How Long Does A Chapter 7 Bankruptcy Stay Open

You can expect a typical Chapter 7 bankruptcy case, which will take four to six months from the time you file your filing until you receive your affidavit .

Remington bankruptcy 2020Who bought out Remington? Famous American soldier Alvin Yorke was armed with a 1917 Remington Enfield on the battlefield. Finally, DuPont bought Remington during the Great Depression and a year later bought the Peters Cartridge Company.When did Remington file bankruptcy?The company said when it first announced its intention to file for bankruptcy in February that the restructuring process would not affect its operaâ¦

How Long Does Bankruptcy Stay On Your Credit Report

Bankruptcy typically stays on your credit report for a minimum of seven years and a maximum of 10 years.

While there are many types of bankruptcy, two of the most common types are Chapter 7 and Chapter 13. With Chapter 7 bankruptcy, all eligible debts are discharged immediately. With Chapter 13 bankruptcy, you agree to a three- to five-year repayment plan to partially or fully repay your debts.

- A Chapter 13 bankruptcy can stay on your credit report for up to seven years.

- A Chapter 7 bankruptcy can stay on your credit report for up to 10 years.

Itâs important to point out that each delinquent account included in the bankruptcy will also remain on your credit report up to seven years. But the seven-year clock for delinquent accounts begins when they were first reported as late, not when you filed for bankruptcy.

So if some of the accounts included in your bankruptcy were already delinquent before you filed, they will fall off your credit report before the bankruptcy does. Any accounts that were current until you filed, however, will be removed from your report at the same time as the bankruptcy.

Why You Need To Work On Your Credit Asap

If you have a 550 credit score, borrowing is going to be challenging. A credit score of 550 or lower is usually too low to qualify for a mortgage. However, youre not that far off from the score you need to qualify for this good debt. With FHA financing options, you only need a 560-600 to qualify. Of course, if you want to use traditional financing options, you generally need at least a 600 credit score.

However, besides loan approvals there are other concerns that come with a low score:

So, is bankruptcy bad for your credit? Yes. But it might not be as bad as you think. And there are financing options specifically designed to help people in your situation. For instance, there are solutions for buying a car after bankruptcy.

Read Also: How To Boost My Credit Score 50 Points

Is My Credit Going To Be Bad As Long As A Bankruptcy Shows Up

Myth: You might as well not even try because youll have poor or bad credit as long as the bankruptcy is on your record.

The truth: Yes, bankruptcy tanks your credit score in the short term. But how much a bankruptcy impacts your credit score depends in part on how old the record is. Like many other types of items reported on your credit file, bankruptcies lose some power over time. Thats especially true if you start managing credit and debt in a more positive way while youre waiting for the bankruptcy to fall off your report.

Some ways to help positively impact your score after bankruptcy can include:

- Adding new credit, such as secured credit cards or small installment loans, to offset the negative information on your credit report.

- Making on-time payments for all debt, new and old.

- Keeping your credit card balances under 30% utilization.

How Long Does It Take To Repair Credit After Bankruptcy

Some have reported obtaining a credit score in the high 600s to low 700s within two years after filing for bankruptcy. The best way to repair your credit after filing for bankruptcy is to open a secured credit card and establish a good payment history. Within a year apply for another credit card and maybe take out an auto loan. Make all of your payments on time and you should have a fair credit score within 24 months of filing for bankruptcy.

Also Check: Suncoast Credit Union Credit Card Approval Odds

How Can I Rebuild My Credit After Bankruptcy

The most important thing you can do to improve your credit score after a bankruptcy is remove the bankruptcy from your credit report.

Equally important is learning and changing your personal finance habits so that it doesnt happen again. This might involve reviewing your income and expenses or building your emergency fund to prevent future financial hardships.

The most important ongoing habit you can begin is to pay all of your bills on time because your payment history accounts for the largest portion of your credit score. Even a single 30-day late payment can cause a significant dip, so imagine how bad it could be if you regularly miss a payment.

Your other best bet for rebuilding your credit after bankruptcy is to avoid accruing new debt.

Depending on the type of bankruptcy filing, you probably had much of your debt discharged. So even though the bankruptcy itself is a major negative item on your credit report, consider the rest a blank slate.

Avoid racking up additional debt because that also has a significant impact on your credit score.

You may also want to get a secured credit card. Its a credit card designed for people who want to rebuild their credit. The credit card issuer will give you a credit limit based on the security deposit you pay upfront. By making monthly payments on time, you can start to rebuild your credit immediately.

When Does Chapter 13 Bankruptcy Drop Off Your Record

Completed Chapter 13 bankruptcy cases are removed from your credit report by all three major credit reporting agencies seven years after filing your bankruptcy case. Thus, if you enter into a five-year Chapter 13 repayment plan, you will have to wait two more years for the bankruptcy to be removed from your credit report.

In fact, by following a handful of proven methods, you can begin to repair your credit almost immediately. If you stick with the plan, you could be back in the market for a car loan or even a home mortgage in as little as two years.

Read Also: How To Unlock My Experian Account

Evaluating Credit Card Offers

You will typically begin to receive new offers for credit after bankruptcy. However, be aware that many new credit card offers will have low limits, high-interest rates, and high annual fees. Reviewing the offer terms carefully before signing up for a new credit card after bankruptcy is essential. The goal is to accept a credit card with the highest possible limit because credit reporting agencies rate you based on your total available credit. Not only can lower limits can harm your score, but you’ll want to pay off the majority of your balance each month.

If you don’t qualify for a typical, unsecured credit card, you might want to start rebuilding your credit by getting a secured credit card from your bank. You’ll deposit a certain amount of money in the bank as collateral for the card. In exchange, you have a line of credit equal to the amount in the account. A secured credit card rebuilds credit because the creditor typically reports payments on your credit reportyou’ll want to be sure that will happen.

Can I Remove A Bankruptcy From My Credit Report On My Own

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

Don’t Miss: How To Remove A Repo From Credit Report

Can You Remove A Bankruptcy On Your Own

Like all negative item disputes, its entirely possible to complete the process on your own. However, removing a bankruptcy from your credit report early can be a lengthy and tedious process that doesnt guarantee results.

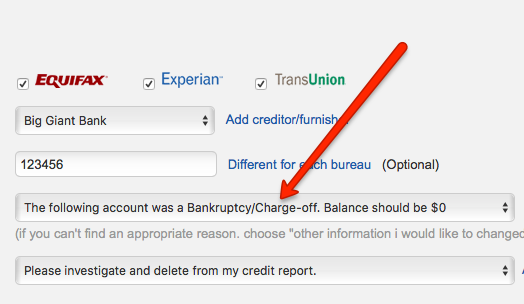

You can dispute the bankruptcy either by stating an inaccuracy of the information on your credit report or by asking the credit bureau how it verified your bankruptcy. As with any dispute, they must respond to your procedural request letter within 30 days.

In most cases, theyll say that they verified it with the courts, but this is unlikely. So you must then contact the court to ask how they verified your bankruptcy.

If they respond that they never verified it, you should get that statement in writing, send it to the credit bureau, and ask them to remove the bankruptcy.

This method isnt guaranteed, but it might be worth trying. Otherwise, enlist the help of a credit repair company to navigate the process for you.

Credit repair companies are highly experienced at disputing negative items on your credit reports. They specialize in getting bankruptcies deleted from your credit report. They also work to remove other negative information included in the bankruptcy, like charge offs and collections.

Can You Speed Up The Removal Process

Under some circumstances it may actually be possible to get a bankruptcy removed from your credit report sooner than expected.

There is a big misconception that bankruptcy cannot be removed from a credit report and that you have to sit out seven to 10 years, says Ash Exantus, director of financial education and a financial empowerment coach at BankMobile.The truth of the law or the way law is written, theres a maximum amount of time a bankruptcy can remain on your report, but there is no minimum amount of time.

In other words, theres nothing stopping you from getting that bankruptcy removed before seven to ten years.

How do you do that exactly? File a dispute with the three credit bureaus.

Review your bankruptcy filing and the items related to your bankruptcy that appear on your credit report carefully, advised Exantus. If you find any incorrect information, you can file a dispute.

If there is anything thats inaccurate on a credit report, it must be removed, Exantus continued. The bankruptcy has to be reported correctly. You want to make sure thats the case. Names, social security numbers, personal information, must all be reported correctly. Any error in the way it was reported is grounds for having it removed from your credit report.

You May Like: What Credit Score Do I Need To Get Care Credit

Can You Still Get A Loan Even With A Bankruptcy On Your Credit Report

Many people think that just because they filed for bankruptcy, then this means that they will not be able to get a loan or a new line of credit. The truth is, there are many different companies and lenders that specialize in lending to people who just filed for bankruptcy or with bad credit.

Of course, you will find that the interest rates and the fees are high compared to when you still had a stellar credit score. Thats why its important to be cautious and to not be blinded by the unbelievable offers immediately after your bankruptcy discharge. Make sure that you read the fine print and clarify all the details before going for a loan or a credit card. You dont want to end up in a more dreadful situation than you were in pre-bankruptcy.

So, what types of loans or credit are you still eligible for even after filing for bankruptcy? We listed down the credit options for you

Bankruptcy And Your Credit Report: The Bad News And The Good News

Keep in mind that the individual accounts included in the bankruptcy also will be noted on your credit reports as negative items. These should also drop off your credit reports automatically, but you may need to follow up with some creditors or the credit reporting agencies if you see them after the bankruptcy itself has been removed.

And a bit of good news in all of this: If you were already delinquent on some of your accounts when you filed for bankruptcy protection, those accounts should drop off a bit sooner seven years from the date you became delinquent instead of the bankruptcy filing date.

Read Also: Highest Credit Score Possible 900

How Does Bankruptcy Affect Your Credit Score

Unfortunately, bankruptcy is considered a seriously negative event by scoring models like FICO and VantageScore. As such, if a bankruptcy is added to your credit report, it can have a severe negative impact on your .

According to myFICO, someone with a score in the mid-600s or 700s could expect their score to fall by 100 points or more even 200+. Also, the more accounts that are included in your bankruptcy, the heavier an impact it’s likely to have on your score.

Thankfully, the negative impact of a bankruptcy on your credit report will diminish over time. So even though a bankruptcy will still be on your credit report five years down the road, its impact on your score will be much less than it was in the year that you filed.

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than youd be able to do yourself.

For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors wont be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as:

- currently owed or active

- having a balance due, or

- converted to a new type of debt .

Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

- having a zero balance, and

- discharged, included in bankruptcy, or similar language.

Unfortunately, some creditors dont update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, youll want to take steps to correct the problem.

Don’t Miss: Comenity Capital Cart

Rebuilding Credit After Chapter 7 Bankruptcy

Keeping your available credit high is a factor that drives up your credit score, along with maintaining a mix of credit types, such as a home loan, car loan, and credit card accounts. So when you begin using credit again, youll want to keep balances below 30%. Keep reading for other factors to consider.

Also Check: Can You Rent An Apartment While In Chapter 7

Can I Rebuild My Credit After Bankruptcy

You can rebuild your credit after bankruptcy, but its a long process. Your options will be limited at the start, but it is key to not get discouraged. As time goes on, if you consistently pursue a credit rebuilding strategy, your reports and scores can improve.

Here are some recommendations to start with:

- Understand the cause: Identify, accept, and learn from the root causes of your bankruptcy so you wont find yourself in the same position down the road.

- Stick to a budget: Re-evaluate your finances and see where you can cut expenses and save more money if you can.

- Start establishing a new credit history: No, this does not mean using an alias . It means starting fresh with whatever credit you can obtain.

This may mean settling for an extremely high-interest rate, taking on a co-signer, depositing cash into a secured credit card, or other options that have been designed specifically to help you re-establish a positive credit record.

Use these credit options sparingly and never put more on a card than you can pay off by the end of the month so your credit improves over time.

Also Check: Speedy Cash Credit Card

Also Check: How To Get Rid Of Serious Delinquency On Credit Report

You Still Deserve An Accurate Credit Report

The one good thing about bankruptcy is that it gets debt collectors off your back and discharges the burdensome debt that has been haunting you for years. If that is not reflected on your credit reports, however, you are not getting the full benefit of bankruptcy. Heres what I recommend:

- Send a copy of your discharge to each of the three credit reporting agencies Experian, Equifax, and TransUnionimmediately to let them know that they should no longer report any negative information on those accounts.

- Check your credit reports until the discharged accounts show a zero balance.

- If one of the CRAs continues to report negative information about an account that has been discharged, send a written dispute to the agency to have it corrected.

If a CRA fails to correct your credit report after you have notified them in writing, you may have cause to file a lawsuit.