Americans With Less Than 10 Years Of Credit History

Account age is not the only reason a lack of credit history can make it harder to obtain an exceptional credit score.

Think of credit like borrowing the car keys from your parents. The first time you ask, Mom and Dad probably are going to be really nervous, Schulz suggests. Theyll make a bunch of rules and restrictions because youve never shown them that you can handle the responsibility.

However, if you show youre reliable by always being home by curfew, regularly putting gas in the tank and avoiding speeding tickets and accidents, eventually theyll become more comfortable with handing the keys over.

On the other hand, if you bring the car home late with an empty tank and a scratched-up bumper, it may be a while before you get to use the car again. Banks are the same way. The more youve shown you can handle your business, the more likely theyll lend to you.

Those who have a short credit history but obtained 800 or higher credit scores nonetheless make up for their age in other ways. For example, analysts found that those with short credit histories have low credit utilization ratios and various active accounts . As with the other groups, theyre paying their bills on time every month.

| Less than 10 years | |

| 2.7 |

Is That High Score Worth The Effort

The good news is that many lenders consider 760 the cutoff for excellent credit. With a credit score above that number, you’ll receive most of the same benefits as someone with an 800 credit score. You’ll just have to work a little harder and wait a little longer if you also want the bragging rights.

Monitor And Protect Your Credit

Its essential that you regularly monitor your credit reports to ensure there is no wrong information on them that might ding your credit score and if there is, make sure you dispute any errors. Consider enrolling in a credit monitoring service that will alert you when anything changes on your credit report. You can also order free copies of your credit reports from AnnualCreditReport.com to make sure they contain completely accurate information.

In addition, you can sign up with an identity theft protection service, which will alert you anyone tries to make changes to your address, orders new services or applies for payday loans. Check out the Federal Trade Commissions advice regarding identity protection services to learn more.

More From GOBankingRates

You May Like: Minimum Credit Score For Affirm

You’ll Receive Better Credit Card Offers

You don’t need perfect credit to get a credit card when you’re young they hand them out like candy but the higher your credit score, the more perks you’ll get. Some people with low credit scores can only qualify for secured credit cards, which require a security deposit. But as your credit score improves and you hit the 800 mark, you’ll qualify for some of the best credit cards around. These might include features such as unique rewards programs, concierge service, and other high-end benefits and unique perks just for proving you know how to manage credit.

Dont Apply For Credit Too Often

This category is meant to restrain credit score enthusiasts from trying to increase their card supply and lower their utilization rate by applying for a bunch of credit cards at the same time.

That strategy will backfire.

Member of the 800 Club only average about one hard credit pull on their account a year. They do things gradually or as their income allows and financial acumen matures.

In other words, there is no rush here. The race to 800 usually is won by those who take their time and make prudent financial decisions.

If you are just starting out, reaching an 800 score is not going to happen overnight, Griffin said. Youre going to need patience as you work toward your goal. It takes time.

You May Like: How To Remove A Public Record From Your Credit Report

Why You Should Be Pleased With An Exceptional Fico Score

A credit score in the Exceptional range reflects a longstanding history of excellent credit management. Your record of on-time bill payment, and prudent handling of debt is essentially flawless.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 6.0% of the credit reports of people with FICO® Scores of 800.

People like you with Exceptional credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you their very best lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and excellent odds of approval for credit cards with premium rewards programs and the lowest-available interest rates.

An 800 Credit Score Is Often Considered Very Good Or Even Excellent

A very good or excellent credit score can mean youre more likely to be approved for good offers and rates when it comes to mortgages, auto loans and credit cards with rewards and other perks. This is because a high may indicate that youre less risky to lend to.

Lenders use this three-digit indicator, which is calculated from all the information collected in your credit reports, to gauge how likely they think you may be to default on your loans and the higher the score, the better you look to a lender.

But even having an excellent credit score doesnt mean youre a shoo-in there are still no guarantees when it comes to credit approval.

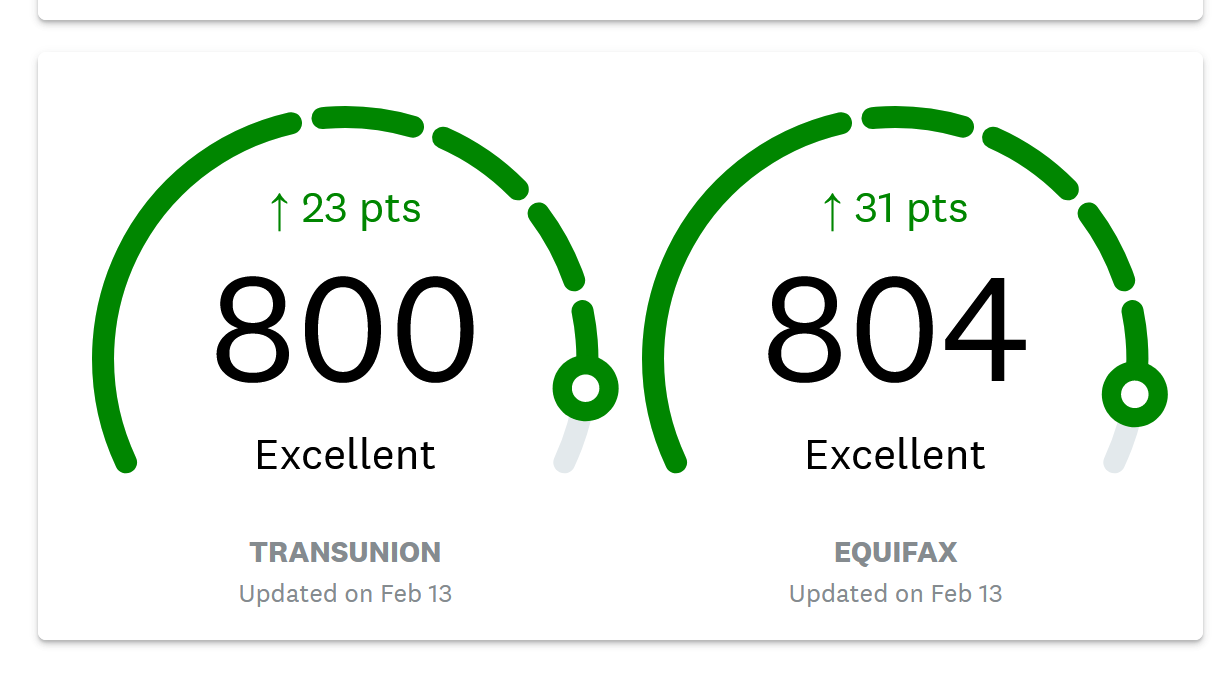

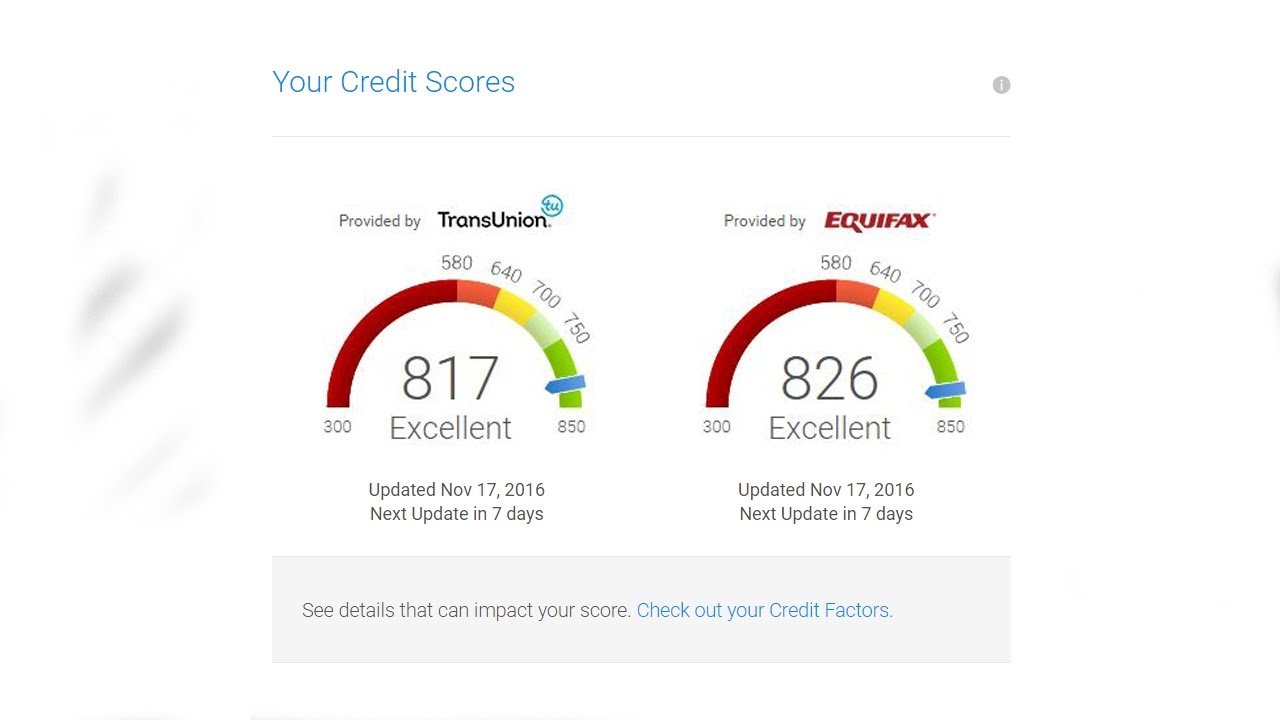

A credit score can be an important factor when you apply for credit, yes. But you actually have multiple credit scores from different sources, each one drawing on data from your various credit reports with the major consumer credit bureaus . A credit score may be considered excellent according to one scoring model but could be calculated differently using another model that weighs certain factors differently, resulting in a different score altogether.

Also, scoring models and lenders can have different interpretations of what qualifies as excellent. And when its time to make a decision about whether to extend credit to you, lenders typically consider other factors not reflected in your scores, such as your income or employment status.

Learn more about keeping up and making the most of an excellent credit score.

Read Also: Does Titlemax Go On Your Credit

What It Means To Have A Credit Score Over 800

Is 800 a good credit score? Having a credit score over 800 isnt just goodaccording to the FICO credit scoring system, its exceptional. Although both the FICO and VantageScore credit scoring systems go all the way up to 850, you actually dont need to hit 850 to reap the same benefits as those with a perfect credit score.

If you have an 800 FICO score, you have an extremely positive credit history. There are no missed payments or to lower your credit score from its exceptional ranking. Its likely that you have been using credit successfully for many years, and you probably have a healthy mix of credit accounts that includes both revolving credit and installment credit . In short, you are the ideal credit consumerresponsible, financially savvy and unlikely to default on your credit obligations.

Essentially, having a credit score over 800 means that there isnt anything else you can do to make your credit score better. All you can do now is maintain the healthy credit habits that got you your 800+ credit score in the first place.

The 800 Credit Score: What It Means And How To Get One

The Balance / Caitlin Rogers

Your is one of the most important numbers in your life. This three-digit number indicates your creditworthiness or the likelihood that you’ll repay the money you borrow. Credit scores generally range from 300 to 850. The higher your credit score, the more likely it is you’ll be approved for new and better credit.

As of April 2018, 21.8% of Americans had a FICO score above 800, according to data from FICO. This makes a record-high percentage of people with credit scores over 800 and correlates directly to fewer blemishes on people’s credit reports, from improvements in payment history to fewer inquiries.

Since payment history makes up 35% of the credit scoring calculation, there’s a strong relationship between having a high credit score and a low number of late payments.

You May Like: How To Remove Repo From Credit Report

You’ll Enjoy Easier Faster Loan Approvals

It doesn’t matter if you apply for a mortgage or an auto loan, an 800 credit score gets your foot in the door with lenders without much effort. People who belong to the 800 Club have demonstrated excellent credit habits and that’s a little like having a permanent hall pass in high school. Since these people are less likely to default on their bills, they’re a creditor’s dream applicant and banks will vie for their business. As long as you have sufficient income, you can walk into practically any bank and get what you need.

On the flip side, if you have bad credit, the bank might reject your application until you’ve made improvements to your score.

You’ll Have An Easier Time Renting An Apartment

According to Experian, a credit score of 620 is often the minimum credit score you need to qualify for an apartment. This falls into the “fair credit” range for both FICO and VantageScore’s rating scales .

But some landlords and property management companies are stricter than others. If your credit score is 700 or above, it’s more likely that the rental application process will be easier since your good score can help you stand out to potential landlords.

Depending on the scoring model used, a good credit score falls between the following ranges:

- FICO: 670 to 739

- VantageScore: 661 to 780

Having a good credit score when you apply for an apartment can also protect you from needing to find a cosigner or paying a large security deposit, as some landlords require when a potential tenant has less-than-great credit.

Recommended Reading: Credit Check Experian Usaa

How People With Short Credit Histories Can Achieve 800+ Scores

Being older can make it easier to earn a good credit score, as youve had a longer time to achieve a good payment history and to keep accounts open. The oldest active account for those with scores of 800 or higher averages more than 27 years. While younger consumers cant reach such steady account ages just yet, an 800 credit score is still obtainable.

How Long Does It Take To Go From A 700 To 800 Credit Score

The amount of time it takes to go from a 700 to 800 credit score could take as little as a few months to several years. While your financial habits and credit history will play a role in how long it takes, there are some factors that have specific timelines. For example, it takes up to 2 years for a hard inquiry to go off your credit report. As hard inquiries are removed, your score can go up. Your score also goes up the longer youve had credit. Each year you have your credit, your credit history gets longer, helping your score improve.

Both of these examples show why its important to consider opening new accounts when building your score. When you open a new account, you put a new hard inquiry on your report and you bring down the average age of your credit. Youll also want to consider the impact closing an account can have on your score, too. Closing an older account can lower the average age of your credit history.

Read Also: How To Get Public Records Off Your Credit Report

Capital One Venture Card

If youre an avid traveler, the Capital One Venture can help you to save on your next adventure. A credit card for people with at least a 700 credit score, the Venture card allows clients to use Venture miles for any charge that has to do with travel. That means miles can be used for more than just airfare. They can be used for things like hotel or cruise reservations, train tickets, travel agent fees and more. Theres an annual fee of $95, but users can rack up savings quickly with 2 miles earned for every $1 spent. Theres typically an initial bonus when you sign up, too.

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

You May Like: Ginny’s Catalog Request

Like This Article Pin It

Disclaimer: The links and mentions on this site may be affiliate links. But they do not affect the actual opinions and recommendations of the authors.

Wise Bread is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

My wife and I, both, have scores north of 800. To be honest, I don’t see any extra benefits. That’s probably because we have no debt other than our mortgage and don’t pursue more debt. I imagine others with similar scores have similar attitudes. I’m going to look into the insurance part of that though.

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we aren’t able to cover every product in the marketplace.

You’ll Be Better Prepared For The Future

When you have a good credit score, you’re more likely to meet lending approval guidelines and borrow money when you need it most, explains McClary.

This can help if you’re ever in a pinch and need to open a credit card. You’re more likely to qualify for a 0% APR card like the Citi Simplicity® Card. During a life-changing transition, such as a move or home remodel, you can take advantage of 0% for the first 12 months on new purchases and 21 months for balance transfers .

Recommended Reading: What Credit Score Do You Need To Get Care Credit

Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

Ask For Lower Interest Rates Higher Credit Limits

The first thing Wayne Sanford, owner of the Texas-based credit counseling firm Credit Bureau Investigations, recommends doing is contacting your current credit issuers to see if they can offer you a better deal.

Call up and say, I just checked my credit score and it was above 780, so why am I still paying this high interest rate? A good chunk of them will drop the rate down for you, he says. And if that doesnt work and youre carrying a high-interest balance, it may be a good time to look into a 0 percent balance transfer card deal, or look into applying for a new, low APR card.

While youre on the line with your credit card issuer, you also can ask for an increase to your credit line. If successful, this is a good win since it can make maintaining a great a bit easier if you tend to carry balances on your cards from time to time.

With a top score, youve already been good about not using too much of your available credit, but a higher limit gives you a bit more wiggle room should you wish to finance a larger purchase over a few months.

Tip:The higher you are up the mountain, the longer the fall, says Sanford. In other words, with a high credit score, even the slightest slip-up can cause as much as a 100-point drop. That said, dont start overspending just because you have a lower rate or a higher limit.

Read Also: Afni Pay For Delete

My Credit Score Is 800 Now What

by The Ascent Staff | Updated July 21, 2021 – First published on Nov. 16, 2018

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Having a credit score of 800 or higher puts you in an elite tier of borrowers, given that only about 20% of people have a credit score in this range. People who have scores above 800 enjoy extraordinary credit card perks, low loan rates, higher borrowing limits, and other financial benefits that aren’t offered to people who have lower credit scores.