How To Improve Your Fico Score

Improving your FICO Score takes some time and patience, but it is possible. Follow these tips to start improving your credit score:

- Review your credit report and dispute any errors

- Pay all of your bills on time

- Get current on any missed payments

- Contact your creditor if you think you may make a late payment

- Create a debt management plan with the help of a nonprofit credit counseling agency

- Pay off debt early by making more than the minimum monthly payments

- Keep balances low on revolving lines of credit, like credit cards

- Refrain from opening multiple new credit cards to increase your available credit

- Keep your oldest accounts open and in good standing

What Is A Fico Score

A FICO score, more commonly known as a credit score, is a three-digit number that is used to assess how likely a person is to repay the credit if the individual is given a credit card or if a lenderTop Banks in the USAAccording to the US Federal Deposit Insurance Corporation, there were 6,799;FDIC-insured commercial banks in the USA as of February 2014.; loans them money. FICO scores are also used to help determine the interest rateInterest RateAn interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal. on any credit extended to an individual. FICO scores range from 300 to 850 .

The Importance Of Credit Categories Varies By Person

Your FICO Scores are unique, just like you. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different. For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.

In addition, as the information in your credit report changes, so does the evaluation of these factors in determining your FICO Scores.

Your credit report and FICO Scores evolve frequently. Because of this, it’s not possible to measure the exact impact of a single factor in how your FICO Score is calculated without looking at your entire report. Even the levels of importance shown in the FICO Scores chart above are for the general population and may be different for different credit profiles.

Read Also: Why Does My Credit Score Go Down

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Fico Score Is 40 Points Lower Than Vantage

I’ve heard from almost everyone that their Vantage credit score is usually way lower than their Fico score. Turns out I’m one of the few where it’s backwards? Vantage score is 762, Fico is 719. To top it all off, I went to annualcreditreport.com to request my report, and Equifax denied me due to “security reasons” so I have to mail in my application, Equifax gave me an error, and I have no interest in a TransUnion report at the moment. Kind of just feeling defeated, I had an overdue bill for 5 months that I wasn’t aware of about 5 years ago and my score dropped 115 points. Here I am thinking that I finally got my score back to where it was before it dropped so much but it turns out that’s not the case.

What gives? I have about $30k in allowed credit over 4 different cards and my usage never goes over $1,000 on any card. I have about 40k left in college loans, but I’ve been paying them on time with no missed payments on any credit card or loan ever . I pay the balance of my credit card every month, not the minimum. I closed 2 of my 9 loans during the pandemic. It just feels like Fico scores are completely arbitrary any meaningless, maybe this is just a vent but it’s super frustrating to have a single late bill stay on your credit history for so long while you pay everything else on time.

Read Also: How To Report Unauthorized Credit Card Charges

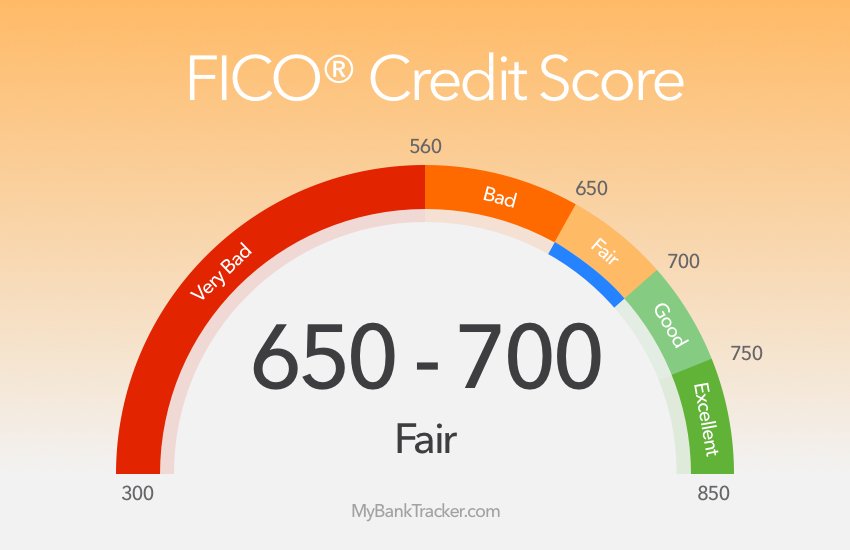

What Is A Good Fico Credit Score

The general guidelines for what FICO qualifies as poor or excellent credit scores are just that guidelines.

Lenders may have different specifications for what they consider to be good or bad credit, and they could have unique requirements when determining which applications to accept and what terms and rates to offer to borrowers.

Minimum credit scores may be one of these requirements. But for some lenders your eligibility could still depend on other factors, such as your debt-to-income ratio.

With some lenders, even if you have excellent FICO® scores, your application could be denied. This could happen for a variety of reasons. A credit card issuer may turn you down because you already have several open accounts with the company, recently opened other cards, or have past-due payments with the issuer, for example.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to;Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,”;tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Read Also: Why Is My Credit Score Different On Credit Karma

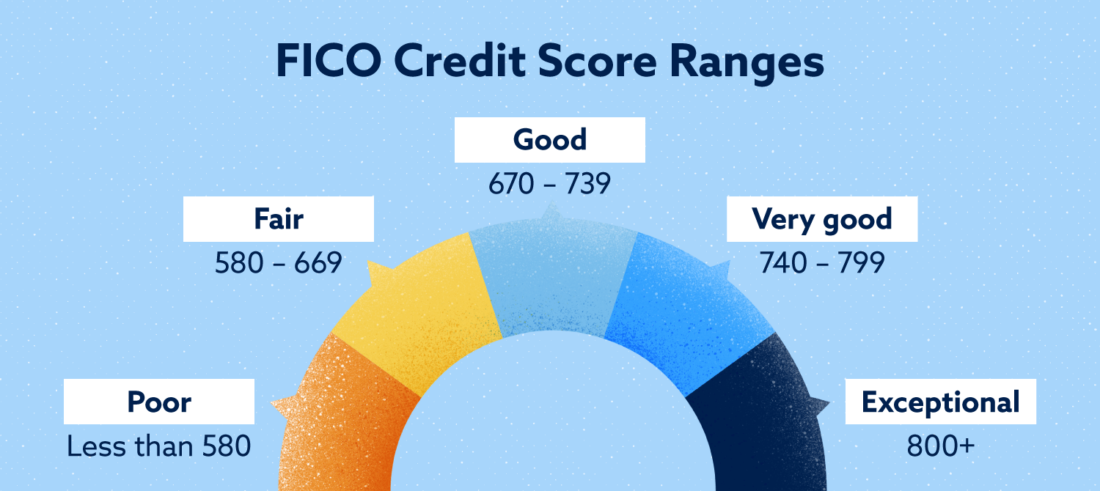

What Is The Fico Score Range

The FICO score range typically goes from 300 to 850, though in some industries it could be as go up to 900. The higher your score, the better. Heres more on the FICO score range below:

| FICO Score Ranges | ||

| A score in this range is below the average score of consumers.; | ||

| 670-739 | Good | A score in this range is at or a little bit above the average of a consumer. This scoring range is generally considered a good score by most lenders. |

| 740-799 | Very Good | A score in this range is above the average of consumers. It demonstrates that you are a dependable borrower. |

| 800+ | Exceptional | A range at or above 800 is well above the average score of consumers. It demonstrates to lenders that you are an exceptional borrower. |

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used;scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO®;Score 2

- FICO®;Score 5

- FICO®;Score 4

As you can see, each of the three;main credit bureaus; use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on;revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

You May Like: How To Analyze A Credit Report

How To Check Your Credit Scores

Now that weve made all this fuss about FICO scores, you probably want to know what yours are, right?

These ranges are somewhat subjective, since lenders base their decisions on more than just credit scores.

To see where you fall, try the Discover Credit Scorecard, which gives a free FICO score to anyone who signs up for an account.

Or, for more options, heres a list of all the places you can get your FICO scores for free. It also includes websites where you can get other free credit scores, like your VantageScores.

Insider tip

While youre at it, you should probably check your credit reports. Theyre what your credit scores are based on, so if theyre not correct, your credit scores wont be either. You can get one free credit report per year, per bureau at AnnualCreditReport.com. You can also use services like ;to monitor two of your VantageScore 3.0 credit scores on a regular basis.

Fico Score Ranges Vary They Can Range From 300 To 850 Or 250 To 900 Depending On The Scoring Model But Higher Scores Can Indicate That You May Be Less Risky To Lenders

Lets take a deeper look at FICO® score ranges, whats considered to be a good FICO® score, and how to improve your credit if your scores fall on the lower end of the credit spectrum.

|

740 to 799 |

800 to 850 |

The latest FICO® base scoring model is FICO® Score 9. But some lenders still use FICO® Score 8 models. Bill Banfield, executive vice president of capital markets for Quicken Loans, says that many conventional mortgage lenders use even older FICO® scoring models.

The base scores are what you may see when you check your FICO® scores after logging into your credit card account or paying for FICO® scores online.

Recommended Reading: Will Increasing Credit Limit Hurt Score

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

What Are Older Fico Models

FICO 8 and 9 arent the only versions in use. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, these are still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

FICO 2, 4, and 5 are very similar. The main differences between the three is that 2, 4,and 5 use data from Experian, TransUnion, and Equifax respectively. Mortgage lenders pull one of each and compile the reports in a document called a Residential Mortgage Credit Report. Duplicate data is screened and removed, and the middle score of the three is picked to represent your worthiness to pay back the mortgage.

FICO 8 and 9 use data from a single credit bureau, so using FICO 2, 4, and 5 together gives mortgage lenders a more complete view of your creditworthiness because they can see the history of every account youve opened. This is especially helpful for mortgage lenders as many creditors don’t report account history to all three credit bureaus.

Also Check: Will A Sim Only Contract Improve Credit Rating

What Is Fico 8

FICO 8 is still the most widely used FICO credit score today. If you apply for a credit card or personal loan, odds are that the lender will check your FICO 8 scores from one or more of the major credit bureaus.;

FICO 8 is unique in its treatment of factors such as , late payments, and small-balance collection accounts. Here are some key things to note about FICO 8:

- This scoring model is more sensitive to higher credit utilization .;

- Isolated late payments on your credit report may not count against you as much as having multiple late payments.;

- Small-balance collection accounts in which the original balance was less than $100 are ignored for credit scoring purposes.

Its also worth pointing out that there are different versions of FICO 8. With FICO Bankcard Score 8, which is used when you apply for a credit card, the focus is on how youve handled credit cards in the past. FICO Auto Score 8, on the other hand, doesnt emphasize credit card activity and history as heavily.

Regardless of which FICO credit scoring model is involved, the same rules apply for maintaining a good score. These include paying bills on time, maintaining a low credit utilization ratio, and applying for new credit sparingly.

How Long Will Negative Information Remain On My Credit Reports

It depends on the type of negative information. Heres the basic breakdown of how long different types of negative information will remain on your credit reports:

- Late payments: 7 years from the original delinquency date.

- Chapter 7 bankruptcies: 10 years from the filing date.

- Chapter 13 bankruptcies: 7 years from the filing date.

- Collection accounts: 7 years from the original delinquency date of the account

- Public Record: Generally 7 years

Keep in Mind: For all of these negative items, the older they are the less impact they will have on your FICO® Scores. For example, a collection that is 5 years old will hurt much less than a collection that is 5 months old.

You May Like: How Long For Things To Fall Off Credit Report

What Affects Your Fico Scores

FICO® credit scores depend on the information in your consumer credit reports, and different pieces of information may raise or lower your scores. For example, making on-time payments may help your scores, while a late payment could hurt it.

FICO breaks its scoring criteria down into five categories, with a percentage value based on each categorys importance, though the importance may vary for individuals.

- Payment history :;Your history of paying bills is one of the most important factors in determining your scores. Your payment history includes your on-time and late payments on credit accounts, and public records related to non-payments, such as a bankruptcy.

- Amounts owed :;How much you owe on credit accounts, such as installment loans and credit cards, and the portion of your available credit that youre using together are worth about a third of your scores.

- Length of credit history :;The age of your accounts including how long youve had your oldest account and your newest account and the average age of all your accounts are worth about 15% of your scores, along with how long its been since you last used specific accounts.

- This includes the types of accounts you have, such as credit card accounts, mortgage loans and retail loans. Its not a key factor but its still considered in formulating your scores.

- New credit :;New credit inquiries and recently opened accounts can also influence about a tenth of your scores.

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

You May Like: Does American Express Report To Credit Bureaus

Is A Fico Score The Same As A Credit Score

As with all credit risk scores, FICO® Scores predict the likelihood that someone will fall 90 days behind on a bill within the next 24 months. FICO® does this using complex algorithms based on information in your from each of the national credit bureaus: Experian, TransUnion and Equifax.

FICO® periodically releases new versions of its scores, and it creates different versions of its scores to work with each bureau’s databases, which is why there are many FICO® Scores. Other companies, including VantageScore®, also create credit risk scores that similarly analyze consumer credit reports to calculate scores.

FICO® and VantageScore credit scores range from 300 to 850, and group consumers by . For example, a FICO® Score of 800 to 850 is considered “exceptional.” However, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score.

FICO® also creates other types of scores that are based in part, or entirely, on your credit reports. For example, FICO® offers and bankruptcy scores, which try to predict the chance you’ll file an insurance claim or declare bankruptcy, respectively.