How Many Capital One Business Credit Cards Can You Have

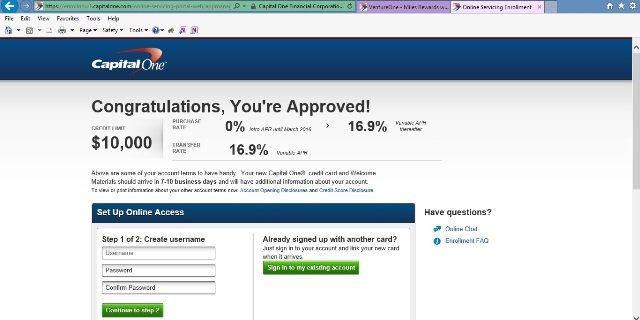

We contacted Capital One support directly to discuss per-person card limits, and heres what we got: You may not be approved for additional accounts if you have 5 or more open credit card accounts with Capital One. This is consistent with what appears in these cards terms.

So you can have up to five Capital One business credit cards open at the same time, as long as you dont have any other open credit card accounts with Capital One.

Recommended Reading: Carmax Credit Score Requirements

How Can I Get My Credit Re

If youre trying to raise your credit score a few points to get approved for a loan or to qualify for a better interest rate, your mortgage lender might be able to pay a fee for a rapid re-score that updates your credit report in two or three days. But only if theres proof of a credit report error or youre able to pay off an account right way and need the balance to reflect on your credit report.

Which Credit Reporting Agencies Banks Use To Pull Your Credit Report And Why It Matters

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This post has been updated with the latest information.

One of the most important things to know when you apply for a credit card is which credit bureau each bank uses to pull your credit report. In case you didnt know, there are three major credit bureaus, also called credit reporting agencies, in the United States. When you apply for a new line of credit, banks and credit card companies can pay to access your credit report from Equifax, Experian or TransUnion.

Related: How to check your credit score for free

The CRA used by a card issuer to see your credit report can determine whether your application is approved or denied, especially when you apply for various cards in a short amount of time. If several card issuers pull from the same credit reporting agency, it could affect your chances of being approved.

However, if card issuers go to different credit bureaus to buy your reports, one issuer might not see that youre applying for a new account elsewhere. As a result, your chances of being approved for several cards should increase.

Don’t Miss: Can You Get Inquiries Removed

How Credit Utilization Affects Your Credit Limits

Your credit utilization is the amount of credit youre using compared to your credit limit. For example, if you have a credit card with a $1000 limit and charge $500, your credit utilization would be 50%.

Your credit utilization has a direct impact on your credit score. The lower your credit utilization, the higher your score will be.

If youre trying to improve your credit score, one of the best things you can do is keep your credit utilization low. You can do this by paying off your balances each month or keeping your balances below 30% of your credit limit.

This Card Is Best For

- Prefers uncomplicated rewards with single rate for all spendingMinimalist

- Resists or refuses an annual fee on principle or due to costAnnual Fee Averse

- Earning a primary or side income from a small businessBusiness Owner

The Capital One Spark Classic is a solid option for small business owners with limited or fair credit, who may have difficulty getting most other cards. Its 1% cash-back rewards are nothing to crow about, but this card mainly provides the opportunity to acquire a credit line while also building a credit history that could help you to graduate to more rewarding alternatives.

The card is especially worth considering for business owners who dont anticipate often , carrying a balance on the card, which could hurt both their personal credit score and that of their business. Having the funds available to pay off what you charge to the account every month and making timely payments will help achieve the goal of building a fine credit record.

Since it lacks an annual fee, Capital One Spark Classic is also an economical choice for those who seek credit-card travel pluses that might otherwise cost you when taking a trip. It provides secondary rental-car insurance coverage, for example, and travel assistance when youre away from home. Its also a decent choice for use abroad, since it doesnt charge a foreign transaction fee, typically of 3%, that many cards impose on purchases made outside the United States.

Don’t Miss: Does Qvc Do A Credit Check

Check Your Credit Report

The bottom line to it all is information. To pick up on problems and learn whats going well, you must see your credit report. Every consumer can do that annually at no cost make your request at www.AnnualCreditReport.com but Griffin said fewer than half of the eligible people take advantage of that.

Thats a huge concern, Griffin said. We want people to be educated and know their course. You cant do anything about your credit report unless you know whats in it. Its all part of the education process. Information is powerful and people need to know how to get the right information.

6 Minute Read

When Does Wells Fargo Report To Credit Bureaus

Wells Fargo reports to all major credit reporting agencies. Credit card issuers typically report to bureaus at the same time as your monthly billing statement or soon after. In some cases, changes may be reflected right away in your credit report in others, it may take more than a month to update. If, for example, you pay your bill before you receive the billing statement, you will see a change on your credit report sooner than if you paid the bill just after receiving the statement.

Also Check: Century Link Collections

Get Another Credit Card

To get approved for another card, you’ll generally need to show consistent debt management, a good credit utilization ratio, and a timely, consistent payment history.

Keep in mind that applying for a new card will result in a hard inquiry on your credit report. In some cases, applying for a credit limit increase will do the same thing. So either way, apply sparingly. Each hard inquiry has the potential to reduce your credit score by a few points. Too many hard inquiries could make it hard for you to get credit in the future when you need to apply.

When Does Capital One Report To Credit Bureaus

Capital One reports account information to the credit bureaus every month. The reported information includes account status, credit limit, payment history, and account balance. The credit bureaus use this information to generate a credit score for an individual.

Its important to understand how your account information is reported to the credit bureaus and how it can impact your credit score. By understanding Capital Ones credit reporting policies, you can better manage your finances and make informed decisions about borrowing money.

Recommended Reading: How Long Do Closed Account Stay On Credit

What Is A Secured Credit Card

This type of credit card usually requires an upfront deposit equal to the credit limit. So, for a card with a credit limit of $500, you’d need to deposit $500. Secured credit cards are still subject to late and rejected payment fees and generate interest on outstanding balances. As such, a secured credit card presents lower risk to card issuers and allows them to extend lines of credit to borrowers who don’t have good credit or meet the minimum credit score threshold.

How To Get A Merchant Account With Bad Credit

Category: Credit 1. Getting a Merchant Account With Poor Credit A business can increase profits a great deal by signing up for merchant accounts. Unfortunately, some business owners do not have good credit and their status Requirements needed when applying for a bad credit merchant account · A valid, government-issued

You May Like: Does Cancelling A Loan Affect Credit Rating

Increase Your Credit Limit

Raising your credit limit isn’t a particularly daunting task. Although methods vary from issuer to issuer, a few clicks within your account management portal can usually lead you to a limit raise request. You can also typically ask for an increase via phone, or with a written request.

Oftentimes, your issuer will offer a credit increase in exchange for a small piece of information or two. It’s common for issuers to bump the limit for cardholders that update their annual income figure, for instance.

It’s also worth noting that your account needs to be in good standing to get a limit bump. Issuers won’t increase their exposure to you as a lender if you haven’t demonstrated you can pay your statements on time or be disciplined about your spending.

Do You Know What Capital One Is

CapitalOne is a well-known U.S. bank holding company, offering various financial products and services tailored for businesses, commercial customers, and multiple consumers.

Originally a credit card issuing bank, it has since begun to expand and expand by acquiring new liabilities. Today, it is one of the top 10 banks in the United States based on asset size.

Recommended Reading: Coaf On Credit Report

Problems With Credit Reporting

Heres where it gets complicated. Some businesses only provide information to the CRAs when an account is past due or has been written off and/or turned over to a collection agency. Creditors will write off a debt when it is deemed uncollectible.

Some of these creditors include:

- Utility companies

- Doctors and hospitals

- Lawyers and other professionals.

The three reporting agencies are making increasing efforts to gather monthly information from utility companies, phone companies and local retailers. That increases the amount of data in an individuals credit profile, which cuts down on the guesswork.

How Can Being An Authorized User Affect Your Credit

First, itâs important to know that credit card companies arenât required to report authorized usersâ activity to credit bureaus. And if information doesnât appear in a , it may not affect an authorized userâs credit or credit score at all.

But if the card issuer reports information, seeing positive effects on the authorized userâs credit starts with both the account holder and the authorized user using the credit card responsibly. That means doing things like making sure monthly payments are on time and keeping balances low.

Plus, as the Consumer Financial Protection Bureau notes, âCredit scores are based on experience over time.â So if a cardholder has good credit and uses their card responsibly, simply adding an authorized user could help that person start a credit history.

Donât Miss: Removing Hard Inquiries From Your Credit Report

Also Check: Itin Credit Report

Chip Lupo Credit Card Writer

The Capital One Quicksilver Cash Rewards Credit Card reports to the credit bureaus monthly, within days after the end of a cardholders monthly billing period. Capital One Quicksilver reports the cards credit limit, account balance, payment history, and more to all three of the major credit bureaus: TransUnion, Equifax, and Experian. Capital One may use a specific credit bureau more than another, depending on the applicants home state, and other factors.

Once Capital One Quicksilver reports your account information to a credit bureau, it may take a few days before the updates appear on your credit report. New Capital One Quicksilver cardholders may not see any new credit account info on their credit report for one or two billing periods after getting a card.

If youd like to review your up-to-date and TransUnion credit report, you can on WalletHub. That way, youll be able to check every day to see if theres any new information about Capital One Quicksilver on your credit report.

When does Capital One report to credit bureaus?

Capital One reports to the credit bureaus on a monthly basis, usually on the monthly statement closing date or a few days after. Capital One doesnt disclose exactly when they report to the major credit bureaus , but users in online forums seem to agree that Capital One information reaches your credit report a few days after the date your statement is issued, and in some cases, on the statement date.read full answer

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Don’t Miss: Does Les Schwab Report To Credit

Re: When Does Capital One Report To The Credit Bureaus

wrote:They do report on statement dates but don’t be shocked if it’s not your first statement. I have a Venture1 that’s still not reporting – opened 8/9, statement cut 8/27 and still nothing. I’m hoping it gets picked up this month.

I’ve noticed that it takes two months to report. Got a card in May? It reports in July. So give it 2 months.

Who Can Be An Authorized User

Becoming an authorized user depends on two things: the account holder and their credit card company.

First, card issuers set their own policies. So they may have rules about who can be added or how old authorized users must be. From there, a lot of it is up to the cardholder.

As long as theyâre willing, there are many reasons a cardholder might add an authorized user. One is to try to help another person build credit. Parents might do it to teach their children about credit. Or someone could add their partner to help simplify their finances as a couple.

Whatever the relationship, trust is key. Once an authorized user is given access to an account, they typically can use their cardâwith or without permissionâuntil access is revoked. So it might be a good idea to talk about budgeting and spending beforehand.

Don’t Miss: Can A Public Record Be Removed From Credit Report

How To Dispute Information On Your Credit Report

If you find yourself with the need to dispute information on your credit report because of an error, you can use Forbes Advisors comprehensive guide to help you open a dispute. You will need to prepare your personal information and sufficient documentation of the error before youll be ready to submit a dispute. You can dispute errors directly with each credit bureau any of three ways: online, by mail or by phone. The credit bureau you file a dispute with will investigate your claim and release results within 30 to 45 days.

If the results lead to a change in your credit report, you will receive a free, updated copy of your reportbut this may take another 45 days. If you are not happy with the results of the dispute, you can resubmit with any additional supporting information to help your case.

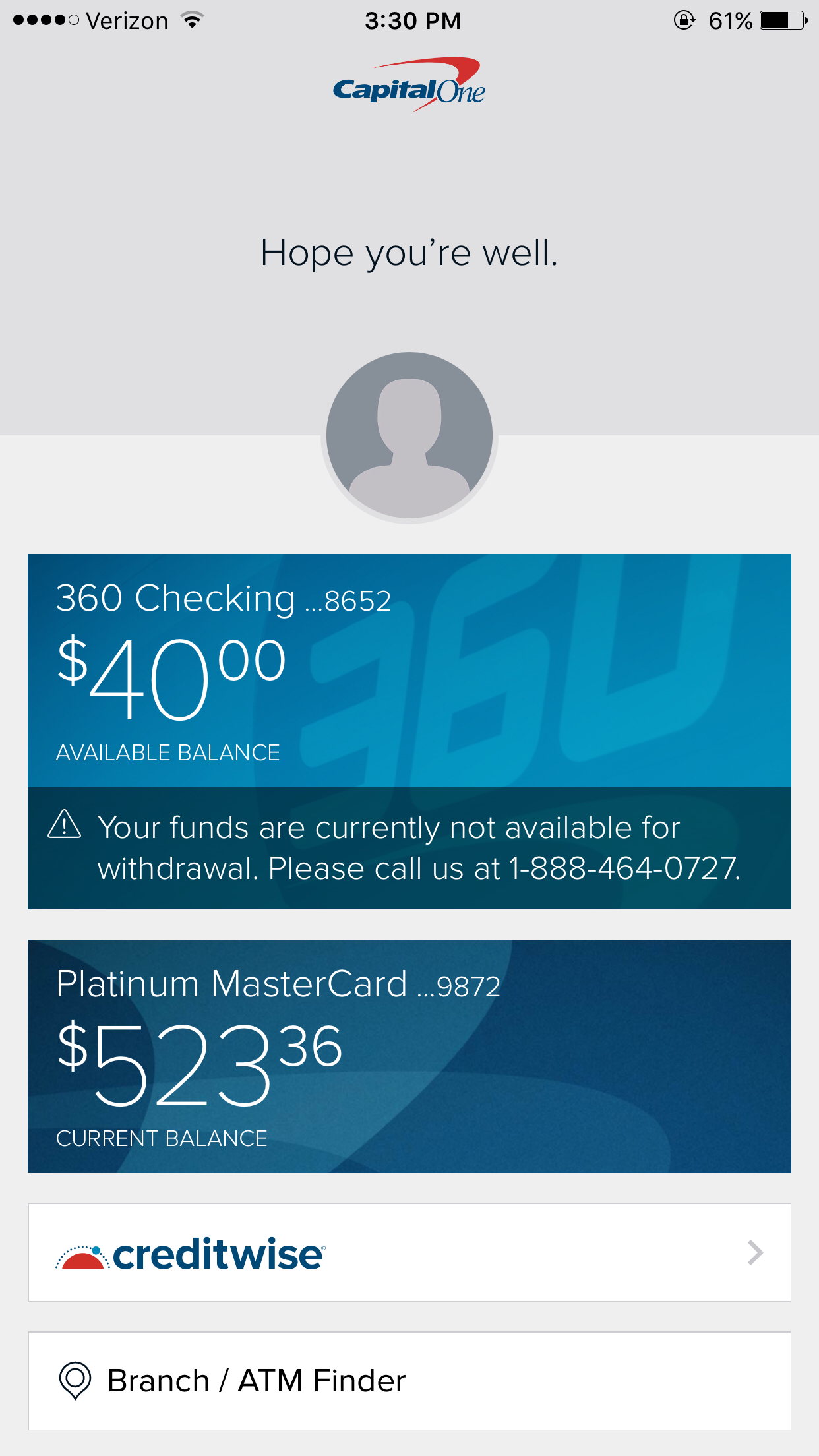

Here Are The Capital One Credit Card Posting Dates:

- Payments submitted before 8 p.m., ET, Monday-Saturday will post the same day by midnight. Funds available by 8 a.m. ET, the day after the payment posts.

- Payments submitted after 8 p.m., ET, or on a Sunday/holiday would post the next day by midnight. Funds available by 8 a.m. ET, the day after the payment posts.

- ACH payments made through your Capital One online account, mobile app, Eno, or IVR payments made through the phone number on the back of your card may post immediately following the transaction.

Regardless of how you choose to pay your Capital One credit card bill, it is always a good idea to not wait until your due date to make a payment. Give yourself enough time to allow for system outages or slow mail delivery. Payments not received by 8 p.m. on the due date, or that are less than the minimum amount due will be considered late and will be charged a late fee up to $40.

Can I trust Credit Karma?

Theres little reason to question the credit data that Credit Karma provides, either, considering that its direct from the credit bureau. It could contain errors, sure. One in five credit reports has a mistake in it, according to the FTC. But that has nothing to do with Credit Karma so-called data furnishers such as financial institutions, landlords and employers are typically to blame. Credit Karmas credit scores are accurate as well, despite being a bit outdated.

With that being said, there are two areas in which doubt enters the trustworthiness equation:

Don’t Miss: How To Get Rid Of A Repo On Your Credit

Here’s A Better Way To Repair Your Credit Report

If you came to DoNotPay because you are fed up with monotonous tasks such as dealing with credit reports that need cleaning, you’ve come to the right place. Unlike “automated customer service” agents that could be more frustrating than helpful, DNP artificial intelligence lawyers get the job done with remarkable agility and accuracy.

Heres how to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps: