Free Credit Scores From Equifax/clearscore

Like Experian, Equifax offers a free 30-day trial of its full credit monitoring service. It costs £7.95 a month after the free trial.

Alternatively, you can get your Equifax report and score free for life through ClearScore.

The company makes it money from commission on products you take out via its website.

So What Is A Credit Score

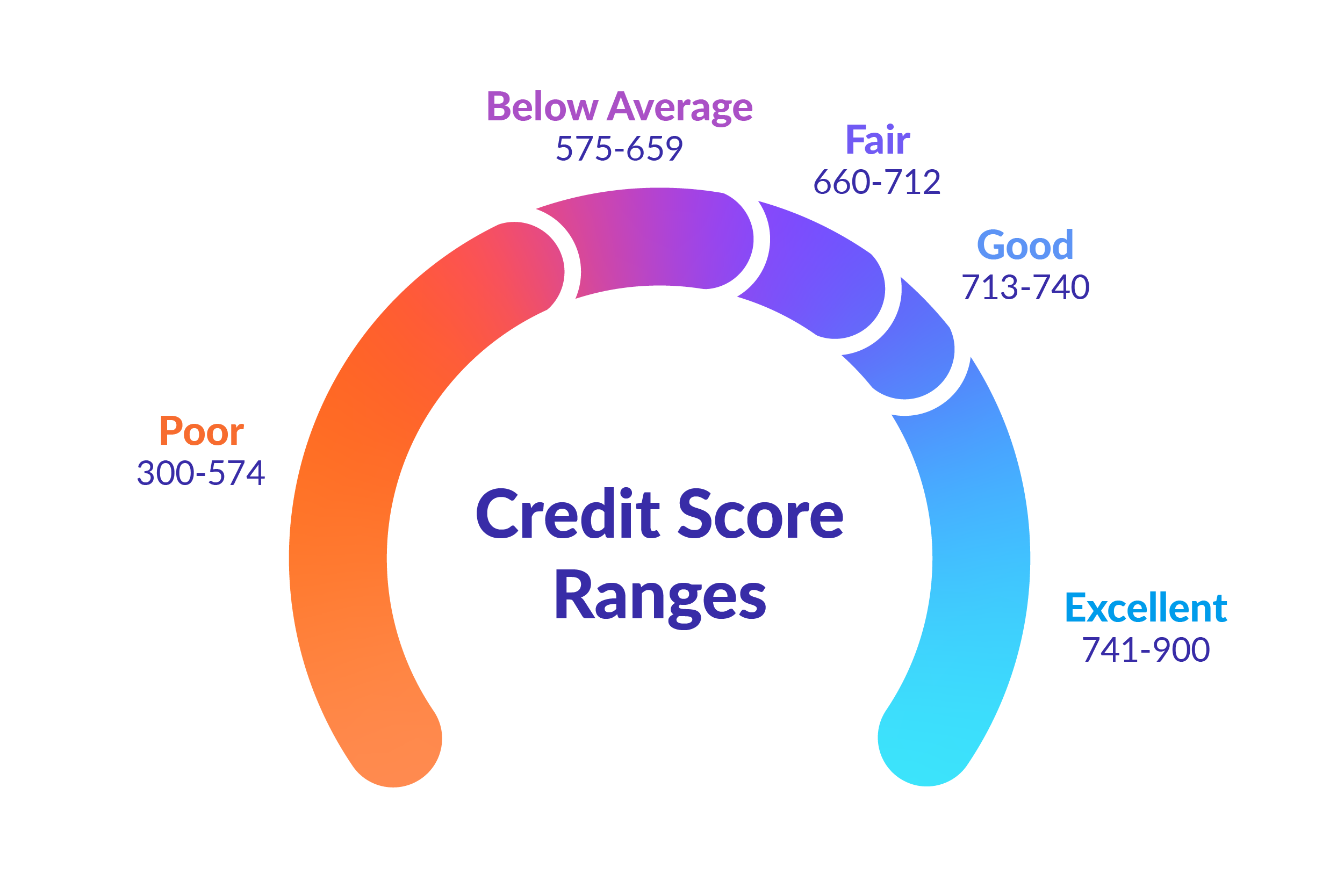

Your credit score is a number that banks and other financial institutions use to gauge your creditworthiness when making a lending decision. The higher the number, the lower the perceived risk. Generally, there is no minimum credit score required for a personal loanbut a healthy number is recommended if you want to get the best rates and avoid rejections. Having said that, if you are looking to apply for a personal loan, you will want a credit score of at least 750 or higher.

Your credit score is calculated taking several factors into account:

Get Your Finances In Order

The stepping stone to building a great credit score is setting correct habits with the rest of your finances. Overspending can lead you to have scrambled finances and you will struggle when it comes to making monthly payments for your bills. The best way to overcome this bad spending habit is to document what you spend every month, eliminate the waste, and then set a monthly budget: and not just make a monthly budget but stick to it as well. That should also include putting money in savingsideally set up an autopay out of your salary account if possible. This is your safety net, plan and keep all of your financial paperwork organized and up-to-date.

Don’t Miss: Does Paypal Credit Build Your Credit

How Does A Credit Rating Agency Work

When any company wants to issue any bonds or securities into the market, they rate this debt instrument in order to attract more customers. The reasoning is that the higher the rating of the debt, the lower the risk associated with that debt and vice-versa. The intended buyer of the debt instrument makes their decision about buying the instrument by having a look at the credit rating of the instrument before investing their funds so that they can have a fair idea about the risk associated with their investments.

The credit rating agencies have a few parameters in place to evaluate and rate the debt instrument of a company. These are:

- Independent evaluation of the capacity of the company to repay the debt

- Overall debt of the company

- The impact of the overall debt on the financial position of the company

- A thorough analysis of the finances of the company. This is done to ascertain the areas through which the principal and interest would be paid

- Past debt repayment behavior of the company

- A general study of the economy and industry in which the company is operating

- The willingness of the company to repay its debt

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Read Also: Does Klarna Affect Your Credit Score

My Free Credit Check Know Your Rights

You have the right to apply for credit

The National Credit Act gives you the right to apply for credit. All consumers must be treated equally in relation to one another when credit providers assess your application, determine rates/fees and compile and enforce the credit agreement.

You have the right to know why credit has been refused

You may ask the credit provider or bank to explain, in writing, their main reasons for:

- Refusing your application for a new loan/credit

- Refusing your application for an increased limit on existing loan/credit

- Refusing to renew a renewable loan/credit

- Offering a lower credit limit than the limit you applied for

- Reducing your existing credit limit

If your credit score or report was the main problem, the bank or credit provider has to disclose the name, address and contact details of the credit bureau that issued the report, so that you can get hold of your credit report to see what information on the credit report is keeping you from a successful application. Please note, your credit score and report are not the only factors lenders, banks and other credit providers look at when doing an assessment. The criteria they look at differs from company to company.

You have the right to receive your credit information in plain and understandable language

You have the right to confidentiality

You have the right to one free credit report per year!

Free Credit Score Resources

Most credit card issuers provide free credit score access to their cardholders making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access, whether you’re a cardholder or not:

Read Also: Credit Inquiry Removal In 24 Hour

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

How Is The Credit Score Important For Any Individual

When you apply for a loan or a credit card, your lender wants to ascertain if you will be able to repay the amount that you are borrowing. Credit score is a measure of your creditworthiness that is assigned based on your past and present credit behavior. It is one of the factors based on which a lender makes a decision to approve or reject your application for loans or credit cards.

A high credit score represents higher levels of creditworthiness and may earn you some brownie points in terms of lower interest or better terms for loans. On the other hand, a low score would mean rejected loan applications or approved on higher rates of interest.

All this makes a credit score important for any individual to be able to avail credit.

You May Like: Does Speedy Cash Report To Credit Bureaus

Where To Check Your Insurance Score

Insurance scores rely on information from your credit reports and are formulated by three main companies: FICO, LexisNexis, and TransUnion.

- FICO insurance scores range from 250 to 900.

- LexisNexis scores range from 300 to 950.

- TransUnion scores fall between 150 and 900.

In general, insurance scores of 770+ are considered good, but the specifics vary based on the type of insurance score, given the different ranges.

How Can You Check Your Credit Scores

Reading time: 2 minutes

-

There are many different credit scores and credit scoring models

-

You can purchase credit scores from a credit bureau or get one free from some banks and credit unions

Many people think if you check your credit reports from the two nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports do not usually contain credit scores. Before we talk about where you can check your credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score there are many different scores used by lenders and other organizations. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time.

Score providers, such as the credit bureaus Equifax and TransUnion along with companies like FICO, use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the two nationwide credit bureaus may also vary because some lenders may report information to both, one or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you check your credit scores? Here are a few ways:

In addition to checking your credit scores, its a good idea to regularly check your credit reports to ensure that the information is accurate and complete.

Don’t Miss: What Credit Score Does Carmax Use

Check Your Reports Carefully For Errors

Look on your credit reports for any debts or credit cards you dont recognize. Also check for disputed items that still show up even though they were resolved in your favor. A late or missed payment isnt an error if it actually happened.

- Use our to review each report.

- If you find any errors on your reports, file a dispute to get them corrected as soon as possible. Learn how.

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Read Also: How Long Does Foreclosure Stay On Credit Report

Work On Your Credit Score

If you have a low credit score, taking time to improve it is actually a good idea. Making payments on time in full consistently without missing the due date could help raise your credit score. Your credit score is largely dictated by how much debt you have and whether you pay your bills on time in a consistent manner. Focusing on these two factors could be a huge help in improving your credit.

On the other hand, if you have no credit history, you can opt for score building credit cards and make small purchases on it that you could pay off in full every month. This will help build a credit history. When you apply for a loan, lenders apply to the credit bureaus to take out your credit history. They do this to study your risk as a borrower. They can only do so if you have a credit history in the first place. If you dont have a credit history, they cannot judge you as a borrower and hence, offer you high rates or reject your loan application outright.

Working on your credit scores could unlock lower interest rates and preapprovals by more lenders. You could play this to your advantage as it gives you a wider pool of lenders from which you could choose the best deal. There is no fast road to an excellent credit score but building responsible financial habits can go a long way toward boosting your credit health.

Here are a few dos and dont to building a good credit score:

How Your Credit Score Can Affect Your Loan

If you have a good credit score, you could qualify easily for a personal loan and that too with a lower interest rate. This is because you are seen as a creditworthy borrower who poses a lower risk. Your credit history is evaluated while making a lending decision, and if your payment behavior is consistent with on-time payments, then you will most probably be approved for a loan. You are seen as a trustworthy borrower who is likely to pay back what you borrowed.

You May Like: Does Barclaycard Report To Credit Bureaus

How To Check Your Credit Score For Free

Just like keeping a close eye on your weight is a good idea if you want to maintain good health, monitoring your credit scores is also a smart move if you want to maintain your credit health. In recent years it has become easier than ever to check your credit scores based on your data from the three major credit reporting agencies Equifax, TransUnion, and Experian.

In fact, thanks to the evolution of the credit score from a lenders-only risk assessment tool, to a product sold to consumers, to a loss leader, there are now many different ways you can check your credit scores without having to pay a dime.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Don’t Miss: How To Get Credit Report Without Social Security Number

How Does Your Credit Score Impact Credit Cards You Qualify For

Credit score has a big impact on what credit cards you qualify for. The cards with the best rewards or premium perks typically require a good to excellent credit score, around 670-850. If you have bad credit or no credit, student credit cards and secured credit cards can be a good option to help you build credit, even if they dont come with as many benefits.

However, your credit score isnt the only thing that matters on your credit card application. Lenders may also look at your credit utilization ratio, your debt-to-income ratio, and outstanding balances on your other cards. To have the best chance of qualifying for the cards you want, make sure youre paying off your balance on time and in full, and dont apply for too many new cards in a short period of time.

Minimum Credit Score For Business Loan Eligibility

There is no minimum credit score requirement for a business loan. But for specific types of loans, lenders strongly prefer to see your credit score. There are no hard and fast rules for having a particular credit score number. Each and every lender will have a different range for determining your creditworthiness. Hence, there are no specific credit score numbers that you really need to have. But it helps to have a good credit score.

Every loan application is evaluated on a case-by-case basis, and every borrower is approved or denied based on a combination of aspects they have mentioned in their application. But assuming your other credentials meet the lenders other standard requirementssuch as, for instance, annual profits and time in businessthen possibilities are that you could be approved even if you dont have a favorable credit score.

Having said that, there are minimum credit scores you should aim to have in order to make your chances of approval high.

Don’t Miss: Usaa Credit Monitoring Review

View Anytime Anywhere For Free

A good credit score can help you reach your financial goals.

Monitor your credit score1 for free through the U.S. Bank Mobile App or online banking. Its easy to enroll, easy to use, and free for U.S. Bank customers.

The VantageScore is a general indication of your credit health. U.S. Bank does not use your VantageScore to make credit decisions.

What Is A Credit Report

A contains the history of your credit behavior and contains detailed information on all your loan and credit-related transactions with banks, companies, and other lenders. It can contain details of your credit activity from 7-10 years before. It is issued by one of the four credit bureaus, or credit rating agencies, in operation in India CIBILTM, Equifax, Experian, and CRIF High Mark.

Lenders use the data in the reports to evaluate your ability to make loan repayments and to decide whether you are creditworthy. If they approve your loan, the information in your report also helps them determine how much to lend, at what rates, and for what period of time.

You May Like: How Are Account Numbers Displayed In A Credit Report