Conventional Loans: Minimum Credit Score 620

Non-government conventional mortgage loans charge higherinterest rates and fees forborrowers with lowcredit scores.

Fannie Mae and Freddie Mac, the agencies thatadminister most of the conventional loans in the U.S., charge loan-level priceadjustments, or LLPAs.

These fees are based on two loan factors:

- Loan-to-value: the ratio between the loan amount and home value

As LTV rises and credit score falls, the fee goes up.

For instance, a borrower with 20% down and a 700credit score will pay 1.25% of the loan amount in LLPAs.

An applicant with a 640 score and 10% downwill be charged a fee of 2.75%.

Thesefees translate to higher interest rates for borrowers. That means lower-creditscore applicants will have higher monthly payments and pay more interest overthe life of the loan.

The majority of lenders will require homeowners tohave a minimum credit score of 620 in order to qualify for a conventional loan.

But although conventional loans are available tolower-credit applicants, their fees often means FHA loans end up being cheaperfor borrowers with bad credit scores.

What Are Fha Guidelines For Employment History And Loan Income Requirements

A two-year employment and income history is required for both employees and self-employed borrowers by way of pay stubs, tax returns and W2s or 1099s.

Borrowers with court ordered alimony and child support must document receipt of the income for a minimum of three months and proof that it will continue for at least three years.

Also Check: Does Affirm Show Up On Credit Report

Fha Loans With No Credit

If you havent established credit yet, FHA lenders will sometimes allow the use of non-traditional credit to qualify for a mortgage. This includes a good payment record for utility payments, rental payments and auto insurance payments. Applicants must also have sufficient income to qualify for an FHA home loan. Lenders require copies of tax returns, W2s, paycheck checks and bank account statements.

Also Check: How To Report Death To Credit Bureaus

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

Wells Fargo Lowered Their Fha Score Requirement To 600

A couple of years ago, Wells Fargo announced they were lowering their minimum credit score requirement for FHA loans from 640 to 600. This is big news for a couple of reasons. First of all, Wells Fargo generates more home loans than any other lender in the U.S. Secondly, going from 640 to 600 is a fairly large reduction.

As a result of this change, tens of thousands of previously unqualified borrowers could now qualify for an FHA loan through Wells Fargo. Why did they do it? According to executive vice president Franklin Codel, it has a lot to do with legal settlements last year that allowed the lender to move away from bad-loan penalties.

“Putting those issues behind us has allowed us to get much more comfortable and we are starting to open up our credit box,” Codel explained.

Recommended Reading: How To Report A Death To Credit Bureaus

Fha Home Loan Requirements

FHA home loan requirements are evident in the last two years especially, if you do not have FHA loans, many people will not be able to get a loan.

Everyone is aware of the fact that there was a recession caused the bankruptcy of many banks. When I ran the news, I saw the people who were looking through their bank cup and knocked on the door demanding that their money is removed before the lockers entered their banks permanently. Secured loans from the Government, such as the Federal Housing Administration loans, have become a common and viable option.

Even people who have bankruptcy can qualify. According to FHA requirements, bankruptcy must be at least two years. If you have a foreclosure on your credit, as many people found themselves in this case, an FHA loan must have been at least three years since the foreclosure.

Many conventional loans have stricter standards. Some conventional loans will not allow the loan if there is ever foreclosure on your record. Since taking the drastic and radical steps of bankruptcy or obtaining foreclosure, the borrower must since have full credit showing goodwill in their ability to maintain now the responsibility of paying your bills on time from that point forward. FHA requirements are very tolerant of flaws and hard times in the past.

Why Do Credit Scores Differ Between Online Sources And Mortgage Lenders

Heres a common story: You apply with a lender thinking that you know your credit scores. Then, the lender informs you that its credit scores were far lower than the free scores you got online. Theres good explanation. There are many different versions, models, and algorithms when it comes to credit scores dependent upon the purpose and type of industry.

The main goal of credit scoring is to predict the likelihood that a person will fall at least 90 days behind on a bill within the next 24 months.

Consider this: There is no default risk to allowing you to check your credit and credit scores online or through an app. However, the default risk to an auto lender for granting you a $40,000 loan is far greater than that of a credit card company that is considering a $2,000 credit limit.

In comparison, the risk associated with granting you a $200,000 mortgage loan is far greater than any of the prior examples. It makes sense that each type of creditor would use a different type of credit scoring.

Related: Raising Your Credit Score Can Save Thousands in Interest. Heres Why.

Don’t Miss: How To Unlock My Experian Credit Report

Fha Maximum And Minimum Loan Limits

There is no minimum loan limit, but there is a maximum limit when it comes to the amount you can borrow with an FHA loan. That max amount depends on where you live and the type of home youre purchasing. You can use this tool to see the specific FHA loan limits for your county, but loan limits are generally informed by the surrounding property values and a certain areas cost of living.

What Are The Lender Requirements For A Fha Loan List

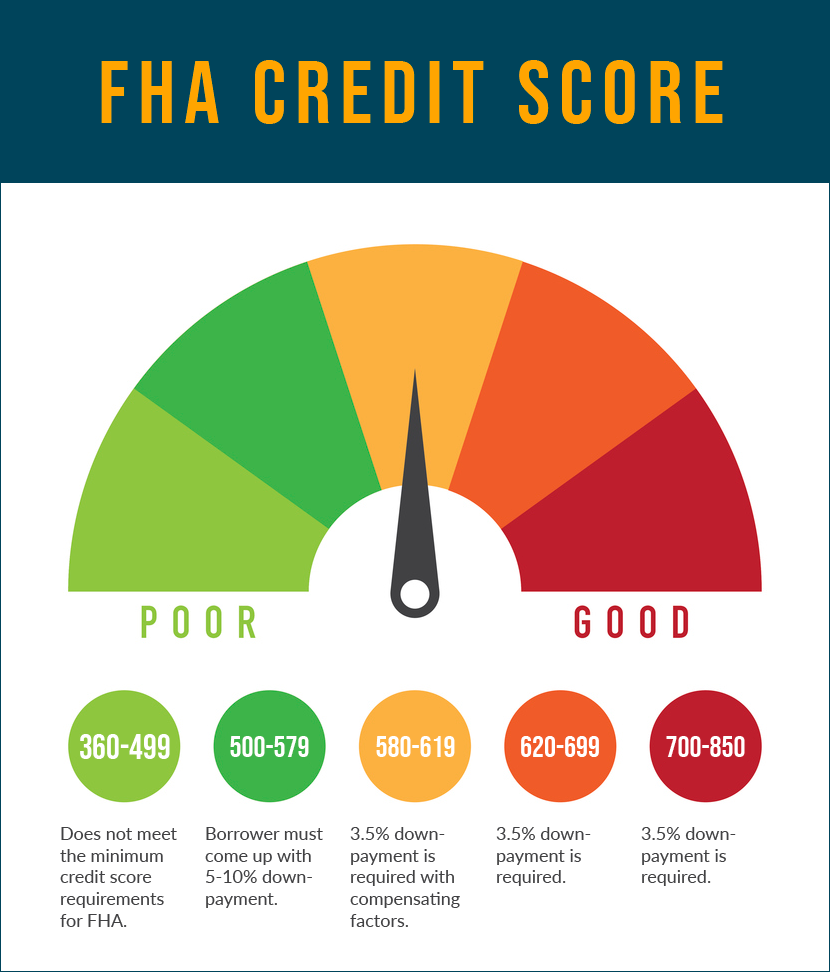

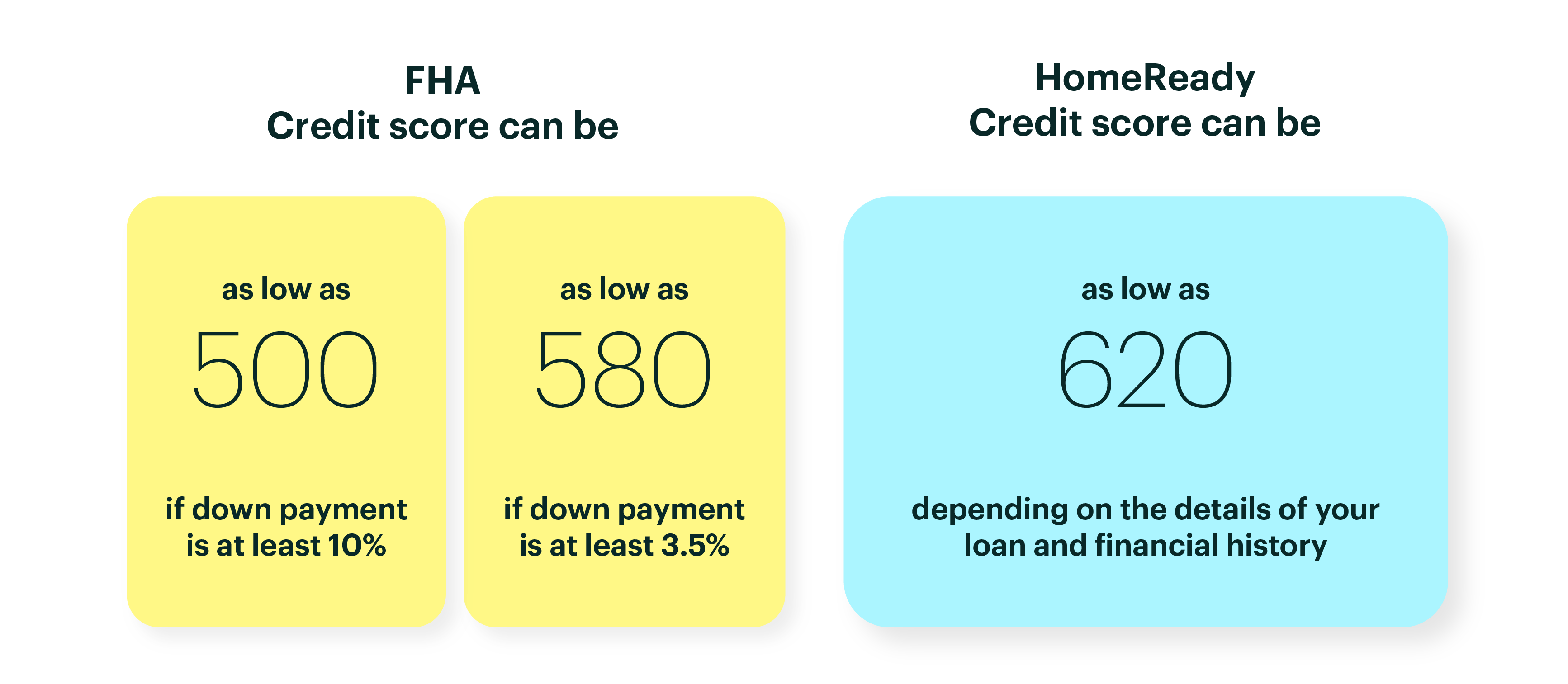

To qualify for an FHA loan, borrowers must meet the following credit criteria: a FICO score of 500 to 579 with a 10% lower, or a FICO score of 580 or higher with a lower percentage. Proven employment in the last two years. Income is verified by payroll, federal income tax returns, and bank statements. The loan is used for primary residence.

Also Check: Speedy Cash Collection Agency

Since You Have A 580 Credit Score You Have Two Options As Far As Down Payment Is Concerned

Mortgage 580 credit score. FHA Loan with 580 Credit ScoreThe most common type of loan available to borrowers with a 580 credit score is an FHA loanFHA loans only require that you have a 500 credit score so with a 580 FICO you will definitely meet the credit score requirements. Instant industry overview Market sizing forecast key players trends. The Federal Housing Administration allows credit scores as low as 580 for a 35 down.

Get professional service leave it to us to get you the best housing loan rates for free. Find updated content daily for mortgage 580 credit score. Available With A Catch.

Ad This is the newest place to search delivering top results from across the web. A long time on the job extra savings reserves. If your credit score falls below that you can still get a mortgage but youll have to.

Read more about getting car loan with 580 credit score. The interest rate for a credit score of 580 will increase the monthly mortgage payment by 222 more than someone with a score 95 points higher at a credit score. The 580 credit score mortgage is a great way back for borrowers that have compensating factors to get approved for a home loan.

Below is a list of some of the best mortgage lenders for borrowers that have a 580 credit score. This is in consideration of mortgage insurance. Home loan with 580 credit.

This goes for mortgages as well. Most stop at 580. However not all low credit score lenders go as low.

Pin On Credit Cards

Pin On Credit Score

Berbagi :

Application Process And Underwriting

Regardless of which mortgage product you choose, the first step to homeownership is applying for preapproval, and that’s true of both USDA and FHA loans. The preapproval shows home sellers youre serious about buying and assures them youll be approved for the mortgage.

You may also have the option of getting a prequalification, where the lender bases the decision on information that you provide. With a preapproval, the lender goes one step further by running a report on your credit history and requiring documentation such as tax documents and pay stubs to get an accurate picture of how much home you can buy. Getting a USDA or FHA preapproval or prequalification will kick off the mortgage underwriting process so you can shop for a home without worrying about whether youll actually be approved.

The process of getting a USDA loan typically takes longer than an FHA loan, largely because USDA loans are underwritten twice, first by the lender and then by the USDA. To have the loan automatically underwritten by the USDA, youll need a credit score of 640 or higher. Manual underwriting, which adds time to the loan closing, is reserved for those with scores under 640. The time it takes for underwriting depends on where youre planning to purchase and how much backlog the USDA agency in that area has. Expect a USDA loan to close in 30 to 45 days.

Recommended Reading: How Accurate Is Creditwise Credit Score

Fha Loan Wisconsin Laws

To qualify for a Wisconsin FHA loan, your home loan must be below the loan limits set by the local FHA in your area. For 2021, Wisconsin’s maximum credit limit is $356,362 for a single-family home and $774,050 for a quadruple room. The limits vary from one area to another. The minimum borrowing limit is $5,000.

How Do Fha Loans Work

FHA loans can give people with lower incomes or those with lower credit scores the ability to become homeowners. In order to offer a more relaxed credit requirement and a lower down payment, FHA requires you to pay mortgage insurance. If you defaulted on your loan, FHA would be responsible for paying off the remainder of your loan. Mortgage insurance limits the amount of money the lender may lose.

Mortgage insurance is considered a closing cost. Closing costs are the upfront fees required when you close on a home, and they’re separate from your down payment. Lenders and third parties can cover up to 6% of closing costs on FHA loans, including attorney, inspection and appraisal fees.

FHA-backed loans allow for financial gifts from family, employers and charitable organizations to help cover closing costs.

The borrower is responsible for paying two FHA mortgage insurance fees:

You May Like: Syncb Ppc Account

Why Do Different Mortgage Lenders Have Different Fha Credit Score Requirements

Each mortgage lender has the flexibility to decide what loans they wish to offer and the lowest credit scores theyre willing to accept. Even though the FHA has requirements, FHA-approved lenders can also impose their own standards, a practice known as overlaying, depending on the level of risk theyre willing to tolerate. Thats why you might see different FHA credit score requirements with different lenders.

We have large lenders in this country that exited from doing government loans five or more years ago, Tait explains. Some of them just wont do an FHA loan.

Fha Loans Vs Conventional Loans

*The percentages show the market shares of each home financing option. Cash purchases of homes are responsible for 11% of the overall home financing. The diagram uses data from 2019.*

FHA loans are provided from institutions which have been approved by the FHA and are guaranteed by the Federal Housing Administration whereas conventional loans are provided by private institutions.

Conventional loan interest ratesare typically a little higher than FHA mortgage rates.Thats because FHA loans are backed by the Federal Housing Administration, which makes them less risky for lenders and allows for lower rates. Todays average FHA rates are as low as 2.25%, while conventional rates are as low as 2.875%. However, if you have a great credit score you might qualify for a lower conventional rate.You also have to consider the annual mortgage insurance rate with each loan.Depending on your credit score and down payment, conventional mortgage insurance rates could be higher or lower than FHA insurance rates. This will affect which loan is cheaper overall.

Check out ourConventional vs FHA Loanspage for more information.

The following table highlights the key differences between FHA loans and conventional loans.

| FHA Loan |

|---|

There are advantages and disadvantages to both loans as shown in the table.

Don’t Miss: Does Paypal Credit Report To Credit Agencies

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Debt In An Fha Dti Ratio Calculation

You must disclose all debts and open lines of credit on your loan application. You might wonder why you need to describe your open line of credit. These can become debt if the homebuyer goes on a shopping spree before closing, so the FHA directs lenders to keep an eye on open lines of credit.

Lets start by calculating a back-end DTI ratio with example numbers.

The FHA calls the back-end ratio the total fixed payment expense DTI Ratio. Disclose your college loans, balances on your credit cards, auto loans, and how much youll pay in both auto insurance and homeowners insurance. Include any personal loans from family, and other debts.

Spousal and child support obligations are considered debt to the person required to make the payments.

Now lets use the same numbers to calculate a front-end DTI ratio:

The FHA calls the front-end DTI ratio the total mortgage expense DTI Ratio.

Dont Miss: How Do I Unlock My Experian Credit Report

Read Also: Authorized User Capital One

Fha Loan Eligibility Requirements

FHA loans are also for low- to moderate-income Americans. You may qualify for an FHA loan through an FHA-approved lender if youre a first-time home buyer or if you havent owned a home for at least 3 years.

- There are no income requirements for FHA loans, but you do need to prove your income and that youll be able to pay your mortgage and insurance each month.

- You must have a minimum credit score of 580 in order to be eligible for an FHA home loan.

- You may still qualify for an FHA loan if your DTI is high compared to your income, particularly if your credit score is higher.

- Youll need to make a down payment of 3.5% if your credit score is 580 or higher. You can still get an FHA loan if youve got a credit score in the 500 579 range, but youll need to come up with a 10% down payment. .

Fha Loan Income Requirements

There are no maximum income limits for FHA loans, which means making a certain amount of money wont disqualify you from eligibility. You will need to provide evidence of steady income and proof of employmentlenders generally want to see at least 2 years of consistent job history, which is a standard guideline with all loan applications. FHA lenders use your employment to confirm your ability to pay back your mortgage, which is why they also evaluate your debt-to-income ratio. In this case, the amount of money you take home is less important than the portion of that income earmarked for other debt.

Read Also: How To Remove Repossession From Credit Report

What Our Customers Say About Us

Neighborhood Loans was great to work with or getting a home mortgage. This team was really quick to respond to any questions that came up, were constantly looking for better rates and on top of all issues that arose. Getting a mortgage is a lot of work. If you are looking for a mortgage broker for purchasing a home, I recommend Neighborhood Loans. They will make the process smooth and look out for your best interests.- Laurel M.

Neighborhood Loans is a top-notch company to work with. Their workers are so knowledgeable and helpful throughout the entire process. I have used Neighborhood Loans for many home purchases and refinances, I would highly recommend them. The owner Reno is the real deal, he cares about his customers and makes sure EVERYONE is 100% satisfied.- J. Conone

They helped me out with a 203K loan on my first property. Explained the steps of the process to me before and throughout, as well as being there through text, call, or email whenever needed. Definitely would recommend Neighborhood Loans if you’re looking to purchase a home. My family definitely is happy with the new place. Thanks again!- Marcin C.

Begin Your

- Downers Grove, IL – 246-4777

- Pulaski Office, IL – 649-4800

- Bucktown, IL – 688-9998

- Old Irving, IL- 938-4848

- Grand Rapids, MI- 828-4165

- Gilbert Office, AZ – 571-8008

- Peoria Office, AZ – 246-4777