View Your Credit Report For Free

In addition to your free credit score, you also get access to your TransUnion credit report for free. Like with your credit score, your credit report can update as often as once per week.

Keep in mind, it sometimes takes a while for an action to reflect on your credit report. CreditWise only shows what TransUnion reports to them.

Even if youve made a change, such as paying off a loan, it wont show up on your free TransUnion credit report in Credit Wise if it hasnt been reported to TransUnion yet.

While this is a great way to monitor your credit report for errors and potential fraud, you still need to check your credit reports from the other major bureaus every once in a while.

You can do this for free once per year for each major credit bureau at AnnualCreditReport.com.

Factors That Affect Credit Scores

FICO and CreditWises VantageScore 3.0 have more in common than otherwise since their goal is to predict your lending risk based on your past financial behavior. VantageScore and FICOs newest XD model can use phone and cable bills to predict borrowing behaviors, even if you dont have established credit.

However, each model places different emphases on factors that contribute to your credit score, leading to different calculations. These factors include when your score is determined, if youve recently missed a payment, how long youve had credit, if you have a low-balance collection on your report, and how far back your hard inquiries go.

You Closed An Account

Closing a credit card account can affect your credit score in a couple ways. If you close one account, maybe one you havent used in a while, but still have a balance on other cards, it can increase your utilization.

Lets say you have two credit cards, both with a $1,000 credit limit. One card has a $500 balance, and the other, a card you never use, has no balance. Your current utilization rate is 25% . Thats below the 30% threshold lenders like you to be at. But if you close the second card that has no balance on it, youll increase your utilization up to 50%! You have to be mindful when closing credit cards for this reason.

Closing a credit card can also impact your score by changing the average age of all your accounts. Lenders like to see that you have accounts with a long history of on-time payments. Generally speaking, the older the average age of your accounts is, the better your score will be. If you close an account thats been open for a long time, it could bring down that average. Think carefully about closing old accounts, especially if you want to limit any negative impact to your score.

Other types of debt can play a role too. Did you recently pay off an installment loan? Those are loans with fixed terms and payment schedules accounts like auto loans, mortgages and student loans. Sometimes, paying off these loans may cause a score to drop slightly, which may seem counterintuitive.

Also Check: Syw Mc/cbna

Start Monitoring Your Credit For Free

Whether youâre a Capital One customer or not, CreditWise is available to you for free. It doesnât take long to . And if you already have a Capital One account, you can simply and follow just one quick step to get started.

You could also go to AnnualCreditReport.com to get free copies of your credit reports from each of the three major credit bureaus.

But with CreditWise, you can get personalized suggestions to help you better understand your score and take control of your credit future.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

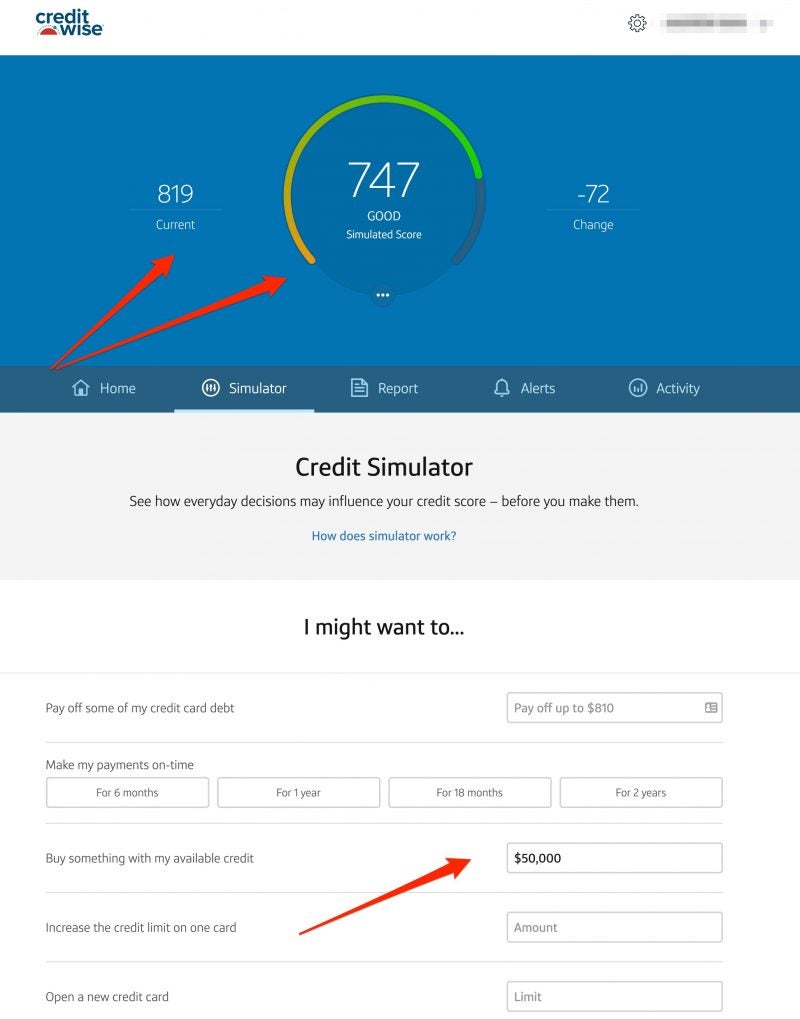

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

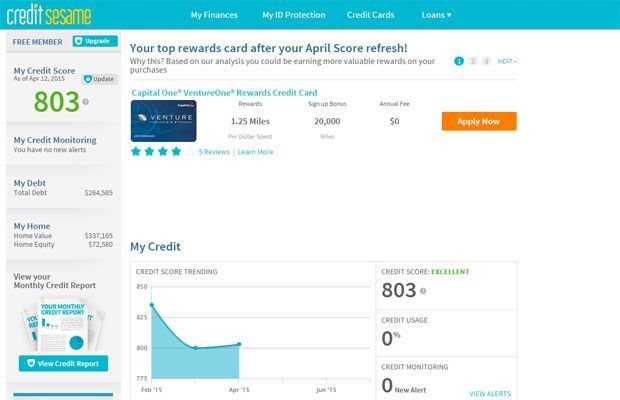

Is The Capital One Venture A Good Card

Its possible to get the Capital One Venture with a credit score in the mid-600s. But, you may need to be a current Capital One member or have a high income to be approved with fair or good credit. For the best approval odds, you may wait until your score is at least 750. You should also get a higher credit limit, making it easier to keep your credit utilization ratio low.

60k mile bonus: Capital One Venture Rewards Credit Card

You May Like: Jefferson Capital Systems Verizon Phone Number

How To Check Your Credit Scores

There are a few ways to check your credit scores:

Top Sources For Free Credit Scores

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

You May Like: Carmax Credit Score Requirements

Something Was Recorded On Your Credit Report

Think back on your payment history have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months?

Missed payments are typically not reported to the credit bureaus until theyre at least 30 days late, so your score wont be impacted until after that time. Your score will be hurt by a payment thats more than 30 days late, but a delinquency, referring to a payment that is over 30 days late, can devastate your score.

Derogatory marks such as tax liens, charge-offs, collections, foreclosures or bankruptcies have drastic impacts on your credit too, and it may take weeks or months for them to show up on your report. If youve experienced any of these, it may take time for your score to change.

Using Creditwise Wont Affect Your Score

Requesting your own credit information through CreditWise will not negatively impact your credit score.

Generally, each time you apply for a new loan or credit card, a lender checks your credit. These inquiries are recorded on your credit report and may have an effect on your credit score. If you apply for credit repeatedly within a short amount of time, however, your credit score may go down noticeably.

However, checking your own credit information through CreditWise or any other service will not have this affect. In credit-speak, checking your own credit is known as a soft pull or inquiry. By contrast, a lender checking your credit after you make a credit application is known as a hard pull or inquiry. Using CreditWise results in a soft pull.

Also Check: Voluntary Repossession Drivetime

What Is A Credit Rating

You may hear the words credit rating and credit score used to describe the same thing. Your CreditWise credit score is TransUnions numerical interpretation of your creditworthiness and is calculated based on a complex combination of all the information TransUnion holds on your credit report over a 6-year period. Your CreditWise credit rating is TransUnions interpretation of how well youre doing. For example, good or excellent. Generally speaking, the higher your credit score, and the better your credit rating, the more likely you are to be accepted for the best credit deals and interest rates.

Capital One offers a myriad of business cards for all kinds of credit levels and business-related spending. They all feature unlimited free employee cards, unlimited rewards, and no foreign transaction fees.

Credit Card Insider receives compensation from advertisers whose products may be mentioned on this page. Advertiser relationships do not affect card evaluations. Advertising partners do not edit or endorse our editorial content. Content is accurate to the best of our knowledge when its published. Learn more in our Editorial Guidelines.

Capital One Spark is Capital Ones line of small business credit cards. For Capital Ones personal cards go to this page.

| Card |

|---|

What Affects My Credit Scores

It’s important to understand the factors that go into determining your credit scores so you know how to improve them if necessary. For the FICO® Score, the credit score version you will receive through Experian, there are five main factors that impact your score. They are all weighted differently:

When you receive your credit score, you should also get some guidelines on your score profile and why your score ranks where it does. This will include information on what’s hurting it and what’s helping your score, as in the image below:

These guidelines will help you figure out what you need to do to maintain a good FICO® Score, and what you need to do to improve it. For example, if bad payment history is one of the reasons your FICO® Score is on the lower side, you should focus on paying your bills on time. Consider automating your payments so you never miss them again.

Don’t Miss: Can A Closed Account Be Reopened On My Credit Report

Whats The Best Credit Score

Theres really no such thing as a best or worst credit score theyre just different, and different lenders may use different credit scores. With that said, FICO Scores are used in over 90 percent of U.S. lending decisions, so your FICO Scores may have more sway over your financial life.

On the other end of the spectrum, some credit scores are meant only for educational purposes and are rarely, if ever, used by lenders when making credit decisions.

What Affects Credit Score Update Timing

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.

Also Check: How To Get Evictions Off Your Credit

How Often Do Issuers Report To Credit Bureaus

Broadly speaking, all issuers have a vested interest in keeping credit profiles current . So they tend to report on a regular basis. Capital Ones reporting rate is not out of the ordinary.

This does not mean, however, that they always do so. There is no legal mandate to report cardholder activity, and there are issuers out there that dont bother. Additionally, some credit card issuers report to one bureau, or two, but not all three.

So at the end of the day, there is no single reporting standard. Different issuers report at different paces, and at different times.

Nevertheless there are numerous situations in which you might want to know this information, like when youre:

- About to apply for a job that requires a credit check

- Trying to get a mortgage

- Thinking about applying for a new credit card

In such instances, its good to know when those reporting dates occur . Take a few moments to contact your issuer to learn these particulars, then try to pay off chunks of your debt in advance of the reporting date if you have the means. Reducing balances always makes your credit file look better. It should also help raise your score.

Is Creditwise Legitimate Website

Yes, Capital One CreditWise is right. Since many people are more familiar with the FICO credit score model than the VantageScore model, they may be confused at first. But all the information about CreditWise is correct in terms of VantageScore. As mentioned above, CreditWise will not show you your Equifax credit report information.

Read Also: Does Wells Fargo Business Credit Card Report To Bureaus

Should You Get Chase Journey

If you take nothing else from our Chase Credit Journey review, know that the service is absolutely 100% free. You dont even have to give payment information. For that reason, you have nothing to lose by signing up.

Personally, I think there are better free credit score products out there. However, theres nothing wrong with signing up for multiple free credit score services. In fact, I suggest it.

This way, you can keep tabs on all of your credit reports and credit scores. Simply sign up for complimentary services that offer different bureaus or scores to get a better picture of your overall credit score.

Why You Might Want A Different Card

While youll avoid certain fees with the Capital One Platinum Credit Card, you wont earn any rewards with it. Also, if you carry a balance on the card, it could get expensive: The ongoing APR is 26.99% Variable APR. And if youre looking for a card that earns rewards, other options may be a better match.

Recommended Reading: How To Report A Tenant To The Credit Bureau

Read Also: How To Report A Delinquent Tenant To The Credit Bureaus

Where Can I Get Accurate Fico Credit Scores

There are a few ways that you can get a FICO score. Many find it easy to sign-up for Experian.com and utilize that to get their FICO score . If you are just in it for the free score, make sure that you cancel your membership.

Sometimes MyFICO offers a free trial so be on the lookout for that. You can also get one free from each of the three major credit bureaus once every 12 months from annualcreditreport.com.

What Do Credit Scores Mean

Because there are so many credit scoring models in existence, you likely have multiple scores. If you pull your score from one site or product, it will likely be slightly different from one you find through another product.

So don’t get hung up on one particular score or even the exact number. Instead, pay attention to what range you fall in. Most websites and card issuers will offer some context behind the score in addition to the number.

That information will typically include where you stand and whether your score is poor, fair, good, very good or exceptional. You will also likely find information about why your score is what it is. Your score range can help you understand how lenders view your creditworthiness and what types of credit products you’re likely to be approved for.

You May Like: How To Get Rid Of A Repo On Your Credit

Whats Considered A Good Credit Score

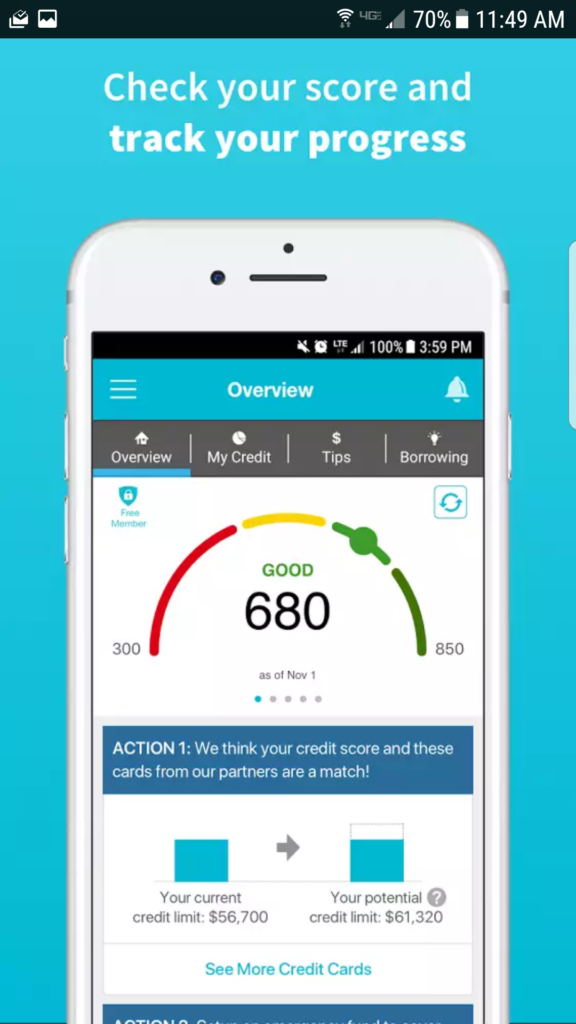

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. As you know, a good credit score can help you get approved and get better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and based on the credit youre applying for. There are also different scoring models, so a good score may vary depending on what product or services you use to see your scores. That said, read on to learn what a good credit score range is when you check your score with TransUnion.

What’s The Difference Between A Soft And Hard Credit Search

You may have heard of ‘hard’ searches and ‘soft’ searches.

A ‘hard’ search such as a credit application search or a debt collection search will not impact your CreditWise credit score but can have an impact on your ability to obtain credit. Lenders won’t know if your application was accepted or not. This is why too many applications over a short space of time can be a bad idea. Lenders may think you’re trying to take on more credit than you can afford and will be less likely to lend to you. Where a debt collection search appears, lenders will see that you are being pursued for money owed.

A ‘soft’ search, for example a ‘quotation search’ does not impact your CreditWise credit score nor your ability to get credit. However, this may differ with other credit reference agencies s.

Recommended Reading: Remove Inquiries In 24 Hours