Is A 770 Credit Score Good Plus How To Get It & More

https://wallethub.com/credit-score-range/770-credit-score/

17-08-2020 ·A 770 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

At A Glance: Additional Key Findings

| Among our members who recently bought a home, those living in West Coast cities tend to have higher average VantageScore 3.0 credit scores, ranging from 704 in Stockton, California, to 782 in San Francisco, California. |

| Among our members, the average amount people owe on a recently opened mortgage varies widely across states, from a low of $126,321 in West Virginia to a high of $384,524 in Hawaii. |

| The average age of Credit Karma members who recently opened a mortgage ranges from 35 in Boston, Massachusetts, to 43 in Scottsdale, Arizona. As a generation, millennials have the highest average mortgage balance at $216,382. |

Whats The Average Credit Score For People With Mortgages In Your State

While its common for mortgage lenders to look at FICO scores in their application review process, we turned to Credit Karmas vast collection of VantageScore 3.0 data to get a broad picture of the credit health of people getting mortgages.

Below, you can see the average TransUnion VantageScore 3.0 credit score of homeowners in each state who recently opened a mortgage.

In general, people in the Northeast or on the West Coast who got mortgages had VantageScore 3.0 credit scores averaging 720 or above on the higher end of the spectrum.

On the flip side, the Gulf Coast, Midwest and Southern coastal states tended to have some of the weakest average credit scores .

| State |

|---|

| 41 |

Also Check: Will An Eviction Show Up On My Credit Report

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

What Kind Of Credit Report And Score Do Lenders Use

There are several versions of your credit score, depending on who issues the score and the lending industry .

To offset their risk and ensure that theyre getting the most accurate picture of a mortgage borrower, most lenders will use whats called a tri-merge credit report showing credit details from multiple credit bureaus.

Instead, they may use a residential mortgage credit report, which may include other details about your financial life, such as rental history or public records. These reports reveal the borrowers credit details from multiple bureausTransUnion, Experian, or Equifaxor all three.

In many cases, the credit score you see as a consumerpossibly through your bank or credit card companyis different from what a potential mortgage lender would see.

Read Also: When Do Closed Accounts Drop From Credit Report

Kann Ich Ein Haus Mit Einer Kreditwrdigkeit Von 643 Kaufen

Wenn Ihre Kreditwürdigkeit 643 oder höher ist und Sie andere Anforderungen erfüllen, sollten Sie keine Probleme haben, eine Hypothek zu bekommen. Die Arten von Programmen, die Kreditnehmern mit einer Kreditwürdigkeit von 643 zur Verfügung stehen, sind: konventionelle Kredite, FHA-Darlehen, VA-Darlehen, USDA-Darlehen, Jumbo-Darlehen und Non-Prime-Darlehen.

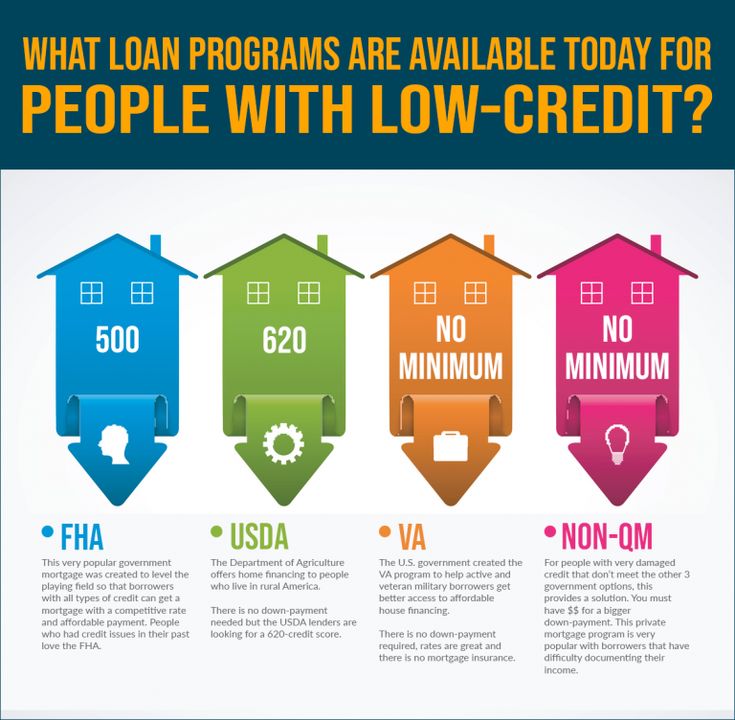

What Is The Minimum Credit Score To Get A Mortgage

Several different types of mortgage loans exist, and each one has its own minimum credit score requirement. Even so, some lenders may have stricter criteria in addition to credit score they use to determine your creditworthiness.

Here’s what to expect based on the type of loan you’re applying for:

If your credit score is in great shape, you may have several different loan types from which to choose. But if your credit score is considered bad or fair, your options may be limited.

You May Like: Credit Score 698

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

What Else Do You Need To Get Approved

In addition to your credit scores, your mortgage lender looks at a few other factors to approve your home loan. Theyll review your employment situation to make sure you have a steady income to make your monthly mortgage payments.

Youll most likely need to submit pay stubs, bank statements, W-2s, and sometimes even a verification of employment form. If youre serious about purchasing a home, start setting these documents aside in a safe place so you have them ready to give to your lender when the time comes.

Not only does the lender look at your debt-to-income ratio and other financials, but theyll also check out the actual home youre purchasing. Some types of home loans require the house to be in a certain condition, which can take rehabilitation projects off the table.

Before making an offer, check with your lender on what types of properties you can consider. That will allow you to avoid making an offer you cant follow through on. The propertys appraisal also needs to come in at or above the amount of the loan, because a lender is not able to loan more than the appraisal value.

Read Also: Does Speedy Cash Report To Credit Bureaus

A Review Of Credit Karma Members Shows The Average Vantagescore 30 Credit Score Across The Us For Those Who Opened Any Type Of Mortgage Tradeline In The Past Two Years Is 717

Looking at VantageScore 3.0 credit scores from TransUnion for tens of millions of Credit Karma members who had a mortgage tradeline open on their credit report in the past two years, we also studied the average VantageScore 3.0 credit score among homebuyers state by state.

Our findings: Average credit scores ranged from 683 to 739 . The range of scores was even wider when broken down by city.

Monitor Your Credit Reports

Each year, youre entitled to one free credit report from each of the Big Three credit bureaus Experian, Equifax, and Transunion. And in light of the pandemic, you can view your report for free weekly through April 2021. It can pay off big time to get those reports and read them carefully, according to Karra Kingston, a New York bankruptcy lawyer. Why? Because even credit bureaus make mistakes, and a mistake on your credit report could cost you a mortgage. You should always be up-to-date on what has changed and why something has changed, Kingston says.

The bureaus make it possible to fix errors in your reports with online forms you can fill out and submit. There are also a number of for-profit companies that will monitor your credit and alert you if there are significant changes, but in most cases, youll be able to do this monitoring yourself for free.

Don’t Miss: What Credit Score Do You Need For Amazon Prime Visa

Tips To Improve Your Credit Score Before Applying

- Check Your Credit For Errors: The first thing you should do is get a copy of your credit report from all three major credit bureaus. You can get a free copy of your credit reports from the government website www.annualcreditreport.com

- Pay down credit card debt Your is the percentage of available credit youre using on your credit cards. Credit utilization ratios account for 30% of your credit score. The more credit card debt you have, the lower your credit score will be. Try to pay your credit card balances to below 30% of the cards credit limit before applying for a mortgage.

- Pay your bills on time your payment history determines 35% of your overall FICO score. A single late payment can have a significant impact on your score. Remember to pay your bills on time. Set up auto-pay if you find yourself forgetting to make your payments.

- Negotiate a Pay for Delete settlement with creditors If you have any collections on your credit report, they are obviously having a significant negative impact on your credit score. You can contact the collection agencies directly and ask them if they will do a pay for delete. A pay for delete is an agreement that you agree to pay the balance, and in return, the creditor agrees to remove the account from your credit report.

Was Ist Die Ideale Kreditwrdigkeit Fr Einen Erstkufer Von Eigenheimen

FICO® Partituren of mindestens 640 oder so sind in der Regel alles, was erforderlich ist, um sich für die Ersthilfe beim Hauskauf zu qualifizieren. FICO® Die Bewertungen reichen von 300 bis 850. Es besteht jedoch die Möglichkeit, dass Sie eine höhere Kreditwürdigkeit von etwa 680 benötigen, um sich für eine konventionelle Hypothek zu qualifizieren. Weitere Informationen finden Sie unter Was ist eine gute Kreditwürdigkeit?

Also Check: What Is Syncb Ntwk On Credit Report

The Minimum Credit Score You Need For A Mortgage Loan

The national median price of a home in the United States is $266,200, according to Zillow. Most people don’t have that amount in cash. So, in order to buy property, you’ll likely need a loan.

To get the best interest rate on a mortgage loan, borrowers should have a credit score of 760 or greater, which is considered “good” on FICO’s scale. But the minimum requirement varies depending on the loan type. Although some loans accept “poor” scores as low as 500, the baseline needed for most is 620.

Here are the minimum score requirements for five mortgage loans, based on FICO data.

- Jumbo loan: Most lenders prefer at least a 680A jumbo loan exceeds the maximum loan limit set by the Federal Housing Finance Agency. It’s used for properties that are too expensive for conventional loans. Jumbo loans are not guaranteed by a government agency, like the U.S. Department of Veteran Affairs, or by the government-sponsored Fannie Mae or Freddie Mac.These loans can be secured through a private lender, but lenders consider them risky since they aren’t federally backed, meaning the financier isn’t protected if the borrower defaults. The required down payment varies.

- USDA loan: Most lenders prefer at least a 640The U.S. Department of Agriculture insures for low- to moderate-income homebuyers. The USDA does not set a minimum credit score requirement and does not require a down payment.

Kann Man Ein Haus Ohne Geld Kaufen

Sie können nur eine Hypothek ohne Anzahlung aufnehmen, wenn Sie einen staatlich gedeckten Kredit aufnehmen. Vielleicht möchten Sie ein staatlich unterstütztes FHA-Darlehen oder eine konventionelle Hypothek aufnehmen, wenn Sie feststellen, dass Sie nicht die Voraussetzungen für ein USDA-Darlehen oder ein VA-Darlehen erfüllen. Beide Optionen ermöglichen Ihnen eine geringe Anzahlung.

Recommended Reading: How To Get Credit Report Without Social Security Number

Wie Kann Ich Meine Kreditwrdigkeit Um 100 Punkte In Einem Monat Erhhen

So verbessern Sie Ihre Kreditwürdigkeit

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

You May Like: Check Credit Score Usaa

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

Tips On How To Get A Good Credit Score

Dont lose hope if you do have an application rejected by your bank, as South Africas leading home loan comparison service, ooba Home Loans, can apply to multiple banks on your behalf, and have been successful in securing home loan financing for two in every three applications that are initially turned down by their bank.

ooba Home Loans also offer a range of home loan calculators to help make the home-buying process easier. Start with their Bond Calculator, then use their Bond Indicator to find out what you can realistically afford. Then, when youre ready, you can apply for a home loan with ooba Home Loans.

Do you know your credit score?

Check your credit score for free in minutes.

Read Also: How To Report A Death To Credit Bureaus

Using Credit For Home

Buying a house involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card < em> after< /em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

You May Like: Does Paypal Working Capital Report To Credit Bureaus