How Long Does Credit Information Stay On Your Credit Report

Home \ \ How Long Does Credit Information Stay On Your Credit Report?

Join millions of Canadians who have already trusted Loans Canada

Your credit report is essentially your credit history. It compiles all the information concerning your credit habits and creates a tool that can be used by lenders and creditors to assess your creditworthiness. While your credit report does represent a good portion of your credit history, the information is not saved for the total duration of your credit using life. Your credit information is eventually removed from your to make room for newer information.

Of course, the question on everyones mind is, how long does this credit information stay on my credit report for? This is what were going to take a closer look at so you can know exactly how long specific credit information will affect your credit report.

How To Remove Late Payments From Your Credit Report

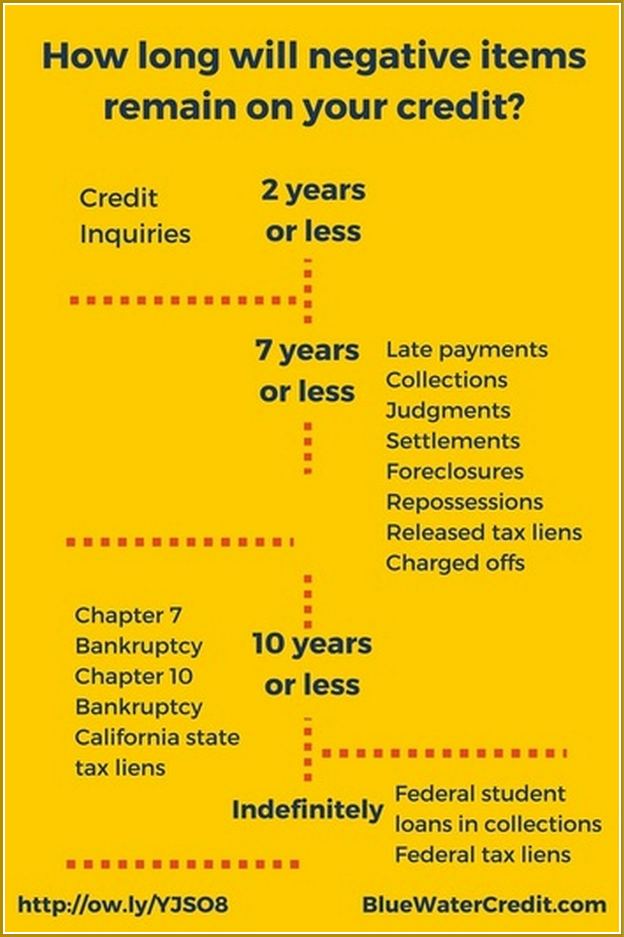

An accurately reported late payment can remain on your credit report for up to seven years. Even if you bring the account current and aren’t late anymore, your credit report is telling an accurate story of your history with the account.

If a creditor reports your payment late when you actually paid on time, however, you can dispute the late payment with the credit bureau. You can file your dispute for free by mail, over the phone or online, and explain why you believe the late payment is an error. You can also send, attach or upload supporting documents, such as bank statements or cancelled checks showing when you paid the creditor.

After receiving a dispute, the credit bureau will investigate your claim and either confirm the late payment was accurate or update your credit history to reflect what actually happened.

Can You Remove Late Payments From Your Credit Report

You can get a late payment taken off of your credit report before the seven years are up. One reason why a lender might remove the late payment is if it made a mistake.

The lender might have reported the information inaccurately so that the late payment showed up on your report.

Reviewing your credit reports on a regular basis will help you detect any mistakes early on so that they are easier to report and correct.

Sometimes, lenders are willing to extend a lifeline to a customer or help people out when they are in a jam.

If you’ve been going through a tough time, for example, if you lost your job or were dealing with an illness, which led you to pay late, the lender might be willing to forgive the lateness.

Some lenders offer a one-time “freebie,” especially to customers who usually pay on time and who have brought their accounts up-to-date.

In some cases, a lender will remove a late payment if you agree to a payment plan or set up automatic payments with them.

Don’t Miss: Affirm Approval Credit Score

Other Rights Related To Ccr Data

Direct marketing – Personal information in your credit report cannot be used by a credit reporting body or a credit provider for direct marketing. But credit providers can ask credit reporting bodies to use your credit information to pre-screen you for direct marketing purposes. You can tell a credit reporting body not to do this.

Preventing identity fraud – If you think you have been a victim of fraud or have transactions you dont recognise you should contact CommBank. You can also inform the credit reporting body that you are a victim of fraud and not to use or give anyone your credit information.

You can also read our Privacy Policy or visit for consumer education on CCR.

Whats In Your Credit Report

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.

Don’t Miss: Zebit Approval Odds

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Can You Remove A Late Payment

If the late payment was reported in error, you could dispute it with the credit bureau to have it removed from your credit report. Provide proof of the error, like a copy of the check used to make your payment, to help your dispute. Accurately reported late payments could rightfully stay on your credit report for seven years. Theres a small chance your credit card issuer may be willing to remove the late payment as a courtesy, but youll have to ask.

You May Like: Increase Fico Score 50 Points

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, then a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there, you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online youll just need to update your annual household income. Its possible to be approved for a higher limit in less than a minute. You can also request a credit limit increase over the phone.

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

You May Like: Is A 524 Credit Score Good

How Can I Remove A Late Payment From My Credit Report

If thereâs a good reason why you were late with a payment, such as redundancy, you can explain it to companies by asking us to add a notice of correction to your report. This can be up to 200 words.

If you think a late payment has been recorded on your report by mistake, we can investigate on your behalf. Get a copy of your Experian Credit Report first to check it for accuracy. If you find an error, get in touch with us. Weâll ask the companies to double-check their data and remove the record if itâs inaccurate. If they think itâs accurate, and you still disagree, weâll help you figure out your next steps.

How Do Late Payments Impact Mortgage Applications

Most people pay a bill late at some point in their life. When applying for a mortgage, lenders can take late payments as a sign of previous financial struggle. How seriously this impacts your application depends on things like how many late payments you have and whether you have any other credit issues on your file.

Life happens, and sometimes late payments are unavoidable.

Late payments are different from missed payments or arrears. A late payment is simply that: a payment that you did make, just not on time. Knowing this difference will help you understand how it affects your credit file.

The good news is, its still possible to get a mortgage with late payments – youll just need to find the right lender who can look at your file on a case-by-case basis.

In this Guide, youll find all you need to know about applying for a mortgage with late payments on your , and practical ways to maximise your chances of being accepted.

In this Guide:

Read Also: Does Paypal Report To The Credit Bureaus

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Its Easier To Recover From Just One 30

There are many things you can do to mitigate the damage done by a single 30-day late payment, Scanlon said.

One of the most common is to request what is referred to as a courtesy deletion or removal.

In a nutshell, Scanlon said, if you have a good payment history, you bring that to the creditors attention and request that they give you a break for your single oversight, which they just might do if you have a good payment history and ask nicely.

Additionally, writing a goodwill letter can help you avoid further damage to your credit score from a late payment, according to Nathan Wade, managing editor for WealthFit Money, a financial education website that provides advice on investing, entrepreneurship and money.

A goodwill letter is a chance to explain your situation to your creditor and kindly ask them to remove a negative mark from your credit report, Wade said.

And he also noted that although creditors are not obligated to grant your request, a goodwill letter will not hurt your credit score if it is rejected.

Keep in mind that it can be a few weeks before your goodwill letter is accepted or rejected, Wade cautioned.

Some tips for writing a strong goodwill letter are to write in a respectful tone, acknowledge your responsibility in paying off debts on time and be detailed about the negative mark you need removed and from which credit bureaus reports.

Recommended Reading: Is 650 A Good Fico Score

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

How Long Late Payments Stay On Your Credit Report

Late payments typically stay on your credit report for up to seven years and can negatively impact your credit score as long as they remain in your credit history. Thats seven years of struggling to get new credit or facing higher interest rates. However, there are things that you can do to remove negative late payments from your credit report.

Don’t Miss: Does Speedy Cash Do Credit Checks

How Do Late Payments Affect Your Credit Scores

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

Ways To Remove Inaccurate Late Payments

Its not uncommon to find inaccurate information on your credit report. If you find do find a mistakenly reported late payment, youre entitled by the Fair Credit Reporting Act to request the credit bureaus to substantiate it, and if found to be an error, remove it. There are a few different ways to do this.

Recommended Reading: Remove Credit Inquiries In 24 Hours

Secured Vs Unsecured Late Payments

There’s two different types of late payments: secured and unsecured. Each affects your credit report differently.

Unsecured late payments are credit agreements where your debt isn’t secured against anything you own. Such as credit cards, overdrafts, loans and mobile phone contracts.

Secured late payments are credit agreements secured against an asset, such as your home for a mortgage and car repayments. A can take away this asset if you don’t keep up your repayments.

Lenders typically view unsecured late payments as less severe than secured late payments.

Does Missing One Payment Affect Your Credit Score

Paying on time is one of the biggest factors that affect your credit rating, so missing a payment can affect your score. Payments over 30 days late will mark your credit file for six years, and will be visible to lenders during that time. Like all credit issues, they lose impact the older they get. Having a reasonable explanation for missing the payment can also help when it comes to applying for a loan, credit card or mortgage. Read more in our Guide: What Credit Score Do I Need to Get a Mortgage?

Also Check: Do Prosper Loans Show On Credit Report

How To Build Your Credit After Bankruptcy

A bankruptcy is a devastating and life-altering event that can leave some serious emotional scars. But just because youve got bankruptcy or other negative info clouding up your credit history, it doesnt mean your life is over. You can come back from a bankruptcy, and it starts with dusting yourself off and learning from your mistakes. Here are some ways to help rebuild your financial stability after a bankruptcy.

Types Of Late Payments On A Credit Report

For creditors, a single late payment may signify a broken trust. A missed payment can identify you as more of a credit risk than before. Thats why payment history is usually the most heavily weighted factor in calculating FICO® credit scores, accounting for about a third of the formula. FICO® puts late payments into various categories, including how severe it is, how recent it is and how frequently youve paid late. The more severe the category, the more damaging it is to your score. Generally, a late payment from many years ago wont hurt as much as the one reported today.

Recommended Reading: Aargon Agency Debt Collector

How Much Do Late Payments Hurt Your Credit Score

The concept is simple enough: pay your bills before theyâre due. This isnât a suggestion payment history is one of the largest components of how your is calculated.

Lenders use your credit report as a measure of financial trustworthiness, and a track record of on-time payments is the single easiest way to prove youâre a reliable borrower. Ideally, you should be paying off your balance in full each month on all your bills: credit cards, line of credit, car loan, mortgage payment, cell phone and internet bill, etc.

Of course, if everyone neatly complied, I wouldnât be writing this. Maybe a financial emergency cleaned out your savings, or you lost your job. Perhaps youâre disorganized and simply forgot to pay on time.

Unfortunately, the reason doesnât matter: late payments shave precious points off your credit score. This has can knock you down into a lesser tier and potentially prevent you from qualifying for the best credit cards and mortgage rates. The later the payment, the greater the damage to your score.

What counts as âlateâ?

On your credit report, payments are categorized as 30, 60, 90, or 120 days late. This is rated on a scale of 1 to 9, with a letter in front indicating what type of credit you hold:

How long do late payments stay on a credit report?

What should you do if you miss a payment?

Never again

Also read: