Information Youll Need To Remove Tax Lien

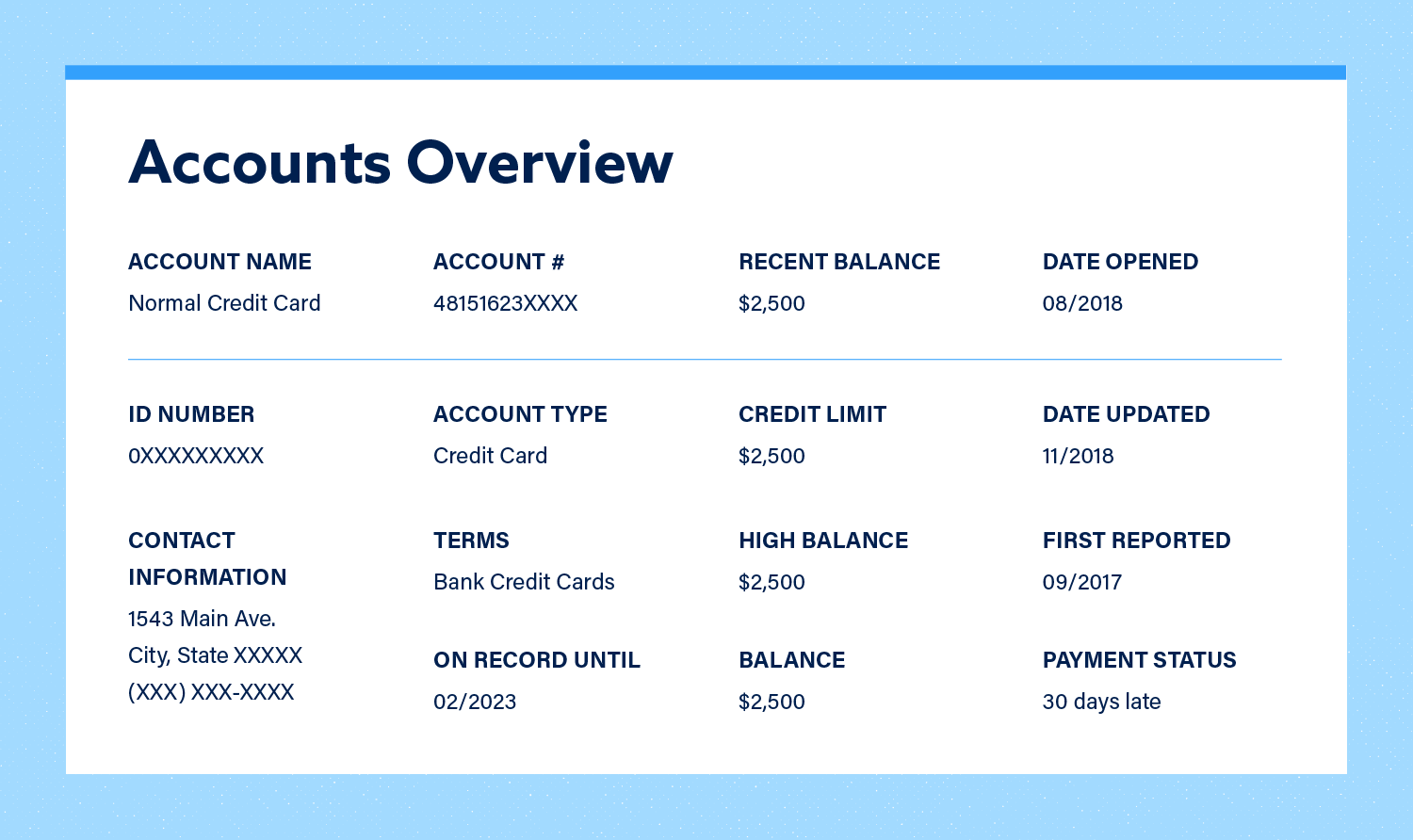

To make your phone call or letter most efficient, be sure you have your Social Security number available. If possible, include the account number for the tax debt.

Also, if you call, be prepared to confirm your personal information such as old addresses and old or current credit account information.

If youre not sure which bureau is reporting a public debt on your credit file, visit annualcreditreport.com to request your free credit report.

Each year, each credit bureau must provide you with one free credit report if you request it.

Why Hiring Professional Tax Representation Can Help

Professional tax representation can answer all of your questions and concerns about your tax debt and negotiate a settlement with the IRS that can save you thousands of dollars. Theyre well-versed with IRS issues and serve to protect their clients. In fact, their goal is to reduce your tax debt. There are a number of strategies they can use to help you achieve the best outcome for your unique tax burden. For example, tax planning can help you settle for far less than what you owe with an offer in compromise.

Bottom line: A tax professional has knowledge of tax laws and resources that you dont have access to. If youre looking for a fresh start, tax representation serves to return your life to normalcy.

How Will A California Ftb Lien Impact Your Credit Score

Both the U.S. Government and the State of California take the collection of taxes very seriously. Both the Feds and the State have a number of ways to force non-compliant taxpayers to pay the government the money that they owe.

One of the most common of these is a tax lien. A tax lien cannot only affect property and assets, it used to have a negative effect on your credit score which made it more difficult to obtain credit. That is, up until April 16, 2018, as all three credit bureaus started removing tax liens from consumer credit reports on that date.

In California, all income and franchise taxes are administered by the California Franchise Tax Board . While the FTB follows the Revenue and Taxation Code in the State of California, it will often piggyback on audit findings of the IRS. So, if you have been audited by the IRS, you may find the FTB using the information discovered by the IRS as the basis for claiming that you owe the FTB additional taxes.

If these taxes are not paid, or if your income or franchise taxes are overdue, the FTB will often place a lien on property that you own. Lets take a closer look at what this means and the impact it may have.

Don’t Miss: How To Print Your Credit Report From Credit Karma

What You Need To Know

- Neither tax liens nor judgments have any effect on your personal credit reports or scores

- Whether its the Internal Revenue Service , your state, your city, or your county, a tax lien can be filed by a government agency

- When a tax lien is filed against you, the IRS will send you a Notice of Federal Tax Lien. Local governments will send different notices

When Is A Tax Lien Cancelled

A tax lien is cancelled by the Department when the delinquency is paid in full. If the debt is paid with secured funds , the lien is cancelled by the next business day. If the lien is paid by any other means, then the lien is cancelled within 15 days. When the lien is cancelled, the State Tax Lien Registry is updated to reflect that the debt is satisfied. A Lien Cancellation Notice is mailed to the taxpayer after the debt is paid in full.

Don’t Miss: Unlock Transunion Credit Report

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Tips For Removal From Your Credit Report

You can have the lien withdrawn and removed after you’ve satisfied the tax obligation if it was filed by the federal government. The IRS indicates that it will release the lien within 30 days after your tax debt is paid off.

You must have filed your tax returns for three previous years to qualify for the 30-day removal, or you must show that you weren’t required to file according to federal rules. You must also be current on any estimated taxes and federal tax deposits you might owe.

Certain taxpayers might also be able to have the tax lien withdrawn by entering into a direct debit installment agreement with the IRS. This allows them to automatically withdraw regular tax payments from your bank account at scheduled intervals. You must owe $25,000 or less to qualify, and have made at least three consecutive payments. Other rules also apply.

Your state might offer a similar tax lien withdrawal procedure, but you’ll have to contact its Department of Revenue to find out what the procedure is and how you should apply. The tax lien will most likely follow the normal credit reporting timeframe if it’s paid in the absence of a process for tax lien withdrawal.

Consider consulting a tax professional about the best way to proceed if you’re having issues with a tax lien to ensure that all procedures are followed correctly.

You May Like: 820 Fico Score

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Filing A Withdrawal Request

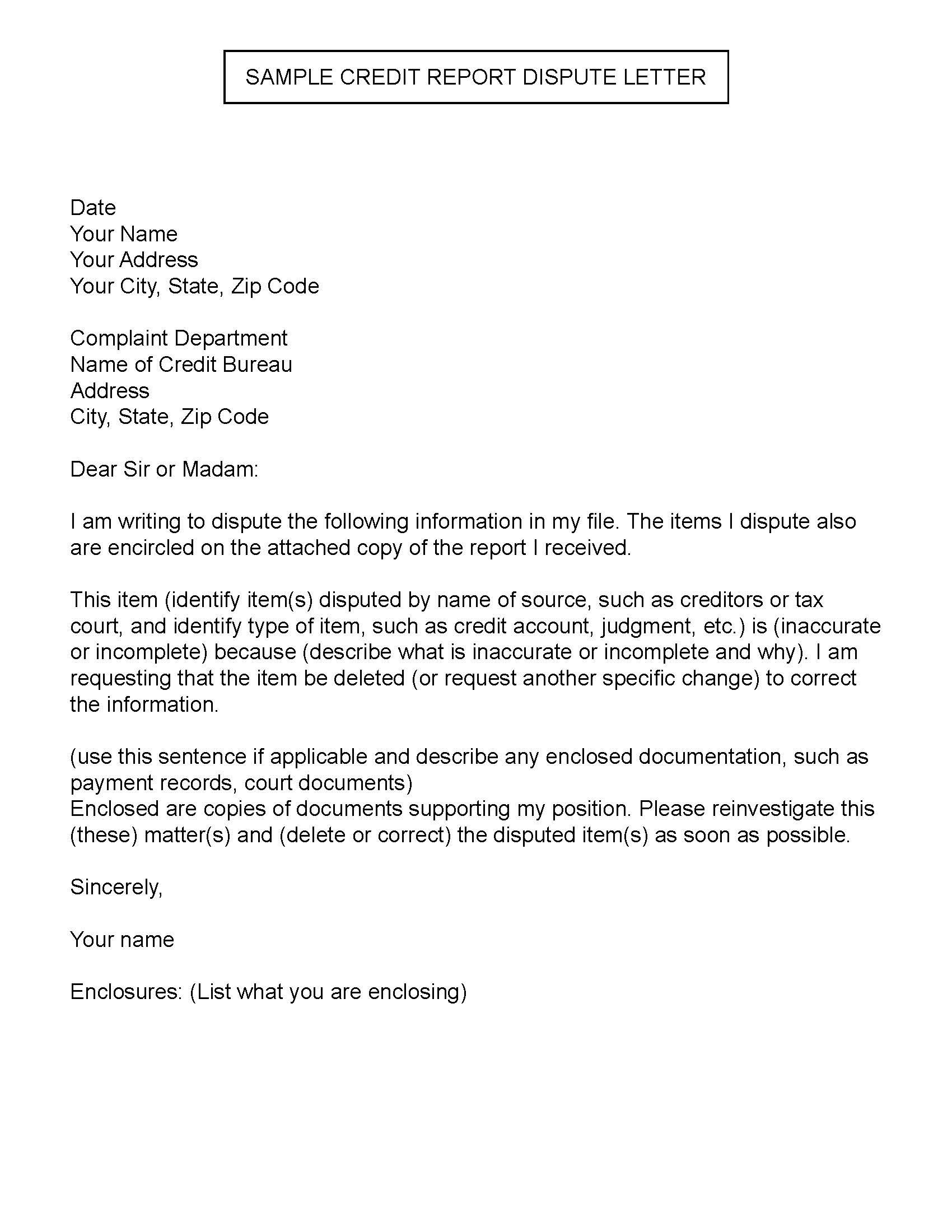

Getting federal tax liens removed from your credit reports requires filing a specific withdrawal request on IRS form 12277. From there, you will still need to follow up with the credit bureaus as the IRS will not notify them that the tax lien has been withdrawn.

That means that you will have to coordinate with the IRS and all three credit reporting agencies to ensure that the tax lien has been removed.

Withdrawals may also be possible for older tax liens that have already been paid off. Still, again you will need to follow the same process of dealing with the IRS and credit reporting agencies separately.

Because the IRS does not coordinate with the credit bureaus the way typical creditors do, it can prove both frustrating and confusing for the average consumer.

Plus, if you arent very familiar with tax laws, its easy to find yourself dealing with a release versus a withdrawal which leaves you with fewer options to restore your credit score.

Also Check: Does Paypal Credit Report To Credit Bureaus

Review Your States Policies For Tax Liens

Each state handles tax liens differently. Contact the Department of Revenue in your state for more information on how you can get the lien withdrawn from your credit report. If the lien is not withdrawn by the state, it will remain on your report for seven years as a back tax thats been paid or released. However, in many cases, you can speak with the state Department of Revenue to have the lien officially withdrawn as soon as its paid.

Do Irs Payment Plans Affect Your Credit

One way to avoid a tax lien or other collection action is to establish a payment plan with the IRS when you receive a tax bill. Taking the step of setting up a payment arrangement with the IRS does not trigger any reports to the credit bureaus.

As mentioned above, the IRS is restricted from sharing your personally identifiable information. While a Notice of Federal Tax Lien could be discoverable by lenders, the payment plan itself would not. Learn about all the IRS payment options you may have if you owe taxes and cant pay.

Read Also: How Long Is A Repo On Your Credit Report

Request A Copy Of Your Credit Report

If your state tax office has agreed to withdraw your tax lien, the next step is checking your credit report to see if it shows this properly. In many cases, the credit reporting agency will overlook the withdrawal, leaving the lien on your report erroneously. Ideally, you should check your credit report at least once a year to make sure all items are accurate. This may be how you find out about a tax lien if one is filed on your report in error.

There are three agencies that produce credit reports:

- Equifax

So How Do I Get Rid Of Negative Public Records

Unfortunately, its not that easy.

The three major credit bureaus wont accept certain poorly sourced public records, and theyre proactively removing some tax liens and civil judgments if they cant verify whos responsible for repayment, along with some recent medical debts.

But theres no legal recourse for you to remove other, accurate public records from your credit reports.

If you spot an error on your TransUnion® credit report, Credit Karmas Direct Dispute tool may be able to help you challenge it. Since 2015, weve helped members remove more than $7.9 billion in erroneous debts.

You may also dispute errors on your Experian® and Equifax® credit reports directly through their websites.

Recommended Reading: Free Credit Report Usaa

Does Irs Debt Show On Your Credit Report

In the past, your IRS debt may have appeared on your credit report if the IRS filed a Notice of Federal Tax Lien against you. Starting in 2018, the three major credit bureaus removed tax liens from consumer credit reports. However, lenders may still search public records for tax liens.

The IRS may file a tax lien if you have an outstanding tax bill. A lien will not be filed if you are making payments under an installment agreement or have made other payment arrangements with the IRS, as explained below.

When the IRS files a Notice of Federal Tax Lien against you, it means that the agency has a legal claim against all your current and future property, such as your home or car. It also establishes the priority of the IRSs claim before those of other creditors.

How Did The Change In Reporting Affect Consumers Credit Scores

While credit scores themselves dont appear on a credit report, they are determined using some of the information on your credit report. The removal of negative information usually means a credit score increase for Americans who previously had tax liens on their credit reports.

After the update, some people saw their score increase a small amount. However, the Consumer Financial Protection Bureau conducted a study to analyze the full impact. They found that only 4% of people with civil judgments or tax liens on their credit report saw a credit score increase enough to move them into a better credit scoring band . So, the impact of this update was minimal with only 0.24% of all U.S. consumers seeing a significant change in their credit scores.

Don’t Miss: Itin Number Credit Report

Tax Liens Are No Longer A Part Of Credit Reports

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Tax liens, or outstanding debt you owe to the IRS, no longer appear on your credit reportsand that means they can’t impact your credit scores.

How A Lien Can Affect Your Credit

In the past, tax liens appeared on credit reports and showed potential lenders that you were a bigger risk than people without them.

Its difficult to determine exactly how much a tax lien can affect your score, but its considered a severe mark against you. According to John Ulzheimer, a credit expert who has worked for FICO and Equifax, A tax lien is considered a severe derogatory entry, just like bankruptcies, judgments, collections, charge-offs and repossessions.

Now you can see why the removal of these liens is such an important move.

Unfortunately, this change might not help everyone. If youve already got a strong credit score and the only problem is the lien, your score may not improve by much. The Consumer Financial Protection Bureau found that when liens were removed from credit reports, the following changes occurred:

- 75 percent remained in the same credit score band

- 17 percent moved to a higher credit score band

- six percent moves to a credit score band of prime or above

- 66 percent stayed subprime or deep subprime

Also Check: Do Student Loans Fall Off

How Do Tax Liens Affect Your Credit

Remember the public record document we just mentioned? There are companies that scour public record information at courthouses around the country and then supply that information to credit reporting agencies, and in turn, the credit bureaus may report them on your business credit report. Business tax liens typically appear on commercial credit reports . Personal tax liens traditionally appear on personal credit reports however, due to new credit reporting standards they are disappearing from these reports.

An IRS tax lien is considered very negative and will almost always cause your business credit scores to drop, and may result in a rejection when you apply for credit.

A tax lien can be devastating to you and you should do everything you can to avoid it.

Tax liens are filed in the same database as UCC filings. Although UCC filings are considered consensual because they are typically associated with a small business loan, a line of credit, or a new credit card. Tax liens are considered non-consensual or statutory liens because they dont involve a contract with a creditor like a UCC lien. Statutory liens are not limited to federal tax liens either. A state tax lien or a judgement lien, occur by operation of law. Statutory liens arise without your permission or consent.

Does Owing To Cra Affect Your Credit Score

Income taxes are a large financial obligation. Every individual files taxes every year. Some get a tax return. Some get a refund. If you own a business, you may also pay business and sales taxes.

Regardless of your situation, we all face tax debt at some point or other.

This may have you wondering how tax debt impacts your and report. Generally speaking, owing money to the Canada Revenue Agency is not reflected in your credit score or report.

However, if the CRA has issues collecting your tax debt, they may escalate their actions. This activity could have negative impacts on your credit score. Lets take a deeper look below.

You May Like: Remove Transferred Student Loans From Credit Report

You Still Have To Pay Off Those Liens

Just because tax liens no longer appear on credit reports doesnt mean you dont have to pay them they can still have a negative financial impact.

For example, if you apply for a mortgage and you have a tax lien against you, mortgage lenders are likely to view you as more inclined to go into pre-foreclosure or foreclosure, which might narrow your options and end up in your paying a higher interest rate on the loan.

And mortgage lenders typically ask potential borrowers if they have any tax liens against them or they can find out if you do via a lien and judgment report, which financial institutions can order.

Tax debt will never disappear, so do yourself a favor and make paying it off a priority so that it doesnt impinge on the rest of your financial well-being.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Barri Segal is a staff reporter at CreditCards.com with 20-plus years of experience in the publishing and advertising industries, writing and editing for all styles, genres, media and audiences.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news from product reviews to credit advice with our newsletter in your inbox twice a week.

Determine If You Qualify

You can qualify to request your lien be withdrawn if:

- Your tax liability has been satisfied because youve paid what you owe

- Youve been filing your individual and business returns for the past three years

- You are current on your estimated tax payments and federal tax deposits

Even if you havent paid the IRS what you owe, you may be able to qualify for this program. You must owe$25,000 or less. You must also have entered into a direct debit installment agreement where your payments to the IRS are taken from your bank account automatically.

There are other requirements youll need to meet. You must have made at least three direct debit installment payments successfully. You must also not have defaulted on a previous installment agreement. The IRS has the full list of qualifications.

Don’t Miss: Credit Monitoring Services Usaa