How Does A Credit Scoring System Work

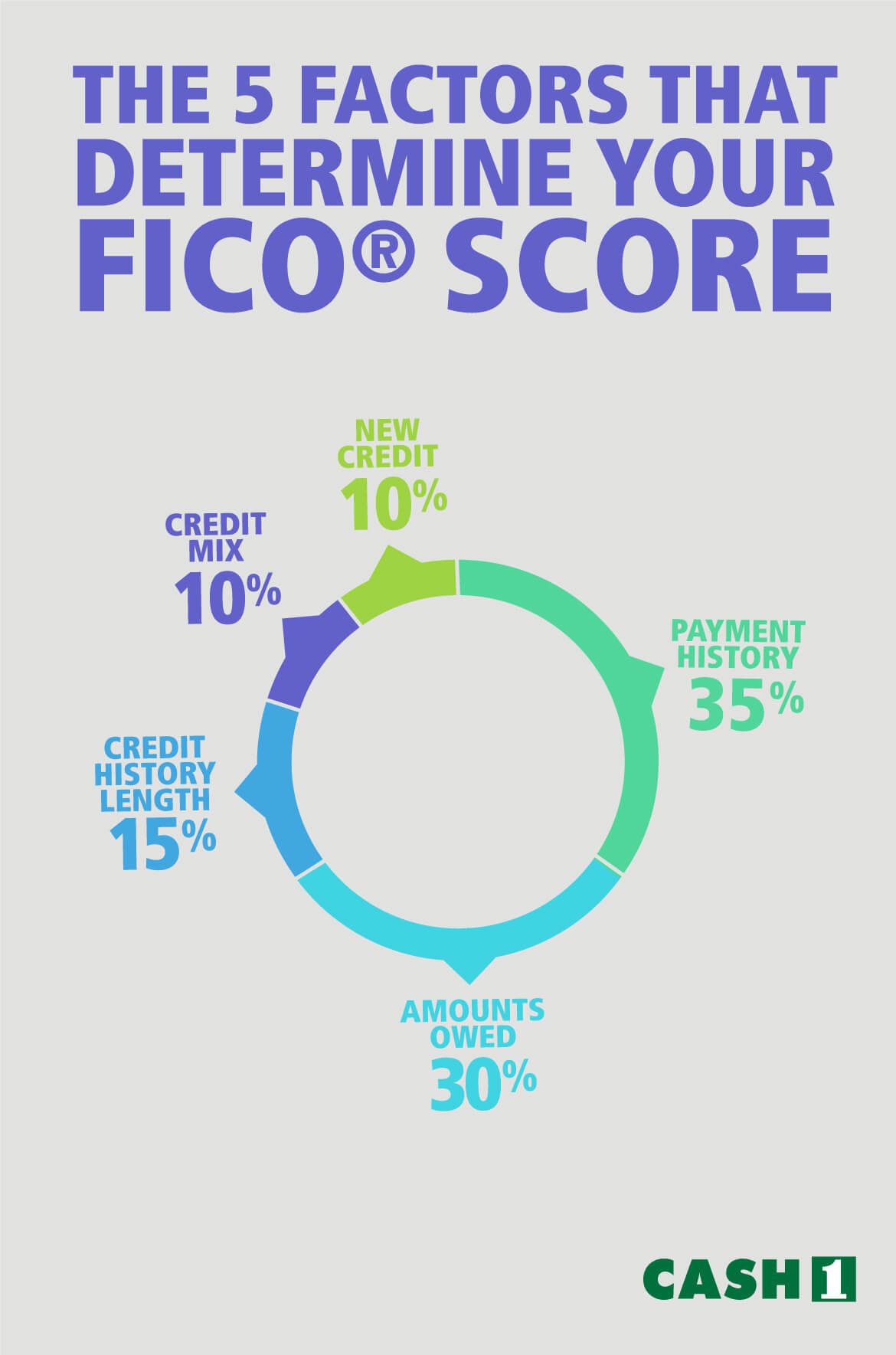

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

How Credit Plays A Role In Getting A Mortgage

Most people Googling how to buy a home soon find out that credit score plays a big role in getting a mortgage.

Your credit score shows lenders how to rate you as a borrower. Lenders want evidence that you pay bills and repay loans. A history of using credit plus a good credit score give a lender reassurance that youll repay the large sum of money theyre handing you.

Also Check: Carmax For Bad Credit

What Is A Fico Score

Many aspects of life are affected by credit ratings. They may:

- Determine whether a lender approves a new loan.

- Influence your interest rates and fees on the loan.

- Be reviewed by employers before they offer you a new job.

- Be used by landlords when deciding whether to rent to you.

- Determine your student loan eligibility, including most private loans.

- Be reviewed by insurance companies when you apply for many types of insurance, including car or homeowners insurance.

Ways To Improve Your Credit

Now that you know more about the benefits of good credit, you may want to work on improving yours. These seven steps for improving your credit could help:

Also Check: Public Records On Credit Report

The Overarching Purpose Of Credit Risk Analysis

Credit analysts may use various financial analysis techniques, such asratio analysisRatio AnalysisRatio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. They are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency. and trend analysis to obtain measurable numbers that quantify the credit loss. The techniques measure the risk of credit loss due to changes in the creditworthiness of borrowers.

When measuring the credit loss, we consider both losses from counterparty default, as well as deteriorating credit risk rating.

Understanding Who Becomes A Subprime Borrower

Lenders rely on to provide credit reports and credit scores on which to base their lending decisions. Credit scores are calculated using a variety of methodologies, and the higher the score, the better the person’s credit is assumed to be. The most widely used credit score is the FICO score.

Experian, one of the three major national credit bureaus, breaks credit scores into five tiers. The top three tiersknown as “exceptional,””very good,” and “good”are reserved for individuals with credit scores of 670 and up.

Subprime borrowers fall into the bottom two tiers, the “fair” and “very poor” categories. Fair credit involves scores ranging from 580 to 669 very poor credit is anything lower than 580.

Their low credit scores make it hard for subprime borrowers to obtain credit through traditional lenders. When they are able to obtain loans, subprime borrowers will generally receive less favorable terms, compared with borrowers who have good credit.

Don’t Miss: How Can I Get Eviction Off My Record

Ok But What About My Other Credit Scores

FICO Scores are just the tip of the iceberg. You may have dozens of other credit scores youre not aware of.

The other main scoring model youll run into is the VantageScore. The three major credit-reporting agencies Equifax®, Experian® and TransUnion® teamed up in 2006 to create the independently managed firm VantageScore Solutions, which just released the fourth and latest version of its credit scoring model, the VantageScore 4.0.

We know this is a lot to take in, but dont panic. While each of these credit-reporting agencies calculates your credit scores differently, they all focus on how responsible you are with the money you borrow.

Better Credit Can Mean Better Loan Terms

A good credit score helps you qualify for a mortgage with the best loan terms. Heres why.

Because good credit scores tell mortgage lenders that youre a safe bet to repay a loan, they may reward you for reducing their risk. A credit score above 720 is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. NerdWallet says that the lending industry, in general, adjusts the interest rates that they offer based on credit score. On a conventional mortgage, the higher your credit score the lower the interest rate will be. The lower your credit score, the higher your interest rate, which could cost you a lot of money over the life of the loan.

Borrower-required credit scores vary with the type of mortgage. A government-insured FHA loan, for example, has lower credit score and down payment requirements than conventional loans. VA loans also offer terms that may have lower credit score benchmarks since many members of the military wont need or get credit until they leave the service. If youre a first-time homebuyer looking for a mortgage program that will make home ownership possible, it pays to shop around.

Recommended Reading: What Is Coaf On Credit Report

Good Credit Gets You Started

Before house hunting, there are steps you can take to fix your credit, like paying down or paying off debt. Youll also want to pull your credit reports to look for incorrect information that may be dragging your score down. Cleaning up credit gives you the opportunity to present yourself to a lender as a solid borrower.

Auto Loans Require Good Credit

Most people do not have the money to fund a vehicle and cover living expenses at the same time. Many will apply for an auto loan. Your credit rating affects whether you are qualified, the amount you can receive, and the interest rate of the loan. Generally, loan applicants with a higher credit rating can qualify for larger loan amounts with lower interest rates.

A low credit rating will limit your choices. Few lenders will work with you if you have low credit, and those that do will charge a much higher interest rate on your auto loan. A higher interest rate will significantly raise the amount you pay monthly on the car, which raises the total amount you’d pay over time.

You May Like: Does Carmax Work With Poor Credit

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

How Are Credit Scores Calculated

Reading time: 4 minutes

Highlights:

-

Payment history, the amount of credit youre using, and the length of your credit history are factors included in calculating your credit scores

While your credit score is important, it is only one of several pieces of information an organization will use to determine your creditworthiness. For example, a mortgage lender would want to know your income as well as other information in addition to your credit score before it makes a decision.

Don’t Miss: Removing Inquiries From Transunion

Lets Start With Your Fico Credit Scores

In the old days, banks and other lenders developed their own score cards to assess the risk of lending to a particular person. But the scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various credit card, mortgage and auto lending decisions.

What Affects Credit Scores The Most

Your payment history is the most important aspect of your credit score, because it shows how youve managed your finances, including any late payments. Your credit history is also very important, as it demonstrates how long you’ve been managing your accounts, when your last payments were made, and any recent charges.

Read Also: Speedy Cash Change Due Date

Types Of Subprime Products

In today’s emerging fintech market, a number of new companies, including various online lenders, now focus on subprime and thin-file borrowers. Credit agencies have also developed new credit scoring methodologies for such borrowers. This has helped to increase the available offerings for subprime borrowers.

Secured credit cards can help subprime borrowers improve their credit scores and eventually qualify for a regular credit card.

One widely available product that provides an alternative for subprime borrowers is the secured credit card. The borrower puts money into a special bank account and is then allowed to spend up to a certain percentage of that amount, using the secured card. After a period of time, the borrower may be eligible to upgrade to a credit card with a higher credit limit.

Some companies also offer conventional, unsecured credit cards tailored to subprime borrowers. The interest rates on these credit cards can top 30%, and they often carry annual fees of $100 or so and monthly fees ranging from $5 to $10 a month. These cards usually also have a lower credit limit than other cards, which is another way lenders mitigate some of the subprime risks.

In addition to credit cards, many subprime lenders also offer non-revolving loans, such as car loans, with interest rates in the range of 36%.

You’ll Get The Best Rates On Car And Homeowners Insurance

According to McClary, having a good credit score can help you save money on your car and/or homeowners insurance.

Most U.S. states allow , where insurance companies assess your risk based on how well you handle your money.

A variety of other factors go into evaluating your rates, and insurance companies don’t rely solely on your credit score in the underwriting process. They cannot penalize you for a bad score by raising premiums, denying coverage or canceling your policy.

But according to the insurance company Nationwide, credit-based scoring results in the most fair assessment of a driver’s risk and the company reports that it actually lowers premiums for about half of its customers.

Getting a free quote from an insurance carrier is the most accurate way to see whether your credit score might bring you savings. You can also view your credit-based insurance score through LexisNexis.

Recommended Reading: What Credit Score Do You Need For Carecredit

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Who Uses Your Credit Score

Lenders of all kinds use your credit score to process your loan application.

Here are a few of the people that might use your credit score:

- Banks

- Insurance companies

- Your employer

It is clear that your credit score is used in a variety of settings. From your bank to your potential employers, everyone has access to your credit score. Each of these organizations is pulling your credit score to determine whether you are a good risk to take on, plus what kind of terms they should offer for any agreement you make.

Recommended Reading: Remove Serious Delinquency Credit Report

More Accurately Assess Consumer Credit Risk

The FICO® Score is used by lenders to help make accurate, reliable, and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used broad-based risk score, the FICO Score plays a critical role in billions of decisions each year.

Unexpected Benefits Of A Good Credit Score

Do people understand the benefits of a good credit score? Everyone knows your credit score is important, but what exactly are the benefits?

In the United States, 28% of its citizens rely on credit when running out of money. While its good to use your credit, its not always wise to carry over a balance from month to month. If you cant pay it back, your credit score will take a hit.

Most Americans know that your credit score is a golden ticket to a more manageable financial life. Whether youre looking to maintain your credit score or increase it, the right motivation is essential.

Thats why were going to talk about the benefits of a good credit score. To keep you motivated to strive for more and let you know whats waiting on the other side.

Also Check: How To Get Public Record Off Credit Report

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

What Is Credit History

Your credit history is a measure of your ability to repay debts and demonstrated responsibility in repaying them. It is recorded in your , which details the number and types of your credit accounts, how long each account has been open, amounts owed, the amount of available credit used, whether bills are paid on time, and the number of recent credit inquiries. Your credit report also contains information regarding whether you have any bankruptcies, liens, collections, or judgments.

All consumers are guaranteed access to their credit history and are eligible for one free credit report from each on an annual basis. It can be accessed from the government-approved website AnnualCreditReport.com.

What Is A Credit Score?

You May Like: How To Get Evictions Off Your Credit