Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

S To Building Business Credit

1. Make sure your business is legally registered

Incorporate or form an LLC, and get a federal employer identification number. Some business credit reporting agencies will use this to track your business instead of the Social Security number they use to track personal credit.

2. Get a business credit card and a business bank account

Keep your business card strictly for business and your personal credit card for personal expenses to make your taxes easier down the line. Otherwise, follow all the good credit card habits you would use to build good personal credit such as keeping your and making consistent, on-time payments.

3. Work with vendors that report payments to the business credit bureaus

If youre not sure whether one of your vendors reports payments to the credit bureaus, feel free to ask. Its OK to prioritize working with vendors who report payments.

4. Pay on time or, better yet, early

Late payments are one of the worst things you could do for your business credit scores, but paying early is even better than on time. The Dun & Bradstreet PAYDEX® score, a commonly used score, will only award you its highest score if you pay vendors early.

5. Check on your scores regularly

Should I Get A Business Card That Doesn’t Affect Personal Credit

If you can imagine making a few slip-ups with business credit, you might want to get a card that doesnt report to consumer credit bureaus as a precaution. But generally, it’s a better idea to apply for the card that offers the rewards and benefits youre most interested in, instead of focusing on the cards reporting policy.

Its important to be mindful of how your business credit card affects your personal credit. But dont make the mistake of thinking you can get rid of all your personal liability by choosing a business credit card that doesn’t report to consumer credit bureaus. If you want to protect your personal assets, your best bet is to borrow sparingly and pay your bill on time, every time.

Recommended Reading: Usaa Credit Monitoring Review

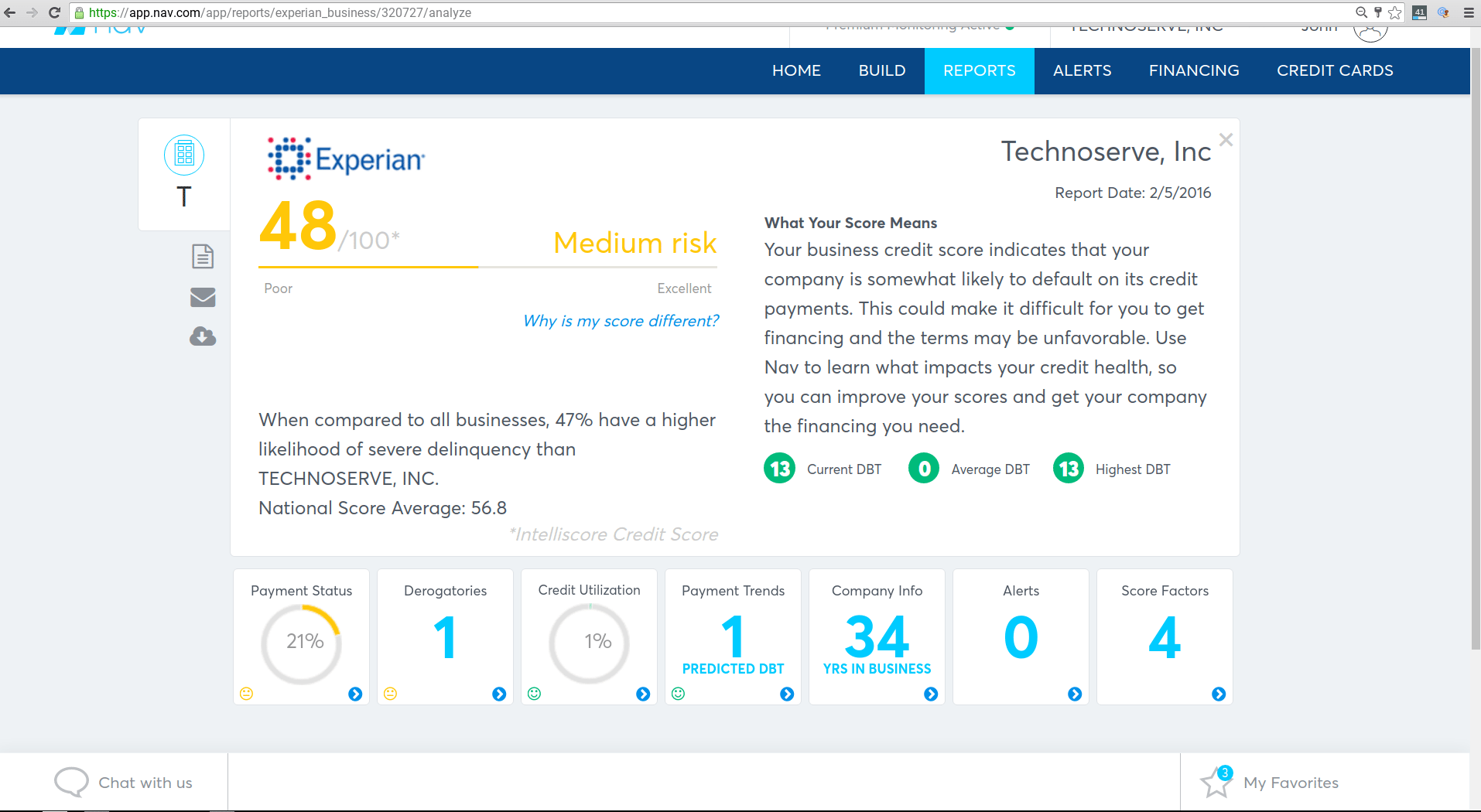

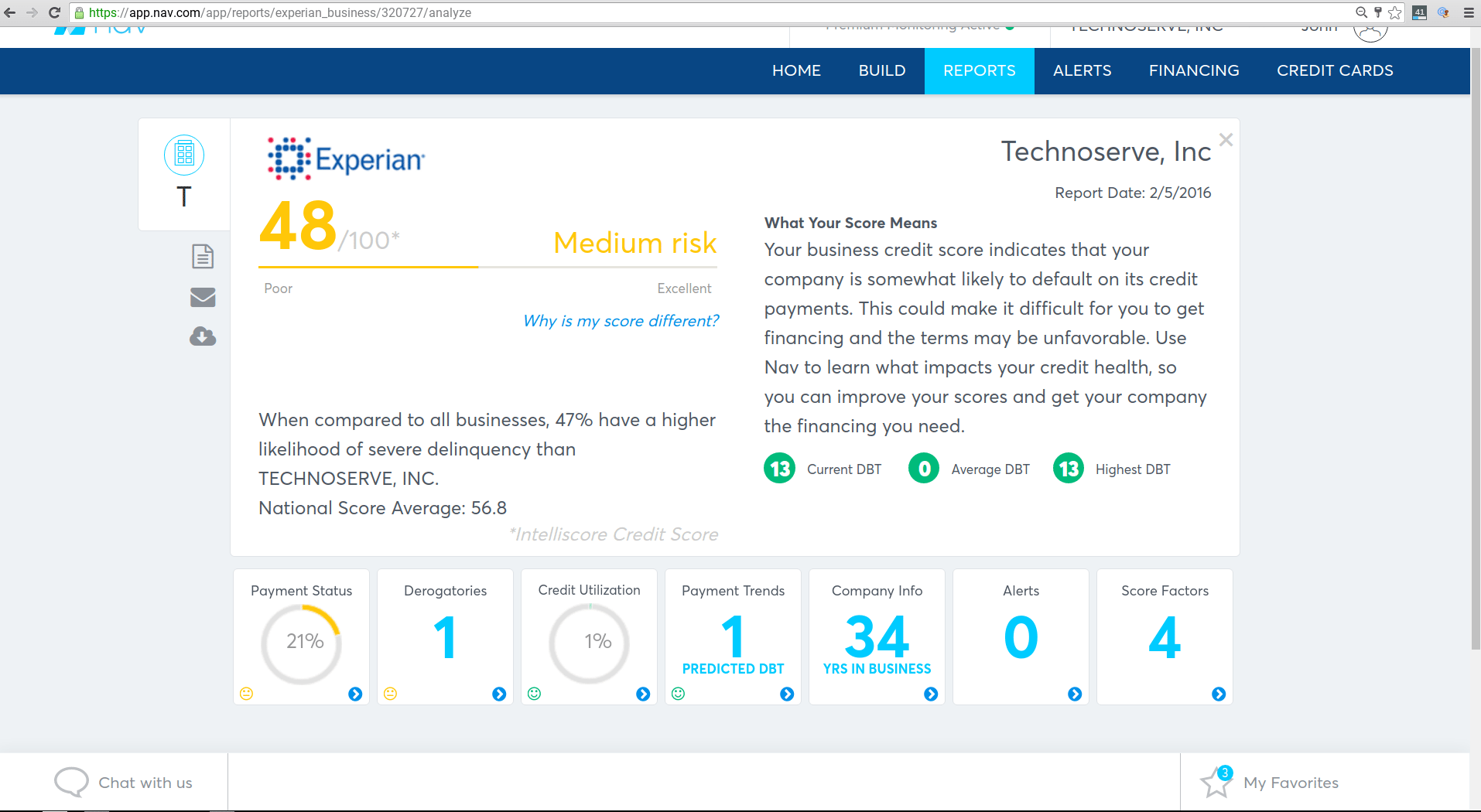

Why You Should Know How To Check The Business Credit Scores Of Other Companies

According to credit bureau Experian, as of 2015 upwards of $8 billion is lost or stolen from small businesses yearly due to fraud. Itâs possible that this number is actually underreported, and that the damage being done is more severe.

With the surge in ecommerce and online storefronts, itâs likely that this trend is only growing. And if you own an online store, youâre already probably hyper-vigilant about fraudâso anything you can do to help keep you safe is in your best interest. You want to know if thereâs anything shady in their historyâdo they not pay their big debts? Checking the business credit scores of the companies you hope to do significant business with helps keep you safely back from the edge.

After all, business credit scores are affected by the same factors as personal credit scoresâlength of credit history, debt repayment, credit utilization, bankruptcies and judgmentsâas well as other considerations, like the age and size of the company, and the risk of their industry . Since these scores are standardized and algorithmic, theyâre the best way for you to get an objective look at a company.

What Can Damage Your Score

Business defaults and late or missed payments are some of the main contributing factors to a low score.

“Another way the score could be impacted is just by the quantum of applications for credit that you’ve made,” said Poolman. “So if you are asking for credit from a large quantum of different institutions, that will have a negative impact on your score.”

Recommended Reading: How To Get Rid Of Repossession On Credit Report

How To Check Your Business Credit

We all know it’s important to check our personal credit report. But for business owners, it’s just as important to keep track of your business credit.

Why? Because it has a direct effect on your business’s financial health. Your business credit score can impact the amount of business credit you receive–or whether you receive any at all. It can also affect what interest rates you’ll pay and even your business insurance premium.

Keep in mind, your suppliers or potential customers can check your business credit too. This means you could be losing business without even realizing it.

Here are some other reasons why we recommend you proactively monitor your business credit:

- Check for completeness and accuracy

- Learn how your company compares with others in your industry

- Examine the strengths and weaknesses of your file

- Develop a strategy to improve your company’s credit standing

- Better control risk

Does My Business Have A Credit Score

Theres a really good chance your business has a credit score, even if you havent created a credit file.

Both Equifax and Experian automatically set up credit files for businesses. So if youve got an official business , then youve probably got Equifax and Experian business credit scores.

You probably dont have a Dun & Bradstreet Paydex score though. In most cases, you have to manually create a credit file with Dun & Bradstreet by requesting a D-U-N-S file.

Recommended Reading: Opensky Payment Due Date

What Is A Dun & Bradstreet Credit Score For Business

Dun & Bradstreet collects a variety of different financial, public filings, and industry information to generate three separate business credit scores. These include a PAYDEX Credit Score, a Financial Stress Credit Score, and a Commercial Credit Score.

Each one of these business credit scores measures a different potential risk factor associated with a company. This can include its payment performance, the likelihood of it ceasing operations within the next 12 months, and the probability of it paying bills in a delinquent manner.

How To Deal With Businesses Who Have A Poor Credit Score

Know what a poor business credit score is

Once you start watching your credit score, youâll see how hard it is to get a really good one. Try and keep some perspective when reviewing the scores of the businesses you deal with.

-

Donât worry if a business has a middle-of-the-road credit score. Just be wary if theyâre in the bottom quarter of the scale.

-

If you find that an existing client has a poor credit score, donât panic. Your personal experience of them counts for more. You only need to worry if their score is trending consistently downward.

Set cautious invoice payment terms for higher-risk businesses

You donât need to turn down businesses with bad credit scores. You can still do a deal, but you may want to structure the agreement differently.

-

Set shorter due dates so youâre not extending them as much credit.

-

Ask for an upfront deposit.

-

Charge them interest or a late payment processing fee when invoices are past due.

Lower your dependence on late payers

Businesses that consistently pay late will put you under cash flow pressure. They may diminish your ability to pay bills on time, which will affect your credit score. Make sure youâre not over-reliant on businesses that keep you waiting. Gradually try to cycle late-paying clients out of your business.

You May Like: Does Paypal Credit Report To Credit Bureaus

How To Check Business Credit With D& b

Access your D& B credit score, report, and monitor changes for free.

With Credit Signal®, you can monitor changes to your scores and ratings with up-to-date business credit information on your company.

Through D& B, paid credit reports are available for multiple companies and to upload multiple trade references to your account.

How Is The Tillful Business Credit Score Different

The Tillful Business Credit Score is based on real-time transaction data from bank and credit card accounts. We apply our machine learning based credit model to find patterns from cash flow data in order to accurately assess business credit scores. In addition to traditional factors, such as payment history, these cash flow patterns could include:

- Increasing or decreasing trend in your cash balance

- Irregularities in inflow and outflow

Read Also: Does Paypal Credit Report To Credit Bureaus

How Do I Check My Business Credit Score

June 29, 2021 byGuest

Both businesses and individual consumers have credit scores that reflect how theyve historically used credit. Lenders and others use these scores to help determine creditworthiness and make decisions based on what they see. Business credit scores are based on different information than personal credit scores and use a different scoring system.

What Information Will You Need To Check Your Score

To access your business credit score with Nav or the D& B CreditSignal program, youll need to provide information such as your business name, your ZIP code and your email address. Youll also need to verify your identity by providing your home address, your date of birth, your phone number and your Social Security number.

Further, you may also need to answer some security questions based on your loan history, your work history or previous addresses you may have had.

Recommended Reading: Usaa Credit Check

Why Separating Personal And Business Credit Matters

Trade credit reporting is beneficial for helping you separate your business and personal finances, which is particularly advantageous in regard to credit. A business credit report offers a clear view into the financial standing of your business, providing you with a clean report of the companys credit inquiries, lines of credit and delinquencies. This streamlined information makes it easier for fraud monitoring and for lenders to accurately assess creditworthiness .

Furthermore, separately listing business credit information protects your personal credit standing. Your company will typically have more annual inquiries and for larger lines of credit. With combined information, these inquiries could hurt your credit score, but a trade credit report gives your business its own history to list your business credit activity.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: Does Paypal Credit Build Your Credit

What Is A Good Credit Score And How Can It Help You

Youre probably already familiar with your personal credit score, which ranges from 350 to 850. Business credit scores work a little differently. They are based on a scale of 0 to 100.

A higher score indicates that your business is creditworthythat is, it says that youre likely capable of repaying any loans you receive.

A good credit score is anything over 80, though Experian breaks down the scores even further, based on the relative risk of your business:

- 0-10: High risk

- 51-75: Low to medium risk

- 76-100: Low risk

Your business credit score matters a great deal, especially if you intend to apply for a loan to grow your business at any point in the future.

When you apply for a business loan, your lender will check your credit score to help to determine your eligibility. A high credit score will grant you access to the best loans and can also lower your interest rates.

Low credit scores wont prevent you from receiving a loan, but it can limit the size of the loan you receive. It can also jack up your interest rates, reducing the cost-effectiveness of the loan. Low credit scores may also increase your insurance rates, since your provider will consider your business to be a higher risk.

If your business just started, you might not generate a meaningful business credit score for a year or two. But that doesnt mean you should ignore your credit score.

How Does My Business Creditscore Impact My Finance Options

Youre probably aware of your personal credit score. But did you know you have a business credit score too?

If not, dont worry. Youre certainly not alone.

Experian is one of a number of credit reference agencies that collect your credit information. It estimates that almost two-thirds of business owners have never checked their credit score, while nearly 90% say they dont know what goes into it.

In this article, we look at:

- Why your business credit score is important

- What affects it

- How you can improve it

- What finance options may be available to you if your score is lower than youd like

You May Like: What Credit Score Do You Need For Amazon Prime Visa

Are All Business Credit Scores The Same

No, not all scores are the same. Different providers have different methods of generating scores. Business credit scores overall are not standardized and cannot be compared across providers.

We have partnered with Dun & Bradstreet, a provider of business credit reporting, to give you easy access to one business credit score that may be used by creditors and lenders to help make decisions about working with your business. Bank of America and other lenders may use other credit scores and additional information to make credit decisions.

Get Your Free Business Credit Check

Doing the right things to build your business credit profile is one of the most important items you can take as a small business owner. Doing so opens up financing opportunities and business relationships that make it a hell of a lot easier for you to run and grow a business.

Ready to see your credit data and start building better business credit? Check Your Personal and Business Credit For Free .

Read Also: What Is The Highest Credit Score A Person Can Have

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How To Check Business Credit

You likely know your personal credit score, but you may not know your business credit score. The two credit scores are not the same, although they serve a similar purpose. Your personal credit score illustrates how well you pay your debts on time. And your business credit score demonstrates your companys ability to pay its debts in a timely manner.

You should review your business credit report for the same reasons you check your personal credit score: to find and fix errors, learn what may be helping or hindering your score, and establish a baseline to improve your score.

There are also two other significant reasons to check your score: Your customers, suppliers, and business partners can access your score for a fee, to determine your creditworthiness. Lenders examine your business credit report as well, to decide whether to approve you for small business financing and at what interest rates.

Contents

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How Is It Different From A Personal Credit Score

According to Poolman, a business credit score doesn’t include the personal information that is used to calculate individual credit scores.

Your company’s file will contain:

- Company details. Information on structure and current shareholders.

- Public record information. This will include any legal matters or action taken against your firm by the Australian Securities and Investments Commission .

- Personal Property Securities Register . Any information the PPSR have concerning your company’s possessions will be on your credit file.

“A business credit score has got more of the commercial information, such as registered defaults, potential loan inquiries or any external administration that may be registered against the business, so it’s very much the commercial and business attributes of the business,” he said.

However, there are some similarities.

“In the same as in the personal space, without any positive credit reporting, it almost accentuates the negative. And so, it is quite difficult to get to build your credit score up again once you’ve got a negative listing or your score has dropped because you’re not getting that positive reporting coming through to increase it,” he said.

How To Check Another Businesss Credit Score

Most of us are familiar with the concept of checking our credit scoreâand, luckily, itâs a fairly simple process these days . And although you almost certainly know how important it is to understand how to check your own credit score, did you know that itâs also just as vital to know how to check another businessâs credit score?

Itâs trueâeven though you might think that a business credit score is just, well, private business, itâs actually publicly accessible. And that could become important to you in the future, especially if youâll be working closely with other companies. For example, perhaps youâre offering trade credit, and want to figure out if a new business will pay their invoices.

Whatever your particular reason for wanting to check the credit score of another business, youâll get the same useful informationâitâs a way to check up on their history with debt, and help you make smart financial decisions as the head of your own business.

Also Check: How To Check Credit Score With Itin