Is Experian Credit Check Safe

Can Experian be trusted n be safe? With more than fifty years of experience, Experian is the worlds most respected provider of commercial credit and identity theft protection. The credit score enhancement services provided by this company are designed especially for consumers with a limited credit history who wish to develop healthier credit behavior.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What To Do If Your Final Credit Report Is Bad

If after all that, you have a low credit score, all is not lost. Its possible to repair your rating with the following methods:

Start making payments on any outstanding debts. Create a timeline and budget to help with this.Keep paid-off accounts open. Even though you might want to remove temptation by cutting up your credit cards once youre out of debt, having at least one account thats not in the minus figures can boost your credit rating.Resist taking out any new loans. This can make you seem more unreliable to lenders.Get to know your credit utilization ratio. This is the amount you owe compared to how much credit is available to you. To make this calculation, simply divide your overall debt by the total of all your credit limits and multiply it by 100 to get a percentage. A rate below 30% is considered acceptable.

Don’t Miss: Cbna Inquiry

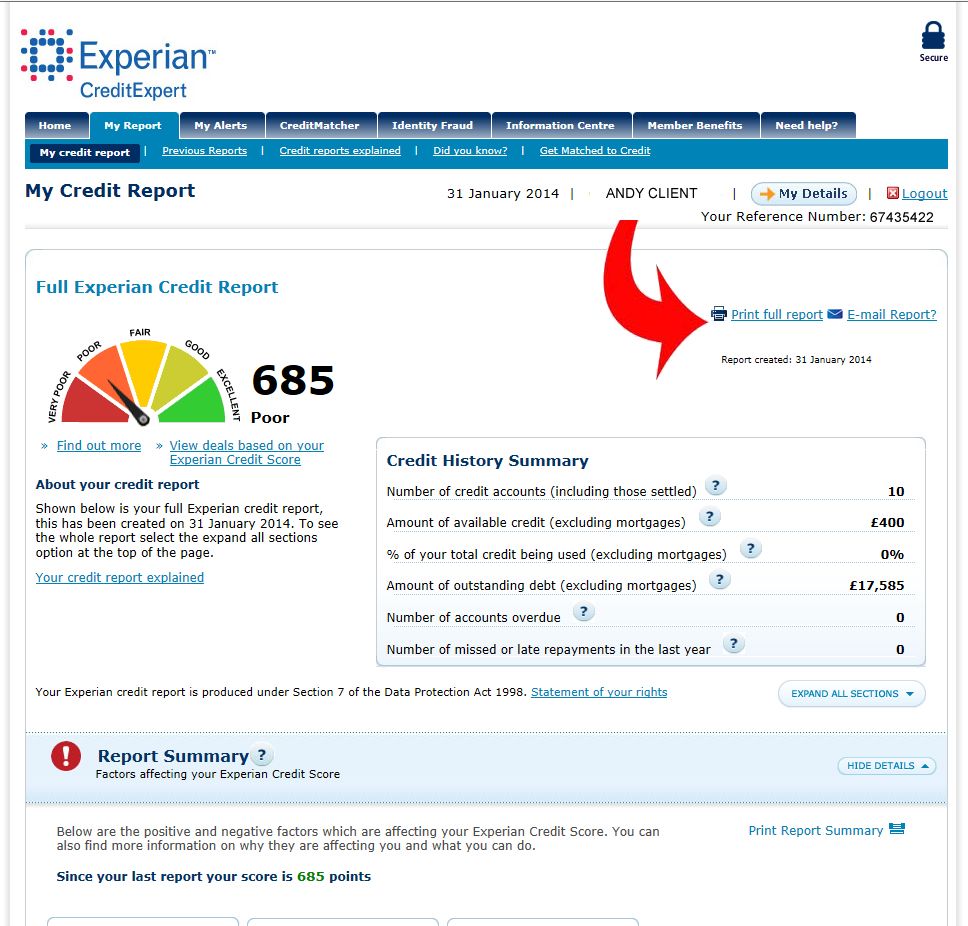

What Is On An Experian Credit Report

One of the three big credit reporting agencies, Experian provides information on consumers credit backgrounds to businesses looking into someones creditworthiness and risk in lending. Most often, banks and lenders will request a consumers Experian credit report to determine a loan approval and amount.

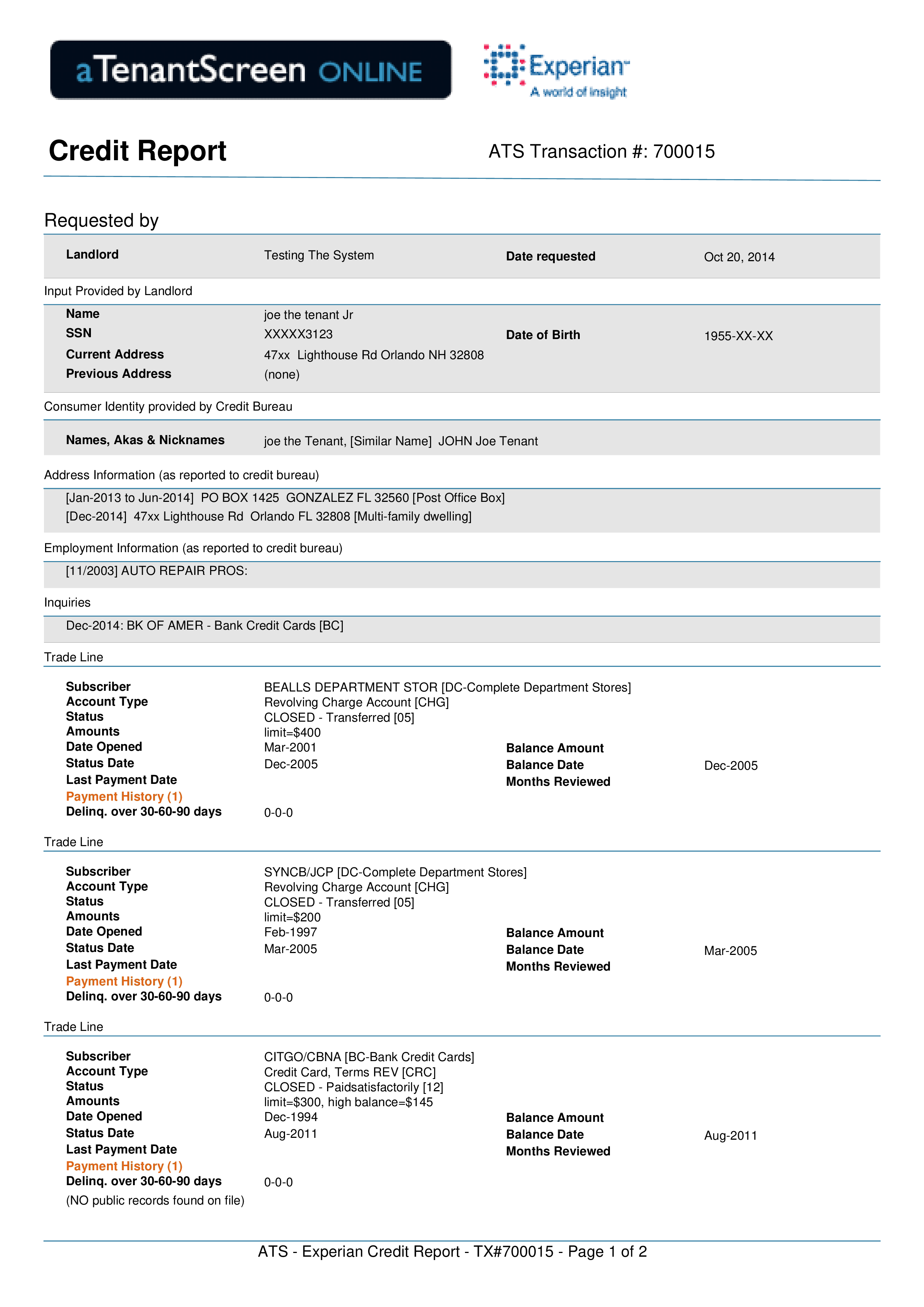

Lenders arent the only entities who can receive an Experian credit report. Other screening services offered are:

- background checks to employers

- tenant screening to residential and commercial landlords

- patient financial screening to healthcare providers

You have the right to request and view a copy of your Experian credit report. Its important to carefully examine the information included in the report. Unfortunately, errors appear on credit reports all too often and carry serious consequences.

Experian Complaints Cases And Lawsuits

The following are complaints and cases recently filed by the consumer law firm, Francis Mailman Soumilas, P.C..If you have experienced any of the following, you too may have a case. Call us at 1-877-735-8600 for a free case evaluation.

Walter Ray Sheldon Brown v. Experian. Southern District of Texas Experian has mixed Plaintiffs credit file with the credit file of another consumer. Experian knows that it must use heightened matching criteria when matching common names. As a result of the mixed file, Plaintiff has been unable to rent a home

Michael Ruzbarsky v. Experian. Plaintiff is the victim of identity theft. He disputed two fraudulent accounts with Experian and included a police report and an identity theft affidavit. Experian failed to block the fraudulent accounts and verified them as accurate.

Barbara Williams v. Experian. Plaintiff had two medical collection accounts on her Experian credit report. The accounts belong to her adult son form whom she is not responsible. Plaintiff disputed the two inaccurate collections accounts with Experian. Experian failed to perform a reasonable investigation into Plaintiffs disputes and verified the collection accounts as accurate.

Pauline Odeyemi v. Experian Plaintiff is the victim of identity theft. She disputed two fraudulent accounts with Experian and included a police report and an identity theft affidavit. Experian failed to block the fraudulent accounts and verified them as accurate.

Read Also: Affirm Credit Score Approval

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report, a credit bureau may charge you a reasonable amount for a copy of your report. But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

To buy a copy of your report, contact the national credit bureaus:

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

Read Also: Carvana Interest Rates

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: Syw Mc/cbna

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

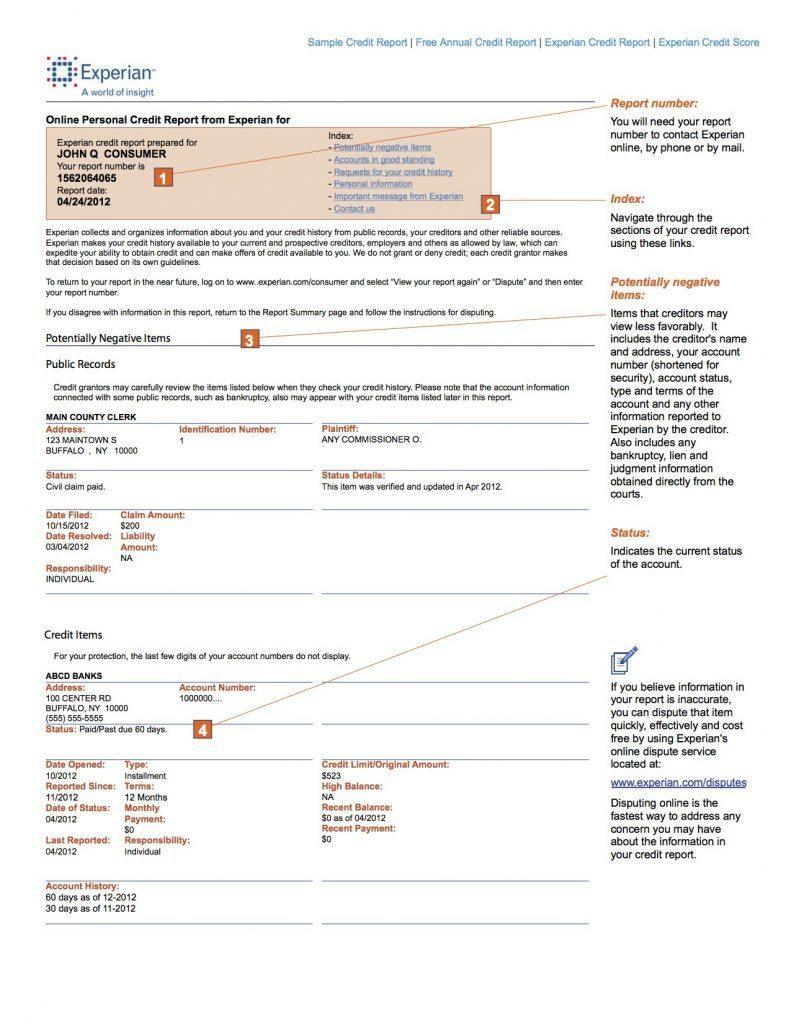

Experian Credit Report Error Disputes

Under the Fair Credit Reporting Act , you are entitled to a copy of your file, and you have the right to dispute errors on your credit report. You also must be notified if a credit or consumer report has been used against you.

If there is inaccurate information on your Experian credit report, contact Experian right a way to file a dispute.

You May Like: Syncb/zulily Credit Card

How Do I Get A One Time Credit Report In Canada

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail see “How to Dispute Credit Report Information” for more details.

Recommended Reading: Qvc Card Credit Score

Data Contained Within The Experian Credit Report

An Experian credit report will hold data regarding the credit accounts of an individual along with details of all credit applications made by the individual. It is a detailed representation of the persons loan / credit history including data regarding recent enquiries, credit cards / loans / credit accounts, payments, identity, etc. Individuals may access their Experian credit report once the requisite fees have been paid. Lenders can also check the credit report of prospective customers by paying a certain fee.

Find Out How You Score

A free Credit Sesame account utilizes information from TransUnion, one of the major national credit bureaus. Upgrade to a premium Credit Sesame plan for credit report info from all three bureaus: TransUnion, Experian and Equifax. With full access to your credit history from each bureau, youll have a complete, comprehensive look at your credit activity.

You May Like:

Read Also: What Collection Agency Does Usaa Use

What Is The Number One Reason For A Copy Of Your Credit Report

Your annual credit report is an essential step in rebuilding your credit and keeping it in good shape. It is useful to check your credit report periodically in order to ensure that it is in good working order when you are planning to apply for a new loan and if you are hoping to recover from previous credit issues.

How To Get Your Credit Report

There are a few ways to get your credit report. One way is to get your reports free once a year through AnnualCreditReport.com. The Fair Reporting Credit Act makes every resident entitled to a free copy of their credit report from all three reporting bureaus , but only through AnnualCreditReport.com. Anything requested within 12 months of your last inquiry or outside of AnnualCreditReport.com requires a fee. However, there are exceptions. If you have experienced identity theft, fraud, credit denial or are currently unemployed and planning to seek employment, then you can request another free copy.

You can get all three at the same time or you can space them out by requesting one report from a different bureau every four months. The former approach is good for tackling issues like identity theft or fraud. The latter helps you stay updated on new entries.

If youre not comfortable requesting your free report online, you can request one over the phone at 322-8228. You can also print off a mail-in application from the website and send it to the following address:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Another way to get your report involves paying for it. You could go to any bureaus website and request your report for a fee. For example, Experian will charge you $39.99 to get all three credit bureau reports plus your FICO credit score.

You May Like: 766 Fico Score

Challenging Your Information With Experian

Experian now holds two databases of consumer information this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if theyve made payments on time, have skipped payments or closed an account.

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Read Also: Credit Report With Itin

How To Dispute Inaccurate Information On Your Credit Report

If there are any inaccuracies listed, there are 2 options to correct the inaccuracies:

- Contact the creditor associated with the account you can find the contact information for each of your creditors on this credit report

- Contact each reporting agency that reports the error

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download

- Language: English

DISCLAIMERNothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

What You Need To Order Your Free* Experian Credit Report

Before we can process your request and to protect your identity, you will be required to provide the credit reporting information we hold on you from ONE of the following identification documents. Please ensure you have acceptable photo identification ready before completing the report request.

Primary Identification:

- Current Australian Drivers Licence

- Current Australian Passport

Read Also: Does Paypal Credit Help Your Credit

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Recommended Reading: Remove Credit Inquiries In 24 Hours

Talk To A Real Person At Experian

Experian makes it relatively hard to talk to a real person on the phone. The company encourages people to use its website for most things. However, there are three main phone numbers that you should know if you want to talk to someone at Experian.

Call 888-397-3742 if you want to order a credit report or if you have any questions related to fraud and identity theft. The number 888-397-3742-6 will also work. You can place an immediate fraud/security alert on your credit with this number.

If you have a question about something on a recent credit report , you will need to have a copy of the credit report. On the report you will find a 10-digit number. This number is different for each credit report and you will need it for the representative to help with any issues related to your specific report. Once you have that number ready, you can call 714-830-7000 with questions about your report.

If you need help with anything related to your membership account with Experian, you should call the companys customer service at 479-343-6239. You will need to call while the Experian office is open in order to speak with someone. The hours are 9 a.m. to 11 p.m. ET, Monday to Friday, and 11 a.m. to 8 p.m. ET, Saturday and Sunday.

| How to Speak With a Real Person at Experian | |

| Reason for Calling | |

| Question about Experian membership account | 479-343-6239 |

Talk To A Real Person At Transunion

TransUnion has one general support number that you can use to talk to a human for help with your credit report , your credit score or any general questions. That number is 833-395-693800.

Note that a human representative is only available Monday through Friday 8 a.m. to 11 p.m. ET, Monday through Friday.

You will hear an automated service when you first call this number. Press 4 in order to speak with a representative. Then you will need to press 1 if you have a TransUnion File Number or 2 if you do not have a number.

A TransUnion File Number is a unique identification number that you can find in the top right of your TransUnion credit report. You do not need a number to speak with a representative, but you will need it to do anything related specifically to your credit report. For example, the file number is necessary for disputing incorrect information.

Also Check: Paypal Credit Report To Credit Bureau

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.