its Back

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Disputing and removing incorrect information on your credit report can be tedious and time-consuming. So having one of these items reappear on your credit report can be frustrating. This information may have negatively affected your credit and even cost you money. So now that youâve had this âblast from the pastâ reappear, what do you do? This article will help you understand when items can be legitimately reinserted onto your credit history and credit profile. It will also help explain how to do credit repair and remove illegitimate items once again from your credit report.

Written bythe Upsolve Team. Reviewed byAttorney Andrea Wimmer

Disputing and removing incorrect information on your credit report can be tedious and time-consuming. So having one of these items reappear on your credit report can be frustrating. This information may have negatively affected your credit and even cost you money. So now that youâve had this âblast from the pastâ reappear, what do you do?

Settle The Debt And Dispute It Again

Many debt collectors will allow you to settle the debt for less than the amount owed. Since they purchased the debt for pennies on the dollar, they can accept half of the balance and still make a significant profit.

Just call the collection company and tell them you wish to settle the debt. Usually, they will want the full payment and will knock between 20%-60% of the balance to settle the account in full.

When you pay the debt, it does not help your score and doesnt delete your reports account. But, you will now be able to go back to the Credit Bureau and dispute the item again and hope the creditor does not go through the hassle of validating a debt thats been paid. They have no incentive to do, so they may not respond to the Credit Bureaus request.

Recommended Reading: Debt Recovery Solutions Verizon

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

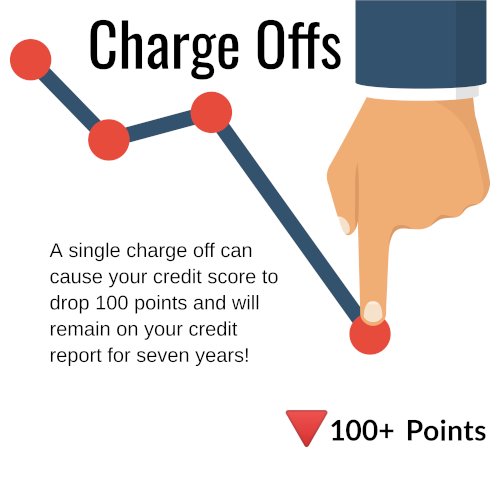

Difference Between A Charge

Most people are familiar with debt collections, which is related to charge-offs, but is not the same thing. In short, debt collection happens after your account has already been charged-off.

Debt collections differ from charge-offs in that the original lender has sold the debt to a third-party agency to collect the debt from the borrower, says Annette Harris, founder of Harris Financial Coaching. When your debt gets sent to collections, it means the debt is no longer able to be settled with the original lender, she says.

When your debt is charged-off, its considered bad debt. Your lending company can sell your unpaid debt to a collection agency or a private debt collector to recoup the money they have lost on your loan.

Once your debt has been sent to collections, the agency will attempt to get the money back from you, just as your original lender did. The difference is, if you choose to ignore the debt collector, they can file a lawsuit and take you to court. If you still refuse to pay, the court can legally seize your assets, like your house or savings account, as a form of repayment.

Not only can debt collectors take legal action against you, but having your debt sent to collections can potentially ruin your credit. If you repay the debt after it goes to collections, the collections account, too, will remain on your credit report for seven years.

You May Like: How Does Navy Federal Auto Loan Work

Do I Need To Notify Credit Bureaus Of Paid Collections

If you pay off or settle a debt with a collection agency, the status of the collection account on your credit report should update to “paid” or “settled” within a month or two. You do not need to do anything to make that happen the collection agency should notify the three national credit bureaus to update their records.

If that doesn’t occur, you can file a dispute with each of the bureaus to have the records corrected. You’ll likely need to provide proof of payment, such as a cancelled check.

Illegitimate Reasons For Information To Reappear

The three credit reporting agencies handle the credit data of millions of American consumers. Based on the scale of the bureausâ collection, organization, and storage of this important personal data, it is not uncommon for credit agencies to make mistakes. The credit bureau may mistakenly reinsert the item in situations when it shouldâve rightfully removed the item. This can happen after a creditor fails to respond to a dispute inquiry.

An old debt may illegitimately reappear on your credit report if itâs acquired by a debt buyer or collection agency that then reports the debt even though it’s more than seven years old. This is past the statute of limitations, meaning itâs too old to remain on your credit report.

If you see accounts listed on your credit report that you did not open, this may be evidence of identity theft. Wrongful activity can appear on your credit report and negatively impact your credit. Under the Fair Credit Reporting Act , businesses are required to provide identity theft victims with a copy of the relevant records related to the theft. Identity theft victims need these records to document the crime and clear their reputation.

Also Check: Syncb/zulily Credit Card