How Does Applying For A Credit Card Affect Your Credit Score

New credit applications account for 10% of your credit score, but it’s important to know that applying for one single credit card won’t affect your rating in any meaningful way.

There’s no real way to gauge exactly how much of a hit your credit score will take if you apply for one card because the exact methods for how FICO® scores are calculated are a mystery to most of the consumer credit market. Nobody, except perhaps a few select people at the credit bureaus, know exactly how much a credit score is affected by applying for one solitary card. But honestly, it shouldn’t be much.

The problem comes about when you start applying for multiple credit cards in a short period of time. To the credit bureaus, it starts to look as if you’re in financial trouble if you suddenly appear to want, say, six credit cards. If at about the same time, you try to get a loan for a house or car, even if your score doesn’t go down much, a lender may look at your recent streak of applying for multiple credit cards and get very, very nervous.

Why? The lender has to allow for the possibility that you’ll max them all out because you’re short on cash. And if you have financial trouble, will you be able to pay off the new loan or will your cash be going toward all these credit cards? Therefore, applying for multiple cards in a short time frame can cause your credit score to take a hit or cause a lender to deny you a loan despite a robust credit score.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Recommended Reading: Repo Removed From Credit Report

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

A Benefit In The Long Run

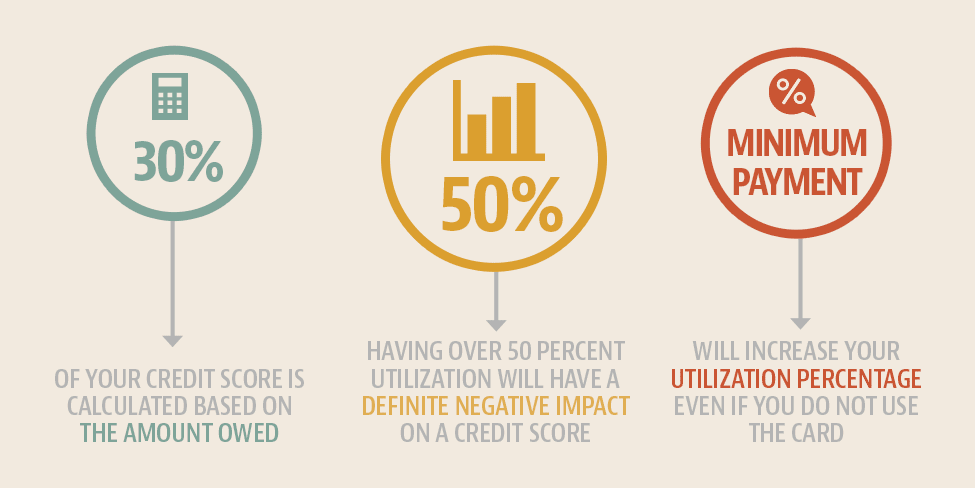

If you don’t rack up a huge balance on your new credit card, then opening it could actually help your credit score improve over time. One big factor that goes into calculating your score is your . That ratio measures how much of your total available credit you’re using at once, and it carries more weight in calculating your score than the length of your credit history.

Let’s say that you currently have a total spending limit of $10,000 across all of your cards, and youre carrying a $3,500 balance. That puts you at 35% utilization, which is kind of high and is likely to cause some damage to your score . If you were to open a new credit card with a $3,000 limit, suddenly, your credit utilization ratio would drop to 27%.

You May Like: Does Paypal Credit Help Your Credit

Can You Have Two Of The Same Credit Card

Many credit card issuers will indeed approve you for another one of their credit cards as long as you meet the qualification criteria. And, if youve always managed your current credit card well, that may make it easier for you to get approved for the new credit card.

However, dont assume that youll get approved for the exact same terms as your current credit card. The credit card issuer will approve your application based on your current income and credit standing, which may have changed since you applied for the first card.

Is It Good To Have Multiple Credit Cards

The effect on your credit score is probably one of your major concerns about having multiple credit cards. That is a common consideration, but having more than one credit card can actually help your credit score by making it easier to keep your low.

For example, if you have one credit card with a $2,000 and you charge an average of $1,800 a month to your card, then your credit utilization ratiothe amount of your available credit that you useis 90%. Where credit scores are concerned, a high credit utilization ratio will impair your credit score. It may not seem fairif you have just one card and pay it off in full and on time every month, then why should you be penalized for using most of your credit limit? But thats how the credit scoring system works.

Is it bad to have multiple credit cards? No, if you handle your credit wisely, keep your credit line utilization ratio below 30%, and keep track of payment due dates.

To improve your credit score, most credit experts recommend that you should avoid using more than 30% of your available credit per card at any given time. By spreading your $1,800 in purchases across several cards, it becomes much easier to keep your credit utilization ratio low. This ratio is just one of the factors that the FICO credit scoring model takes into account in the amounts owed component of your score, but this component makes up 30% of your credit score. Only your payment history is weighted more heavily in determining your credit score.

Also Check: Does Cancelling A Loan Affect Credit Rating

How Much Does A Credit Score Drop When Applying For A Credit Card

Theres no set number of points for each inquiry. But things such as your credit history and recent credit activity can determine the number of points an inquiry will have. If your credit profile is healthy, you dont have to worry much because the impact a single inquiry can have on your credit score is relatively small.

Hard inquiries often last on your credit report for two years, but if you pay your debts on time, your credit score has a chance to rebound within a couple of months. Plus, credit scoring models like those from FICO and VantageScore no longer count hard inquiries in score calculations after one year.

In addition to other factors, such as and payment history, your length of credit history can influence your credit score. When credit scoring models examine your length of credit history by looking at the average age of your accounts on your credit report, your credit score may go down slightly.

How To Maintain A Good Credit Score

You can maintain a solid credit score by being smart about your credit card usage. First, limit the amount of credit cards you apply for and the amount of accounts you open. Some consumers get in trouble when it comes to retail accounts, especially. They open multiple store credit cards just to take advantage of that day’s discount offer. Don’t fall into that trap. Stick to retail card accounts for your favorite stores or avoid them altogether.

Always pay your credit card bill on time and, if you’re able, in full every month. Using too much of your available credit will leave you with a high credit utilization ratio, and that will hurt your score. Try to pay off debt as fast as possible, either by transferring high-interest rate credit card debt to a card with a lower interest rate or by cutting back expenses or earning more income to pay off debt faster. Another important thing to note: Never close any long-term accounts, as the length of your credit history accounts for 15% of your overall score. Instead, pay down the balance on your credit cards and leave the accounts open. You can cut up the cards to reduce the temptation to use them or you can save them for smaller expenses every so often so these accounts remain active.

Also Check: Do Student Loans Fall Off Your Credit

Does Applying For A Credit Card Hurt Your Credit Score

Yes, applying for a new credit card can hurt your credit score a little. According to FICO, a hard inquiry when a card issuer pulls your credit after you apply can lower your score by five points or less. However, the impact is temporary. Hard pulls stay on your credit report for two years, but their credit score effects wear off after one year, according to national credit bureau Experian.

Additionally, new credit is among the five most important factors in your FICO score, though it only counts for 10%. So new credit card accounts will have a much smaller effect than a truly negative credit report item, like a missed credit card payment or a maxed-out card.

Though the credit score impact of a single card application can be small, too many of them in a short amount of time can add up to a significant loss. And if youre in the process of applying for a mortgage, hard inquiries from new credit card applications can give your prospective lender the impression that youre about to overextend yourself or go on a credit card spending spree.

How Applying For A Credit Card Can Hurt Your Credit Score

When you apply for a credit card, your card issuer will check your credit report to ensure that youre eligible. This triggers a hard inquiry. Hard inquiries affect your credit profile, leading to a slight dip in your credit score. Taking on a new credit card signals an additional risk, which is the reason this affects your score.

Hard inquiries can damage your credit score, but this effect is temporary. While a single inquiry wont have a significant impact, several hard inquiries could hurt your credit score, particularly if its less than stellar or borderline to begin with.

You May Like: What Credit Score Does Usaa Use For Credit Cards

Is A New Credit Card Right For You

Theres no denying the benefits of credit cards. When you use a credit card responsibly, it can help you build credit and earn valuable rewards in the process. A credit card is also one of the safest ways to pay for transactions thanks to the robust fraud protections available through the Fair Credit Billing Act.

But there are some instances where a new credit card might not be a good fit for youat least not for now. As mentioned, if you plan to apply for major financing in the next three to six months, you may want to put off all non-essential credit applications in the interim.

A new credit card might also be a bad idea if you dont trust yourself to avoid racking up additional debt. When you revolve a balance from month to month on your credit cards, its expensive. This bad financial habit could also trigger an increase in your credit utilization rate. Higher credit utilization might lower your credit score even if you keep your monthly payments on time.

Are you worried the additional credit limit of a new credit card will be too tempting? If so, its better to focus on budgeting and paying off debt first, before opening a new account.

How Often Should You Apply For A Credit Card

In theory, you can apply for new credit cards as often as you like. Since the average online application only takes a few minutes, you can apply for a lot of cards in a very short amount of time.

But that doesnt mean you should apply for multiple credit cards all at once. In most cases, waiting between credit card applications is better for your credit scoreand it can even improve your chances of getting accepted.

Also Check: Credit Score 588

It Can Be Hard To Manage More Than One Due Date

Payment history is the most important factor of your credit score, which makes it crucial to pay each of your credit card bills on time. Beyond helping your credit score, on-time payment history helps you avoid late fees and penalty interest rates.

When you have more than one card, it may be harder to manage multiple due dates. But there’s a simple workaround: Change your due dates.

Many card issuers allow you to change the day your payment is due online or in-app, so you can choose a day that works best for you. This may mean you set your due dates all to the same day so you don’t have to keep track of multiple dates, or you can choose to space them out throughout the month based on when you get paid.

In addition to changing your due date, you can set up autopay for at least the minimum due to ensure payments are made on time.

How To Quickly Improve Your Credit Score

Recommended Reading: What Credit Score For Care Credit

Fact: A New Card Affects Your Credit Even If You Dont Use It

You might have heard that its only after you use a new credit card that the account affects your credit score. However, applying for new credit comprises 10 percent of your credit score. It doesnt matter if youre approved for the card or if you use it its the inquiry that counts. Frequently applying for new credit can hurt your credit score, so make sure you really need that new card before you apply for it.

Opening A New Card Also Has Benefits

A new line of credit can also help your credit profile.

A better track record. Paying on time, every time is essential for good credit. FICO, the credit score used most for credit decisions, says payment history accounts for 35% of credit score. Competitor VantageScore calls it extremely influential.

If youre trying to build credit, nothing is more important than consistent, on-time payments. A new account gives you another opportunity to build up a record of on-time payments.

More room on credit cards. A new card will increase your overall credit limit. If your spending stays the same, your overall credit utilization will be lower, and that could help your score.

Credit diversity. Credit scores award points for showing you can manage more than one type of credit. If you have an installment loan but do not have a credit card, successfully managing your new credit card is likely to help. But if you already have several credit cards, adding one more is not as likely to have much of an impact.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: Carmax Income Requirements

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Recommended Reading: What Score Is Needed For Care Credit