The 5 Biggest Factors That Affect Your Credit

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

A is a number that lenders use to determine the risk of loaning money to a given borrower.

Here are the five biggest things that affect your score, how they affect your credit, and what it means when you apply for a loan.

How To Report And Fix Any Errors On Your File

If you do spot any mistakes, challenge them by reporting them to the credit reference agency.

They have 28 days to remove the information or tell you why they dont agree with you.

During that time, the mistake will be marked as disputed and lenders arent allowed to rely on it when assessing your credit rating.

Its also best to speak directly with the credit provider you believe is responsible for the incorrect entry.

Negative information in your name usually stays on your credit report for six years and cant be removed sooner if its accurate. However, if there were good reasons why you fell behind with payments that no longer apply, such as not being able to work during a period of illness, you can add a note to your credit report to explain this. This note is called a Notice of Correction and can be up to 200 words long

Read about notices of correction on the Experian website

Find out more about correcting personal information on your file on the Information Commissioners Office website

Sign Up To Mse’s Credit Club Which Includes Your Experian Credit Report

Our totally free MoneySavingExpert.com Credit Club helps you keep a track of your credit record. You can here’s what it does:

You can get your full Experian Credit Report for FREE through Credit Club. See our full details on how this will work.

You’ll get a free Experian Credit Score. This will give you an indicator of how lenders see you when assessing you for credit applications.

Our unique affordability score. This clever tool will help you work out how much you can afford to borrow, using calculations based on your income and estimated spending.

Our unique Credit Hit Rate this will show you your chances of success, expressed as a percentage, of grabbing our top cards and loans.

Eligibility tool to show your best credit deals. It reveals the likelihood of you getting top credit cards or loans.

Wallet workout tool to check if youre on the best credit products for YOU.

Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Recommended Reading: Account Closed Repossession

Missing Your Credit Or Loan Repayments

Missing your repayments can have a pretty significant impact on your credit score. According to Experians 2019 Know Your Score report, your credit score can drop by 22% if you miss just one credit card repayment and a massive 42% if you miss three or more credit card repayments within three months. You are considered to have missed a payment if you make the payment more than 14 days late. This can be recorded on your credit report and it will stay there for two years.

If you are more than 60 days late and the payment is more than $150, then a default may be listed on your report. The credit provider will need to have taken steps to collect the debt before this, including contacting you to let you know about it and request payment. A default will remain on your report for five years.

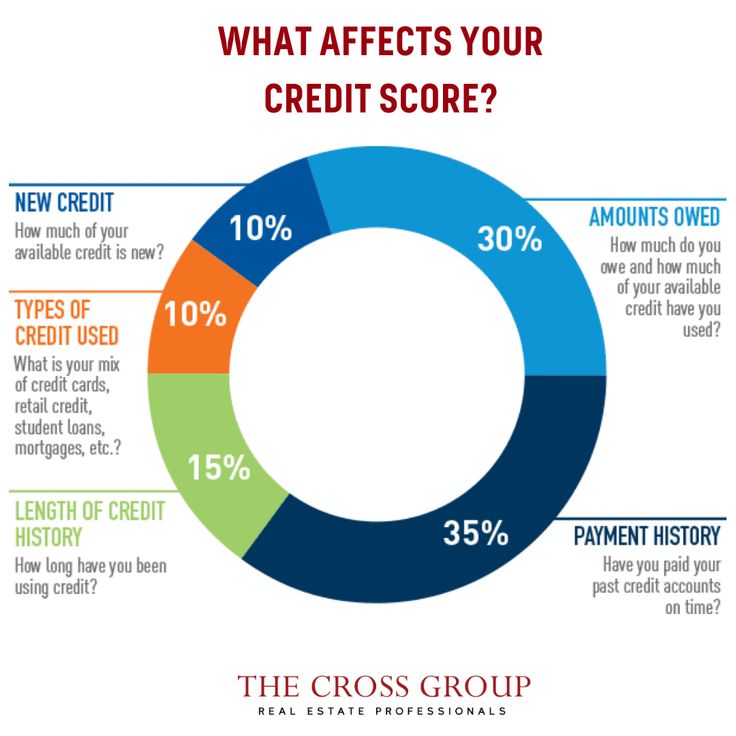

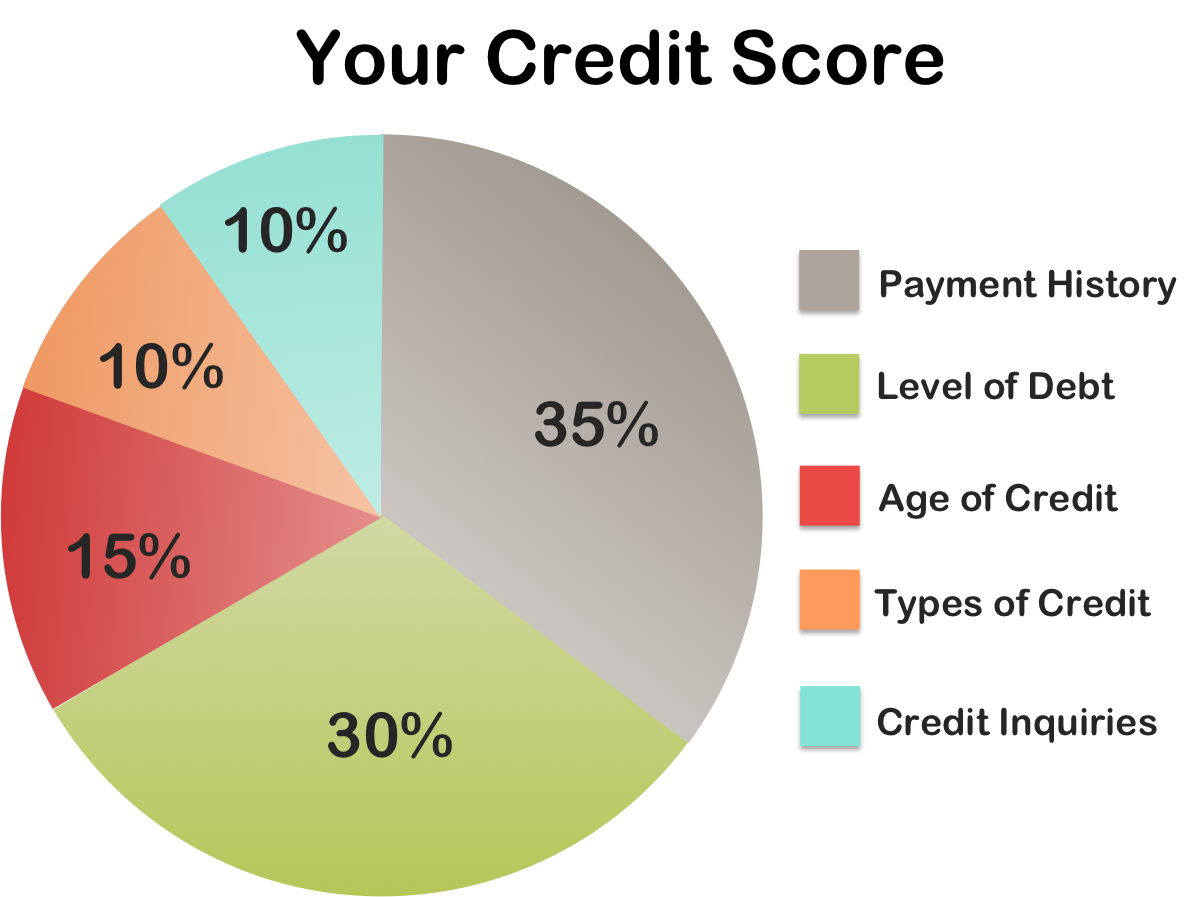

Top 5 Credit Score Factors

While the exact criteria used by each scoring model varies, here are the most common factors that affect your credit scores.

Read Also: 877-392-2016

Factors That Affect Your Credit Score

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Your credit score is a powerful number that can affect your life now and in the futurein some ways that you might not even imagine. Your score determines interest rates you pay for credit cards and loans and helps lenders decide whether you even get approved for those credit cards and loans in the first place.

Unexpected businesses, such as insurance companies, have started to use credit scores to make decisions about you. Utility companies check your credit before establishing new service in your name, and some employers check your credit history to decide whether to give you a job, a raise, or promotion.

Protecting and building your credit is more important than ever, and how you handle the following five factors can make all the difference in determining your credit score.

Your Credit Report Dictates The Product And Rate You’ll Get

In the past 10 years the credit landscape has almost completely shifted towards ‘rate for risk’. This means almost every credit provider on the market uses your credit file to not only dictate whether they’ll provide you with credit, but also what interest rate you’ll get.

The most obvious way this manifests itself is in representative rates on loans.

Here, only a minimum of 51% of accepted customers must get the rate advertised. They might be advertising a 6% rate . But you could be accepted and offered a 40% interest rate instead, because of a poor credit score.

It applies to other products too. Some 0% credit cards give you a shorter 0% period if you’ve got a poor credit history , others will simply offer you a different product to the one you’ve applied for. This is why it’s so important to manage your creditworthiness.

Don’t Miss: Can A Closed Account On Credit Report Be Reopened

Can Lenders Find Out About Coronavirus Payment Holidays

At the start of the coronavirus pandemic, lenders were offering coronavirus-related payment holidays on mortgages, credit cards, loans and more to customers struggling to make repayments. If you applied for one, here’s how taking one might have impacted your credit file:

For more information on the help currently available, and whether it’ll affect your credit file, see our Coronavirus finance & bills help guide.

Does Checking Credit Score Affect It

No, checking your credit score does not affect it. This is considered a soft enquiry and will neither increase nor decrease your score

Hard enquiry vs soft enquiry

When a lender runs a credit check for your application during its approval process, it is a hard enquiry and will appear on your credit report. Several hard enquiries in a short time will temporarily lower your credit score, as its a sign that you are experiencing difficulties getting approved.

A soft enquiry has no impact on your credit score, since it is not linked with getting approved for a loan.

You May Like: Comenity Bank Credit Bureau Dispute

Payment History: 35% Of Credit Score

This one should come as no surprise. Your history of making on-time payments on debts is one of the most important factors affecting your credit score.

No matter what type of debt, whether installment loans and revolving credit, both are heavily impacted by timely payments.

In fact, it accounts for 35% of your overall score, on two different types of credit scoring models, the FICO credit and VantageScore credit reporting scales.

Every 30 days, creditors report to the major credit bureaus , telling them whether you make your payment or not.

The bottom line, one late payment wont make or break your credit score, but multiple missed payments can seriously hurt your score.

In fact, missed payments that lead to foreclosures, bankruptcy, repossessions, and tax liens can devastate your credit score and your creditworthiness.

The longer you wait to make a payment to the issuer, the harder it is to improve your score in the aftermath.

Payment history mostly pertains to debts from mortgages, car loans, personal loans, and credit cards.

However, after several missed payments on services like your phone, internet, and medical bills, those accounts can be turned over to a debt collection agency and placed on your credit report.

Pro Tip: Automate your payments wherever possible to ensure none of your payments slip through the cracks and prioritize catching up on late payments ASAP.

Somewhat Important: Length Of Credit History

A variety of factors related to the length of your credit history can affect your credit, including the following:

- The age of your oldest account

- The age of your newest account

- The average age of your accounts

- Whether youve used an account recently

Opening new accounts could lower your average age of accounts, which may hurt your scores. But the hit to your scores could also be more than offset by lowering your utilization rate and increasing your total , making sure to make on-time payments to the new card and adding to your credit mix.

Closed accounts can stay on your credit reports for up to 10 years and increase the average age of your accounts during that time. But once the account drops off your credit reports, it could lower this factor, and hurt your scores. The impact could be more significant if the account was also your oldest account.

Don’t Miss: Do Pre Approvals Affect Credit Score

Length Of Credit History

The length of your account history makes up 15% of your credit score. It is calculated mainly by these three things:

- The average age of all of your credit lines or loans that are reported on your account

- How long your accounts have been open

- How long since you used your account last

Knowing that the age of an account on your credit report affects your score, it may be wise to hesitate from opening too many new accounts. Closing old accounts will also impact your score. The key is being balanced. You dont want to close multiple accounts at once, and you dont want to apply for several different credit lines within a short period of time either. Spread your applications out over time and remember that the longer an account is open and being reported to the credit bureaus, the better your score will be.

Having A Good Credit Mix

People with strong credit scores have often used a number of different types of credit in the past. They can also demonstrate an ability to manage them all successfully. For example, someone with a good credit score might have had a car loan, credit card, personal loan and mortgage.

You should understand what a good credit score is before you rush to take out every type of credit you can. Taking out multiple lines of credit can affect your credit score in a bad way.

You May Like: Tax Id Credit Score

I Don’t Need To Worry About My Credit Score Until I’m Older

False. The minimum age at which you can apply for credit is 18 and that’s when you should start worrying about your credit score. Financial experts recommend young people start building credit as soon as possible. The length of your credit history is a big factor in your credit score, so the sooner you establish credit the better.

For those just beginning their credit journey, check out CNBC Select’s recommendation for the best first credit card. If you’re a student, check out our list of the best cards for college students.

Your Monthly Credit Card Payments

Your last credit card payment amount is listed on your credit report, but it’s not factored into your credit score. Even so, your payment amount can indirectly influence your credit score. Remember that your balance relative to your credit limit is included in your credit score. Larger payments reduce your balance faster and can help boost your credit score.

The timeliness of your credit card payments is one of the most important factors influencing your credit score. On time credit card payments help boost your credit score while late payments will bring your credit score down.

On most types of accounts, late payments aren’t reported to the credit bureaus until they’re 30 days late. You might have to pay a late fee if you’re a few days late on your credit card payment, but your credit score should be safe as long as you pay before you’re 30 days past due.

You May Like: How Do I Check My Credit Score Chase

The Age Of Your Accounts

Just like with your address, banks and lenders like to see signs of stability in the age of your credit accounts. So, they like to see that at least one of your credit accounts has been held for several years. Just like your address, this not only proves who you are, but shows youâve been trusted by another lender over a long period of time. Itâs likely to have a positive impact on your credit score if you have an older credit account on there. If your credit accounts are all mostly new this could lower your credit score.

Tip: if you’re going to close any of your credit accounts, try not to close your oldest one. This could cause a drop in your credit score.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

You May Like: Navy Fed Car Buying Program

How Can People Improve Their Credit Scores After Being In Debt

Being in debt will automatically impact your credit rating, which can put your financial life on hold. While it wont be easy, there are ways you can gradually boost your credit rating after youve been in debt.

Register for the electoral roll

The simple act of proving where you live can improve your credit rating. All you have to do is register for the electoral roll in you local area, which will help lenders confirm your address in their accounts. That automatically makes you less of a risk in their eyes.

Maintain low credit utilisation

Pay for things on time and in full

It may sound obvious, but the best way for you to boost your credit report is by repaying your credit on time, every time, whether thats a mobile phone, money owed to utility companies, or a credit card.

Minimise Credit Applications By Using Our Free Eligibility Calculators

The only way to know if you’ll get accepted for a product is to apply. Yet that leaves a footprint on your credit file, and too many of those, especially in a short space of time, can hurt future applications. This is a catch-22, as if you get rejected, or the rate you’re offered is rubbish, you’ll want to keep applying.

These use a soft search to show your odds of acceptance for the top cards , so you can hone and minimise your applications.

You only need to fill in your details once using the eligibility calculator to find your chances for all cards from the card category you click on. The Loans Eligibility Calculator is separate, so if you’re looking for both cards and loans, you’ll need to use both calculators separately.

What are good odds?

Some will find they’re pre-approved for cards or loans. This means that you’ll get that card or loan, subject to the lender’s ID and fraud checks.

Yet if you’re not pre-approved, anything above 70% means you’ve a strong chance of getting the credit . Anything above 50% is also pretty reasonable. Anything below, and you’re taking a chance.

Don’t Miss: Notify Credit Bureau Of Death