How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

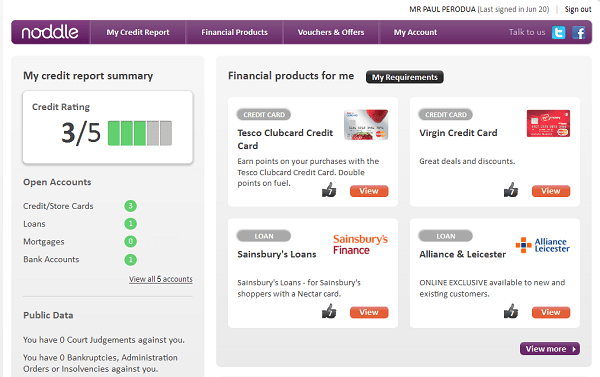

Basics Of Credit Reports And Scores

Your are statements of your . And there are three major bureaus that compile credit reports: Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so your credit reports may be slightly different.

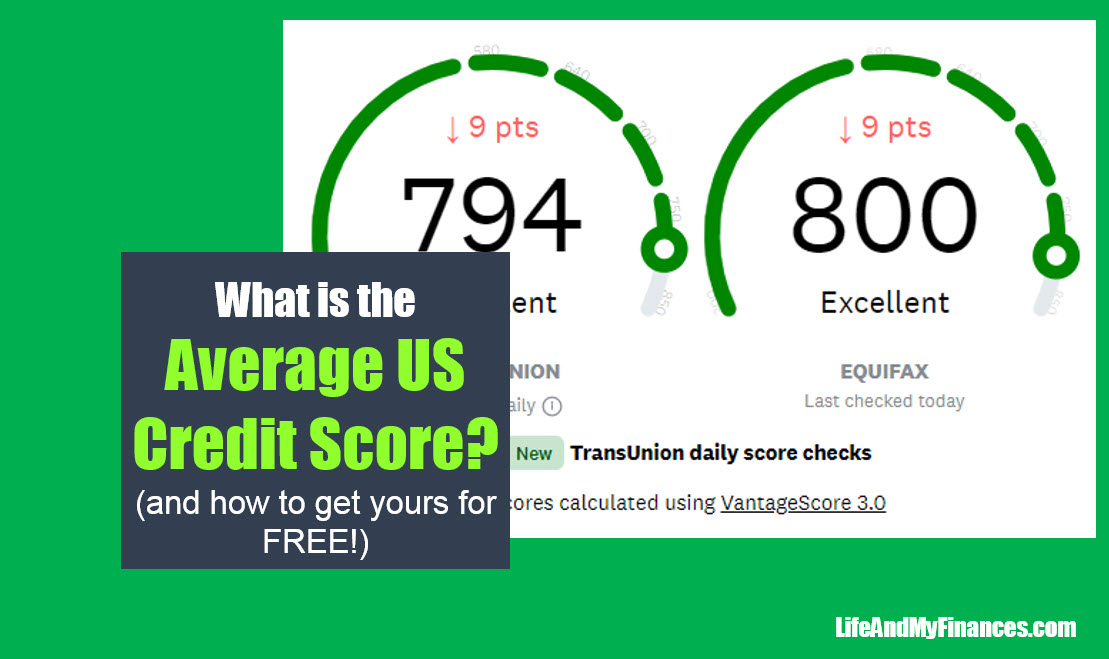

Your are based on the information in those credit reports. Generally speaking, the higher the score, the better. FICO® and VantageScore® provide some of the most commonly used scores. But keep in mind that you have many different credit scores that different lenders use.

As the Consumer Financial Protection Bureau explains, âYour score can differ depending on which credit reporting agency provided the information, the scoring model, the type of loan product, and even the day when it was calculated.â

Why Is Credit Important?

Your because it gives lendersâand othersâa general idea of how financially responsible you are. And many companies use your credit to predict your future financial behaviors.

So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates might be.

You May Like: When Does Usaa Report To The Credit Bureaus

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

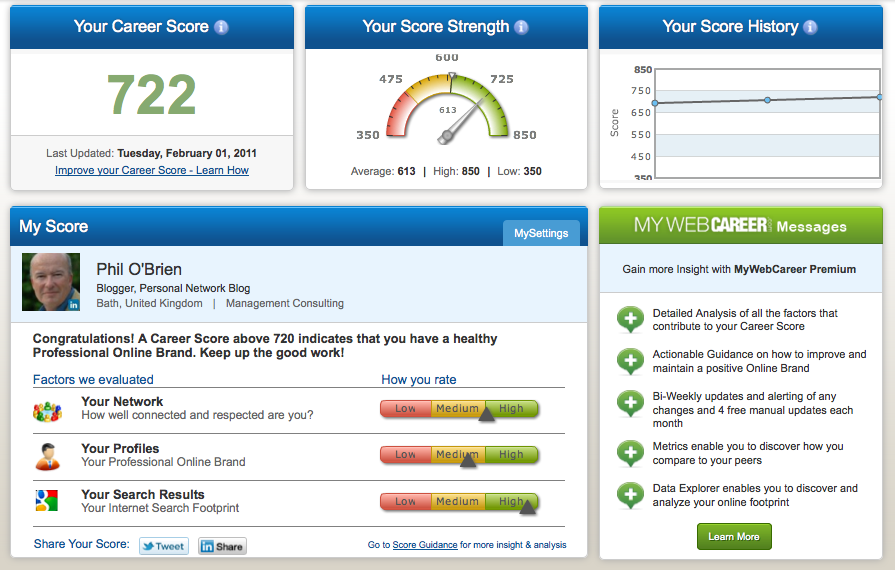

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Read Also: How To Get Public Record Off Credit Report

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

You May Like: Speedy Cash Collections

How To Safeguard Your Identity

If you find accounts listed on your credit reports that you did not open or if you are worried about identity theft, you might consider filing a free fraud alert on your credit file that remains active for one year through the Experian fraud center. The fraud alert notifies lenders pulling your credit report to take extra steps to verify your identity.

You can also freeze your credit reports, another free measure that prevents lenders from issuing new credit in your name altogether. Or try Experian CreditLock, a benefit of your Experian membership, which allows you to lock and unlock your report in real time, with no waiting period.

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

Also Check: Raise Credit Score 50 Points In 30 Days

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

Recommended Reading: Usaa Credit Monitoring Experian

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

You May Like: Syncb/ppc Credit Card

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

Recommended Reading: Sync/ppc On Credit Report

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Don’t Miss: What Is Cbna Bby

What Is A Credit Report How Can It Help Me Monitor My Credit

Your credit report shows information about you and your history with credit. It includes your accounts, payment history and sometimes negative marks such as collections, if you have them. That information has a powerful impact on your finances and your credit score so its important to be sure the data is correct and up to date. You can dispute errors and ask for them to be removed by the credit bureau or creditor responsible for the data. Checking your credit report also helps you watch for signs of identity theft or fraud. To help you stay on top of things, NerdWallet will alert you to changes on your TransUnion free credit report so you can monitor your credit efficiently.

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

Recommended Reading: Unlock Transunion Credit Lock

Contacting The Credit Agencies Directly

If you prefer, you can call the major credit agencies directly and request a credit report at no charge. However, the FCRA-mandated Annual Free Credit Reports are only available through the website and phone number above. In other words, you might have to pay if you contact a directly.

The only way to get your annual free credit report is to use AnnualCreditReport.com or the phone number above. If you go any other route, you may have to pay or subscribe to a private service.

If you need additional credit reports , numerous companies try to sell subscription services or paid reports. That said, you might not need those services.

Contact the credit bureaus:

What Does A Credit Report Show

Your credit report will show personal information that identifies you like your date of birth, social security number, address, previous addresses, phone numbers, credit accounts and payment history. It may also include things like collections, repossessions, foreclosures and bankruptcy filings. Credit reports also have records of who has accessed your credit information. This can consist of the names of your creditors and marketers.

You may find two types of inquiries on your credit report and it’s beneficial to know the difference between the two. The two types are hard inquiries and soft inquiries. Hard inquiries on your credit report indicate that a lender checked your credit report and typically involves a decision about loaning money or extending credit. Hard inquiries can show up on your credit report for up to two years and could potentially affect your credit score. Soft inquiries are simple reviews of your credit and don’t affect your credit score or appear on the credit reports that potential lenders view.

Keep in mind, your credit report won’t include information about your marital status, income, level of education or checking or savings account balance. It could, however, include your spouse’s name if it’s been reported by a creditor.

Don’t Miss: Experian Temporary Unlock

To View Your Score In Online Banking:

- Sign in to Online Banking

- Scroll down to the box on the right-hand side labelled My Services

- In the My Services box, select View Your Credit Score

- Review the legal disclaimer and select Continue

- Review the CreditView Dashboard agreement and select I Accept & Continue

Your credit score appears, along with various tools, calculators and educational information about credit reports, credit monitoring, credit cards, mortgages and much more.

Warning About Impostor Websites

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

Read Also: Does A Closed Account Affect Credit

Additional Ways To Acquire Your Credit Report

The above strategies are focused on the three major credit bureaus: Equifax, Experian and TransUnion. However, while those three bureaus are nationwide and are likely to have the most comprehensive consumer data on you, they are not the only organizations to compile credit reports.

According to the CFPB, you are also eligible to receive free annual reports from approximately 50 additional specialty credit-reporting agencies. These companies compile consumer data in the following areas:

- Checking and banking accounts

- Gaming history

- Low income and subprime credit

- Medical records

- Supplementary credit records

- Tenant and rental records

- Utility payments

While it may be overkill to pull dozens of credit reports from these niche agencies on a regular basis, their reports can come in handy in certain circumstances. If a bank denies your request to open a checking account or if a landlord rejects your rental application, you can pull a report from the corresponding agencies to see if somethings on your consumer record.

View the CFPBs detailed list of credit agencies for contact details of the individual companies and what areas they specialize in. Note that not all of the companies are nationwide, and they might not all have data on you.