How Long Information Is Kept By Credit Reference Agencies

Information about you is usually held on your file for six years. Some information may be held for longer, for example, where a court has ordered that a bankruptcy restrictions order should last more than six years.

If information is held for longer than it is supposed to be, you can ask for it to be removed.

In England and Wales, for more information about bankruptcy, see Bankruptcy.

How Long Does A Default Stay On Your Credit File

A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once your default is removed, the lender wonât be able to re-register it, even if you still owe them money. Nevertheless, you should continue to meet any remaining payments as the lender could go on to register a CCJ against you.

Note that the lender may sell your debt to a debt collector . However, the lender must make this obvious on your credit report, so it wonât look like you have two defaults. Also, the amount and date shouldnât change, so you wonât need to pay more or wait longer for your default to be removed.

You can see if you have a default on your credit profile by checking your Experian Credit Report.

How Long Do Medical Bills Stay On Your Credit

seven years

Keeping this in view, how do I remove medical bills from my credit report?

Ways to remove medical collections from credit reports

Similarly, do medical bills affect your credit score 2019? Yes, unpaid bills can affect your credit score and your ability to qualify for future . The key is whether your inability to pay results in the provider turning your bill over to a collection agency. In that case, the debt will likely appear on your credit report.

Also, do medical bills go away after 7 years?

According to provisions in the Fair Credit Reporting Act, most accounts that go into collection can only be reported on your credit report for up to seven years. While unpaid medical bills will come off your credit report after seven years, you’re still legally responsible for them.

How long does a medical bill Stay on credit?

seven years

Recommended Reading: Does Removing An Authorized User Hurt Their Credit Score

Request A Change To Your Credit Report

What can you do if there is incorrect information on your creditreport?

You have the right under the General Data Protection Directive toaccess the records held about you by credit agencies and to have incorrectinformation rectified. If you are not satisfied with how your request ishandled, you can appeal to the DataProtection Commission.

Central Credit Register

If you believe there is inaccurate, incomplete or out-of-date information inyour credit report, you have a right to apply to your lender and the CentralBank to amend the information held on the Central Credit Register.

You can get more information in the Central Banks factsheet Howto request an amendment to information on my credit report.

Irish Credit Bureau

If you want to have inaccurate information on your credit record amended,contact the lender concerned and ask them to forward the correct information tothe ICB. The ICB cannot change the information unless the lender asks themto.

Can you add a statement to your credit report?

It is possible to add a personal statement to your credit record to clarifyit. This is known as an explanatory statement or personal declaration .

For example, if you have had significant expenses due to relationshipbreakdown, bereavement, illness or another cause, you may add these details toyour record.

The statement must be factual, relevant to the information in the creditreport, and under 200 words. It should not contain information that couldidentify another individual .

How Long Your Information Remains Available

Information about the officers of a company remains on the public register for the lifetime of the company. This information will be available to the public as long as the company is active. This includes details of all resigned officers and also applies to dormant companies.

When a company is dissolved, this information remains on the public register for 20 years. After 20 years, we have an agreement to transfer a selection of dissolved company records to The National Archives .

TNA will direct us to destroy any records that are not transferred. Any records transferred to TNA can be requested by the public.

Following the governments response to the Corporate Transparency and Register Reform consultation, weve:

- stopped removing dissolved records from CHS

- added the records of all companies dissolved since January 2010 to CHS

Previously, records of dissolved companies were removed from CHS after 6 years . These dissolved records are currently available for 20 years on other Companies House products for a fee.

You May Like: Fedup-4u

How To Check Your Financial Associates

Checking who your financial associates are is as simple as checking your credit report.

For more information about how to obtain your credit report please see our guidance.

In the connections section of your report, youll be able to see the names of everyone you have financial links with and if any of them are incorrect, you can issue a notice of disassociation.

What Is A Credit Rating

Your credit rating is an assessment of your creditworthiness based primarily upon your history of borrowing and repayment. The higher your credit rating, the lower your credit risk and the more likely you are to have your application for credit accepted.

Remember, a high credit rating isnt a guarantee youll be accepted for products you apply for, nor does a lower rating mean youll be turned down, as this is at the sole discretion of the product provider. Every credit provider will have their own rules and use a combination of the following to aid in decision-making:

How do I get an Bankruptcy or Insolvency marked as discharged or completed?

Don’t Miss: Paypal Credit Score Requirement

If Theres A Search On My Report I Know Nothing About What Should I Do

In the first instance, you should contact the company who made the search to ask for further details. The search could be in the name of a company thats the parent company or subsidiary of a company you may recognise. If the company agrees to remove a search, theyll tell us and well update your report.

How do I remove other people’s details off my credit report?

How Do Lenders Make Their Decisions On Whether Or Not To Give You Credit

Lenders may use a combination of the following to help them make their decision:

- Information supplied by you when you applied.

- Data supplied by a credit reference agency like TransUnion. This data allows lenders to check if you’re on the electoral register at your current address if you’ve paid your credit commitments on time and if you have insolvencies or County Court Judgments.

- Your financial connections Anyone youre financially connected to, such as those with whom you have a joint bank account, or taken out a loan or mortgage. When lenders assess your credit history, they may also look at your financial associates credit histories, as they may affect your ability to repay money you borrow.

- Information about any existing accounts you already have with the lender

- Their own policies and rules

Read Also: Does Paypal Credit Report To Credit Bureaus

Why Your Credit History Is So Important

When you apply for a loan or other type of credit, such as a credit card,overdraft, HP or personal contract plan , the lender has to decide whetheror not to lend to you.

The information on your credit report can be used to decide:

- Whether to lend to you

- How much to allow you to borrow

- How much interest to charge you

Under EUlaw, lenders must assess your creditworthiness before agreeing to give youa loan. Creditworthiness means your ability to repay the loan. This assessmentmust be based on the information you provide as part of your loan application,and also on the information in your credit report.

Information in your credit report may mean that lenders could decide not tolend to you, even if you have the income to repay the loan. They could refuseyour loan if they believe they might be taking a high risk in lending toyou.

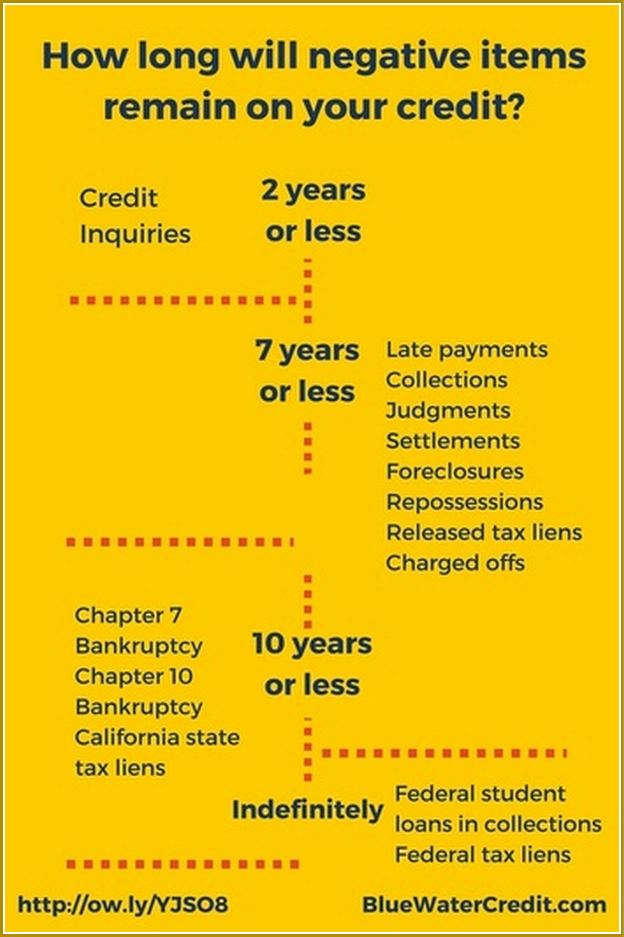

Tax Lien: Once Indefinitely Now Zero Years

Paid tax liens, like civil judgments, used to be part of your credit report for seven years. Unpaid liens could remain on your credit report indefinitely in almost every case. As of April 2018, all three major credit agencies removed all tax liens from credit reports due to inaccurate reporting.

Limit the damage: Check your credit report to ensure that it does not contain information about tax liens. If it does, dispute through the credit agency to have it removed.

Recommended Reading: How To Remove Repo From Your Credit Report

How Much Does It Cost To View My Report

Accessing your report is free. If youre looking for more information about your credit profile, use our one-off Statutory Credit Report for a basic credit report. To view a copy of your TransUnion report, where you can see the information held on you, and if necessary raise a dispute with us to investigate any inaccuracies

My details on the Electoral Register are incorrect, how do I update them?

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Also Check: Aargon Agency Hawaii

You Have Defaulted On An Account

An account is in default when the borrower has missed payments and the account is then closed by the lender. There is no set number of missed payments that result in a default being recorded. This is down to the individual lender, but when they believe a debt can no longer be recovered they record a default.

If a debt cannot be recovered many lenders sell the account to a debt collection agency. This will show negatively on your credit file and will remain on it for a period of six years from the default date, regardless of any settlement. After this time it is removed from your report automatically even if the full amount has not been settled.

Although a default will be removed from your report after 6 years the lender may still pursue you for the debt, unless the debt is statute barred. A statute barred debt is a debt which is seen as unenforceable as the creditor has not chased it in the period allowed. If you have not been chased for payment, have not made payment or signed any acknowledgement of a debt in writing for 6 years in England and Wales and 5 years in Scotland then it could be statute barred.

How Can Other Peoples Credit Histories Affect Mine

Your financial associates are just one more contributing factor to the lenders decision whether or not to give you credit. Before youre accepted for a loan or a mortgage, lenders want to make sure you can afford to pay it back. This involves assessing your other financial ties and commitments.

For example, if you and your spouse share a mortgage and your spouse loses their job, youre likely to have to pick up their half of the payments. This could affect your ability to pay off other debts, and potential creditors will take that into account when deciding whether to give you credit.

Read Also: When Do Collections Fall Off Your Credit Report

Does A Missed Or Late Payment Impact Your Credit Report

When you sign up to a , such as for amortgage or mobile phone contract, youre promising toabide by its rules. This includes when youve got to make repayments. The agreement will likely includehowmuch you have to pay, and by when. If you miss one or more payments, youre not fulfilling your end ofthecontract. This could impact not only that particular credit agreement, but also your credit report andyourability to obtain credit later on.

Missed or late payments are recorded on your credit report for six years. Lenders can view this if youreapplying for credit in this time. If youve missed payments, it may suggest to them that youre in somesortof financial difficulty and may have trouble paying back any new credit repayments should they give youaloan. This could lead to your credit application being rejected or, if its accepted, at worse ratesthanyoud have received without the missed payments on your report.

How Do I Correct Credit Report Mistakes

If you spot a mistake on any of your credit files, it’s important to get this rectified otherwise it could harm your ability to get credit later.

Mistakes can range from basic errors relating to your address details to incorrect information supplied by your bank, which could deter another company from lending to you.

You may even come across fraudulent activity, such as a credit application made in your name.

If you do spot a mistake, you can contact the company that provided the information or the credit reference agency itself to get it corrected.

The agency has 28 days from your request to tell you if it has removed the entry, amended it, or taken no action. The entry will be marked as ‘disputed’ in the meantime. This is so any lender searching your file will know not to rely on that piece of information.

If the credit reference agency doesn’t amend your records, you can add what’s known as a ‘notice of correction’ to your file.

This can be used to explain why you think a particular piece of information is wrong or to highlight any mitigating circumstances for example, a sudden bereavement that may have caused you to miss a credit card or loan repayment.

Also Check: What Is Syncb Ntwk On Credit Report

What Is A Default Notice

A default notice is a notification from a lender asking you to catch up with your payments or else have your account closed. Itâs your chance to stop a default from happening. You should try and pay the amount you owe immediately to avoid a default. Note that lenders donât have to send a default notice when you miss payments, although itâs considered good practice.

Can A Late Payment Affect My Credit Score

Your reflects how reliable you are with credit, and it affects your ability to borrow money. Each company will calculate your score in their own way to decide if you meet their criteria. They do this using your credit history, details on your application form, and any other information they hold on you .

Some companies take late payments into account when calculating your score. This is because overdue payments can suggest youâre struggling to manage your finances. As a result, you might not meet some companies lending criteria.

The Experian Credit Score can give you an idea of how companies see you. Itâs based on information in your credit report, and is the UKâs most trusted score*. If youâve been late with payments, check your Experian Credit Score to understand how your ability to get credit may have been affected.

Also Check: What Is Syncb Ntwk On Credit Report

Withhold Your Address From Credit Reference Agencies

If youre at risk of violence or intimidation because of your companys work, you may be able to restrict the disclosure of your home address to credit reference agencies. You must be able to provide proof, which could include:

- a police incident number if youve been attacked

- documentary evidence of a threat or attack, such as photos or recordings

- evidence of possible disruption or targeting, such as by animal rights or other activists

- proof showing that you work for an organisation whose activities put you at risk, such as the Secret Intelligence Service

For more information, read our guidance and to discuss your circumstances.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

You May Like: Does It Hurt Your Credit Score To Increase Your Credit Limit