How Do Credit Scores Affect Renting

Potential landlords or leasing agents run credit checks on potential applicants to help evaluate that individual’s financial situation. Your credit score is like a financial report card, and it’s used to determine how financially responsible you’ve been in the past.

It may feel unfair, especially if you’ve worked hard to get yourself out of debt but your credit score hasn’t yet recovered. But put yourself in the landlord’s or leasing company’s shoes: their rental property is a business, and renting to someone with a low credit score appears more risky than renting to someone with a good credit score.

Using a credit score to determine the likelihood of a potential tenant paying rent in full, on time, and throughout the life of the lease is not a personal attack. It’s simply a business decision.

Most individuals or companies renting an apartment want credit scores from applicants to be 620 or higher. People with credit scores lower than 620 may indicate a high risk of default on rent owed.

A lower credit score could mean you’re less likely to be approved for the rental you want, especially if you’re looking to rent in a popular area. If 10 other people apply for the apartment, it makes good financial sense for the landlord to accept a person with a higher credit score.

Renting An Apartment With Bad Credit

Join millions of Canadians who have already trusted Loans Canada

Having good credit is often essential to securing loans like a car loan or mortgage. To rent an apartment, having a good credit score is also a common requirement. Landlords rely on credit scores as a tool to assess how big a financial risk they are faced with if they choose to rent to you.

Your credit score plays a huge role in your ability to secure an apartment, so big a role that oftentimes, landlords wont accept your application if you have bad credit, even if you have a decent income and good references.

Luckily, there are actions you can take to increase your chances of finding a good apartment despite having bad credit.

Check out why landlords check your credit.

Are Landlords Only Looking At Credit Scores Or The Whole Report

In most cases, landlords are going to look at both your report and credit score. In many ways, your credit score is a summary. It lets landlords know at a glance your overall creditworthiness, and may be used to determine if the rest of your application is worth reviewing.

However, if your credit score doesnt automatically disqualify you from renting the apartment, they are likely going to review the rest of the report.

Generally, landlords will want to review your credit reports for potential red flags, such as:

- Late payments

- Bankruptcy history

- High debt payment amounts

Whether any of those details make you ineligible for an apartment may vary from one landlord to the next. Additionally, there may be state laws that prevent landlords from considering certain information that may appear on your credit report, though this can differ depending on your location.

Read Also: How To Boost My Credit Score 50 Points

What Credit Score Do Landlords Look For

So, what credit score is needed to rent an apartment? There’s no single number, but just to give you an idea, you’re probably going to need a 740 score or higher to rent in a hot rental market.

Landlords in desirable and competitive markets like San Francisco or New York may sometimes even require a minimum credit score to be able to rent in their buildings and generally speaking, the higher the rent, the better credit you’ll need.

Include Positive References In Your Application

If you have a rental history, reference letters can go a long way. Positive testimonials from past landlords will help prospective landlords see that you are able to pay rent on time, will be a good tenant, and are committed to keeping the apartment in good condition. If you dont have a rental history when choosing your rental reference, be sure to choose someone who can speak positively about you, such as an employer.

Recommended Reading: How To Remove A Repo From Credit

Offer To Move In Right Away

Having one or more empty apartments is expensive for landlords. They have to pay the mortgage and utilities without any reimbursement in the form of rent. Because of this especially if you live in a place with low rental demand you may be able to rent a place without a credit history if youre able to move in immediately.

» SIGN UP: Check your free credit score and track your progress

What Is The Minimum Credit Score To Rent An Apartment

Technically, there isnt a mandatory minimum credit score to rent an apartment. There isnt a law that says a person has to have a particular score or any rules that prevent landlords from setting the minimum anywhere theyd like.

As long as landlords apply the minimum credit score they choose to all applicants equally, landlords can generally select any cutoff point. However, that doesnt mean there arent some norms.

Usually, the minimum FICO credit score to rent an apartment falls somewhere between 620 and 650.

However, some landlords may be open to scores of 600 or lower, while others may consider 700 to be the lowest qualifying score.

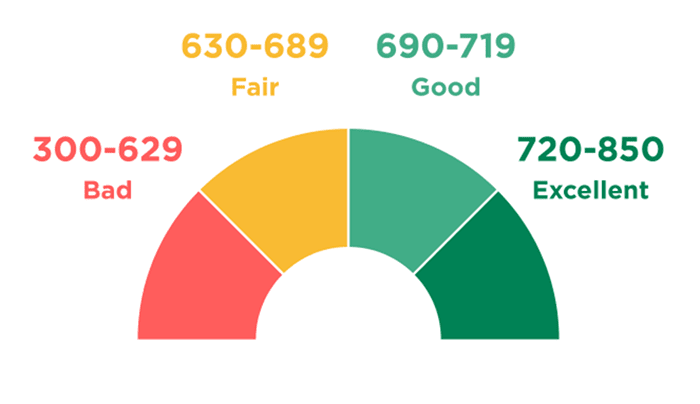

Most landlords use FICO credit scores to determine if an applicant qualifies for an apartment. The typical categories for those scores are:

- Exceptional: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

That can be a bit confusing for some applicants. After all, 620 and 650 are both in the fair range, so they may wonder why a landlord isnt open to renting to a person with a 580 FICO score. Its completely up to the landlord. They dont have to follow the brackets they just have to select a minimum and apply that requirement equally.

Read Also: Suncoast Credit Union Credit Card Approval Odds

Can I Rent An Apartment With A Bad Credit Score

Do you have a credit score lower than 650? Have you ever gotten denied for rental applications? Renting can be incredibly challenging when you have a bad credit score. From a landlords perspective, a bad credit score usually means late payments, or worse, financial losses. Landlords, therefore, may be reluctant to rent to someone who has a low credit score, or they may require more security deposits. However, just because you have a bad credit score, it does not mean that you will not be able to rent. In this post, we will go through everything you should know when it comes to renting with a bad credit score.

In case you are unfamiliar, a credit score is a statistical three-digit number that predicts how likely a consumer will repay his or her debts. Landlords utilize credit scores to see if renters will be able to pay rent on time. Credit scores range from 300 to 850, and a credit score of 700 or above is generally considered good. With proof of income, a valid photo ID, and a good credit score, a renter should be able to apply for an apartment without difficulty.

Once you have identified the neighborhoods, you can then shift your focus onto apartments. A bad credit score might hurt your chances of getting approved. However, there are still ways to get an apartment, such as:

1. Focus on properties owned or managed by independent landlords and property managers.

2. If that does not work, try looking for sublets or roommates.

3. Offer to pay more security deposit.

What Landlords Look At On Your Credit Report

When your landlord reads your credit report, they will be looking for clues about your financial health and habits.

Of much importance is your debt-to-income ratio. In a nutshell, this is the amount of your monthly pre-tax income that gets spent on debt payments. Its certainly not news to you that filing for bankruptcy can have a negative impact on ones credit. A landlord also may be spooked if you have hefty credit card balances.

Your credit history disclosed on your credit report also may include your rental history as some landlords and rental property managers share your business to the credit bureaus. This can be plus if youve been doing the right thing if not, this can work against you.

Too many hard inquiries also can raise red flags for a landlord. This is because frequently applying for different types of credit could suggest financial instability, which increases risk in the eyes of lenders as well as landlords.

Read Also: Does Affirm Approve Bad Credit

Offer To Pay A Higher Security Deposit

Most landlords see renters with sub-650 credit scores as a more significant risk. To get rid of this perception of being a high-risk tenant, offer to pay a higher security deposit.

As long as youre timely with rent payments and respect the property, its a no-risk move on your part since youll get the deposit back at the end of your lease.

Landlords see this as a sign of good faith. Win-Win!

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Recommended Reading: Carmax Finance Rate

So What Credit Score Do You Need To Rent An Apartment

If you research this further online, youll likely find mentions of landlords wanting minimum credit scores of 600 or 620. According to FICO, the company behind the most widely used scoring systems, those scores are within the fair credit range. Thats a bit below average.

That 600620 is perhaps a good baseline for you to guesstimate the score youll need. If youre looking to rent at the bargainbasement end of the market, you might get away with a fair score. But if youre wanting a swanky penthouse in San Francisco, Manhattan, or somewhere with similarly high rents, youre probably going to need a 740+ score.

Renting Without Great Credit

If you don’t meet the credit qualifications, all’s not lost. There may be a few ways to get your foot in the door, depending on the landlord. For starters, you may be able to pay a higher security deposit or cover a few months of rent in advance. Paying more money upfront may eliminate some of the risks associated with your previous credit mistakes.

Having someone vouch for you, either rental references or a co-signer can give you some additional credibility. Or, in the case of a co-signer, there’s another person sharing the risk with you, which may make it easier to get approved.

You also may have more success with an individual landlord rather than a property management company whose rules tend to be less flexible.

On the flip side, a higher credit score doesn’t get you a better rental rate, but having good credit may give you the benefit of moving in with a low or no security deposit requirement.

Looking for information on how to manage your credit during coronavirus? Check out Protecting Your Credit During Coronavirus Outbreak.

LaToya Irby

LaToya Irby is a financial writer with over 14 years of experience. She’s been quoted and published as a credit expert in several major publications including USA Today, U.S. News and World Report, TheBalance.com, and The Chicago Tribune.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Also Check: Unlock My Experian Credit Report

Whats An Apartment Credit Check

Before we dive in, lets figure out what a credit check is. An apartment credit check reveals your credit history by looking into your bank and credit card account balances. The credit check also shows any outstanding loans or payments. The reason for running the credit check is simple: the better your credit, the more evidence you have that you will pay your monthly rent on time.

Heres what your landlord will ask you for:

- Full legal name

- Current and former addresses from the last two years

- Current and past employment

S For Improving Your Credit Score

Of course, the ultimate fix for a low credit score problem is to work to improve your score over time. This isn’t a quick process, so have patience with yourself and trust that small, positive actions add up to big, positive changes in the future.

If you’re in debt and haven’t established a debt repayment plan, reach out for help. Use the tools available to you like ReadyForZero! to help you attack and eliminate all your debt.

Once a plan of action for repayment is in place, work to establish consistent money management habits:

- Don’t carry balances on credit cards.

- Make all payments on time each month.

- Pay more than the minimum on debt repayments.

- Pay the full amount on other bills, like monthly credit card statement and rent.

It’s also important that you avoid running up big balances on your credit cards, even if you pay those balances off in full and on time each month. A high credit utilization ratio hurts your credit score.

Stick with these good habits over time, and your credit score will improve. You’ll soon have that good score for renting an apartment — and then some.

Kali Hawlk is a personal finance writer for ReadyForZero, a website for getting out of debt. She enjoys discussing topics like student loans, budgeting, and paying off debt from the perspective of a millennial. You can read more of her work at the ReadyForZero Blog.

Also Check: Derogatory Marks Removed

Can I Rent An Apartment Without Rental History

Renting an apartment without a credit history is not a death sentence. Having a good credit score is important as having a rental history. Renting an apartment without rental history is not the end of the word. We all start somewhere so renting a small apartment first is the right way to go.

Not only will a smart affordable apartment help you understand how to keep an apartment and paying for it every month. This will work but it will help you have a rental history.

Menu

Why Do They Want To Know My Credit Score

It may not seem so obvious how credit cards and loans have anything to do with getting a home or an apartment, but they do.

Your credit rating will tell the landlord if you are a good payer–meaning someone who will not only pay the rent every month without fail but also pay on time for the full length of the lease.

A broker, landlord, or management company will use a third-party credit service to pull up not only your FICO score but also a detailed credit report.

They will be able to see any open collections or payment delinquencies and then judge whether you are a good or risky candidate.

Read Also: How To Remove A Public Record From Your Credit Report

How Does An Apartment Credit Check Impact Credit Score

Landlords can check credit in a few different ways some are considered hard pulls while others are considered soft pulls. You are well within your right to ask the landlord what type of credit check theyre going to do.

A hard credit inquiry could lower your credit score by up to 10 points. However, unless you are applying for a large loan, the drop in your score probably wont be that significant.

However, if you dont want the landlord to do a hard pull, you can offer to send them your own credit report for an apartment credit check. Since checking your own credit report is a soft pull, the credit check wont reflect in your credit report.

What To Do If You Have Poor Credit To Avoid High

Having a low credit score isnt the end of the world actually, its pretty common for many college students with student loans to have poor credit. The goal is to work on it to make it better.

Local Records Office suggests that the best way to avoid ridiculous security deposits is to have a co-signer this will help the landlord to feel more secure. Providing proof of a steady job and pay stubs to prove you meet the landlords income requirements will help you avoid rejection.

Making your landlord and property management company feel secure is the best way to avoid high fee and rejection. adds, Torres.

You May Like: What Credit Bureau Does Paypal Use

Is A 700 Credit Score Good To Rent An Apartment

Credit scores range from 300 to 850, and a credit score of 700 or above is generally considered good. With proof of income, a valid photo ID, and a good credit score, a renter should be able to apply for an apartment without difficulty. However, if your credit score is below 700, you might find renting more difficult.