Why Is My Credit Score Dropping

Its hard to make any kind of financial decision these days without considering how it might impact your credit score. And it’s no wonder! Your credit score could make the difference between getting that rental apartment you’ve been eyeing or even qualifying for a great cell phone plan or insurance rate. The truth is many important financial transactions rely on your credit score. That’s why it’s important to know if your credit score has dropped and what might have caused it.

Its always a good idea to track your credit score. Not only can significant changes in your credit score help you identify potential cases of identity theft and fraud, but they can also help you address any discrepancies in your credit report and take the necessary steps to correct actions that might be causing your credit score to drop. For this reason, many Canadians have started tracking their credit score regularly and checking with both Equifax and TransUnion to get updates when it does change.

Have you ever wondered, Why is my credit score dropping? or How can I improve my credit score? Lets go through what a credit score is and how you can take control of it!

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

Also Check: Bpvisa/syncb

Length Of Credit History

The average age of your credit accounts is another important factor in determining your credit score. Having many older accounts has a positive impact on your credit score, and having several new accounts is a negative contributing factor. If you pay off debt on an older account and subsequently close it, your credit score may drop.

You Applied For A Loan Or Credit Card

Each time you apply for a loan or new credit card, the lender will pull your credit history from one of the major credit bureaus before deciding whether to approve your application or not. This is called a hard inquiry, and it can decrease your credit score by several points.

The good news is that a dip in your score from a hard inquiry is usually temporary, and it should go back up again soon.

What to do:

Unfortunately, hard inquiries are just a part of life when you apply for new credit. Continue to keep an eye on your score, and avoid applying for any new loans or credit cards until you see that it has returned to normal.

Stacking up hard inquiries in a short amount of time can cause extra damage to your credit score, so its a good idea to space out your applications, and only apply for loans or credit cards that youre confident youll be approved for.

You May Like: Is 626 A Good Credit Score

Youre A Victim Of Identity Theft

A big, unexplained drop in your credit score can be the first sign of identity theft. When checking your credit reports, look for warning signs like addresses where youve never lived or accounts that look unfamiliar. You can clean up the mess, but the sooner you discover its there, the simpler the job.

The fix: Go to identitytheft.gov and file a report. Youll need that report to dispute the information on your credit reports. Follow up by checking your credit reports again in 30 days to be sure corrections have been made. Consider freezing your credit or at least adding a fraud alert to protect yourself in the future.

A Short Credit History Or None At All

Even though age is not considered in the FICO score, the length of your credit history is. A young person will typically have a lower credit score than an older one, even when all other factors are the same. Another 15% of your FICO score is based on the length of your credit history, including the amount of time since the various accounts were opened and used.

Also Check: Does Carvana Report To The Credit Bureaus

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

You Applied For New Credit

Any application for new credit, be it a credit card, a line of credit, or a loan, results in a hard inquiry on your credit file. Each hard inquiry can cause your score to drop a few points, although it’s nothing big.

How to fix it — There’s no work needed on your part this time, as hard inquiries only affect your credit for a year. One hard inquiry won’t cause that much of a dip in your score.

You will, however, want to avoid any more credit applications so that your score can recover.

Don’t Miss: 778 Fico Score

Someone Else Missed A Payment

If you co-signed on a loan or a credit card for a friend or family member, youre responsible for making sure the payments are made on time.

When the person you co-signed for misses a payment or runs up a large balance, its your credit score thats on the line, unfortunately.

What to do:

If youre worried the person you co-signed for might not be able to make their payments, you should set up the account so that you can monitor it online.

Schedule a reminder on your calendar app for a few days before the monthly payment is due, and check the statement to make sure that its been paid up.

In the event that the payment has not been made, you might need to cover it yourself if you want to prevent your credit score from taking a hit.

You also should consider having a talk with the person you co-signed for, and explaining that your credit score has been affected. It might be a bit awkward, but, unless your family member or friend starts making timely payments, the only alternative is to close the account.

A Payment Was Late Or Is Missing

Payment history on all types of debts has a huge impact on your credit score . The later the payment is, the greater impact it will have on your credit score. If you’re 30 days late or more, your credit card company or lender is likely to report the problem to Equifax and/or TransUnion, which can automatically lower your credit score. After 60 to 90 days, the negative impact on your credit score increases.

Even making the minimum required payment on time can prevent this problem. If you’re not always on the ball when it comes to making your payments on time, consider setting up auto-payments for your credit card bills, even if it’s just $20. That way, you won’t get docked for unnecessarily late payments.

Don’t Miss: Synchrony Bank Ppc

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account that’s six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you don’t meet the criteria, the scoring model can’t score your credit reportin other words, you’re “credit invisible.” As a result, creditors won’t be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where they’ve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If you’re brand new to credit, or reestablishing your credit, revisit step one above.

Why Does Your Credit Score Drop When You Check It

Your credit score shouldn’t drop when you check it yourself. These pulls are typically soft inquiries, which don’t affect your credit score. If a lender or creditor checks your credit score, that may lower it.

Hard credit inquiries, or hard pulls, do affect your credit score. These happen when a lender or credit card issuer pulls your credit to determine whether to extend credit to you. In this case, you should be aware and consent to the pull.

Don’t Miss: When Does Usaa Report To Credit Bureaus

You Are Using Your Credit Card Way Too Much

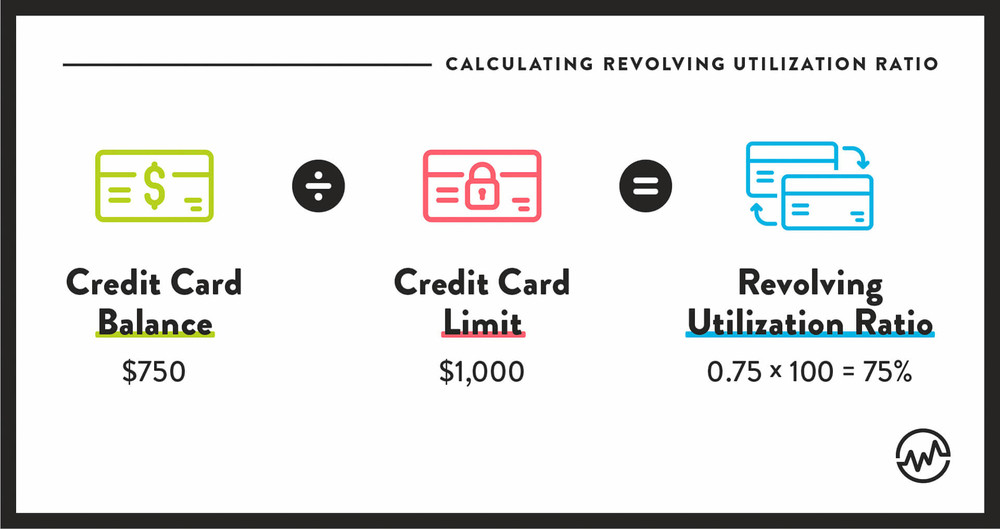

If you are spending money from your credit card on whatever you want without even considering your budget or circumstances, you may face problems with your credit score afterward. You see, your credit card has a certain limit, lets say it is $5,000. There is a thing called a credit utilization ratio.

In a nutshell, the more credit you spent, the worse your future credit score will be, as a lender sees that you tend to live beyond your means and spend more money than you actually need to, like on a new TV, for example.

The lower this ratio is, the better things are for you. Spending $1,000 would make the ratio 20%, which is rather good. However, if you spend $2,500, you make your ratio 50%. And that is already a cause for concern.

Getting Your Credit Score Back In Shape

Taking care of your credit is one of the smartest financial decisions you can make. There’s plenty of ways your credit score can drop, some of them more severe than others, but they’re all fixable if you know what you’re doing.

If your credit score recently went down, start by figuring out what the cause is. Then follow the steps above to fix the problem.

You May Like: Cbcinnovis Credit Inquiry

Someone Else Used Your Credit Card Account

Whether your 10-year-old pulled it out of a desk drawer and set up an online game account or your credit card was cloned and used by a stranger, someone ran up a big balance and you had no idea.

The fix: Call your credit card issuer. In the case of a stranger using your card, youll get a new card and wont be responsible for charges. Someone in your household using the card without your knowledge is more of a family issue. Consider setting up alerts to notify you when the card is used.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Don’t Miss: Syncb Bp

Work On Paying Down High Credit Card Balances

Your credit card balances play a huge role in your credit score. In particular, it’s important to have a low . That ratio is your current card balances compared to your credit limits.

The ideal credit utilization ratio is 20% or less. If you have $5,000 in total credit limits, you should aim for a total balance of $1,000 at most.

For an example of how much credit utilization matters, one personal finance writer’s by 32 points when she went over 50% credit utilization.

If your credit utilization is higher than 20%, put as much of your extra cash as possible toward your credit card debt. Once you pay down those balances, you should see your credit score go up in one or two months.

One Of Your Credit Limits Decreased

Similar to maxing out your credit cards, having your can increase your credit utilization ratio and negatively affect your credit scores.

Imagine, as in the example above, your total credit limit was $10,000 and you carried a balance of $3,000. In this case, your utilization ratio would be 30%. If a credit card issuer lowered your limit to $6,000, but your balance remained the same, your utilization ratio would change to 50%. This could cause your credit score to drop.

Credit card issuers set initial credit limits based on factors including your income, current debt-to-income ratio, credit history and credit score. An issuer might lower your credit limit if, among other reasons, you haven’t been using your card much or if you frequently miss payments or pay late.

You can request a from your current issuers or open a new credit card account if you’re concerned that your credit limit is too low. But know that if your limit recently went down, an increase might be hard to come by, and it may be best to wait to request more credit until your score improves.

Regardless of whether your credit limits are shrinking or your balances are increasing, keeping an eye on your credit utilization ratio will help you better understand your fluctuating credit score.

Read Also: Does Removing An Authorized User Hurt Credit

Tips To Boost Your Credit Score By Over 50 Points In 2021

by Lyle Daly | Jan. 10, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Want to make a serious change to your credit score in 2021? Here are all the credit-building methods that make the biggest difference.

If your goal is to increase your credit score, that probably means you want to see results quickly. Because let’s be honest — there’s nothing exciting about seeing your credit score tick up by a few points.

While improving your is a process, it doesn’t always need to be a long one. By following a few tips, you could raise your score by 50 points or more before the end of the year.

Change In Credit Utilization Rate

Your is another important factor in determining credit scores. VantageScore says that its extremely influential, and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month , it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 . If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 , your scores could start showing a decline.

You May Like: Is Creditwise Score Accurate

How Much You Owe To Your Creditors

When deciding whether or not to lend you money or provide you with additional credit, creditors want to know how much you already owe other creditors. This information helps them determine if you can handle any additional debt.

For example, if your existing credit cards and/or lines of credit are close to being maxed out, creditors may interpret this as high risk, as you’re already carrying quite a bit of unpaid debt. When creditors see that you have already used up a good portion of your existing credit, it’s an indication that it could impact your ability to repay them if they were to extend to you additional credit.