How To Build Credit With A Credit Card

If you want to build your credit using a credit card, it’s important to remember that the way you use it will determine whether your scores are hurt or helped. Signing up for a credit card to build credit only to max out your balance and miss payments will leave you worse off than before. Ensure that you make timely payments on your debts, the goal is to build up enough credit to acquire some of the best credit cards available.

Here are four strategies for responsibly building good credit using a credit card:

Get A Handle On Bill Payments

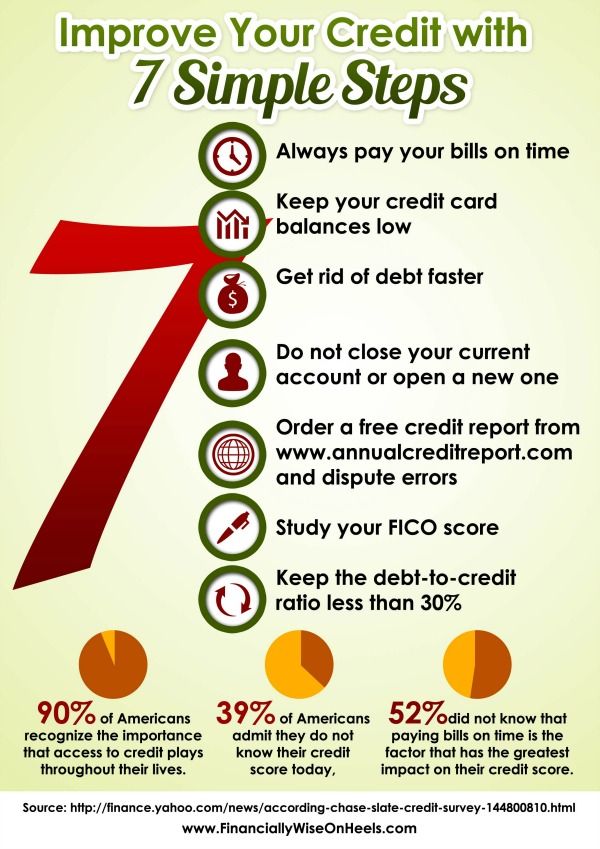

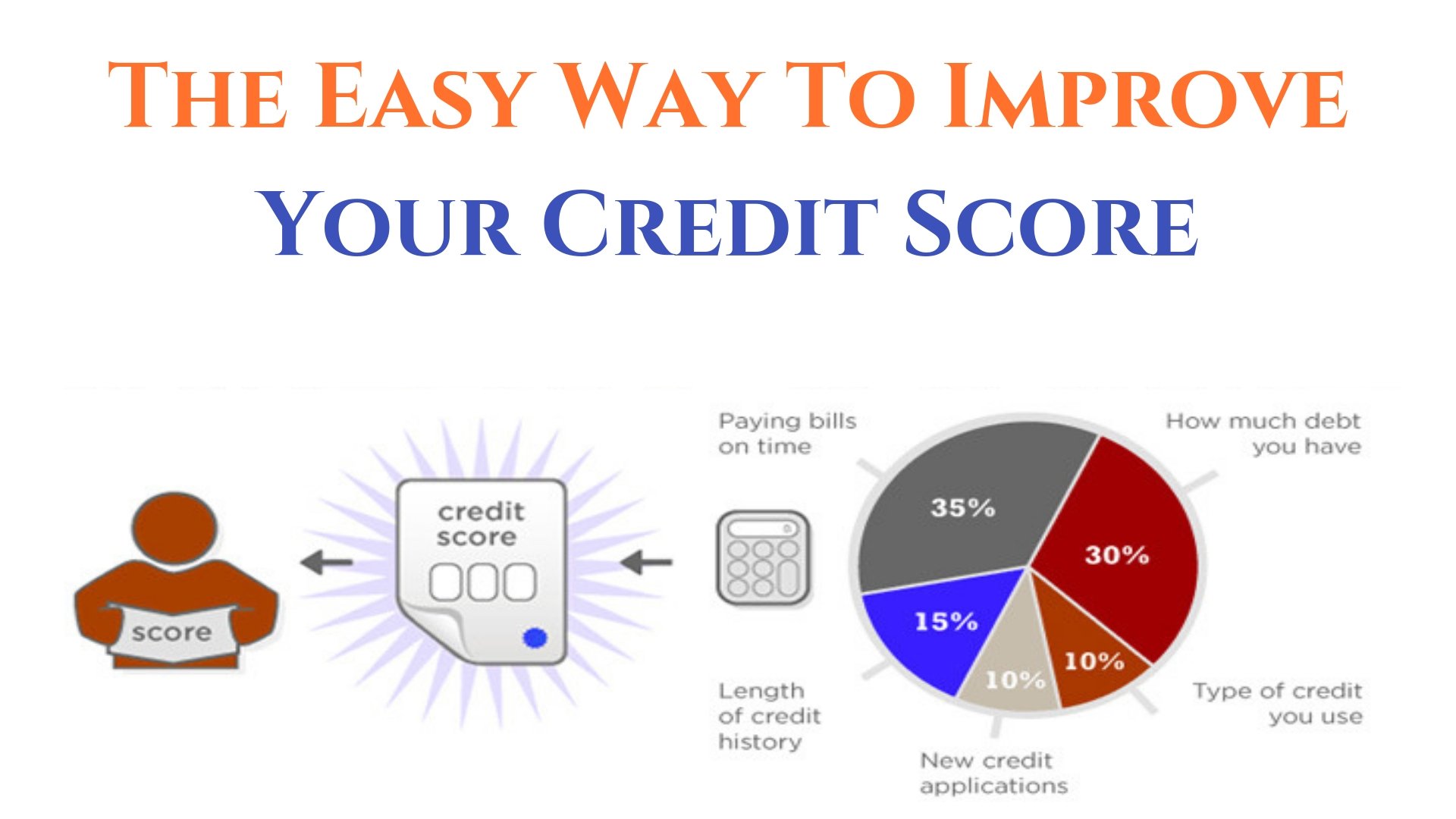

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this so it doesn’t play any role in any assessment of you.

Don’t Miss: Which Bureau Does Care Credit Pull

Can You Pay To Have Your Credit Fixed

If your credit file has information you feel is incorrect, credit repair companies may offer to dispute the information with the credit reporting agencies on your behalf. Credit repair companies typically charge a monthly fee for work performed in the previous month or a flat fee for each item they get removed from your reports. However, Experian does not charge consumers or require any special form to dispute information, so this is something you can do on your own at no cost.

If you’re on a monthly subscription, the cost is typically around $75 per month but can vary by company. The same goes for paying a fee for each deletion, but that option typically runs $50 each or more.

That said, it’s important to keep in mind that credit repair isn’t a cure-alland in many cases it crosses the line into unethical or even illegal measures by attempting to remove information that’s been accurately reported to the credit bureaus. While these companies may try to dispute every piece of negative information on your reports, it’s unlikely that information reported accurately by your lenders will be removed.

And again, credit repair companies can’t do anything that you can’t do on your own for free. As a result, it’s a good idea to consider working to fix your credit first before you pay for a credit repair service to do it for you.

Keep Your Credit Utilization Ratio Below 30%

One of the most important metrics for judging the impact of your credit card debt is the or credit utilization rate which is the amount of credit used versus the credit line authorized, i.e., your credit card balance versus your credit limit.

The importance of the CUR is that you cant judge creditworthiness simply by the total of your credit card balances. Rather, creditors contextualize that total by comparing it to the sum of all your credit card credit limits.

For example, the fact that John owes $5,000 on his credit cards while Mary owes $3,000 does not necessarily make John a greater credit risk. If Johns credit lines add up to $20,000 while Marys total $6,000, some simple math puts their CURs at 25% and 50% respectively. John is in much better shape, credit-wise, than Mary, who needs to reduce her balances by at least $1,200 just to reach the critical 30% CUR target.

The following chart from Credit Karma shows the relationship between CUR and credit score:

How do we explain the relatively low average credit for the 0% CUR? We guess that some of these cardholders simply dont use their credit cards much and therefore have little opportunity to improve their credit scores. Further research is needed to nail down the answer.

You May Like: Credit Report Serious Delinquency

Reducing The Amount Of Debt You Owe

One good step is to start a debt reduction plan to clear up your financesâand set you on the path to a better score. Start by paying off your high interest rate cards: put all your effort into paying off a higher rate card, while maintaining payments on all other cards on auto pay. Once you’ve paid off the balance, don’t cancel your card! Keep it open, even if you don’t use it, so you can boost your credit utilization.

Does Paying Off Collections Improve My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

You May Like: Is Carmax Pre Approval A Hard Inquiry

Responsibly Add To Your Credit Mix

Lenders look for a mix of accounts in your credit file to show that you can manage multiple types of credit. These include installment loans, for which you pay a fixed amount per month, and revolving credit, which comes with a limit you can charge up to .

If you only have one type of credit in your file, adding something different could improve your credit mix. Credit mix accounts for just 10% of your FICO® Score, however, so don’t apply for credit simply to improve your score. That could put you at risk of taking on debt you can’t repay.

Ways To Improve Your Credit Score

Your credit score is a fluid number, changing as information is added, altered or removed from your credit report. But your credit score also takes into account past behaviors, meaning raising your score requires time and patience.

In addition to making the right moves, you will also need to be consistent.

You May Like: When Does Usaa Report To Credit Bureaus

Who Has Access To Your Credit Reports

Although not many people can access your credit report, a few individuals and institutions who legitimately requires it may have access to it. If a company has a genuine business requirement with you, it is safe to assume that they have access to your credit report and score. Hereâs a list of some of the institutions and individuals that have access to your credit report.

Banks â Quite naturally, banks can gain access to your to gauge your credit worthiness. You donât necessarily have to have a credit card for banks to have access to it. Your credit worthiness may be examined if youâre applying for a loan or even opting for an overdraft facility as this is considered to be a line of credit as well.

Anyone willing to loan you money will have to determine your credit worthiness before they put their faith in you. Credit card issuers and mortgage lenders are amongst a few that fall in this category. Determining your credit worthiness helps the creditor gauge if youâre capable of repaying the loan and helps the creditor determine the terms and conditions of the same. Generally, the better your credit score, the more likely you are to get a loan approved and attain favourable terms when it comes to repayment and interest rates.

Insurance Companies â Statistically, it shows that individuals with poor are more likely to file a claim. Insurance companies often measure your credit worthiness to determine how much they need to charge you for a new policy.

Cancel Unused Credit And Store Cards

These can kill your application. Access to too much available credit, even if it isn’t used, can be a problem. If you have a range of unused credit cards and lots of available credit, it could be a good idea to cancel some of them. This lowers your available credit and should help.

However, just to complicate things, long-standing accounts with good credit histories can be a benefit to your credit score, so they’re often best left open. There’s no definitive answer as to whether you should close down your old cards, because all lenders are different. But, look to strike a happy medium if you’ve lots and lots of unused credit, close some cards down, but don’t close ’em all. And above all, don’t max out.

If you need to cut credit card debt costs, first check if the old cards will let you shift debt from other cards to them cheaply, as you then won’t need to apply for new credit. This helps your credit file, and means you’re using your existing credit more efficiently. See Balance Transfers for full info.

Don’t Miss: Optimum Outcomes Inc Collections

Comparing Credit Repair Companies

Before enrolling with a credit repair company, its important to understand how much it will cost, if the company offers a money-back guarantee, and the services youll receive . Some of the factors to consider include:

- Cost: After providing you with a free consultation, most credit repair companies charge an upfront setup or enrollment fee. This fee is intended to cover the initial work needed for the company to start resolving your credit issues. Plus, youll usually be required to pay a monthly fee for the duration of the program. This means the quicker your credit issues can be resolved, the less money youll be required to pay.

- Money-back guarantee: Many credit repair companies offer a money-back guarantee, that promises a full refund if your credit issues arent resolved in three-to-six months . This type of money-back guarantee is important, as it provides the credit repair company with an incentive to resolve your credit issues as quickly as possible.

- Services: Although the primary goal of credit repair companies is to help you fix errors on your credit report, the exact services vary by provider. For example, many providers offer an unlimited number of credit disputes, while some providers limit the number of items you can dispute . Plus, some credit repair companies only offer credit monitoring with their higher-cost plans. Make sure you understand what youll get before enrolling.

Boost Your Credit Score With A Moneylion Credit Builder Loan

So, how long does it take to raise your credit score? You can raise your score in as little as three months! There are lots of ways by which you can boost your score, like paying down debt, making payments on time, disputing errors on your report, and only applying for new loans when necessary.

Make sure you always make your payments on time for each and every line of credit that you have, including personal loans, student loans, credit cards, home loans, and auto loans, as they can all impact your credit score. Want to take improving your score a step further? Apply for a from MoneyLion!

Youll be able to establish or rebuild your credit score in no time! With a Credit Builder Plus membership, you can obtain a loan of up to $1,000 with a competitive APR and no hard credit checks. As you make consistent payments to your loan, your credit score will improve over time.

Most members found that their credit scores improved by an average of 60 points in only 60 days! Start boosting your credit score today by downloading the MoneyLion app.

Create an account and follow the instructions so that you can apply for a Credit Builder Plus membership. Once you are approved for your credit-building loan, youll be on the fast track towards improving your credit score. Plus, you can enjoy the benefits of credit monitoring, credit advice, and more as part of your MoneyLion Credit Builder Plus membership.

You May Like: How Can I Raise My Credit Score 50 Points Fast

Use A Secured Credit Card

Another way to build or rebuild your credit is with a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help build your credit.

Impact: Varies. This is likeliest to help someone new to credit with accounts or someone with dented credit wanting a way to add more positive credit history and dilute past missteps.

Time commitment: Medium. Look for a secured card that reports your credit activity to all three major credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

How fast it could work: Several months. The goal here is not just having another card, although that can help your score a bit by improving your depth of credit. Rather, your aim is to build a record of keeping balances low and paying on time.

Should You Hire A Credit Repair Company

Theres no way to raise your credit score overnight, and any credit repair company that offers fast solutions is likely trying to pull the wool over your eyes. In fact, the Federal Trade Commission even has a webpage dedicated to warning people against credit repair scams.

There are legitimate steps you can do yourself without having to pay a credit repair company to repair your credit. These steps include reviewing your credit reports for errors, paying down debt and getting a credit card that reports on-time payment activity to the credit bureaus. In other words, taking steps to fix your credit on your own is likely to be safer and cheaper than looking to a credit repair company.

For those situations where managing your debt and fixing your credit seem impossible on your own, a nonprofit credit counseling agency may be a better choice than a for-profit credit repair company.

If you decide to go with a credit repair company rather than fixing your credit yourself or working with a nonprofit credit counseling agency, its important to know your protections under the Credit Repair Organization Act . The law requires these companies to explain the following:

- Your legal rights in a written contract and the services the company will provide

- That you have three days to cancel without any charge

- How long itll take for the company to get results for you

- The total amount youll pay the company for credit repair services

- Any guarantees the company makes to you

Read Also: Can A Closed Collection Account Be Reopened

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit.

Impact: Highly influential, because utilization is a large factor in credit scores.

Time commitment: Low. Contact your credit card issuer to ask about getting a higher limit. See if it’s possible to avoid a hard credit inquiry, which can temporarily drop your score a few points.

How fast it could work: Fast. Once the higher limit is reported to credit bureaus, it will lower your overall credit utilization as long as you don’t use up the extra “room” on the card.

If You’ve Split Up Ensure You Financially De

If you split up with someone you’ve had joint finances with , once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. You can also call up or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they can’t do this if you still have a joint account open with the ex. The account’ll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Tip Email

Don’t Miss: Wipe Your Credit Clean