Exceptions To The Impact On Your Credit Scores

If you’re shopping for some types of loans, such as a mortgage loan, multiple inquires for the same purpose within a certain period of time are generally counted as one inquiry. The timeframes may vary, but range from 14 days to 45 days, depending on the credit scoring model being used. All inquiries will show on your credit reports, but generally only one within the specified period of time will impact your credit scores. This exception does not apply to credit cards.

Care Credit Approval Odds And Starting Limit

Hi. I posted earlier about wanting to apply for care credit. I would like to get opinions on if I might get approved. Per credit karma I have one collection that is 3 years old for $1083 from breaking my lease before it was time. I have four store cards that are all 3months to 18 months old, a car loan which will be paid off in June of this year and student loans totalling $32k that are in a repayment plan for $0 but currently showing in ck that I have paid off -1% of my loan. My student loans are 12 years old and I consolidated the 5 into one loan 6 months ago. My car loan was a 3 year note. I am currently living with family and we split the rent and bills and I pay around $500 a month. My utilization is at 8 % and also per credit karma my payments history shows 100%. I would like to know if a. I have a good chance of getting approved and b. If I get approved what is the highest limit, both starting and months down the road with cli that I could possibly expect with a $35k annual income. I really need about $11k-$12k for the dental procedure. I am not sure on myfico scores but my credit karma shows 675 for transunion and 660 for equifax.

Get Your Inquiries Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Read Also: How To Report A Death To Credit Bureaus

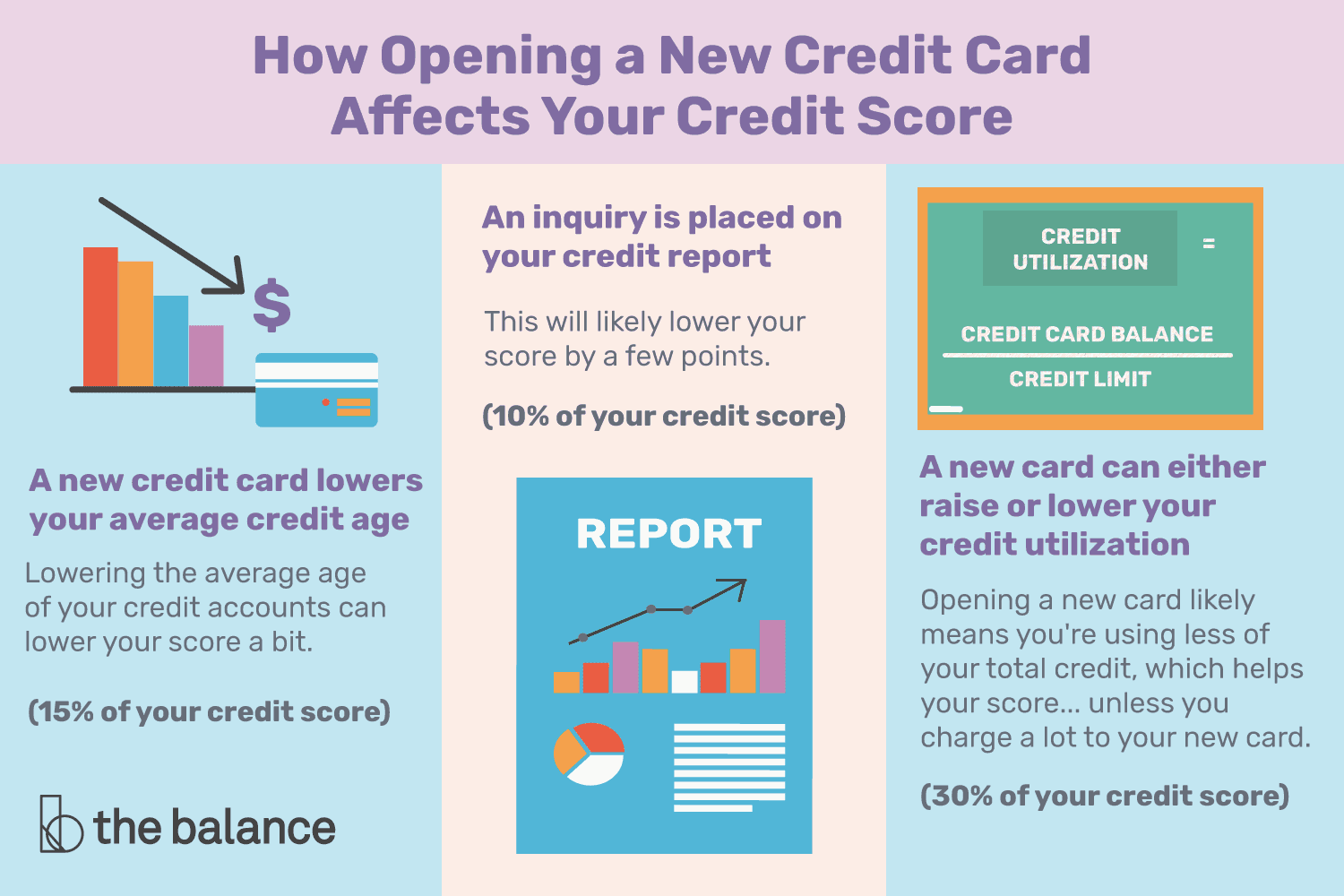

Does Adding A Credit Card Improve Your Credit Score

If you’re thinking about opening a new credit card and are wondering whether it will help your credit score, the answer is yesand no.

Applying for a new card can initially lower your score because the card issuer will do a hard credit pull when deciding whether to approve your application. Further, a new account can potentially work against your scores as it will lower the average age of your accounts. On the other hand, a new credit card can help your credit utilization, which is an important factor in your scores. A new card can help you in the long run, especially if you keep it open for several years and make payments on time, but you may feel some short-term pain.

How To Use Your Credit Card To Improve Your Credit Score

If you decide to open a new credit card, it’s important to be strategic about how you use it. After all, you want the card to help you build credit and develop an excellent financial profile. Here are some ways to do that:

Recommended Reading: Removing A Repossession From Credit Report

Benefits For Providers And Patients

Used wisely, medical credit cards offer benefits to both health care providers and patients.

For providers, the cards enable their patients to get treatment they need without delay. The card issuer pays the charge upfront and assumes all the risk of the borrower not paying, so medical providers dont have to be in the financing or debt collection business.

For patients, paying a little bit each month on a large bill lets them get treatment on a manageable budget as long as they understand how these cards work.

Alternatives To Closing Your Card

Closing your credit card isnt the only measure you can take, especially considering the potential damage to your credit score.

TIP: Keep in mind the two credit cards you may want to keep around: your oldest and the one with the highest credit limit. These will limit the damage to the length of your credit history and your credit utilization ratio.

If youre keeping a credit card you dont use much but are looking for some ways to make it more beneficial, consider switching to another credit card from the same credit card issuer. Take a look through their current offerings to see whether theres a comparable credit card that would be a better fit for you. Some issuers allow you to switch credit card accounts, or change products, without a detriment to your credit history, but you likely will not be able to take advantage of new-customer sign-up bonuses if you change credit card products with the same issuer.

If the credit card you want to cancel has a high interest rate, consider transferring the balance to another, lower-interest, card. Youll be able to keep your card and pay off the balance at a lower rate. Keep the old credit card active by making a small purchase each month and then paying it off in full.

Finally, if youre having trouble resisting the temptation to spend, you can put your credit card awayor cut it upat least until youre finished paying off your debt.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Carecredit Is In Business To Make A Profit

Though their marketing pitches focus on providing access to affordable healthcare, it is important for consumers to keep in mind that CareCreditand other similar healthcare credit card companiesare in business to make a profit.

They offer no-interest financing, counting on many consumers overextending themselves and being unable to pay their bills in full, thus incurring expensive financing charges. They may also count on consumers misunderstanding the terms.

According to the Consumer Financial Protection Bureau , CareCredit has “misled some consumers during the enrollment process by not providing adequate guidance clearly laying out the terms of the deferred-interest loans.” Such loans assess interest starting from the date of purchase throughout the promotional period if cardholders fail to pay the debt in full by the end of that period, they must pay all the accrued interest .

In 2013, CFPB ordered CareCredit to refund $34.1 million to cardholders. In response, the firm created a CareCredit Certification with its providers “in an effort to ensure that every CareCredit card applicant is given a clear, easy-to-understand explanation of financing options available.”

However, the firm’s “promotional financing options”the ones with no interest, or a relatively low interest rateare not available through every provider. Cardholders should check with their provider to determine the available options.

S To Take To Improve Your Credit Score

Knowing that credit can impact so many aspects of your life, you may want to take an active approach to monitoring and improving your credit score. Even if youve made mistakes in the past, you can follow these basic credit improvement tips and work your way toward good credit.

Don’t Miss: How Long Does It Take For Opensky To Report

Is Care Credit Available In Canada

Canadian residents are welcome to apply however, applications must be made in person at a providers U.S. location.

About the author

Clara is the founder of Credit Rise Up, an entrepreneur, credit, and personal finance enthusiast. Shes committed to helping her readers get on the right track and take actionable steps towards improving their credit by using the experience that allowed her to join The 800 Club. Find out more.

How A Car Loan Can Improve Your Credit Score

One of the best overall ways to improve a credit score is to seek a diversity of revolving credit and include investments like credit cards and installment loans.

Car loans are a great starting point for many people looking to establish a credit history through installment loans. This loan is much less of a financial investment than other borrowing options, like a mortgage. However, it still helps you build credit.

If youre seeking a car loan and already have a high credit score, youre ahead of the curve. Those with established credit can secure a car loan with lower interest rates. And that can save you thousands over the lifetime of the loan. Its a good idea to build up your credit history so that you can lower your payments.

Anytime you take out a loan, it will affect your credit history. Whether it has a positive impact or not comes down to your spending habits. You may take out a loan with good intentions, but if you dont make your payments on time, it can really damage your credit scores.

There are some key strategies to consider to increase your credit score if its no longer in the budget.

Check Out Our Top Picks:Best Auto Loans of 2021

Recommended Reading: What Credit Bureau Does Target Pull From

Some Clinics Aggressively Promote Health Care Credit Cards To Make More Money

Banks oftenencourage dentists, medical clinics, chiropractors,cosmetic and eye surgeons, weight loss programs,hearing aid dispensers, and other providers to offerhealth care credit cards to their patients as a way tomake more money for the clinic. When a patientcharges services on a health care credit card, the clinicis paid right away by the credit card company, evenif the services are to be delivered in the future. Somepatients report feeling pressured by their clinics toenroll in health care credit cards to pay for care thatthey do not need or want or cannot afford.

Patients should remember that clinics have an incentiveto aggressively promote these credit cards as aguaranteed way for the clinic to get paid promptlybut that the cards may not always be in the patientâsbest interest. Do not let your clinic pressure you intotaking out a credit card you do not want. Do not signup for anything without asking to read the fine print.

Why Should You Check Your Credit Score

Now you know that you can check your credit report and score without damaging the credit youve worked hard to build, but why should you care? Does your credit score really matter as much as some people say it does?

Its easy to believe your credit score is inconsequential, but anyone whos ever purchased a home, borrowed money for a car or applied for a credit card can tell you otherwise. While your past credit behavior isnt the only factor thats considered when you apply for new credit, your credit score alone tells lenders a lot of what they want to know.

If you have a credit score thats considered good meaning a FICO score of 670 or better youre much more likely to be approved for the new credit line you want with fair terms and conditions. But if your credit score is lower than that, you may have to pay more fees and higher interest along the way, or you may not get approved at all.

Interestingly, your credit can even impact your auto insurance rates or your ability to get a job if a potential employer asks to see a modified version of your credit report as a condition of your hire. Good credit can be the key to getting the life you want, but the opposite is also true.

Checking your credit wont hurt your score, and its the best way to know where you stand. It always makes sense to keep your credit score in good shape, so yes, check your credit score now and keep track of how your score changes over time.

Read Also: Bp Visa Syncb

How Do You Apply For Carecredit

You have several options. You can apply:

- Through a participating healthcare provider

- By calling 800-677-0718 note, they ask that you read the credit card agreement before you call

Be prepared to provide the following personal information:

- Your name

- Net income

- Housing info

Youll also be asked your doctors name or how you plan to use the card. And, of course, you need to be at least 18.

Approvals are instantaneous.

Apply For Credit When You Really Need Credit

Nonetheless, dont try to trick the system. Most credit and financial professionals are very clear on one thing dont apply for credit that you arent going to use. That means, dont apply for a credit card only to help your score. Only apply when you have a need and are able to manage new debt. If you are a responsible borrower with an established credit history who pays their bills on time, the rest will take care of itself.

FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com and cardmembers are also provided a score on statements. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Read Also: How Personal Responsibility Can Affect Your Credit Report

Should You Close Old Credit Cards

If you have an old credit card that you rarely use, you might think the best option is to get rid of it. After all, why keep an account you never touch?

Reality is a little more complicated, though. When you close a credit card, you lose access to that credit line and your credit utilization can increase . The overall age of your credit also drops, since that account no longer factors into your score. The result is that your score could actually decline in the months following your account closure. Because of that, you may want to keep your old accounts open if you plan to apply for new financing soona mortgage or car loan, for example.

However, there are circumstances in which it may be best to close the account, particularly if you aren’t applying for a new loan or card anytime soon. If your card has a high annual fee or high interest rate, you may want to close it in favor of getting a more competitive card down the road. You might also want to close the account if you find that you’re overspending on it and racking up more debt than you can afford.

What You Can Do If Your Application Is Approved With Insufficient Credit Or It’s Declined

If your application is declined, a message with an explanation is sent to the primary email address associated with the Apple ID you used to apply for Apple Card. The message might show your credit score. If information provided by a credit bureau contributed to your application being declined, you can request a free copy of your credit report from that credit bureau using the instructions in the email you receive.

If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How A Card Switch Affects Your Credit Score

- Copy Link URLCopied!

Dear Liz: I have one American Express card and two Visa cards, all of which I have held for many years. I received notice that my American Express card was being converted to a Visa card. I do not want a third Visa card but have no choice. For credit score purposes, will this conversion appear to be a closing of my old card and an application for a new one? Obviously, closing a long-held credit card and applying for a new one will affect my excellent credit score, which is 830. If I decided to apply for a new American Express card, how would that impact my score?

Answer: Conversions from one issuer to another can have a temporary negative impact on your credit scores as one account is closed and another opened. The effect should be minor as long as you have other open, active accounts.

Within a month or two, the new account should show the same history as the old one, and your scores should recover.

The type of card usually matters less than the benefits associated with the card. If those benefits are useful to you and are enough to offset any annual fee, consider keeping the card. Its long history and credit limit are likely helping your scores.

That doesnt mean you have to keep a card you really dont want. The fewer cards you have, though, the more careful you probably need to be about closing one.

A South L.A. woman was told the limit on a credit card shes held for 36 years was reduced because she didnt use it enough during the pandemic.