Above 760 The Benefits Of A Higher Score Are Diminishing

As you read this guide and begin to think about the changes you want to make to improve your credit, its important to remember that it can take time.

Lowering your utilization drastically can quickly improve your credit, but dont get discouraged if you dont see a change overnight. Its also important to remember that you dont need to have a perfect credit score of 850 in order to receive the perks of a high score. Many lenders consider a score of 760 to be perfect enoughmeaning having a perfect 850 wont get you a better rate.

Finally, if you dont have credit and have been rejected for new cards, it can seem impossible to start building credit. If thats the case for you, youll want to look into applying for a secured card. This is an entry level card that requires a deposit as collateral.

Can You Raise Your Credit Scores In 30 Days

Building your credit typically takes time, but there are a few things you can do right now that may help you raise your credit scores in 30 days. Here are some suggestions that may give your credit scores a quick boost:

Make All Your Debt Payments In Full

Your payment history usually accounts for around 35% of your credit scores. As such, paying your debts and bills on time and in full is important in improving your credit scores. Any secured credit cards or lines of credit should be paid off in full whenever possible. The more you build a positive payment history, the more likely it may give your credit scores a boost.

Dont Use More Than 30% Of Your Credit Card Limit

Just because your credit card company allows you to spend a certain amount of money on your credit card doesnt mean you should max out your credit card every month. To help increase your credit scores quickly, its recommended to keep your debt-to-credit ratio around 30% and lower. This refers to the amount of credit youve used versus your total available credit limit. Doing so may increase your credit scores by 200 points or more quickly.

Fix Any Mistakes On Your Credit Report

Any mistakes on your credit report could be pulling your credit scores down. Identifying these errors on your credit report and having them rectified, is perhaps the fastest way to increase your credit scores.

Increase Your Available Credit

Negotiate With Creditors

Be An Authorized User On Someone Elses Account

Additional Reading

Use A Secured Credit Card

Another way to build or rebuild your credit is with a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help build your credit.

Impact: Varies. This is likeliest to help someone new to credit with accounts or someone with dented credit wanting a way to add more positive credit history and dilute past missteps.

Time commitment: Medium. Look for a secured card that reports your credit activity to all three major credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

How fast it could work: Several months. The goal here is not just having another card, although that can help your score a bit by improving your depth of credit. Rather, your aim is to build a record of keeping balances low and paying on time.

Recommended Reading: Does Mortgage Pre Approval Affect Credit Score

Implement Several Strategies For The Fastest Results

For maximum impact, exercise several of our recommended fastest ways to raise your credit score so they occur at the same time. Some strategies require positive action, while others would have you refrain from harmful behaviors.

You dont necessarily need excellent credit. With a little time and effort, you can once again enjoy the fruits of a good credit score, including a nicer lifestyle and increased financial security.

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account that’s six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you don’t meet the criteria, the scoring model can’t score your credit reportin other words, you’re “credit invisible.” As a result, creditors won’t be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where they’ve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If you’re brand new to credit, or reestablishing your credit, revisit step one above.

You May Like: What Is A Good Credit Score In California

Limit How Often You Apply For New Accounts

While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Each application can lead to a hard inquiry, which may hurt your scores a little, but inquiries can add up and have a compounding effect on your credit scores. Opening a new account will also decrease your average age of accounts, and that could also hurt your scores.

Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. One exception is when you’re rate shopping for certain types of loans, such as an auto loan or mortgage. Credit scoring models recognize that rate shopping isn’t risky behavior and may ignore some inquiries if they occur within the span of a couple of weeks.

Actions You Can Take To Improve Your Credit Score

Your credit score is vital for your financial life. Its what lenders will look at when deciding whether to offer you a loan or credit, and it will impact the terms they offer.

As you can see from our What is a Good Credit Score? infographic and video, credit scores range from 300-850, with general categories of:

- 300-550 Poor credit

- 680-740 Good credit

- 740-850 Excellent credit

Improving your score from one category to another could potentially save you tens of thousands of dollars on a home loan, thousands on an auto loan, and may even lower your insurance premiums.

Knowing how to improve your score involves a solid understanding of how credit scores are calculated. While the precise methods used are trade secrets, generally, we do know what factors contribute to a credit score.

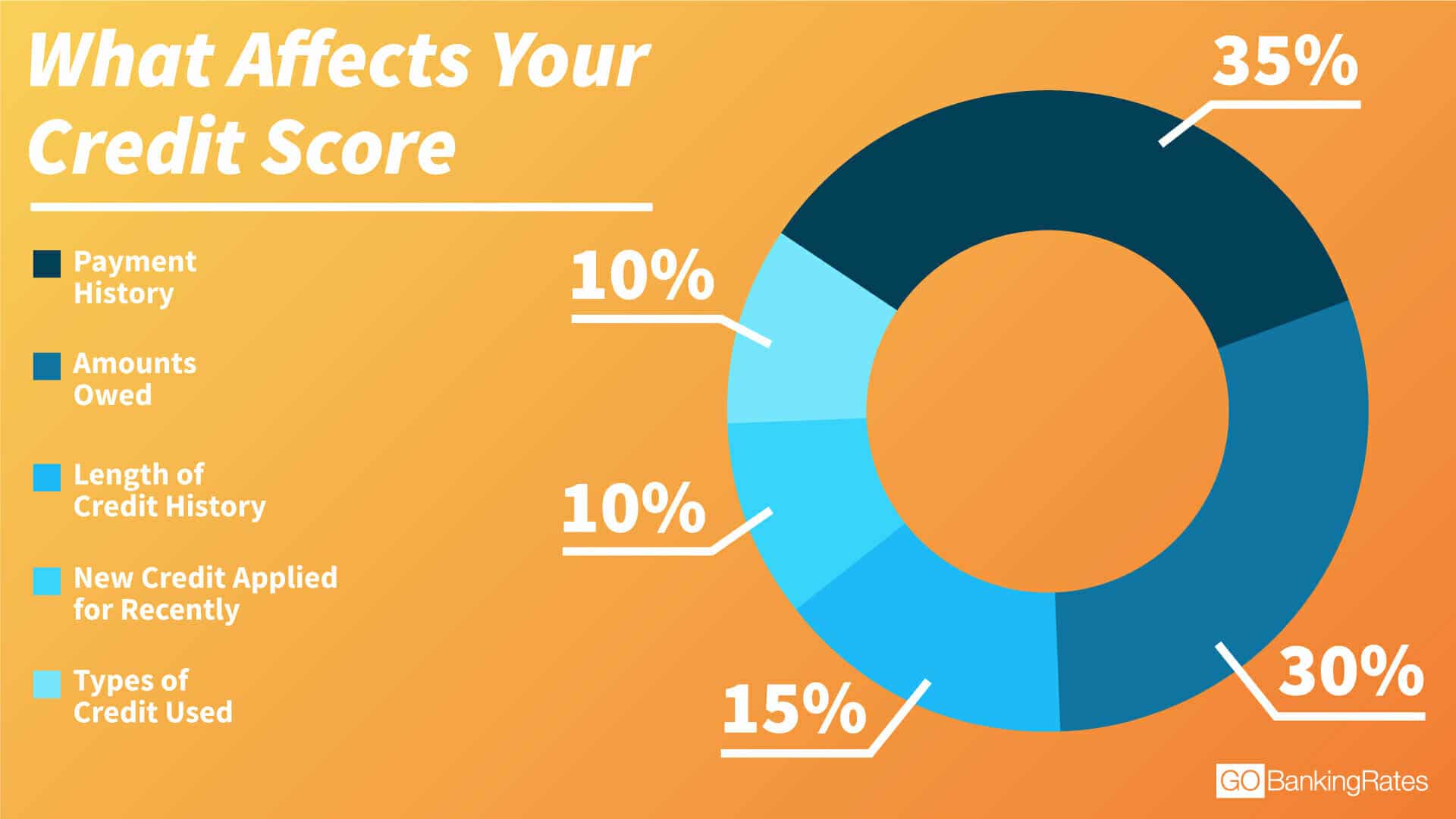

For FICO scores, the factors or calculation breaks down as follows:

- 35% Payment history

- 15% Length of credit history

- 10% New credit

- 10% Types of credit used

VantageScores, the FICO alternative from the 3 major credit bureaus, break down slightly differently, but with the same general categories.

If youre thinking of buying a home or taking out a major loan, its worth your while to know your score and if you are in a lower tier, work on improving your credit score ahead of time. Here are 5 of the best ways to raise your score.

Also Check: What Is A Consumer Credit Report

Dispute Credit Report Errors

Under the Fair Credit Reporting Act, you have the right to an accurate credit report. This right allows you to dispute credit report errors by writing to the relevant credit bureau, which must investigate the dispute within 30 days.

Errors, which can stem from data entry snafus by creditors, easily interchangeable Social Security numbers, birthdays, or addresses, or identity theft, can all hurt your credit score.

For example, if you already have a history of late payments, an inaccurately reported late payment on the report of someone could have a dramatic and fairly immediate negative impact on your score because late payments represent 35% of your credit score. The sooner you dispute and get errors resolved, the sooner you can start to increase your credit score.

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Read Also: Is 739 A Good Credit Score

What Is The Average Credit Score

The average credit score in the U.S. in 2021 was 714, according to data from Experian, one of the biggest credit bureaus in the country. The average FICO score increased 4 points from 710 in 2020, marking a record high for the nations credit score averages.

Your credit score changes over time, and the older you are, the more likely you are to have a higher credit score. Experians data highlighted the average credit scores in different age groups across the country.

Average FICO Score by Age Group

| Age Group |

|---|

Young people had the lowest average credit score at just 679. The averages steadily increased through the age groups, with Generation X achieving an average score of 705. Americans 76 and older had the highest average FICO scores, with an average score of 760.

How Long Does It Take To Improve My Credit

If you are actively trying to raise your credit score, it could take as little as three to six months before you start noticing a difference. Your consistent repayment of any loans or credit cards you may have is rapidly reflected in these developments.

However, it typically takes six years of consistently paying bills on time for a very low credit score to improve to an excellent one. The earlier you start, the better. you can start by taking small measures to raise your score, and over time, it will get better.

Some financial programs like credit builder loans and secured credit cards can help you improve your credit even faster.

Read Also: How Important Is Credit Score

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Make Payments On Time

If you are already behind or have been in the past 6 months, this step isnt a quick fix, but its the most impactful thing you can do to improve your credit score. Getting current AND making payments on time every month will steadily raise your score over time. Conversely, missing a payment will likely cause a quick drop in your score. With the credit scoring model you lose points for late payments, however, you gain points back for on-time payments. It takes time for the effects both good and bad to be seen and felt.

To keep all of your existing payments paid timely, set up automatic payments through your banks online payments tools.

Also Check: What Credit Score Do You Start With

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Deal With Collections Accounts

Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it. You can also remove collections accounts from your credit reports if they aren’t accurate or are too old to be listed.

Impact: Varies. An account in collections is a serious negative mark on your credit report, so if the collector agrees to stop reporting the account it could help a great deal.

If the collector keeps reporting the account, the effect depends on the scoring model used to create your score. The FICO 8 model, which is most widely used for credit decisions, still takes paid collections into account. However, more recent FICO models and VantageScores ignore paid-off collections.

Time commitment: Medium. You’ll need to request and read your credit reports, then make a plan to handle collections accounts that are listed.

How fast it could work: Moderately quickly. On credit scores that ignore paid collections, such as VantageScore and newer FICOs, as soon as the paid-off status is reported to credit bureaus it can benefit your scores. In other cases, such as disputing a collection account or asking for a goodwill deletion, the process could take a few months.

Recommended Reading: Will Bankruptcy Show On My Credit Report

Pros And Cons Of A Credit Builder Loan:

Getting a secured loan for credit building may seem like the ideal solution for your financial strategy, but keep in mind that every decision has advantages and disadvantages. Therefore, we highlighted the greatest benefits and drawbacks of this form of credit in order to make it simpler for you to decide whether taking out a credit building loan is the best decision for you.

Request A Credit Limit Increase

You can directly increase the denominator of your CUR, and thereby lower the ratios value, by increasing your available credit. You can do this without opening a new account if you already have one or more credit cards.

Most credit card companies will seriously evaluate a request for a higher credit limit, but you may have to provide extensive financial information to back your request.

The credit card company may ask for bank statements and tax returns before granting a higher limit. You should expect the creditor to do a hard pull of your credit, which reduces the positive impact of the higher limit, at least in the short run.

Naturally, youll get the biggest CUR improvement by not actually using your additional credit, as explained earlier. A credit card company expects you to use any card it issues to you otherwise, its not worth their effort.

Read Also: How Long Closed Accounts Stay On Credit Report

S To Improve Your Credit Score Right Now

Leslie CookKristen Bahler11 min read

Taking good care of your credit score is an important part of your financial life.

Interest rates on all kinds of products from personal and student loans to mortgages and have increased significantly since January, making it more costly for people to borrow money. When you apply for a new line of credit, a high credit score can help you qualify for a low interest rate. Good credit also makes it easier to refinance your debt, which can lower your monthly payments and free up money for other purposes.

Improving a credit score takes time, however. So if your score needs some work, the sooner you start working on it the better off you’ll be. Here’s how to start.

How Can I Raise My Credit Scores By 100 Points

If you have poor credit and are looking to increase your scores by 100 points, you will need to put in the work. This wont happened overnight and depending on your credit profile it could take several months. But, dont be discouraged, it is still an attainable goal.

Practicing the healthy credit habits weve outlined in this article is the best way to improve your credit. If a company or service promises that they can guarantee your credit will improve by 100 points, they are likely lying. All credit scores react differently, keep that in mind during your credit improvement journey.

Don’t Miss: Is Chase Credit Score Accurate