Hows Your Experian Credit Score Calculated

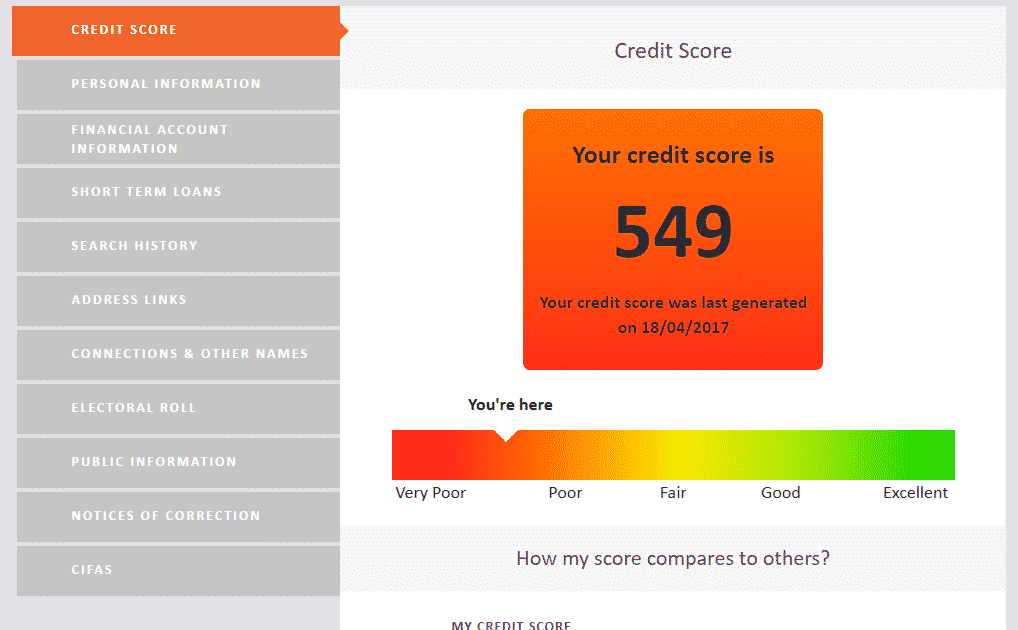

The Experian Free Credit Score runs from 0-999. Itâs based on information in your Experian â like how often you apply for credit, how much you owe, and whether you make payments on time.

Youâll lose points for having information on your report that suggests to lenders youâre unlikely to manage credit responsibly, such as previous late payments and defaults. Youâll gain points for things that lenders usually view positively, such as a track record of always paying on time and being on the electoral roll.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

What Is A Good Credit Score To Get A Mortgage

The Experian Credit Score is based on the information in your Experian Credit Report. It runs from 0-999 and can give you a good idea of how lenders are likely to view you. The higher your score, the better the chance you have of getting the mortgage youâre after.

This table is a general guide to how lenders may see you, based on your Experian Credit Score – of course there are other factors involved, in particular how much deposit you have – which would bring the loan-to-value down and could give the chance of lower interest rate deals.

Excellent

Recommended Reading: Credit Report With Itin Number

Which Credit Report Is Most Accurate

The three major credit bureaus get their information from different sources. This means that your three credit reports from these bureaus may all be slightly different. Consider monitoring each of these reports on an annual basis to help make sure the information is correct.

If youre using Credit Karma to check your credit scores and monitor your credit reports, keep in mind that we update your TransUnion credit scores on a daily basis, so you can follow your progress closely.

But as we mentioned, the most important credit report is the one your lender reviews when you apply for a new credit card, loan or mortgage. Because you may not know which report your lender might use, its more important to focus on the general principles of building credit than on memorizing whats in a particular report.

Cons Boost Your Credit Score Experian

Right here are some disadvantages of Experian Boost that we need to consider to derive at a meaningful analysis of Boost Your Credit Score Experian.

Not Offered In All Places

Experian Boost is not offered in all states. Experian, among the 3 significant credit rating bureaus, does not provide its solutions to every U.S state. There are 17 states where Experian can not assist boost your FICO rating which might lead you to think about other options for enhancing a bad credit report and even surrender on Experian Boost entirely if it cant be made use of at all in your state.

Not ideal For Mortgage

You ought to not utilize Experian Boost if you are going to apply for a mortgage loan. Experian discloses that its Experian Boost item is designed just as an instructional tool.

The credit score it offers might change depending on which credit rating report information is made use of, whether your FICO Rating has actually been adjusted recently due to adjustments in the scoring model, the number of times your information has altered when given that last time Experian opted-in updated your documents with new ratings.

Blunders On Credit Rating

If there is any sort of mistake on the credit reports provided by creditors Experian Boost is unable to take any type of action on it. Experian does not manage the details in your credit rating reports. And Experians products are unable to make corrections or avoid errors from appearing on your credit score record.

Don’t Miss: Does Klarna Financing Report To Credit Bureaus

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

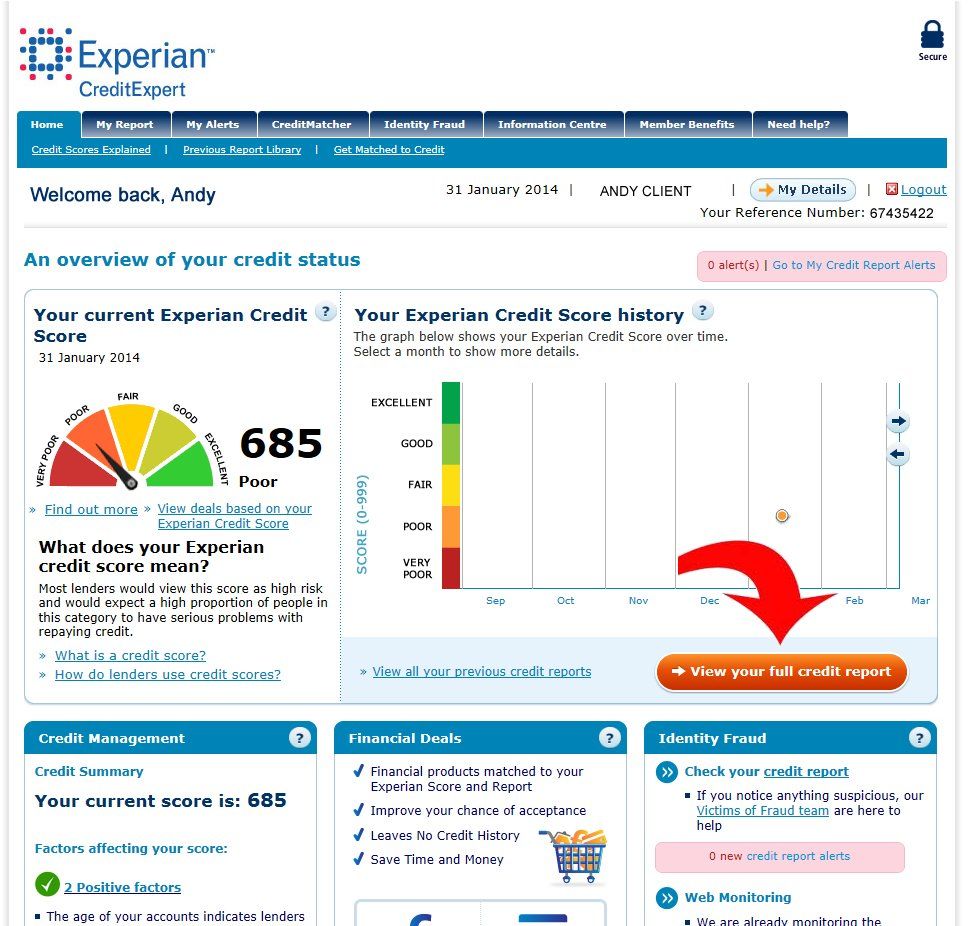

Experian’s CreditExpert free 30-day trial*. CreditExpert offers new customers a “free 30-day trial, then £14.99 a month” service. It’s different from MSE’s Credit Club in that it gives you real-time access to your credit report . It also offers an eligibility checker. You can only do the free-trial once. To cancel your subscription, log into your account and go to ‘My Subscriptions’.

Experian’s Credit Score free subscription to your score. If you don’t want to pay a subscription to see your credit report, you can sign up for free to see your Experian Credit Score. You won’t have to pay anything, but the information is limited to seeing your credit score, as opposed to credit report. The score updates every 30 days.

Experian Creditworks Review : Get Your Free Fico Score

- Joshua Mayo

- Free FICO credit score from Experian

- Free monthly Experian credit reports

- Free one-time dark web scan

- Free one-time identity scan for your child

- Free credit monitoring

- Easily submit and track Experian credit report disputes online

Cons

- The price of the premium plan is a bit high

- The free plan only gives you access to one credit score

Read Also: Does Overdraft Affect Credit Rating

Keep An Eye On Your Credit

Your real FICO® Score can be had for free in several ways, but if you want to check multiple FICO® Scores, you’ll generally need to opt for a paid service. You can look for services that come with more than just your credit scores, such as Experian CreditWorks Premium. Experian’s service also includes free credit report and score monitoring with notifications if there are any suspicious changes. Additionally, you get a wide-range of identity theft monitoring and protection services, including dark web surveillance and up to $1 million in identity theft insurance.

You can also match your score checking or monitoring with your current needs. A free score tracking service can help you keep an eye on one of your FICO® Scores and give you a sense of if your credit is improving. But a paid service may make more sense if you want identity theft protection, or if you’re planning to buy a home and want to check the FICO® Scores that mortgage lenders commonly use.

Second Stop: My Banker

We just completed the building of our dream home earlier this year and refinanced when rates dropped a few months back, so I knew that my bank would have our most recent credit scores. I contacted my banker to see what scores they had on me.

This is what I got from them:

776 / 765 / 773 These are from all three credit bureaus. Also, these are mortgage report credit scores which will be lower than credit scores that you would pull.

Did you catch that? Look again:

.these are mortgage report credit scores..

Mortgage report credit scores.what the heck is that? Now thoroughly perplexed, I emailed my banker to see exactly what that meant. His second response:

I found out about a year ago, that Freddie & Fannie had been working with the three credit bureaus to set up a scoring model for the purpose of mortgage loan requests. The mortgage scoring is tougher then the normal consumer scoring. Both are FICO scores utilizing the same system, but as one example, consumer models dont give a lot of weight to collection items, whereas the mortgage scoring system does. People who have collection items on their credit will score lower with the mortgage scoring system then the traditional consumer scoring system. Thats one of the examples, but since FICO is a proprietary system, the public knows very little about the full details that go into your score.

After I read the email, this was my response: Huh?

I knew at this time I was in way over my head.

Read Also: Does Opensky Report To Credit Bureaus

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Don’t Miss: When Do Hard Inquiries Fall Off Credit Report

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

Also Check: Speedy Cash Change Due Date

Free Credit Scores From Experian

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score free forever, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the best rates on cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

Recommended Reading: How To Unlock Experian Account

Fifth Stop: Getting A Second Expert Opinion

Then I checked with Philip Tirone, a mortgage broker and the author of 7 Steps to a 720 Credit Score, from 720CreditScore.com. Philip echoed what Liz said, and then he added this:

The consumer education score is worthless because no lender will ever use it. And because it is almost always higher than a FICO score, the consumer score gives a person an artificial sense of security about their credit score. They would be much better off getting the scores directly from FICO and ignoring the consumer scores entirely.

Philip added that 100 percent of the credit scores that he reviews in his capacity as a mortgage broker have been based on the FICO score.

Okay, but Im still confused. Where do TransUnion and Experian come into play?

Philip explained,

There are three primary credit-reporting bureausTransUnion, Experian, and Equaifaxwho are responsible for collecting your credit information and applying a formula to the information: TransUnion, Experian, and Equifax. So you have a TransUnion FICO score and a TransUnion consumer score, and so on and so forth. When a lender pulls your credit score , the lender actually gets three scores, one from each of the three bureaus. The lender ignores the high score and the low score, looking at the one that falls in the middle, and assigning interest rates only.

What About All The Sites Offering A Free Credit Score

Understandably, this is one of the most confusing parts about making sure you get an accurate credit score. Tons of sites offer free credit reports and credit scores without letting you know they are providing what we often call a FAKO score.

Someone clever came up with FAKO as a way to combine FICO and fake. Genius!

When considering whether to apply for a new credit card, you need to know your FICO credit score. Thats it. Not a score that is close to a FICO score, but your actual FICO score.

Have I said that enough yet?

If you look at Credit Karma, Credit Sesame, and Quizzle all provide FAKO scores. While they help with monitoring your credit reports, they are not accurate sources for your FICO credit score.

Don’t Miss: When Do Companies Report To Credit Bureaus

How Do You Check Your Credit Score

You can check your credit score from many sources, including Experian. Learning what your credit scores mean and what affects them can help you when you’re getting ready to apply for new credit.

Lenders use credit scores to decide how likely it is you will repay your debts on time. There are hundreds of credit scoring models in existence, though the FICO® Score is the most common. The higher your credit scores, the better offers you are likely to receive from lenders in the form of lower interest rates and other favorable terms.

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Recommended Reading: What Credit Score Do You Need For Amazon Prime Visa

Third Stop: Credit Scores At Myficocom

Still curious I decided to actually purchase my credit score through MyFico.com. It cost me $25 bucks, but I didnt care. I was on a mission.

Thinking there would only be only one true credit score, it gave me two. One from TransUnion and the other from Equifax, which were 779 and 770 respectively.

Really? Two Credit Scores?!

So heres what Im looking at so far: 758, 776, 765, 773, 779, and 770. At this point I have no clue which one is the real deal. No more messing around. It was time to break out the big guns.

Who Experian Boost May Be Best Suited For

Experian Boost may be best for an individual who has been making on-time cell phone, utility and/or service payments for some time but has never opened a credit card or another type of loan account.

Experian Boost doesnt work for everyone, though. The free feature is best suited for individuals who pay their telecom, utility or service bills through an eligible account. If the feature doesnt work for you, you can try other methods to boost your credit scores.

Nevertheless, with how fast it is to set up an account with Experian and start the process, it might provide an easy way to raise your credit score by a few points.

Recommended Reading: Does Snap Report To Credit Bureaus

What Is A Credit Score

Checking your credit report is an important part of maintaining your financial health. Itll allow you to pick up on any mistakes or even fraudulent applications that could hinder your chances of getting credit.

Theres no such thing as a universal credit score. Each lender has its own system in place to decide whether or not to accept you as a customer, meaning you could be turned down by one, but successful with another.

To give you a better idea of how your application might be viewed by lenders, credit reference agencies produce their own version of your credit score.

The higher this number, the higher your chances of getting the best credit deals but a good score from a credit reference agency is no guarantee that your application will be successful.

And confusingly, each credit reference agency uses a slightly different scale. For example, a score of less than 560 is very poor with Experian, but excellent with Equifax.